- South Korea

- /

- Interactive Media and Services

- /

- KOSE:A035420

The past three years for NAVER (KRX:035420) investors has not been profitable

While it may not be enough for some shareholders, we think it is good to see the NAVER Corporation (KRX:035420) share price up 18% in a single quarter. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 44% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

View our latest analysis for NAVER

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate three years of share price decline, NAVER actually saw its earnings per share (EPS) improve by 0.2% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

It looks to us like the market was probably too optimistic around growth three years ago. However, taking a look at other business metrics might shed a bit more light on the share price action.

With a rather small yield of just 0.4% we doubt that the stock's share price is based on its dividend. We note that, in three years, revenue has actually grown at a 16% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating NAVER further; while we may be missing something on this analysis, there might also be an opportunity.

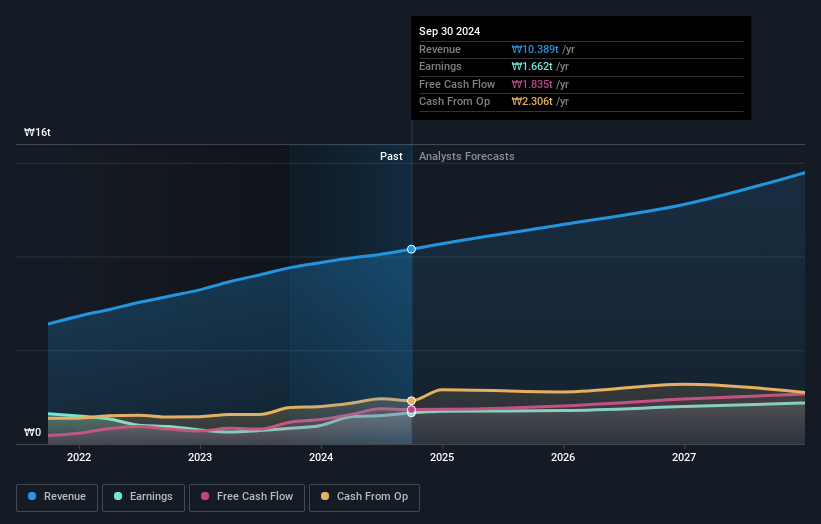

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

NAVER is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling NAVER stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

The total return of 10% received by NAVER shareholders over the last year isn't far from the market return of -11%. Longer term investors wouldn't be so upset, since they would have made 2%, each year, over five years. If the fundamental data remains strong, and the share price is simply down on sentiment, then this could be an opportunity worth investigating. Before forming an opinion on NAVER you might want to consider these 3 valuation metrics.

But note: NAVER may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if NAVER might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A035420

NAVER

Provides online search portal and online information services in South Korea, Japan, and internationally.

Excellent balance sheet with proven track record.