Undiscovered Gems With Strong Fundamentals To Explore January 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by resilient labor markets, inflation concerns, and political uncertainty, small-cap stocks have notably underperformed their large-cap counterparts, with the Russell 2000 Index entering correction territory. Amid this backdrop of volatility and investor caution, identifying stocks with strong fundamentals becomes crucial for those seeking potential opportunities in the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 23.14% | -3.64% | 30.64% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ASRock Rack Incorporation | NA | 45.76% | 269.05% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Co-Tech Development | 26.81% | 3.29% | 6.53% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

PSK HOLDINGS (KOSDAQ:A031980)

Simply Wall St Value Rating: ★★★★★☆

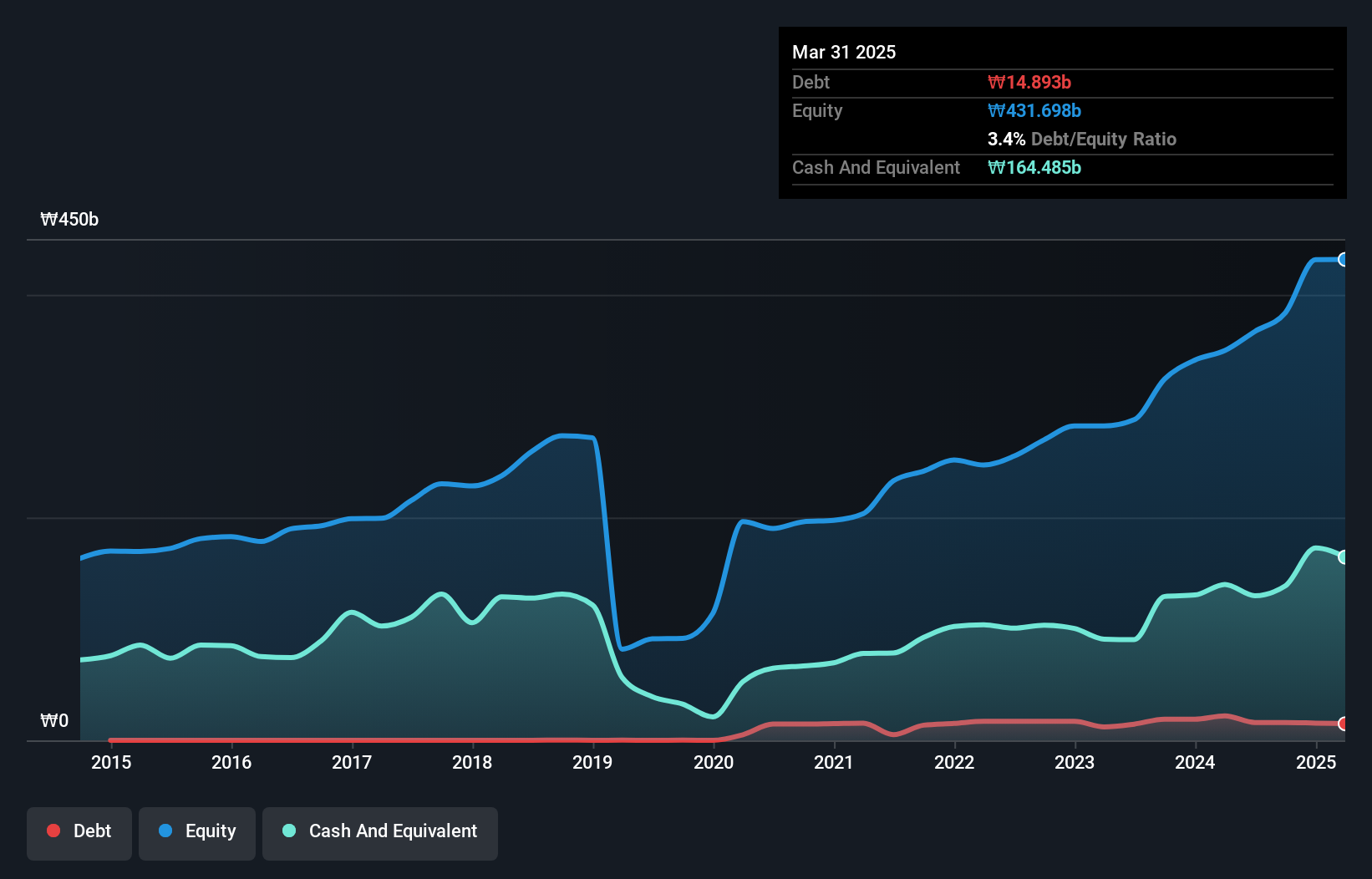

Overview: PSK HOLDINGS Inc. is a global manufacturer and seller of semiconductor manufacturing and flat panel display equipment with a market cap of ₩1.07 trillion.

Operations: PSK HOLDINGS generates revenue primarily from semiconductor manufacturing equipment, amounting to ₩157.18 billion.

PSK Holdings, a small player in the semiconductor space, has shown impressive earnings growth of 89% over the past year, surpassing the industry average of 7%. Despite a large one-off gain of ₩27.1 billion affecting its recent results, its price-to-earnings ratio stands at 15.6x, undercutting the industry norm of 17.2x. The company is profitable and not burdened by debt concerns as it holds more cash than total debt; however, its share price has been highly volatile recently. Looking ahead, earnings are projected to grow at an annual rate of 10.81%, suggesting potential for future value creation.

- Click to explore a detailed breakdown of our findings in PSK HOLDINGS' health report.

Gain insights into PSK HOLDINGS' past trends and performance with our Past report.

Star Lake BioscienceZhaoqing Guangdong (SHSE:600866)

Simply Wall St Value Rating: ★★★★★☆

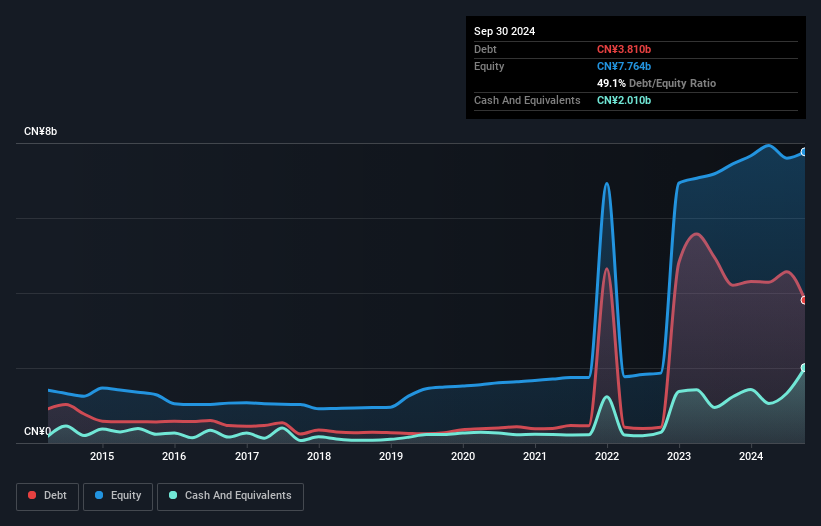

Overview: Star Lake Bioscience Co., Inc. Zhaoqing Guangdong is involved in the production and distribution of pharmaceutical raw materials, as well as food and feed additives, under the Star Lake and Yue Bao brands both in China and abroad, with a market capitalization of CN¥10.09 billion.

Operations: Star Lake Bioscience generates revenue primarily from the sale of pharmaceutical raw materials and food and feed additives. The company has a market capitalization of CN¥10.09 billion.

Star Lake Bioscience, a smaller player in its field, has shown notable financial performance recently. Over the past year, earnings grew by 44.9%, outpacing the broader food industry which saw a -5.8% change. The company's debt to equity ratio rose from 18.3% to 49.1% over five years, yet interest payments are well covered with an EBIT coverage of 12.1 times, indicating solid financial management despite higher leverage. With net income climbing to CNY 677 million for nine months ending September 2024 and basic EPS improving from CNY 0.29 to CNY 0.41, Star Lake seems poised for continued growth amidst competitive pressures.

- Unlock comprehensive insights into our analysis of Star Lake BioscienceZhaoqing Guangdong stock in this health report.

Understand Star Lake BioscienceZhaoqing Guangdong's track record by examining our Past report.

Jiangsu Rutong Petro-Machinery (SHSE:603036)

Simply Wall St Value Rating: ★★★★★★

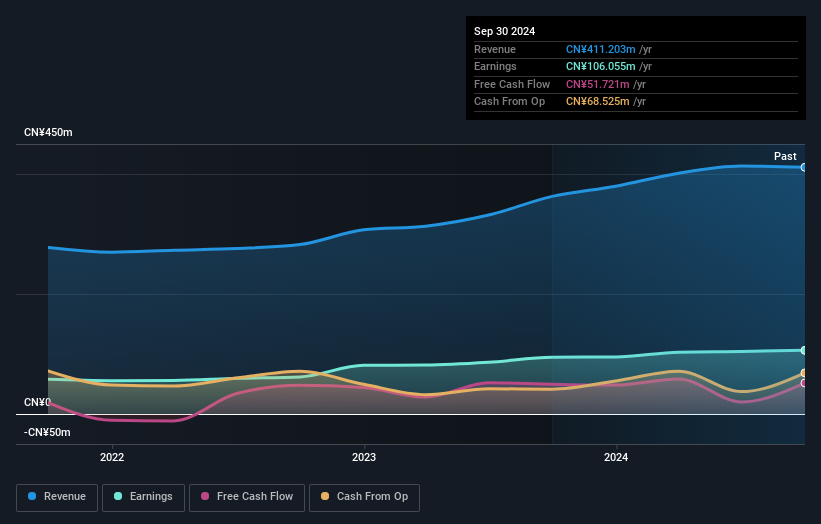

Overview: Jiangsu Rutong Petro-Machinery Co., Ltd is involved in the research, development, manufacturing, and sale of oil drilling and production equipment and tools with a market cap of CN¥3.29 billion.

Operations: Rutong Petro-Machinery generates revenue primarily from its oil drilling equipment segment, totaling CN¥411.20 million. The company focuses on this specific product line for its income stream.

Jiangsu Rutong Petro-Machinery stands out in the energy services sector with earnings growth of 12.1%, surpassing the industry average of 7.6%. The company reported a revenue increase to CNY 288.78 million for the first nine months of 2024, up from CNY 257.28 million last year, and net income rose to CNY 71.2 million from CNY 60.26 million, suggesting robust operational performance. With no debt over the past five years and a price-to-earnings ratio of 32x below the CN market's average, it appears well-positioned financially and offers high-quality earnings without concerns over interest payments or cash runway issues.

Make It Happen

- Discover the full array of 4631 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600866

Star Lake BioscienceZhaoqing Guangdong

Engages in the manufacture and sale of pharmaceutical raw materials, and food and feed additives under the Star Lake and Yue Bao brand names in China and internationally.

Undervalued with solid track record and pays a dividend.