- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A171090

Even though SUNIC SYSTEM (KOSDAQ:171090) has lost ₩43b market cap in last 7 days, shareholders are still up 413% over 5 years

SUNIC SYSTEM Co., Ltd. (KOSDAQ:171090) shareholders might be concerned after seeing the share price drop 20% in the last month. But that doesn't undermine the fantastic longer term performance (measured over five years). In fact, during that period, the share price climbed 396%. Impressive! So we don't think the recent decline in the share price means its story is a sad one. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain.

Since the long term performance has been good but there's been a recent pullback of 10%, let's check if the fundamentals match the share price.

View our latest analysis for SUNIC SYSTEM

Given that SUNIC SYSTEM didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years SUNIC SYSTEM saw its revenue shrink by 1.5% per year. This is in stark contrast to the strong share price growth of 38%, compound, per year. Obviously, whatever the market is excited about, it's not a track record of revenue growth. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

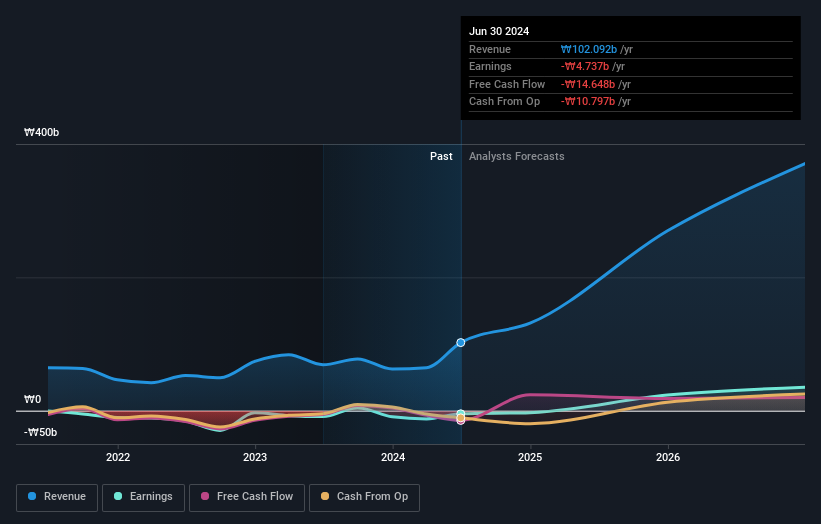

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at SUNIC SYSTEM's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between SUNIC SYSTEM's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for SUNIC SYSTEM shareholders, and that cash payout contributed to why its TSR of 413%, over the last 5 years, is better than the share price return.

A Different Perspective

It's nice to see that SUNIC SYSTEM shareholders have received a total shareholder return of 134% over the last year. That gain is better than the annual TSR over five years, which is 39%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand SUNIC SYSTEM better, we need to consider many other factors. Even so, be aware that SUNIC SYSTEM is showing 1 warning sign in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A171090

Exceptional growth potential with solid track record.