- South Korea

- /

- Entertainment

- /

- KOSE:A036570

High Growth Companies With Insider Ownership In January 2025

Reviewed by Simply Wall St

As global markets navigate a mixed start to 2025, with the S&P 500 and Nasdaq Composite reflecting strong annual gains despite recent economic data challenges, investors are increasingly focused on identifying resilient growth opportunities. In this environment, companies that exhibit high insider ownership often attract attention for their potential alignment of interests between management and shareholders, which can be particularly appealing in times of market uncertainty.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We'll examine a selection from our screener results.

NCSOFT (KOSE:A036570)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NCSOFT Corporation develops and publishes online games worldwide, with a market cap of ₩3.74 trillion.

Operations: The company generates revenue primarily from online games and game services, amounting to ₩1.61 trillion.

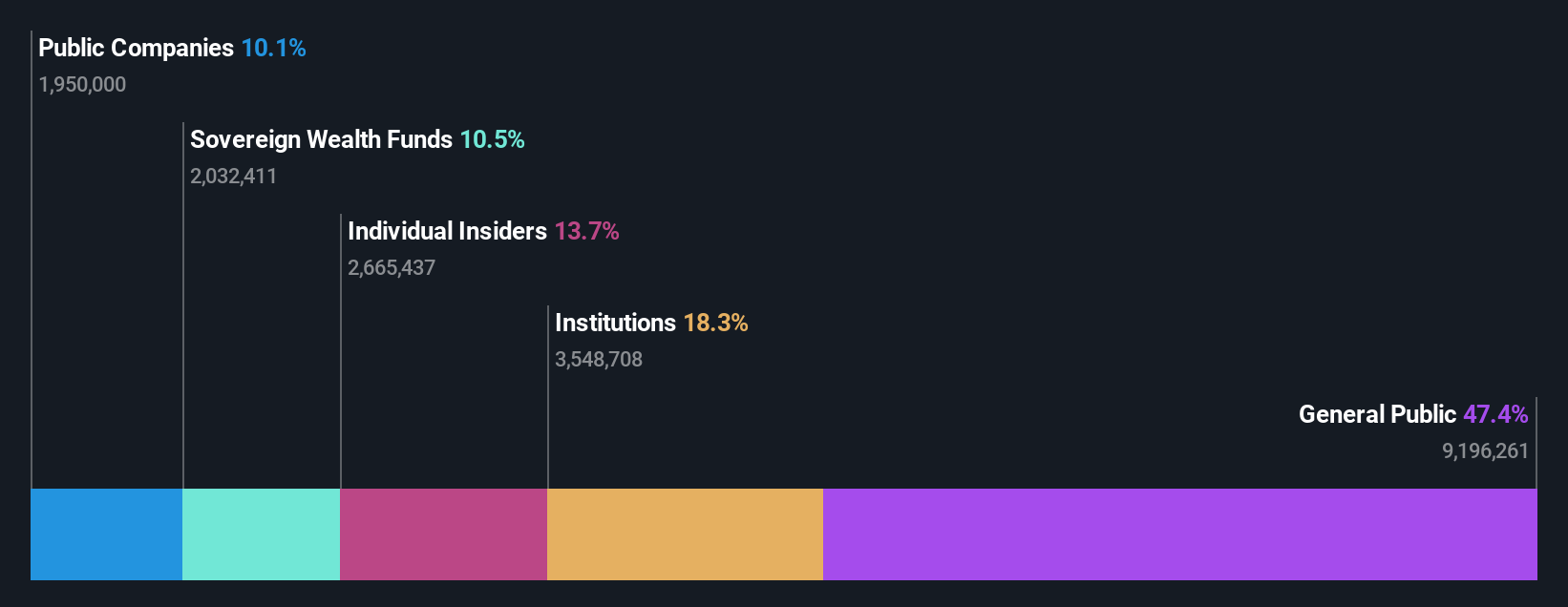

Insider Ownership: 13.3%

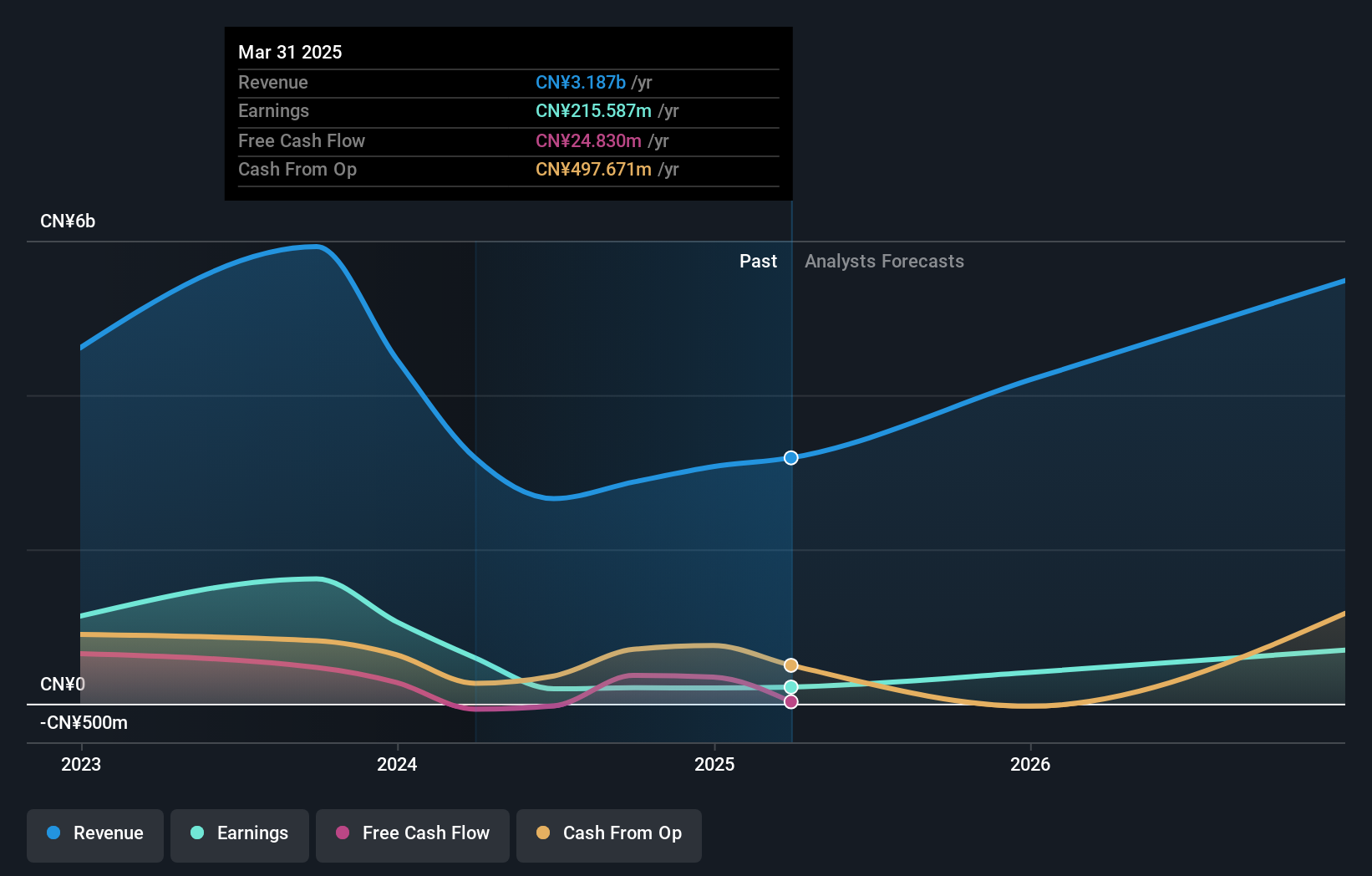

NCSOFT's earnings are forecast to grow significantly at 41.5% annually, outpacing the Korean market's growth rate. Despite this, recent financial results show a decline in sales and profitability, with a net loss reported for the third quarter of 2024 compared to a profit the previous year. The stock trades at 53.5% below its estimated fair value, suggesting potential undervaluation despite an unstable dividend history and low projected return on equity.

- Take a closer look at NCSOFT's potential here in our earnings growth report.

- According our valuation report, there's an indication that NCSOFT's share price might be on the cheaper side.

SolaX Power Network Technology (Zhejiang) (SHSE:688717)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SolaX Power Network Technology (Zhejiang) Co., Ltd. (ticker: SHSE:688717) operates in the renewable energy sector, focusing on the development and manufacturing of solar power products, with a market cap of CN¥7.39 billion.

Operations: The company's revenue is primarily derived from its Electronic Components & Parts segment, amounting to CN¥2.87 billion.

Insider Ownership: 35.1%

SolaX Power Network Technology is expected to see significant earnings growth of 55% annually, surpassing the broader Chinese market's growth rate. However, recent financial results reveal a substantial decline in sales and net income for the first nine months of 2024 compared to the previous year. The stock trades at nearly 20% below its estimated fair value, with analysts predicting a potential price increase of over 45%, despite lower profit margins and return on equity forecasts.

- Delve into the full analysis future growth report here for a deeper understanding of SolaX Power Network Technology (Zhejiang).

- Insights from our recent valuation report point to the potential undervaluation of SolaX Power Network Technology (Zhejiang) shares in the market.

Suzhou Recodeal Interconnect SystemLtd (SHSE:688800)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Recodeal Interconnect System Co., Ltd specializes in developing, producing, and selling connection systems and microwave components globally, with a market cap of CN¥8.41 billion.

Operations: The company's primary revenue segment is Electric Equipment, generating CN¥2.10 billion.

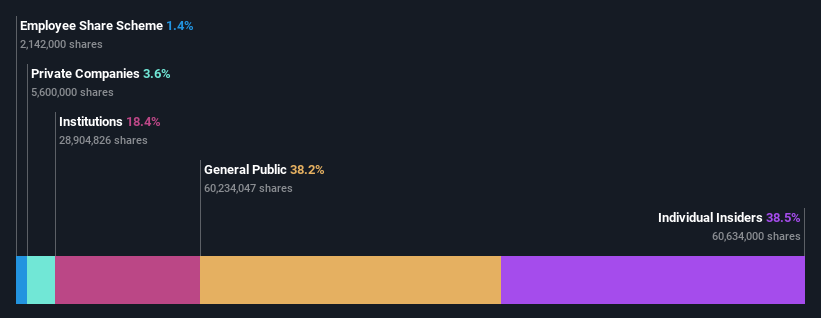

Insider Ownership: 38.5%

Suzhou Recodeal Interconnect System Ltd. is poised for significant earnings growth of 31.6% annually, outpacing the Chinese market's average. Despite this, profit margins have declined to 7% from 10.1% last year, and its share price has been highly volatile recently. The company reported a revenue increase to CNY 1.59 billion for the first nine months of 2024, up from CNY 1.04 billion in the previous year, with net income also rising modestly to CNY 105.96 million.

- Get an in-depth perspective on Suzhou Recodeal Interconnect SystemLtd's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Suzhou Recodeal Interconnect SystemLtd shares in the market.

Next Steps

- Click this link to deep-dive into the 1500 companies within our Fast Growing Companies With High Insider Ownership screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if NCSOFT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A036570

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives