- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A101490

Top Growth Companies With Insider Ownership In February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and mixed economic signals, investors are keenly observing how these factors influence market indices and broader economic trends. In such an environment, growth companies with significant insider ownership often attract attention due to their potential alignment of interests between management and shareholders, which can be particularly appealing when navigating volatile market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Pharma Mar (BME:PHM) | 11.9% | 44.7% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 101% |

Let's review some notable picks from our screened stocks.

S&S Tech (KOSDAQ:A101490)

Simply Wall St Growth Rating: ★★★★★★

Overview: S&S Tech Corporation manufactures and sells blank masks globally, with a market cap of ₩637.72 billion.

Operations: Revenue segments include ₩1.56 billion from S&S Lab Co., Ltd., ₩158.48 billion from S&S Tech Co., Ltd., and ₩10.65 billion from S&S Investment Co., Ltd.

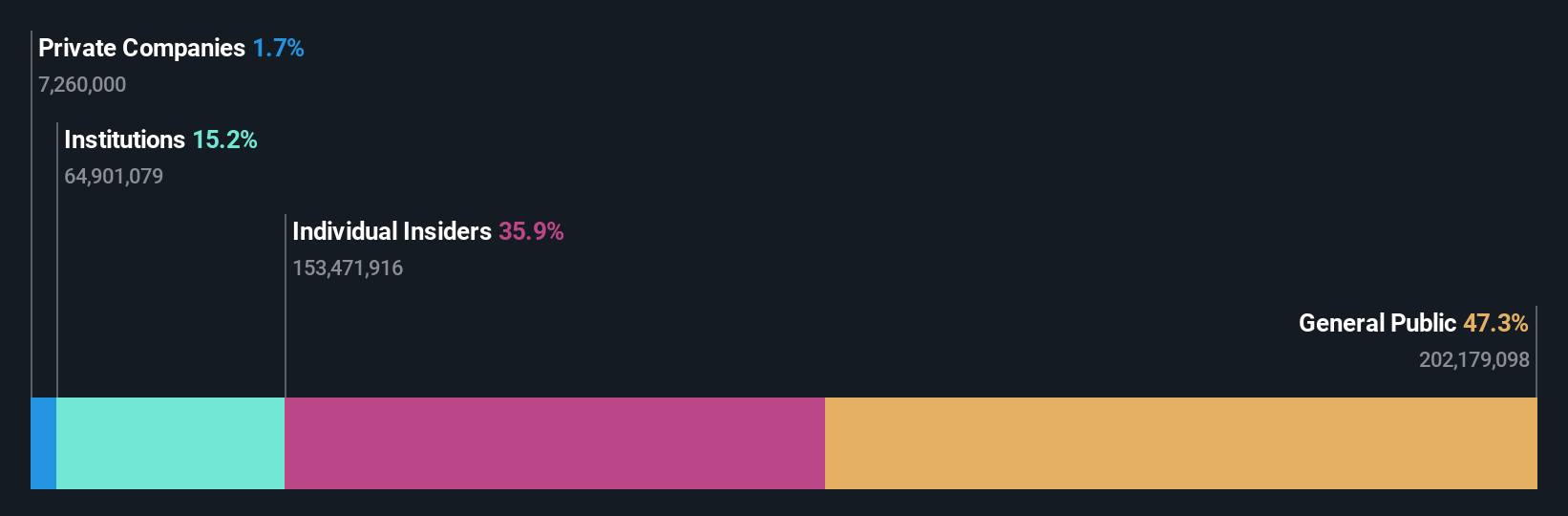

Insider Ownership: 23.2%

Revenue Growth Forecast: 35.1% p.a.

S&S Tech demonstrates strong growth potential with forecasted earnings growth of 45% annually, outpacing the KR market's 27%. Revenue is expected to increase by 35.1% per year, significantly above the market average. Insider ownership remains high, although recent buybacks have not included additional insider purchases. The company completed a share repurchase program totaling KRW 4.73 billion, enhancing shareholder value amidst robust financial performance and substantial net income growth in recent quarters.

- Dive into the specifics of S&S Tech here with our thorough growth forecast report.

- Our expertly prepared valuation report S&S Tech implies its share price may be too high.

Tianyang New Materials (Shanghai) Technology (SHSE:603330)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tianyang New Materials (Shanghai) Technology Co., Ltd. operates in the materials technology sector and has a market cap of CN¥2.93 billion.

Operations: Tianyang New Materials (Shanghai) Technology Co., Ltd. does not have specific revenue segments listed in the provided text.

Insider Ownership: 36.5%

Revenue Growth Forecast: 27.4% p.a.

Tianyang New Materials (Shanghai) Technology is expected to achieve profitability within three years, with earnings projected to grow 170.04% annually. Revenue growth at 27.4% per year surpasses the Chinese market average of 13.5%. Despite high growth forecasts, the share price has been volatile recently, and its dividend yield of 1.13% lacks coverage by earnings or free cash flows. Recent insider trading activity shows no substantial buying or selling over the past three months.

- Click here to discover the nuances of Tianyang New Materials (Shanghai) Technology with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Tianyang New Materials (Shanghai) Technology is trading beyond its estimated value.

Money Forward (TSE:3994)

Simply Wall St Growth Rating: ★★★★☆☆

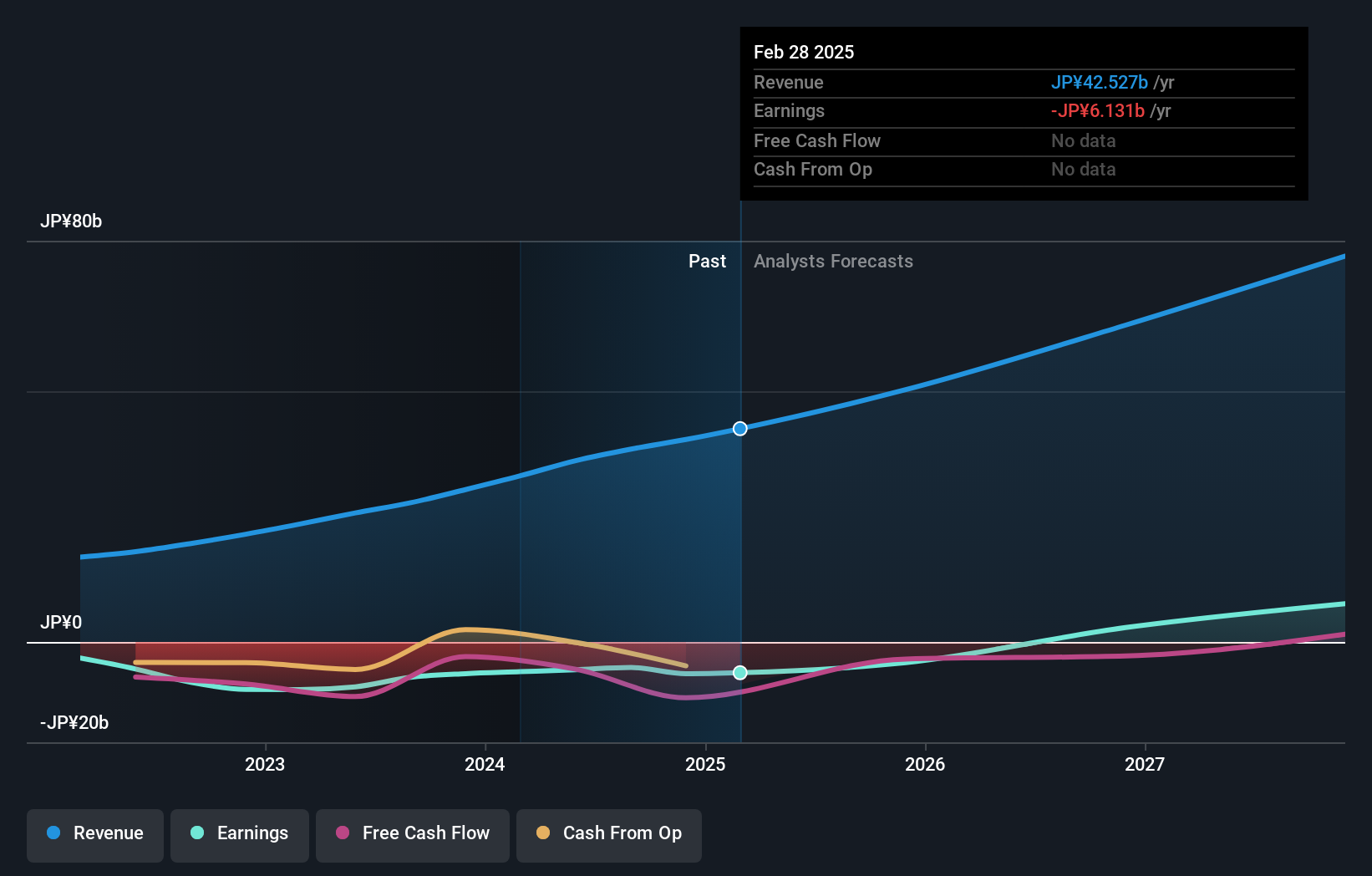

Overview: Money Forward, Inc. offers financial solutions for individuals, financial institutions, and corporations mainly in Japan with a market cap of ¥245.17 billion.

Operations: The company's revenue is primarily generated from its Platform Services Business, amounting to ¥40.36 billion.

Insider Ownership: 21.2%

Revenue Growth Forecast: 19% p.a.

Money Forward is forecast to achieve profitability within three years, with earnings expected to grow 58.72% annually. Revenue growth at 19% per year outpaces the Japanese market average of 4.2%. The stock trades at a significant discount to its estimated fair value and analysts predict a potential price increase of 38.4%. Recent developments include proposed amendments to the Articles of Incorporation and financial forecasts indicating net sales between ¥50 billion and ¥52.60 billion for FY2025.

- Click here and access our complete growth analysis report to understand the dynamics of Money Forward.

- Insights from our recent valuation report point to the potential undervaluation of Money Forward shares in the market.

Turning Ideas Into Actions

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1436 more companies for you to explore.Click here to unveil our expertly curated list of 1439 Fast Growing Companies With High Insider Ownership.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A101490

Flawless balance sheet with solid track record.

Market Insights

Community Narratives