As global markets react to the recent U.S. election results, with major indices like the S&P 500 and Nasdaq Composite reaching record highs due to optimism about growth and tax policies, investors are closely watching how these developments might influence corporate earnings and regulatory landscapes. Amidst this backdrop of economic shifts, stocks with high insider ownership often capture attention because they suggest a strong alignment between company leadership and shareholder interests, potentially offering resilience in fluctuating markets.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 45.4% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Medley (TSE:4480) | 34% | 30.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's take a closer look at a couple of our picks from the screened companies.

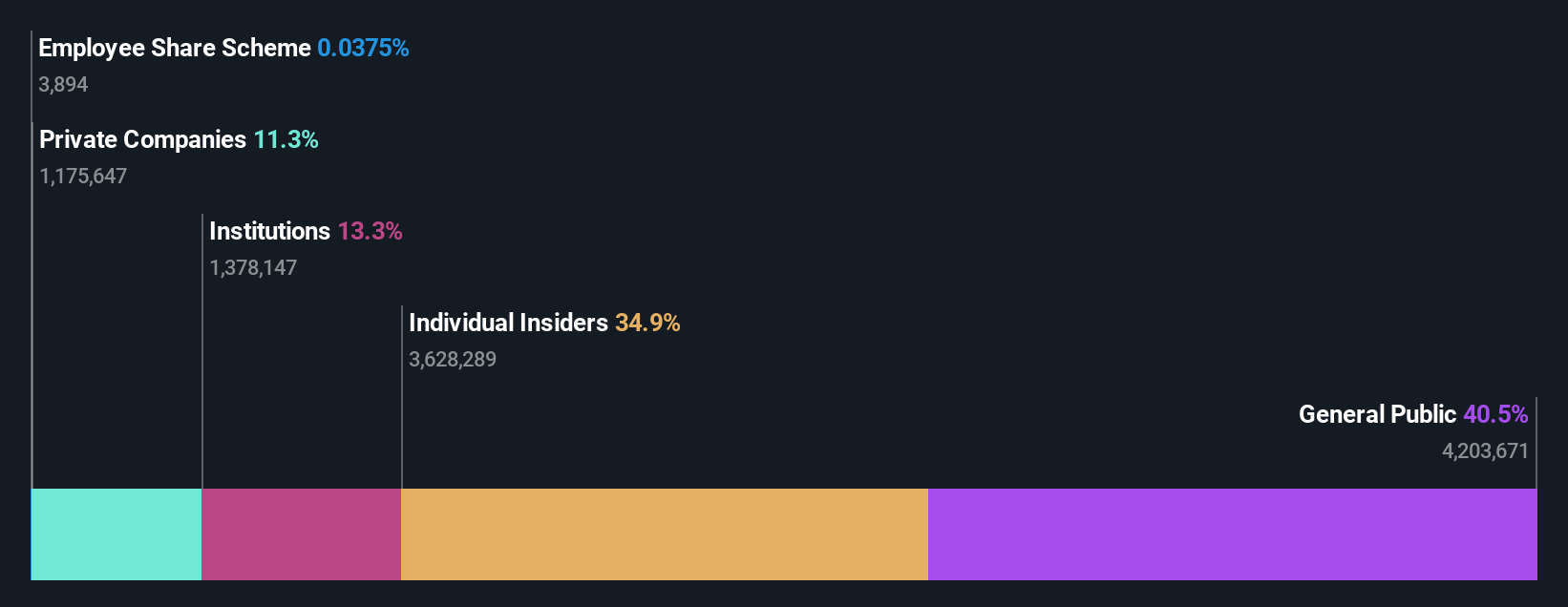

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, is a biopharmaceutical company operating mainly in South Korea with a market cap of ₩2.22 trillion.

Operations: The company generates revenue from its Pharmaceuticals segment, amounting to ₩296.59 billion.

Insider Ownership: 38.6%

Revenue Growth Forecast: 22.3% p.a.

PharmaResearch demonstrates potential as a growth company with substantial insider ownership. Its earnings grew by 63.2% over the past year, and revenue is forecast to grow at 22.3% annually, outpacing the KR market's 9.9%. While earnings growth is slower than the market average, its return on equity is expected to reach 21.3% in three years. Recently, it announced a private placement for gross proceeds of approximately KRW 200 billion, indicating strategic expansion efforts.

- Click here to discover the nuances of PharmaResearch with our detailed analytical future growth report.

- According our valuation report, there's an indication that PharmaResearch's share price might be on the cheaper side.

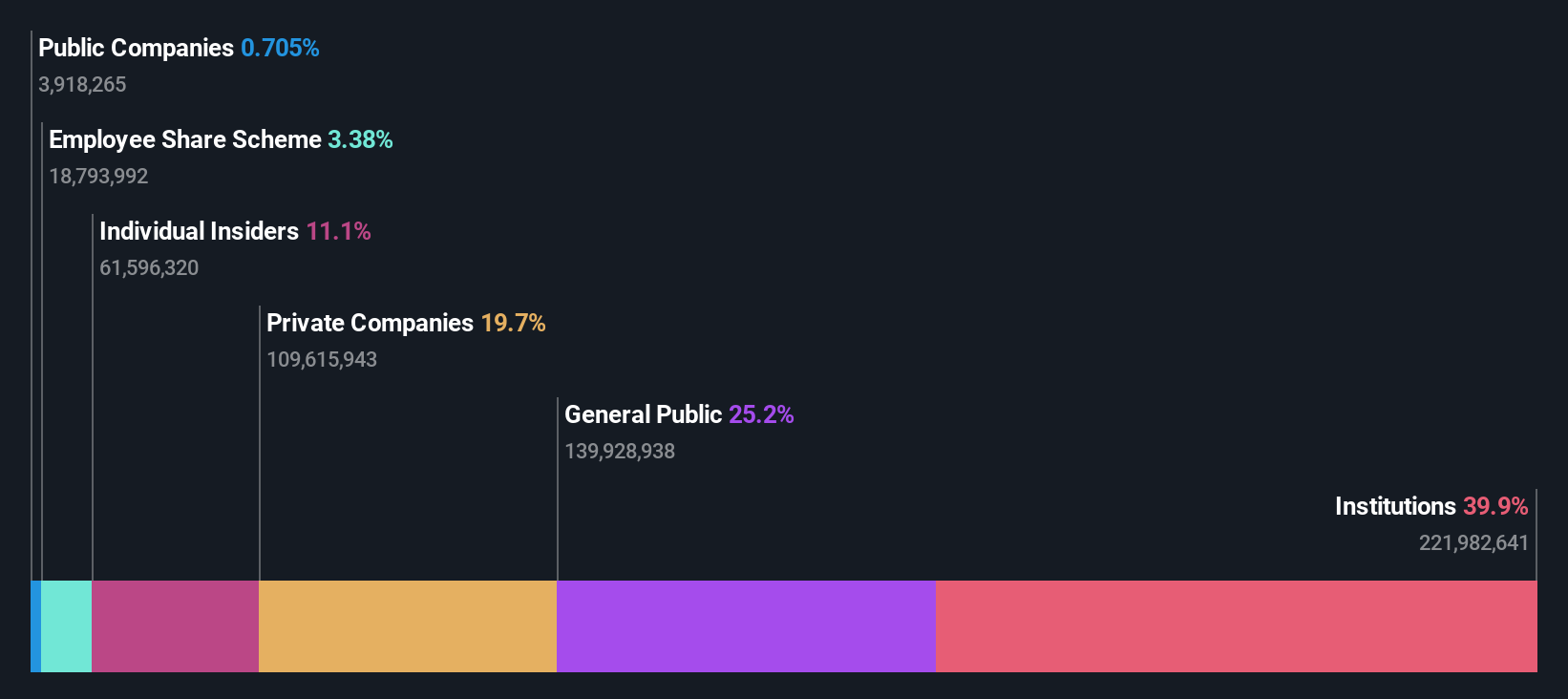

RemeGen (SEHK:9995)

Simply Wall St Growth Rating: ★★★★★☆

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on discovering, developing, and commercializing biologics for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States, with a market cap of approximately HK$17.31 billion.

Operations: The company's revenue from biopharmaceutical research, service, production, and sales is CN¥1.52 billion.

Insider Ownership: 11.4%

Revenue Growth Forecast: 25.9% p.a.

RemeGen shows potential as a growth company with substantial insider ownership, despite recent challenges. Its revenue increased to CNY 1.21 billion for the nine months ending September 2024, but net losses also grew to CNY 1.07 billion. The company is trading at a significant discount to its estimated fair value and is expected to become profitable within three years, with revenue forecasted to grow at 25.9% annually, surpassing market averages in Hong Kong.

- Get an in-depth perspective on RemeGen's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, RemeGen's share price might be too pessimistic.

Plus Alpha ConsultingLtd (TSE:4071)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Plus Alpha Consulting Co., Ltd. provides marketing solutions and has a market cap of ¥75.38 billion.

Operations: The company's revenue segments are not specified in the provided text.

Insider Ownership: 39.4%

Revenue Growth Forecast: 13.5% p.a.

Plus Alpha Consulting Ltd. demonstrates growth potential with robust insider ownership, despite recent share price volatility. The company forecasts annual earnings growth of 17.3%, outpacing the Japanese market average, and anticipates revenue expansion at 13.5% annually. Analysts predict an 80.6% rise in stock price from current levels, trading significantly below its estimated fair value. Recent dividend increases reflect a commitment to shareholder returns while maintaining reserves for future growth and management strengthening initiatives.

- Click to explore a detailed breakdown of our findings in Plus Alpha ConsultingLtd's earnings growth report.

- Our valuation report unveils the possibility Plus Alpha ConsultingLtd's shares may be trading at a discount.

Taking Advantage

- Click this link to deep-dive into the 1522 companies within our Fast Growing Companies With High Insider Ownership screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9995

RemeGen

A biopharmaceutical company, engages in the discovery, development, and commercialization of biologics for the treatment of autoimmune, oncology, and ophthalmic diseases with unmet medical needs in Mainland China and the United States.

Undervalued with high growth potential.