- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A108230

Promising Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic uncertainties, investors are increasingly turning their attention to dividend stocks as a potential source of stability and income. With U.S. indices closing out a strong year despite recent volatility, identifying stocks with reliable dividends can be an effective strategy for those looking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.40% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.95% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.34% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.89% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.07% | ★★★★★★ |

Click here to see the full list of 1972 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

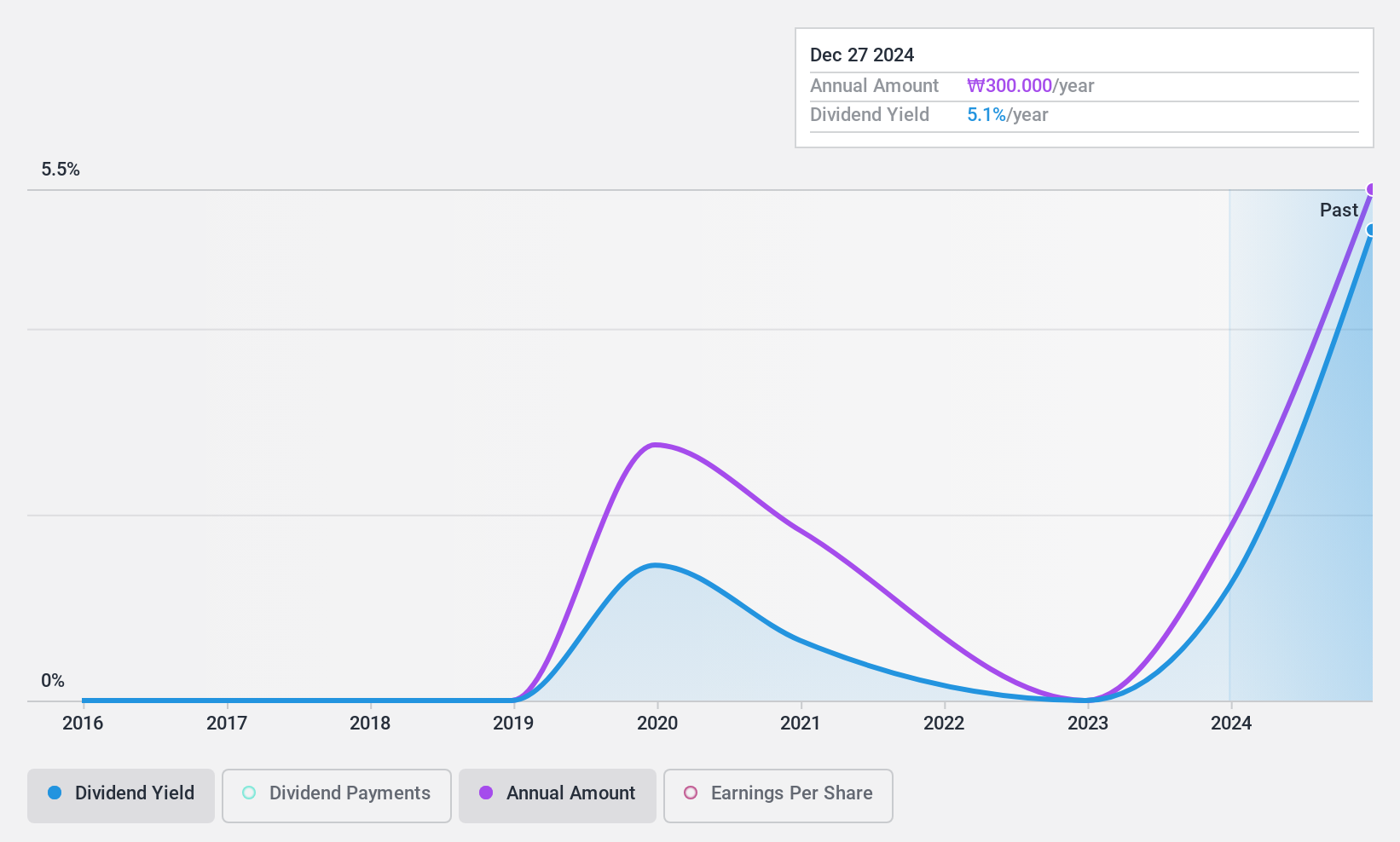

TOPTEC (KOSDAQ:A108230)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TOPTEC Co., Ltd. operates in the secondary batteries, smart factories, and displays/semiconductors sectors both in South Korea and internationally, with a market cap of ₩172.16 billion.

Operations: TOPTEC Co., Ltd.'s revenue is derived from its operations in the secondary batteries, smart factories, and displays/semiconductors sectors.

Dividend Yield: 6.2%

TOPTEC's dividend yield of 6.15% places it in the top 25% of KR market payers, with dividends well-covered by both earnings (payout ratio: 15.2%) and cash flows (cash payout ratio: 10.9%). However, its dividend track record is unstable, showing volatility over the past five years despite recent growth in payouts. While trading significantly below estimated fair value, recent financials reveal a third-quarter net loss amid increased nine-month sales and improved net income year-on-year.

- Take a closer look at TOPTEC's potential here in our dividend report.

- Our valuation report here indicates TOPTEC may be undervalued.

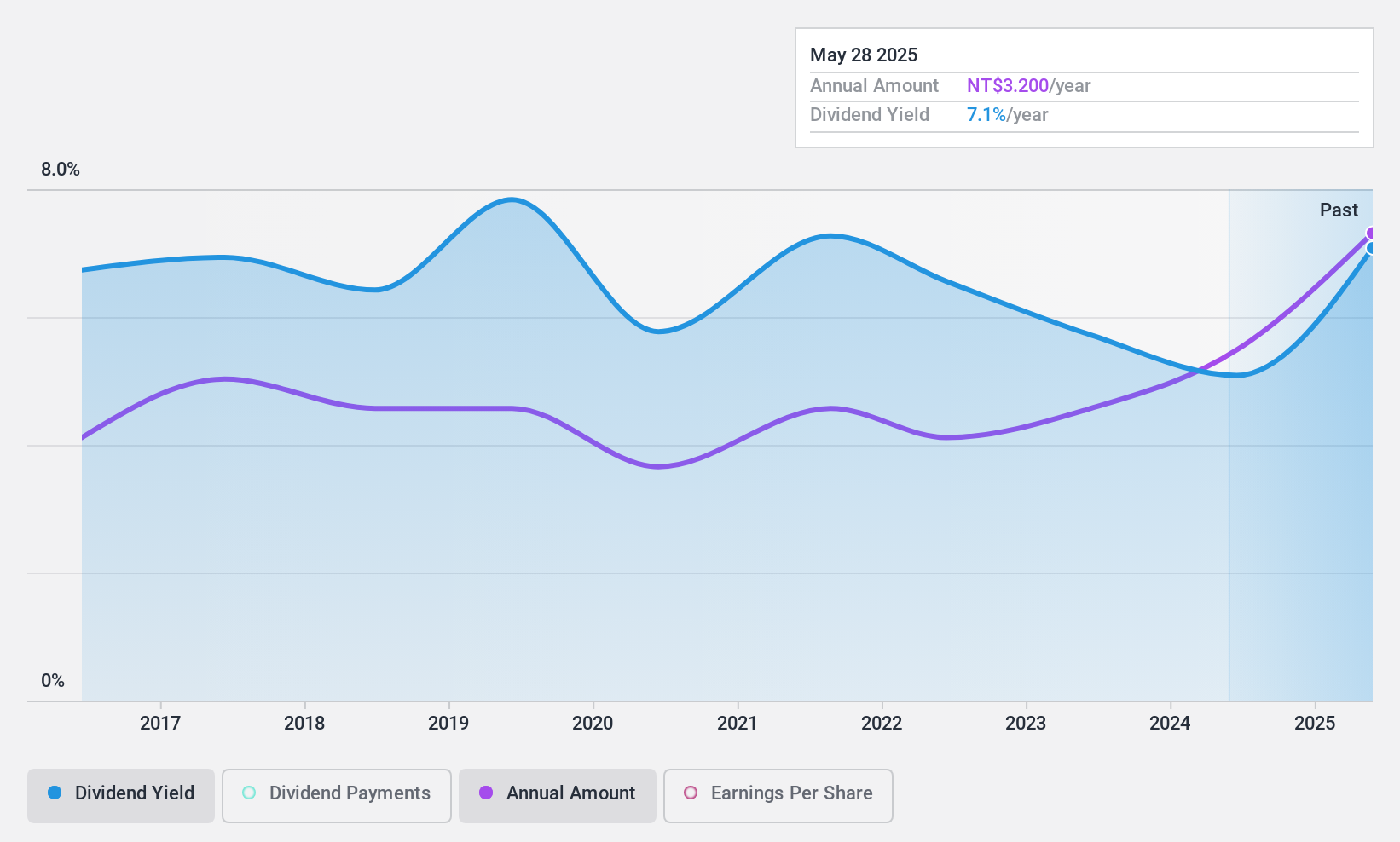

Kuen Ling Machinery Refrigerating (TPEX:4527)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kuen Ling Machinery Refrigerating Co., Ltd. operates in the machinery and refrigerating equipment industry, with a market cap of NT$3.44 billion.

Operations: Kuen Ling Machinery Refrigerating Co., Ltd. generates its revenue primarily from the Taiwan Area with NT$3.51 billion, followed by the Mainland Area at NT$1.93 billion, and the Vietnam Region contributing NT$85.42 million.

Dividend Yield: 5.1%

Kuen Ling Machinery Refrigerating's dividend yield of 5.14% ranks it among the top 25% of TW market payers, supported by a payout ratio of 53.3% and a cash payout ratio of 65.4%. Despite recent earnings growth and favorable valuation with a P/E ratio below the market average, its dividend history is marked by volatility over the past decade, raising concerns about reliability despite coverage by earnings and cash flows.

- Click to explore a detailed breakdown of our findings in Kuen Ling Machinery Refrigerating's dividend report.

- Upon reviewing our latest valuation report, Kuen Ling Machinery Refrigerating's share price might be too optimistic.

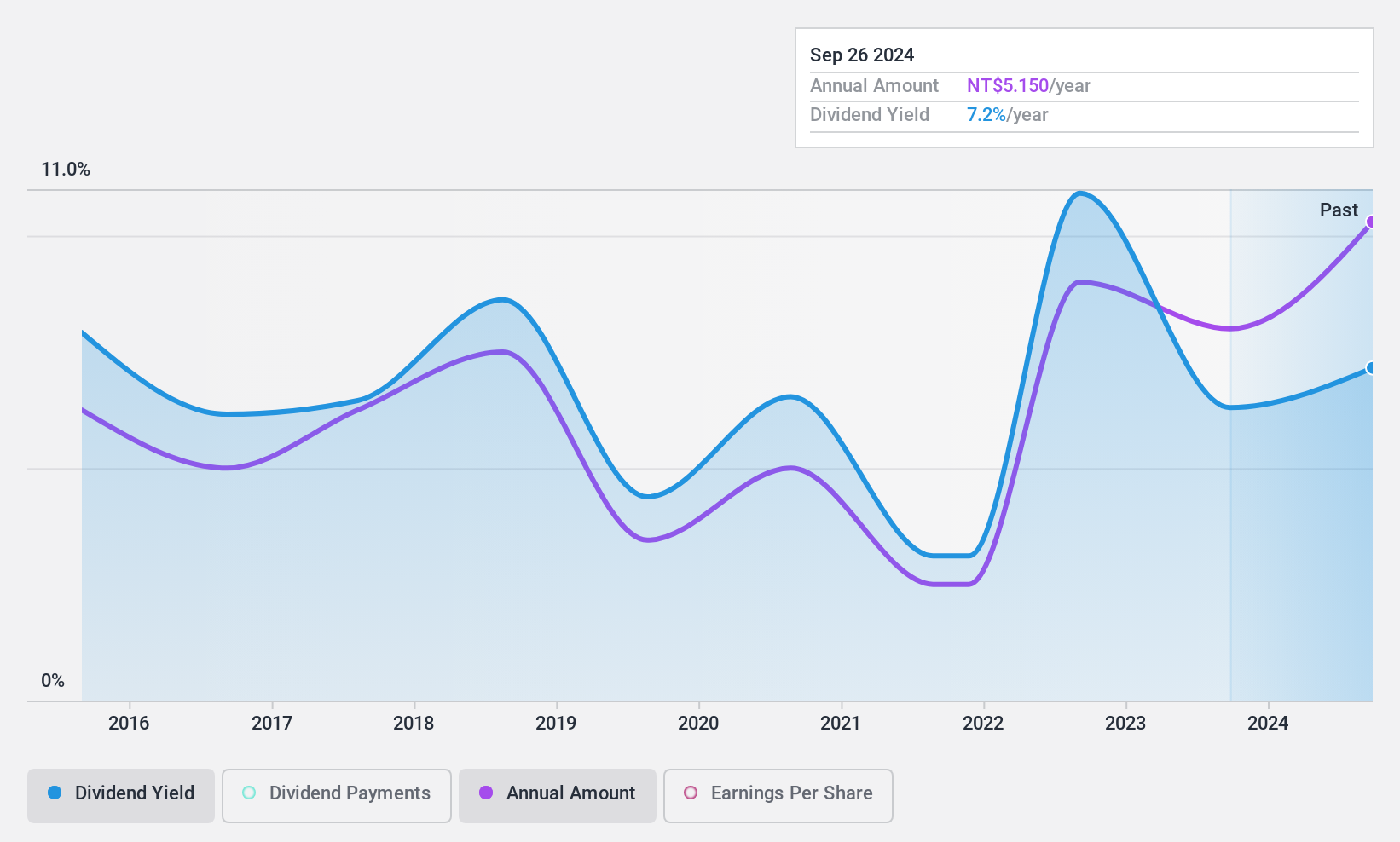

Thye Ming Industrial (TWSE:9927)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Thye Ming Industrial Co., Ltd. manufactures and sells lead alloys and lead oxide in Asia, with a market cap of NT$10.69 billion.

Operations: Thye Ming Industrial Co., Ltd.'s revenue comes from Taiming Co, contributing NT$6.22 billion, and Thye Ming Industrial (Vietnam) Co., Ltd., which adds NT$2.71 billion.

Dividend Yield: 7.8%

Thye Ming Industrial offers a dividend yield of 7.8%, placing it in the top 25% of Taiwan's market, but its high payout and cash payout ratios (87% and 94.1%) indicate dividends are not well covered by earnings or cash flows. Despite past profit growth, the company's dividend history is marked by volatility with significant annual drops, questioning reliability. Its P/E ratio of 11.1x suggests potential value compared to the market average.

- Click here and access our complete dividend analysis report to understand the dynamics of Thye Ming Industrial.

- Insights from our recent valuation report point to the potential overvaluation of Thye Ming Industrial shares in the market.

Summing It All Up

- Gain an insight into the universe of 1972 Top Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOPTEC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A108230

TOPTEC

Engages in the secondary batteries, smart factories, and displays/semiconductors businesses in South Korea and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives