- China

- /

- Auto Components

- /

- SZSE:002048

3 Reliable Dividend Stocks Yielding Up To 5%

Reviewed by Simply Wall St

In the midst of a choppy start to the year for global markets, characterized by inflation fears and political uncertainty impacting U.S. equities, investors are seeking stability in their portfolios. As interest rates remain high and economic data points to persistent inflationary pressures, dividend stocks can offer a reliable income stream amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.01% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.53% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.96% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.93% | ★★★★★★ |

Click here to see the full list of 1996 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Guangzhou Restaurant Group (SHSE:603043)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Guangzhou Restaurant Group Company Limited operates in the food manufacturing and catering sectors both within China and internationally, with a market cap of CN¥8.70 billion.

Operations: Guangzhou Restaurant Group Company Limited generates its revenue through its food manufacturing and catering businesses, with a market cap of CN¥8.70 billion.

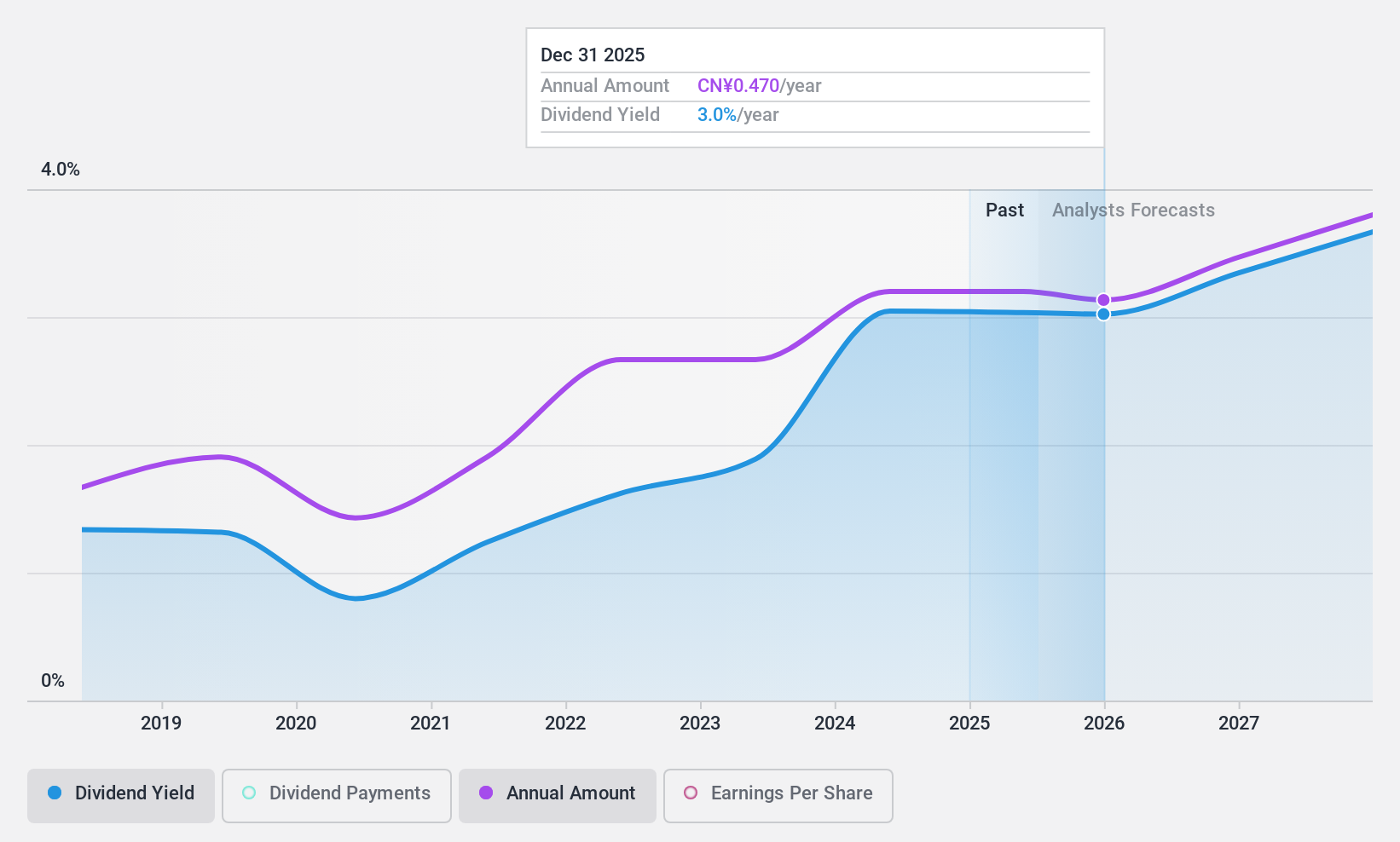

Dividend Yield: 3.1%

Guangzhou Restaurant Group's dividend payments are covered by earnings and cash flows, with payout ratios of 53.9% and 45.4%, respectively. The company offers a competitive dividend yield of 3.07%, placing it in the top 25% within the Chinese market. However, its seven-year dividend history is marked by volatility and unreliability, with periods of significant drops exceeding 20%. Recent earnings show declining net income despite increased sales, raising concerns about sustainability.

- Get an in-depth perspective on Guangzhou Restaurant Group's performance by reading our dividend report here.

- Our valuation report here indicates Guangzhou Restaurant Group may be undervalued.

JinGuan Electric (SHSE:688517)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jinguan Electric Co., Ltd. focuses on the research, development, and manufacture of lightning arresters in China, with a market cap of CN¥1.75 billion.

Operations: Jinguan Electric Co., Ltd. generates revenue primarily from its Electric Equipment segment, amounting to CN¥681.61 million.

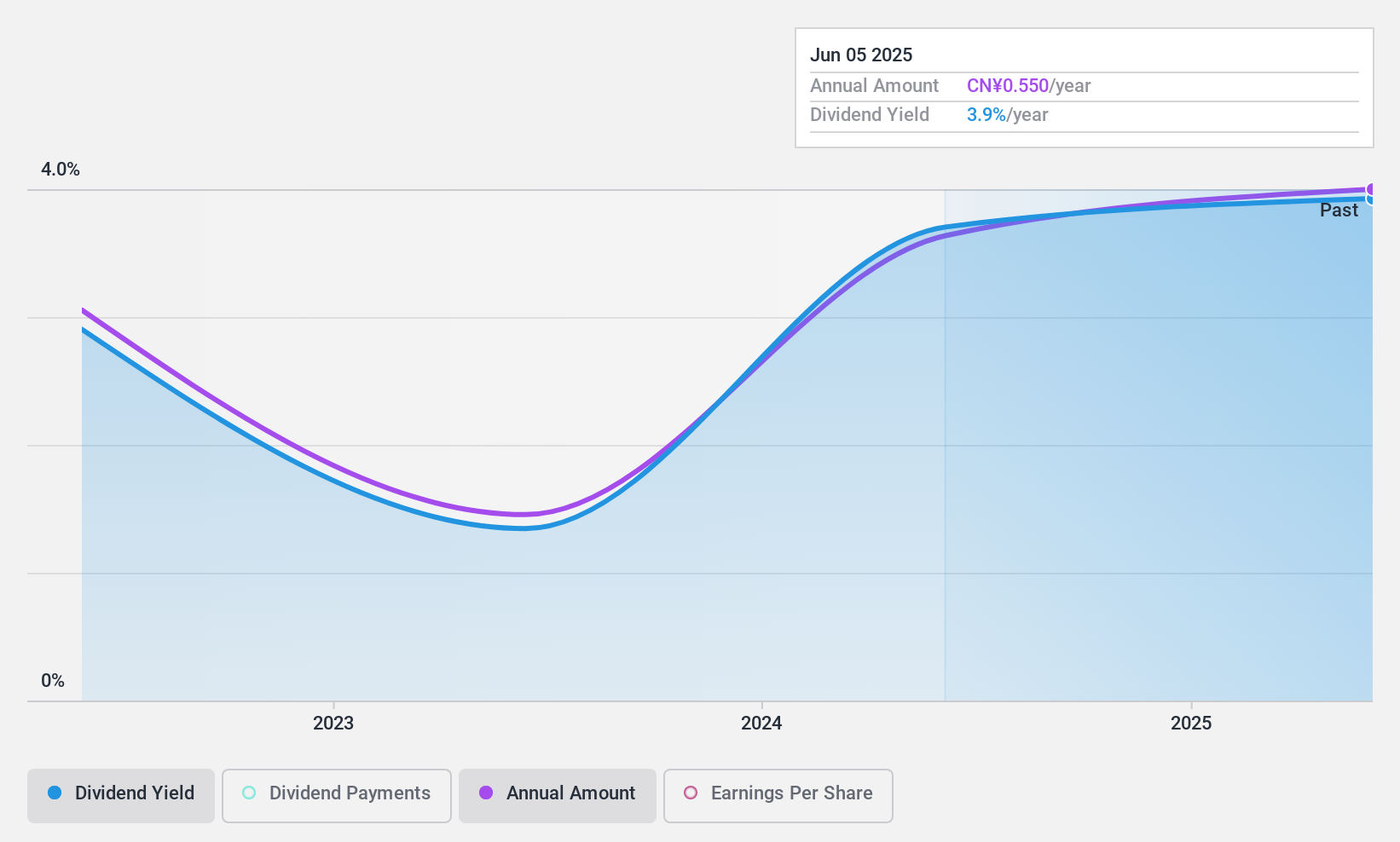

Dividend Yield: 3.9%

JinGuan Electric's dividend yield of 3.86% ranks in the top 25% of the Chinese market, supported by a payout ratio of 68.3% and cash payout ratio of 51.9%, indicating coverage by earnings and cash flows. However, its three-year dividend history shows volatility with significant drops over 20%. Recent financials reveal increased revenue to CNY 469.17 million and net income to CNY 66.23 million for nine months ending September 2024, suggesting potential stability improvements.

- Unlock comprehensive insights into our analysis of JinGuan Electric stock in this dividend report.

- The valuation report we've compiled suggests that JinGuan Electric's current price could be quite moderate.

Ningbo Huaxiang Electronic (SZSE:002048)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ningbo Huaxiang Electronic Co., Ltd. is engaged in the design, development, production, and sale of auto parts both within China and internationally, with a market capitalization of CN¥9.89 billion.

Operations: Ningbo Huaxiang Electronic Co., Ltd. generates revenue of CN¥24.97 billion from its Automobile Accessories segment.

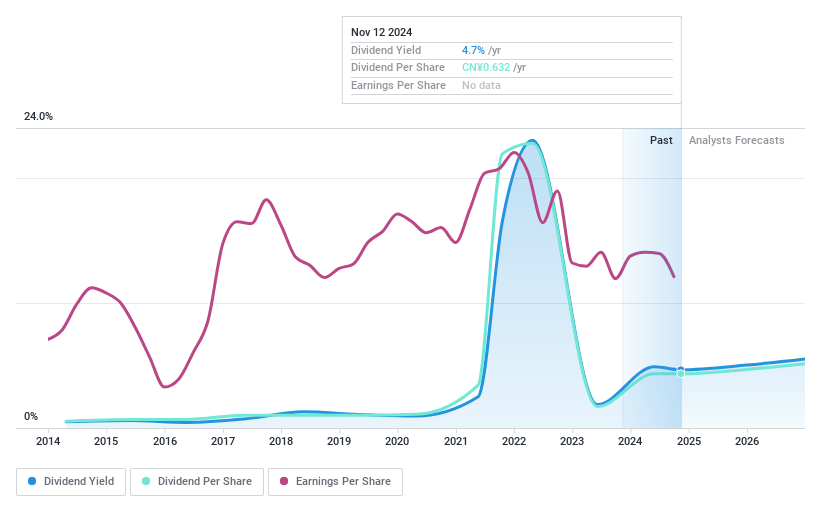

Dividend Yield: 5.1%

Ningbo Huaxiang Electronic offers a 5.06% dividend yield, ranking in the top 25% of the Chinese market, yet its high cash payout ratio of 264.8% indicates insufficient coverage by free cash flows. Despite a reasonable earnings payout ratio of 56.9%, dividends have been volatile over the past decade. Recent financials show increased sales to CNY 18.14 billion but a decline in net income to CNY 716.76 million for nine months ending September 2024, reflecting potential challenges in sustaining payouts.

- Click here to discover the nuances of Ningbo Huaxiang Electronic with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Ningbo Huaxiang Electronic shares in the market.

Seize The Opportunity

- Take a closer look at our Top Dividend Stocks list of 1996 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Huaxiang Electronic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002048

Ningbo Huaxiang Electronic

Designs, develops, produces, and sells auto parts in the People’s Republic of China and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives