- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A140860

Park Systems' (KOSDAQ:140860) five-year earnings growth trails the fantastic shareholder returns

It hasn't been the best quarter for Park Systems Corp. (KOSDAQ:140860) shareholders, since the share price has fallen 13% in that time. But that doesn't undermine the fantastic longer term performance (measured over five years). To be precise, the stock price is 481% higher than it was five years ago, a wonderful performance by any measure. Arguably, the recent fall is to be expected after such a strong rise. Only time will tell if there is still too much optimism currently reflected in the share price.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

Our free stock report includes 1 warning sign investors should be aware of before investing in Park Systems. Read for free now.There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

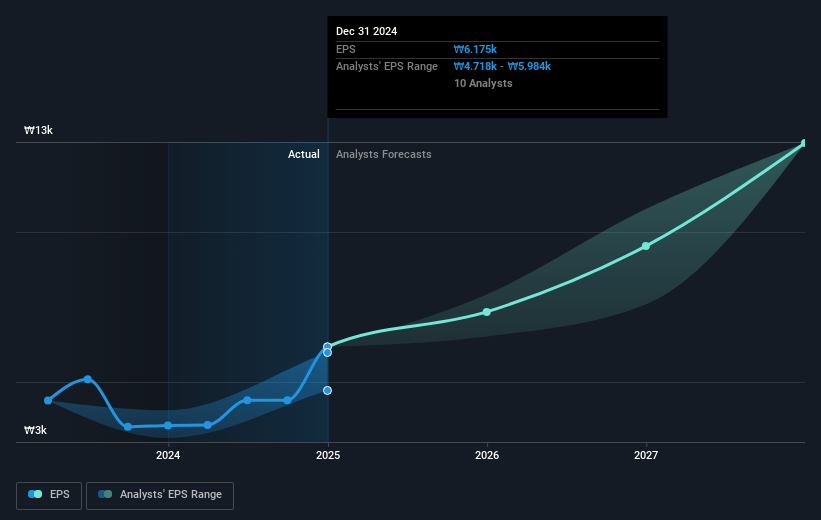

During five years of share price growth, Park Systems achieved compound earnings per share (EPS) growth of 37% per year. This EPS growth is reasonably close to the 42% average annual increase in the share price. That suggests that the market sentiment around the company hasn't changed much over that time. Indeed, it would appear the share price is reacting to the EPS.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Park Systems has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Park Systems stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Park Systems the TSR over the last 5 years was 488%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Park Systems has rewarded shareholders with a total shareholder return of 45% in the last twelve months. Of course, that includes the dividend. That's better than the annualised return of 43% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Park Systems you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A140860

Park Systems

Develops, manufactures, and sells atomic force microscopy (AFM) systems worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives