- South Korea

- /

- Semiconductors

- /

- KOSE:A000660

Is It Too Late To Consider SK hynix After Its 233.5% AI Fueled Surge?

Reviewed by Bailey Pemberton

- Wondering if SK hynix is still worth buying after its massive run, or if the smart move now is to wait for a better price? This article is going to unpack exactly what the current share price is really baking in.

- The stock has climbed 5.0% over the last week and a huge 233.5% year to date, even after a recent 6.7% pullback over the past month and a 228.8% gain over the last year.

- Much of this surge has ridden the wave of enthusiasm around AI infrastructure and high bandwidth memory, with SK hynix being a key supplier to major tech players. At the same time, shifting expectations for global chip demand and supply discipline across the sector are reshaping how investors price in future growth and risk.

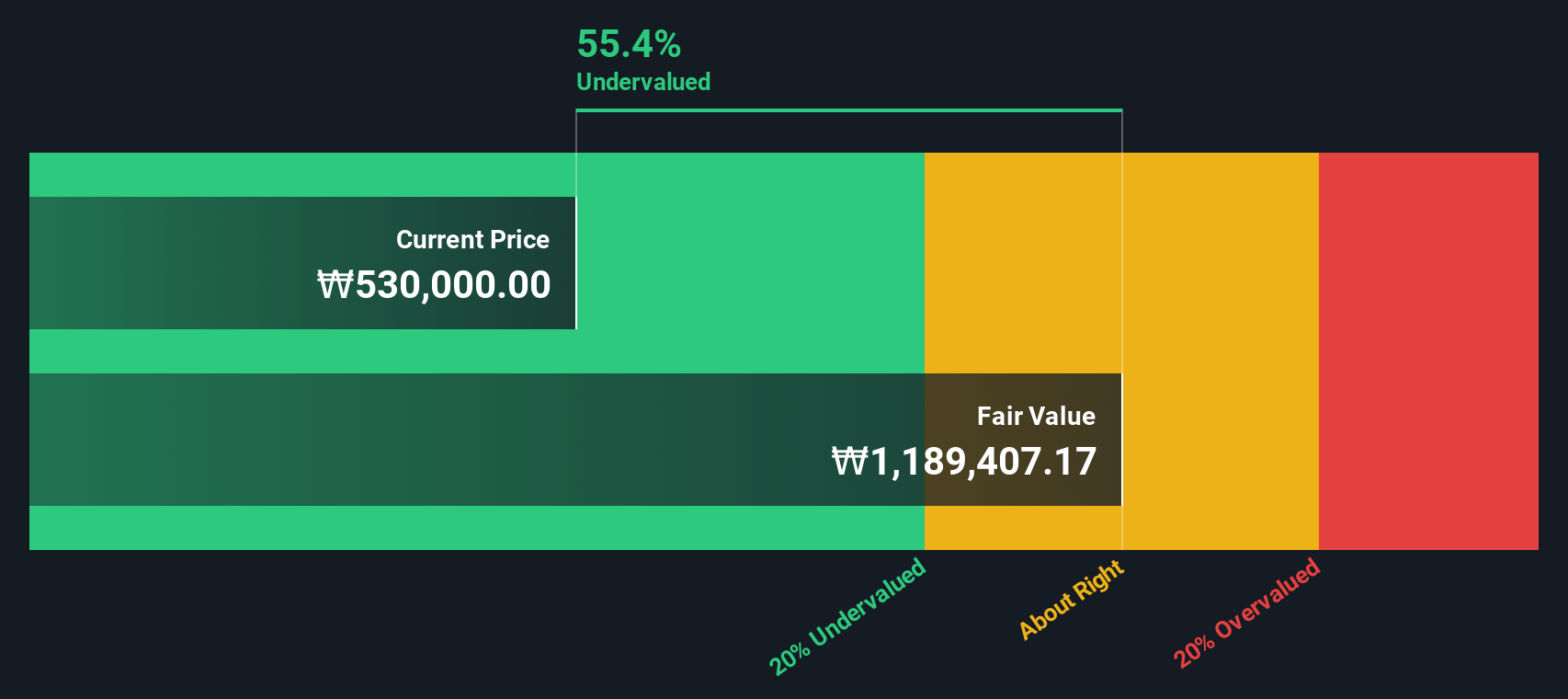

- On our metrics, SK hynix scores a 5/6 valuation score. This suggests it looks undervalued on most of the checks we run. Next, we will break down those different valuation approaches before circling back to a more powerful way of thinking about what the stock is truly worth.

Approach 1: SK hynix Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in ₩ terms.

For SK hynix, the latest twelve month Free Cash Flow stands at roughly ₩20.9 trillion. Analysts project strong growth over the next few years, with Free Cash Flow expected to rise to around ₩41.3 trillion by 2026 and ₩53.8 trillion by 2027. Beyond the explicit analyst horizon, Simply Wall St extrapolates these trends, with modeled Free Cash Flow reaching about ₩104.8 trillion by 2035, using a 2 Stage Free Cash Flow to Equity approach.

When all these projected cash flows are discounted back, the model arrives at an intrinsic value of about ₩1,321,270 per share. Compared with the current market price, this implies a 56.8% discount, suggesting the shares trade well below the modelled long term value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SK hynix is undervalued by 56.8%. Track this in your watchlist or portfolio, or discover 903 more undervalued stocks based on cash flows.

Approach 2: SK hynix Price vs Earnings

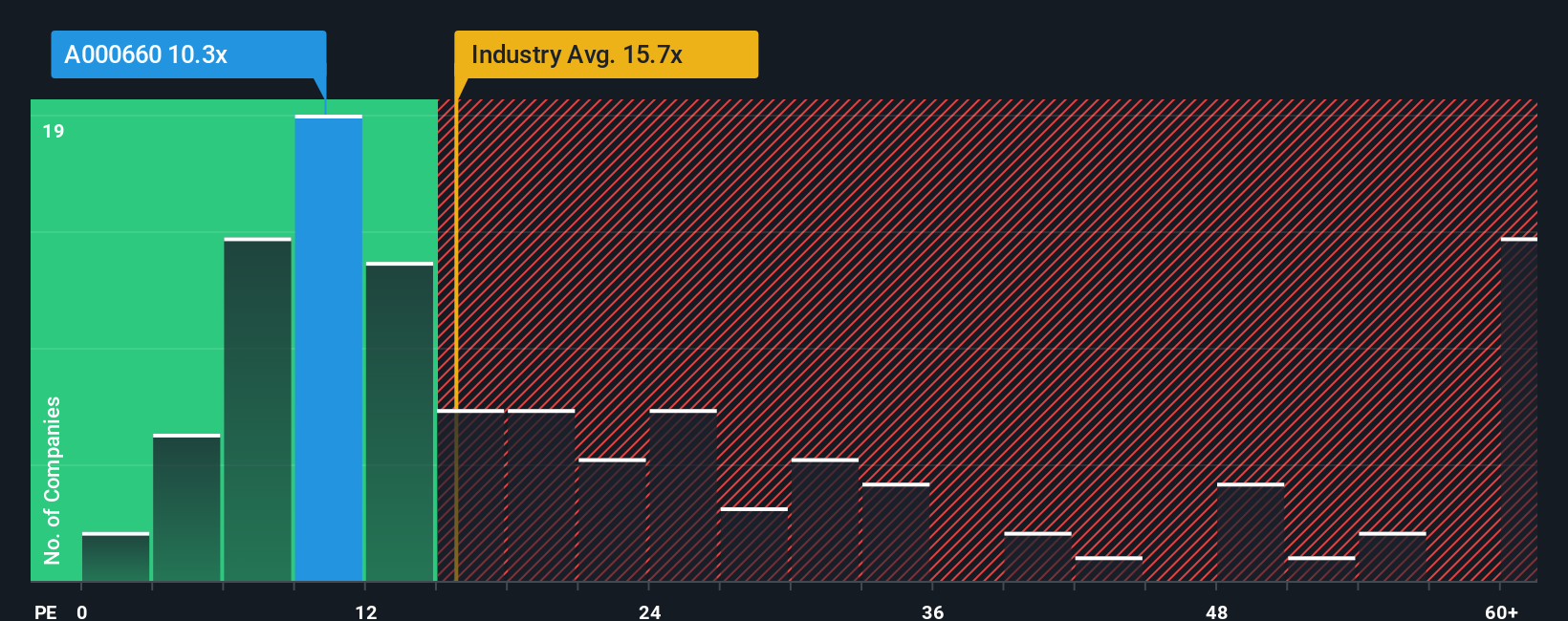

For a profitable business like SK hynix, the Price to Earnings (PE) ratio is a useful way to gauge value because it directly links what investors are paying to the company’s current earnings power. In general, higher expected growth and lower perceived risk justify a higher “normal” or “fair” PE ratio, while slower growth or more uncertainty call for a lower one.

SK hynix currently trades on a PE of about 11.0x. That is well below the global Semiconductor industry average of around 16.6x, and dramatically below the 32.9x average of its peer group, which reflects how highly many AI and memory names are being priced right now.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE multiple SK hynix should trade on, given its earnings growth outlook, margins, industry position, market cap and risk profile. For SK hynix, this Fair Ratio comes out at roughly 32.4x, which is much higher than its current 11.0x multiple. On this basis, the stock appears meaningfully undervalued relative to what its fundamentals would justify.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SK hynix Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of SK hynix’s future with a concrete financial forecast and Fair Value on the Simply Wall St Community page, where millions of investors share their perspectives. A Narrative is just your story behind the numbers, where you decide how fast revenue grows, what happens to earnings and margins, and what a reasonable multiple looks like. The platform instantly translates that into a Fair Value you can compare with today’s price to help you judge whether to buy, hold, or sell. It then automatically updates your Narrative when new information, like fresh earnings or HBM4 news, arrives. For example, one SK hynix Narrative might assume strong AI memory demand, rising margins and a Fair Value well above the current price. A more cautious Narrative could focus on geopolitical and capex risks, softer NAND conditions, and a lower Fair Value closer to or even below where the stock trades today.

Do you think there's more to the story for SK hynix? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000660

SK hynix

Manufactures, distributes, and sells semiconductor products in Korea, China, rest of Asia, the United States, and Europe.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)