- South Korea

- /

- Software

- /

- KOSDAQ:A189330

We're Not Very Worried About XIIlabLtd's (KOSDAQ:189330) Cash Burn Rate

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given this risk, we thought we'd take a look at whether XIIlabLtd (KOSDAQ:189330) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for XIIlabLtd

Does XIIlabLtd Have A Long Cash Runway?

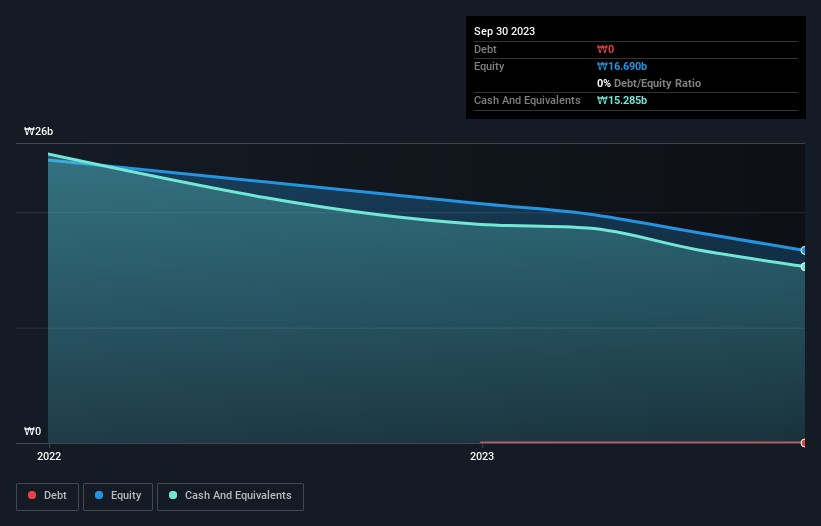

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When XIIlabLtd last reported its September 2023 balance sheet in November 2023, it had zero debt and cash worth ₩15b. Looking at the last year, the company burnt through ₩4.2b. So it had a cash runway of about 3.6 years from September 2023. A runway of this length affords the company the time and space it needs to develop the business. The image below shows how its cash balance has been changing over the last few years.

How Well Is XIIlabLtd Growing?

Some investors might find it troubling that XIIlabLtd is actually increasing its cash burn, which is up 9.3% in the last year. And we must say we find it concerning that operating revenue dropped 47% over the same period. Considering both these metrics, we're a little concerned about how the company is developing. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how XIIlabLtd has developed its business over time by checking this visualization of its revenue and earnings history.

Can XIIlabLtd Raise More Cash Easily?

Even though it seems like XIIlabLtd is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

XIIlabLtd's cash burn of ₩4.2b is about 6.1% of its ₩69b market capitalisation. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

How Risky Is XIIlabLtd's Cash Burn Situation?

Even though its falling revenue makes us a little nervous, we are compelled to mention that we thought XIIlabLtd's cash runway was relatively promising. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. Separately, we looked at different risks affecting the company and spotted 4 warning signs for XIIlabLtd (of which 1 is a bit unpleasant!) you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A189330

XIIlabLtd

Provides data-driven AI video analysis services in South Korea.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)