In the current global market landscape, small-cap stocks have been under pressure, with the Russell 2000 Index dipping into correction territory amid inflation concerns and political uncertainties. Despite this challenging environment, value stocks have shown resilience compared to their growth counterparts, suggesting potential opportunities for discerning investors. In such a climate, identifying promising stocks involves looking for companies with strong fundamentals that can withstand economic fluctuations and capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ASRock Rack Incorporation | NA | 45.76% | 269.05% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Alembic | 0.72% | 21.20% | -6.80% | ★★★★★☆ |

| Wealth First Portfolio Managers | 4.08% | -43.42% | 42.63% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Sinopec Kantons Holdings (SEHK:934)

Simply Wall St Value Rating: ★★★★★★

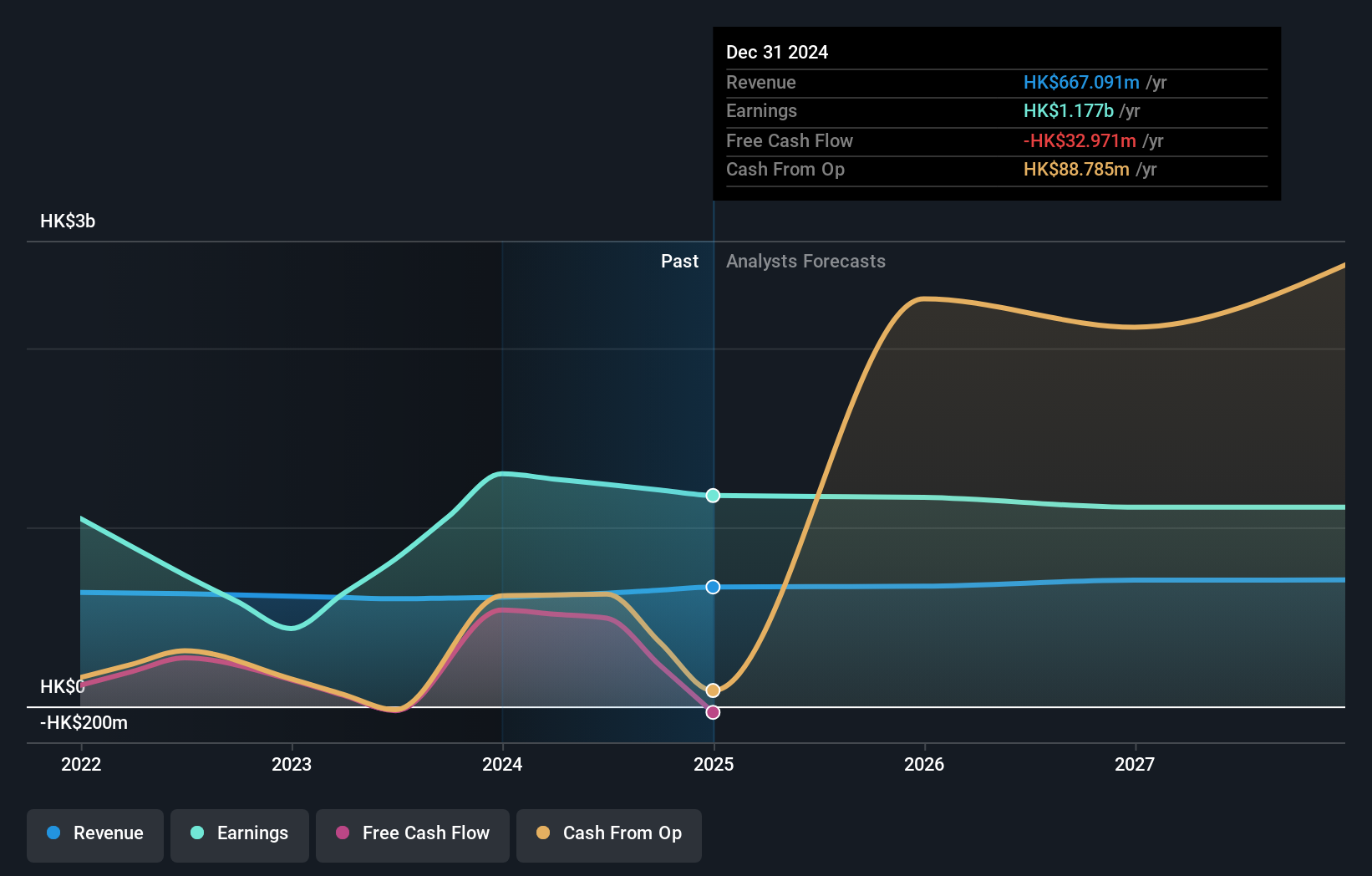

Overview: Sinopec Kantons Holdings Limited is an investment holding company that offers crude oil jetty services, with a market capitalization of approximately HK$10.99 billion.

Operations: The company generates revenue primarily from its crude oil jetty and storage services, amounting to HK$632.38 million.

Sinopec Kantons Holdings, a small player in the oil and gas sector, is trading at 61.8% below its estimated fair value. The company has no debt now compared to five years ago when its debt-to-equity ratio stood at 25.5%, indicating prudent financial management. Earnings have surged by 50.8% over the past year, outpacing the industry's -0.9%, showcasing robust performance against peers. With high-quality past earnings and free cash flow positivity, Sinopec Kantons seems well-positioned for growth with earnings forecasted to increase by 5.83% annually, reflecting potential for continued expansion in its market segment.

Fujian Start GroupLtd (SHSE:600734)

Simply Wall St Value Rating: ★★★★☆☆

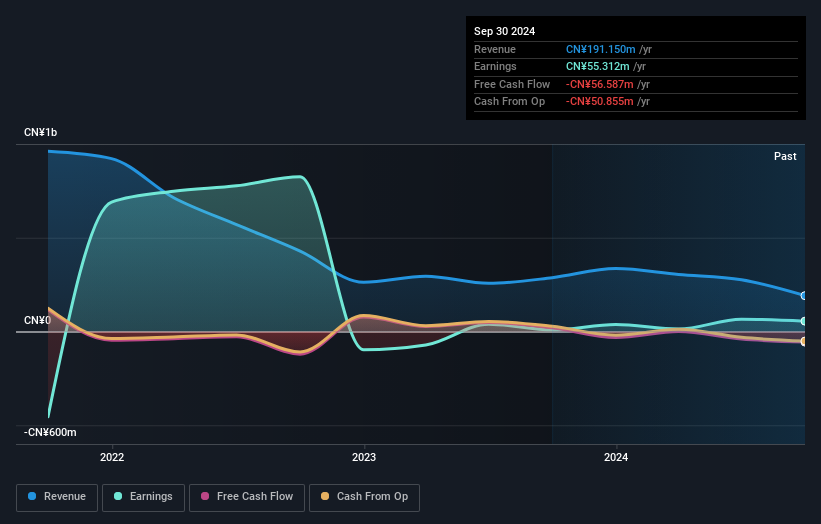

Overview: Fujian Start Group Co. Ltd specializes in providing anti-intrusion detection systems in China and has a market cap of CN¥7.82 billion.

Operations: Fujian Start Group Co. Ltd generates its revenue primarily from the sale of anti-intrusion detection systems in China.

Fujian Start Group, a smaller player in the tech sector, has seen remarkable earnings growth of 532.7% over the past year, outpacing the industry average of 3%. Despite this impressive performance, their revenue for the first nine months of 2024 was CNY 63.49 million, significantly lower than last year's CNY 207.82 million. The company is profitable with more cash than total debt and a reduced debt-to-equity ratio from 74.2% to 35.8% over five years. However, their free cash flow remains negative and interest coverage data is insufficient for clarity on financial obligations management.

Jiangsu SOPO Chemical (SHSE:600746)

Simply Wall St Value Rating: ★★★★★☆

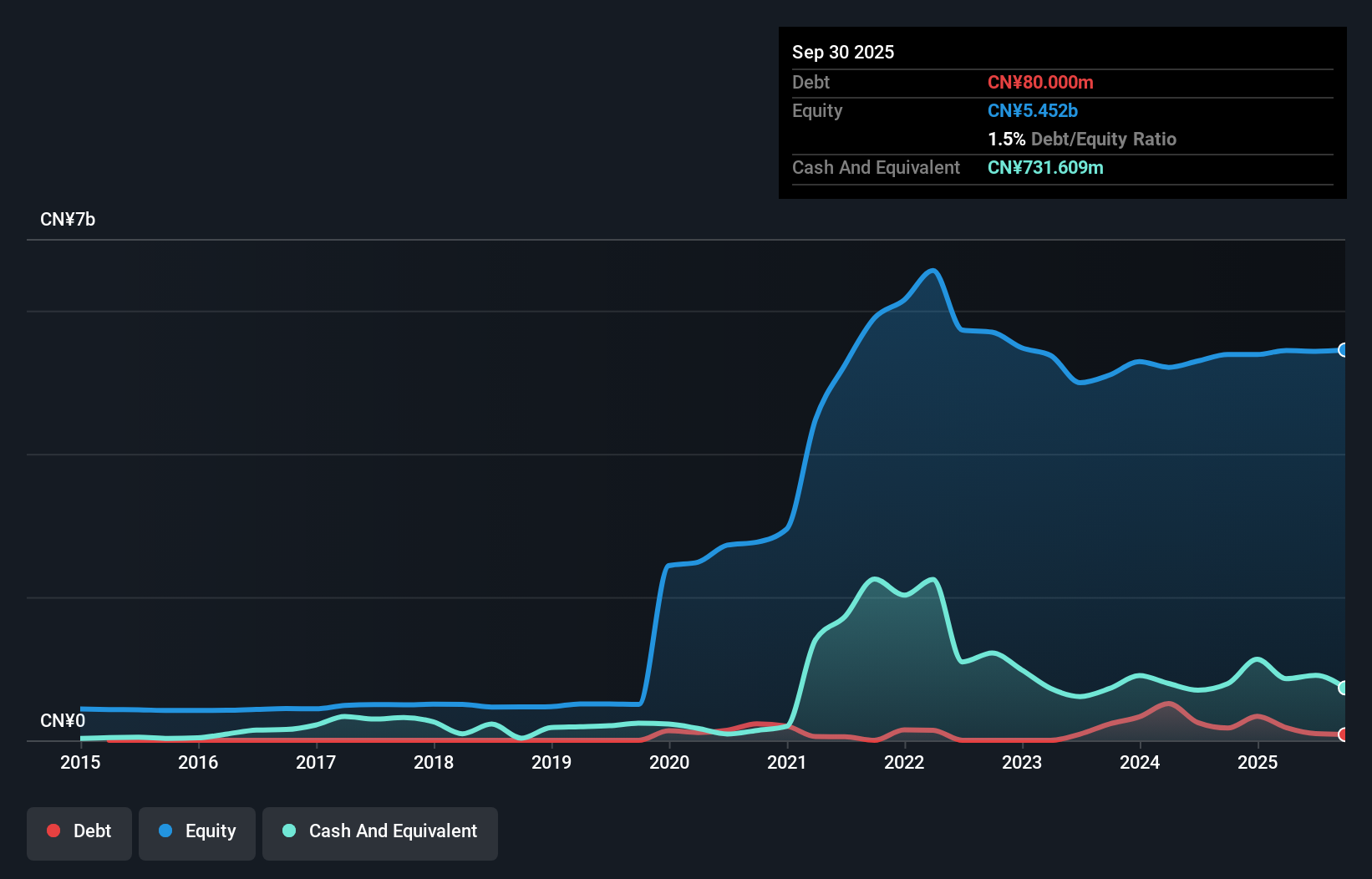

Overview: Jiangsu SOPO Chemical Co. Ltd. is engaged in the manufacturing and sale of chemical products both in China and internationally, with a market capitalization of approximately CN¥7.83 billion.

Operations: Jiangsu SOPO Chemical generates revenue primarily from the sale of chemical products, amounting to CN¥6.42 billion. The company's market capitalization is approximately CN¥7.83 billion.

Jiangsu SOPO Chemical, a promising player in the chemical sector, has recently turned profitable, contrasting with the industry's -5% earnings trend. With a debt to equity ratio rising to 3.2% over five years, it still manages more cash than total debt. The company repurchased 446,374 shares for CNY 3.29 million in late 2024 and completed a larger buyback of 15.73 million shares for CNY 86.74 million earlier that year. Its net income reached CNY 207 million from a previous loss of CNY 148 million, while sales climbed to CNY 4.94 billion from CNY 3.92 billion year-over-year.

- Unlock comprehensive insights into our analysis of Jiangsu SOPO Chemical stock in this health report.

Understand Jiangsu SOPO Chemical's track record by examining our Past report.

Key Takeaways

- Explore the 4630 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Jiangsu SOPO Chemical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600746

Jiangsu SOPO Chemical

Engages in the manufacture and sale of chemical products in China and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives