- South Korea

- /

- Pharma

- /

- KOSE:A326030

Three Stocks Conceivably Priced Below Estimated Value In January 2025

Reviewed by Simply Wall St

As we close out 2024, global markets have exhibited mixed signals with moderate gains in major stock indexes despite declining consumer confidence and manufacturing data. Amid these fluctuations, investors are increasingly on the lookout for stocks that may be undervalued relative to their intrinsic worth, presenting potential opportunities for those who can identify companies with strong fundamentals not yet fully reflected in their current market prices.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Globetronics Technology Bhd (KLSE:GTRONIC) | MYR0.585 | MYR1.17 | 49.9% |

| Decisive Dividend (TSXV:DE) | CA$5.93 | CA$11.83 | 49.9% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.77 | €5.51 | 49.7% |

| Cettire (ASX:CTT) | A$1.51 | A$3.02 | 50% |

| Charter Hall Group (ASX:CHC) | A$14.35 | A$28.66 | 49.9% |

| Medley (TSE:4480) | ¥3835.00 | ¥7645.06 | 49.8% |

| Ally Financial (NYSE:ALLY) | US$36.01 | US$71.77 | 49.8% |

| Progress Software (NasdaqGS:PRGS) | US$65.15 | US$129.87 | 49.8% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.45 | NZ$2.89 | 49.8% |

Let's uncover some gems from our specialized screener.

UPM-Kymmene Oyj (HLSE:UPM)

Overview: UPM-Kymmene Oyj, along with its subsidiaries, operates in the forest-based bioindustry across Europe, North America, Asia, and internationally with a market cap of €14.17 billion.

Operations: The company's revenue segments include UPM Energy (€658 million), UPM Fibres (€3.51 billion), UPM Plywood (€412 million), UPM Raflatac (€1.55 billion), UPM Specialty Papers (€1.47 billion), and UPM Communication Papers (€3.06 billion).

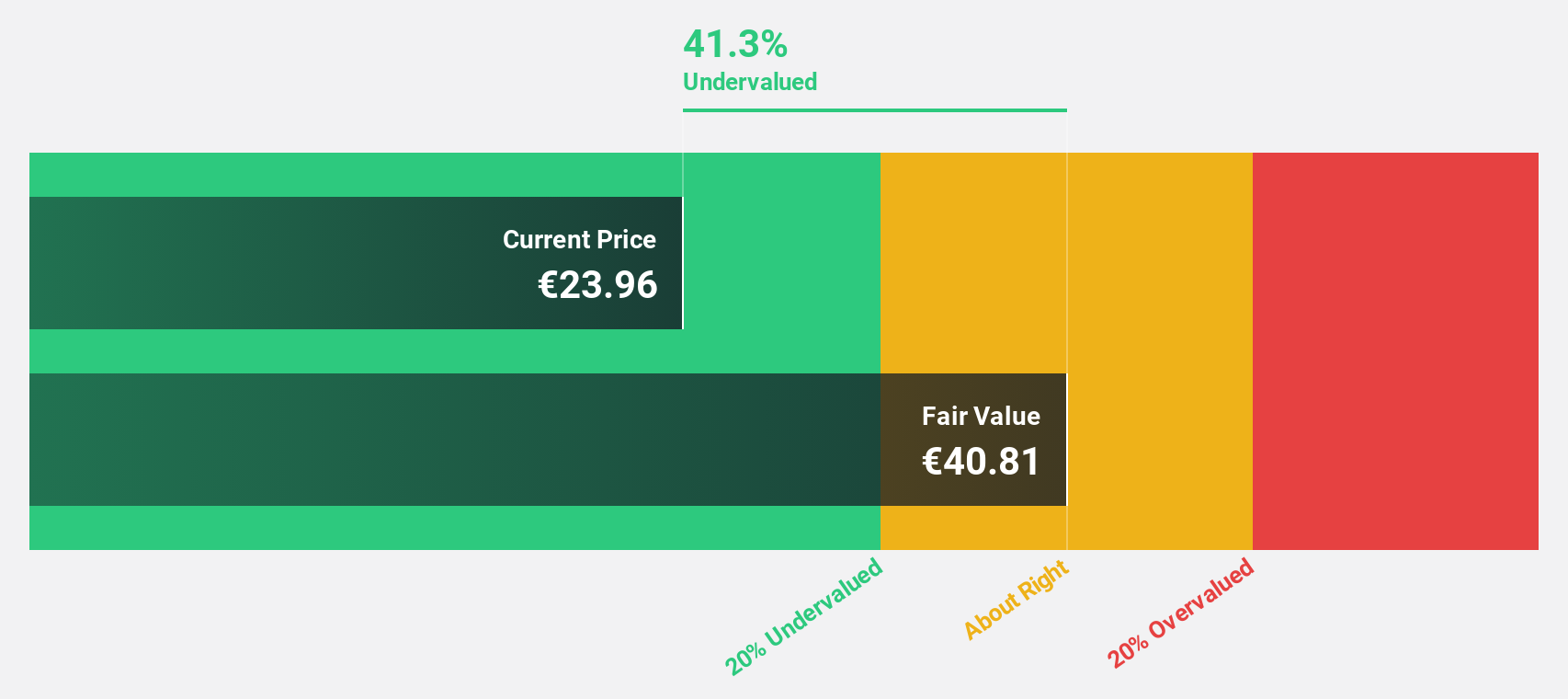

Estimated Discount To Fair Value: 27.9%

UPM-Kymmene Oyj appears undervalued based on cash flow analysis, trading at €26.56, significantly below its estimated fair value of €36.86. Despite recent earnings volatility with large one-off items impacting results, UPM's earnings are expected to grow significantly over the next three years at 22.62% annually, outpacing the Finnish market. Strategic initiatives like exploring agroforestry concepts and seeking inorganic growth opportunities may bolster future cash flows and reinforce long-term competitiveness amidst evolving executive leadership changes.

- Our earnings growth report unveils the potential for significant increases in UPM-Kymmene Oyj's future results.

- Click to explore a detailed breakdown of our findings in UPM-Kymmene Oyj's balance sheet health report.

SK Biopharmaceuticals (KOSE:A326030)

Overview: SK Biopharmaceuticals Co., Ltd. is a pharmaceutical company focused on researching and developing drugs for central nervous system disorders, with a market cap of ₩8.70 trillion.

Operations: The company's revenue primarily comes from its new drug development segment, amounting to ₩511.33 million.

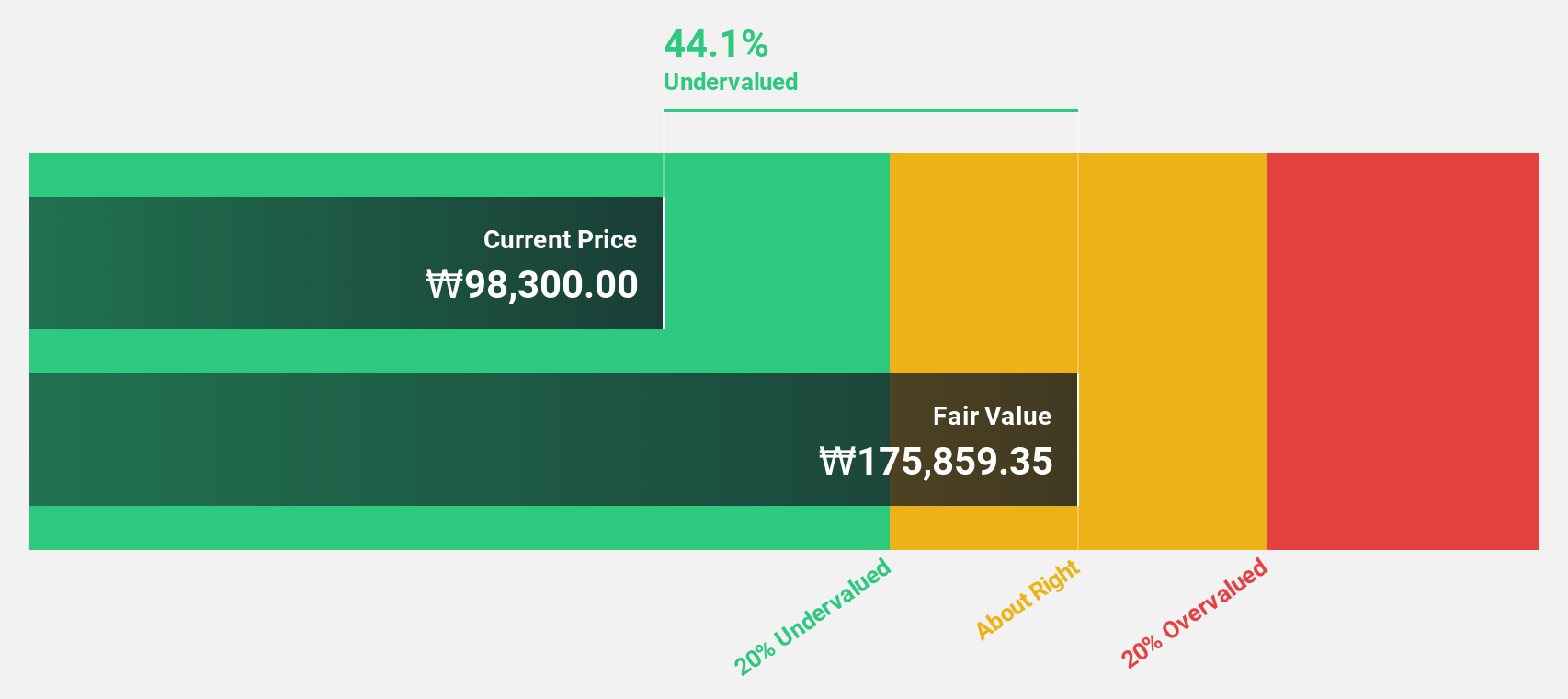

Estimated Discount To Fair Value: 44.1%

SK Biopharmaceuticals, trading at ₩111,100, is significantly undervalued based on cash flow analysis with an estimated fair value of ₩198,795.73. The company's earnings and revenue are forecast to grow over 50% annually in the next three years, outpacing the Korean market. Recent strategic alliances aim to enhance its radiopharmaceutical therapy pipeline by 2027 through collaborations and supply agreements for critical radioisotopes, potentially boosting future cash flows and competitive positioning in nuclear medicine.

- Our growth report here indicates SK Biopharmaceuticals may be poised for an improving outlook.

- Get an in-depth perspective on SK Biopharmaceuticals' balance sheet by reading our health report here.

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global technology, defence, and engineering company with a market cap of SGD14.51 billion.

Operations: The company generates revenue from three main segments: Commercial Aerospace (SGD4.34 billion), Urban Solutions & Satcom (SGD2.01 billion), and Defence & Public Security (SGD4.54 billion).

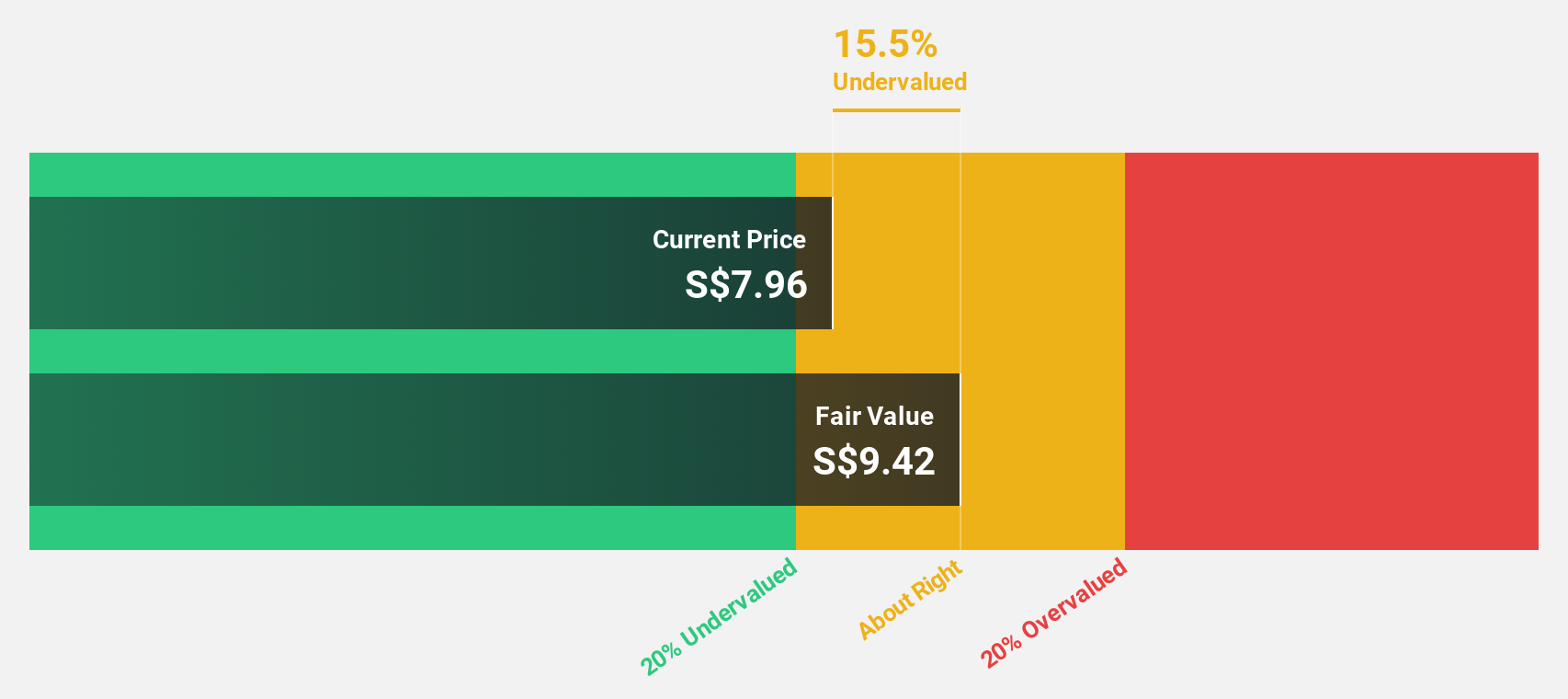

Estimated Discount To Fair Value: 37.9%

Singapore Technologies Engineering is trading at S$4.66, significantly below its estimated fair value of S$7.51, suggesting it is undervalued based on cash flow analysis. Despite a slower revenue growth forecast of 6.2% per year compared to the global benchmark, earnings are expected to grow faster than the Singapore market at 11.3% annually. However, its debt coverage by operating cash flow remains a concern and it has an unstable dividend track record despite recent affirmations of payouts.

- Insights from our recent growth report point to a promising forecast for Singapore Technologies Engineering's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Singapore Technologies Engineering.

Key Takeaways

- Click through to start exploring the rest of the 875 Undervalued Stocks Based On Cash Flows now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A326030

SK Biopharmaceuticals

A pharmaceutical company, engages in the research and development of drugs for the treatment of central nervous system disorders.

Exceptional growth potential with excellent balance sheet.