- South Korea

- /

- Chemicals

- /

- KOSE:A002100

Kyung Nong And 2 Other Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic uncertainties, investors are increasingly turning their attention to stable income sources like dividend stocks. In this context, understanding what makes a strong dividend stock—such as consistent payouts and robust financial health—becomes crucial for those looking to bolster their portfolios amidst fluctuating indices and economic shifts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.48% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.89% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.89% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.07% | ★★★★★★ |

Click here to see the full list of 1972 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

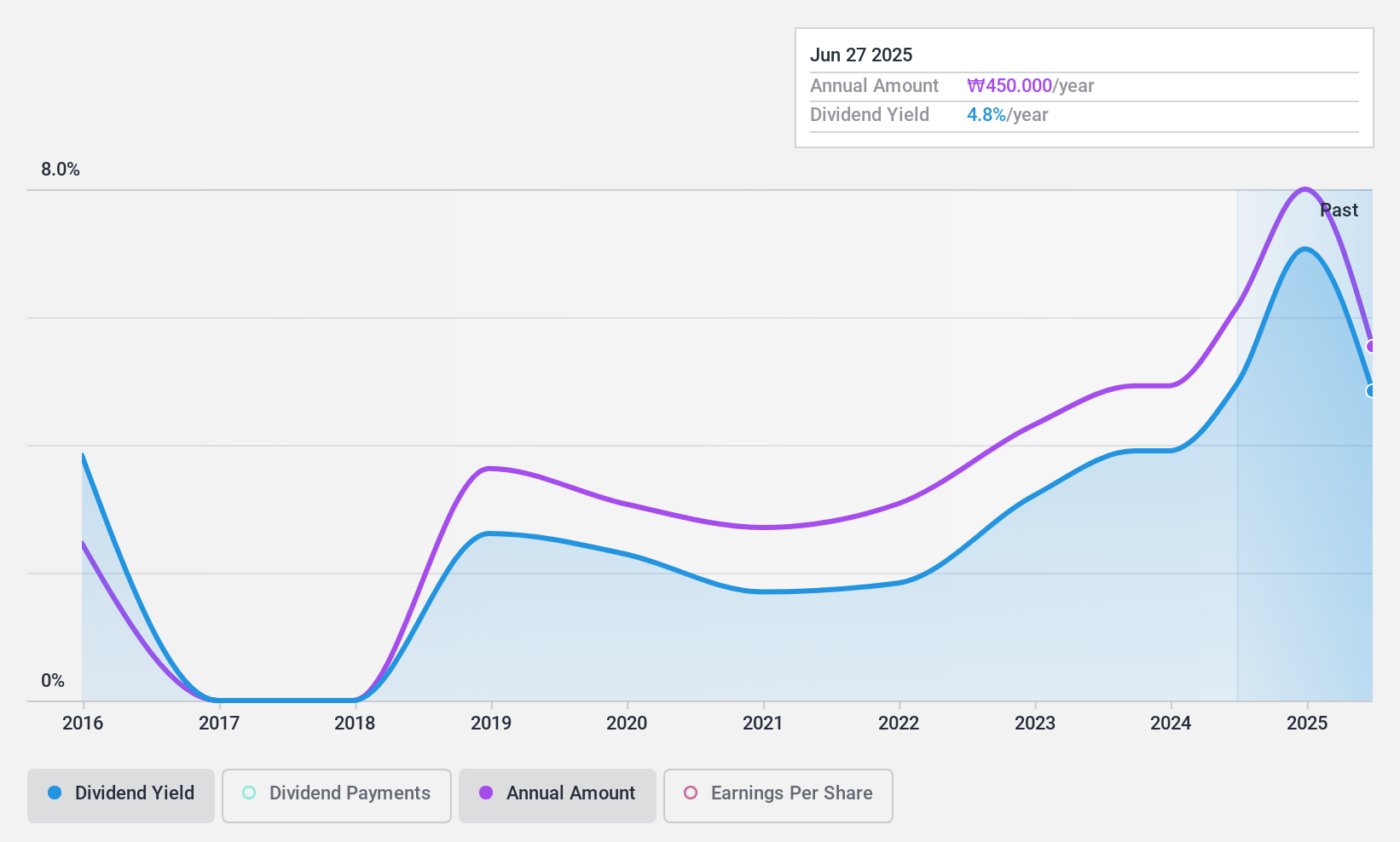

Kyung Nong (KOSE:A002100)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kyung Nong Corporation is involved in the manufacture and sale of agricultural chemicals in South Korea, with a market cap of ₩161.68 billion.

Operations: Kyung Nong Corporation generates revenue primarily from its Agrochemical segment, amounting to ₩207.09 billion, and its Fertilizer Business segment, contributing ₩108.15 billion.

Dividend Yield: 7.2%

Kyung Nong's dividend yield of 7.18% ranks in the top 25% of the Korean market, suggesting an attractive income opportunity despite a volatile history with dividends not consistently growing over the past decade. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 70.4% and 43.2%, respectively, indicating sustainability. However, its unstable track record may concern investors seeking reliable income streams.

- Navigate through the intricacies of Kyung Nong with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Kyung Nong's current price could be quite moderate.

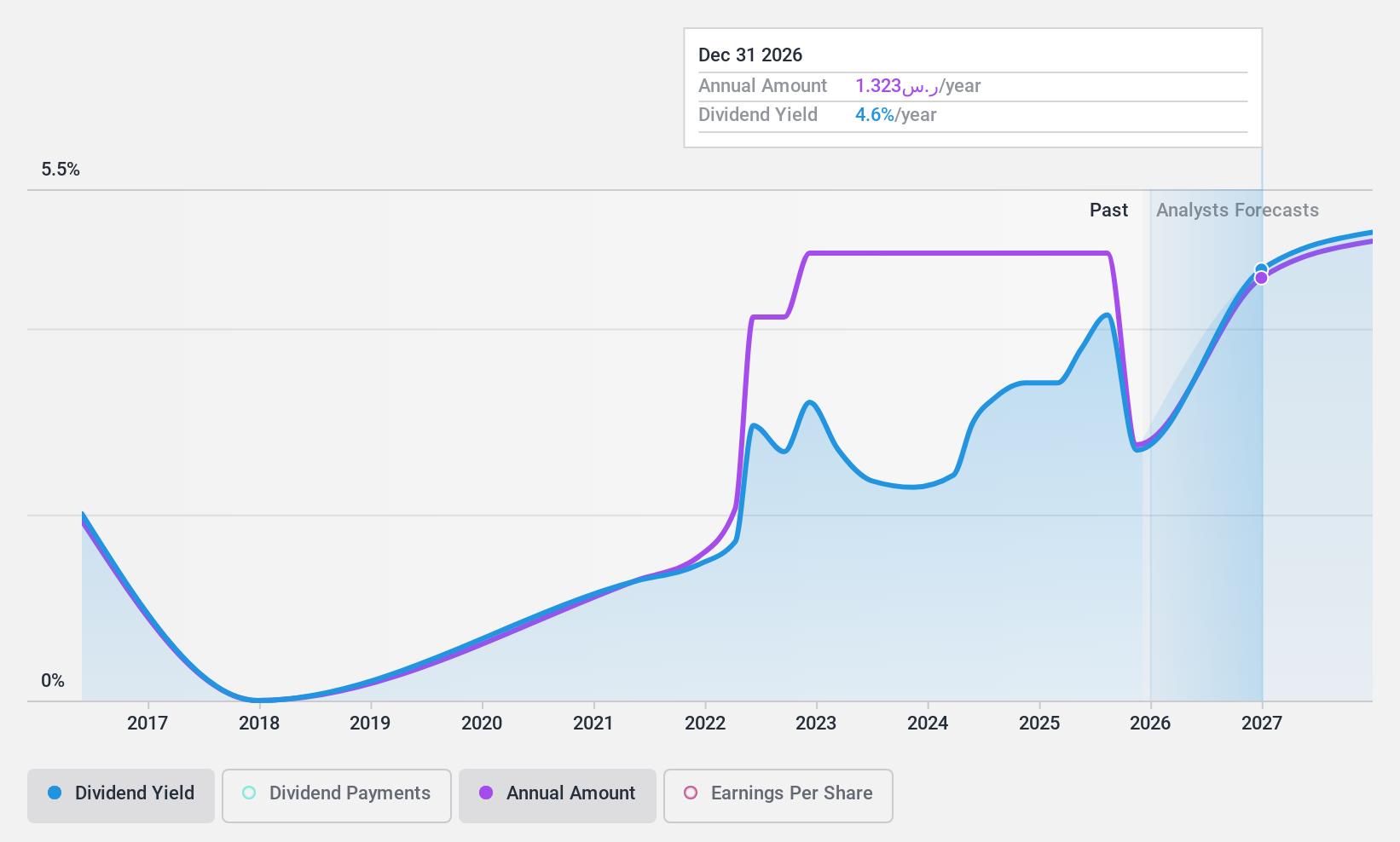

Al Hammadi Holding (SASE:4007)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al Hammadi Holding Company is a healthcare group that offers a range of medical services in the Kingdom of Saudi Arabia, with a market cap of SAR6.16 billion.

Operations: Al Hammadi Holding Company generates revenue through its Medical Services segment, contributing SAR935.68 million, and its Pharmaceutical Products segment, adding SAR199.10 million.

Dividend Yield: 3.6%

Al Hammadi Holding's dividend yield of 3.64% is below the top 25% of dividend payers in Saudi Arabia, and its dividends have been volatile over the past decade. Despite this, dividends are covered by earnings and cash flows with payout ratios of 68.7% and 60.1%, respectively, indicating sustainability. The stock trades at a good value compared to peers and industry standards, though its unstable dividend history may deter income-focused investors seeking reliability.

- Take a closer look at Al Hammadi Holding's potential here in our dividend report.

- Upon reviewing our latest valuation report, Al Hammadi Holding's share price might be too pessimistic.

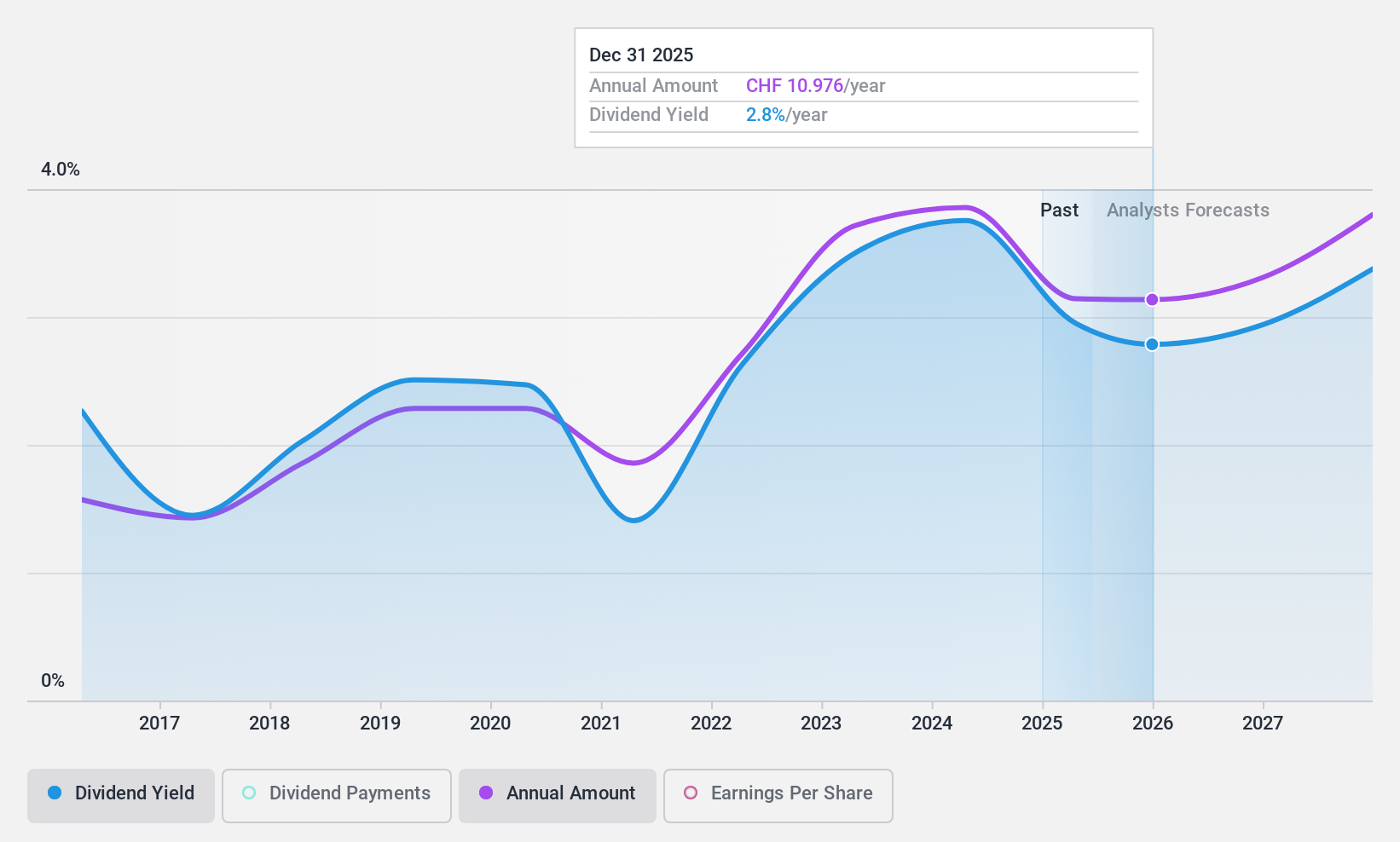

Bucher Industries (SWX:BUCN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bucher Industries AG manufactures and sells machinery, systems, and hydraulic components for various industries including agriculture and public safety across global markets, with a market cap of CHF3.36 billion.

Operations: Bucher Industries AG's revenue segments include Kuhn Group (CHF1.27 billion), Bucher Specials (CHF373.90 million), Bucher Municipal (CHF593.40 million), Bucher Hydraulics (CHF699.20 million), and Bucher Emhart Glass (CHF502.10 million).

Dividend Yield: 4.1%

Bucher Industries offers a 4.11% dividend yield, slightly below the top tier in the Swiss market. While dividends have been stable and growing over the past decade, their sustainability is questionable due to a high cash payout ratio of 102.5%, indicating they are not well covered by free cash flows. However, with a low earnings payout ratio of 46.4%, dividends are covered by profits. The stock trades at good value relative to peers and fair value estimates.

- Dive into the specifics of Bucher Industries here with our thorough dividend report.

- According our valuation report, there's an indication that Bucher Industries' share price might be on the cheaper side.

Seize The Opportunity

- Get an in-depth perspective on all 1972 Top Dividend Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyung Nong might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A002100

Kyung Nong

Engages in the manufacture and sale of agricultural chemicals in South Korea.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives