- South Korea

- /

- Entertainment

- /

- KOSE:A079160

3 Stocks Investors May Be Undervaluing By Up To 38.8%

Reviewed by Simply Wall St

Amid a turbulent global market landscape, characterized by cautious Federal Reserve commentary and political uncertainties, investors are navigating through a period of heightened volatility. With U.S. stocks experiencing broad-based declines and concerns about the durability of recent index runs, identifying undervalued opportunities becomes crucial for those looking to capitalize on potential market inefficiencies. In this context, understanding what constitutes an undervalued stock—often one with strong fundamentals but trading below its intrinsic value—can be particularly relevant as investors seek to make informed decisions in these challenging times.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | US$26.66 | US$53.14 | 49.8% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1129.90 | ₹2252.82 | 49.8% |

| Hanza (OM:HANZA) | SEK76.20 | SEK151.92 | 49.8% |

| HealthEquity (NasdaqGS:HQY) | US$94.95 | US$189.22 | 49.8% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP293.50 | CLP584.13 | 49.8% |

| Ingenia Communities Group (ASX:INA) | A$4.66 | A$9.19 | 49.3% |

| South Atlantic Bancshares (OTCPK:SABK) | US$15.02 | US$29.98 | 49.9% |

| KebNi (OM:KEBNI B) | SEK1.09 | SEK2.17 | 49.8% |

| RENK Group (DB:R3NK) | €18.342 | €36.50 | 49.7% |

| iFLYTEKLTD (SZSE:002230) | CN¥51.75 | CN¥103.29 | 49.9% |

Here's a peek at a few of the choices from the screener.

CJ CGV (KOSE:A079160)

Overview: CJ CGV Co., Ltd. operates theaters under the CJ CGV brand in South Korea, with a market cap of ₩890.82 billion.

Operations: The company's revenue segments include Multiplex Operation, generating ₩1.48 billion, and Technology Special Format and Equipment, contributing ₩108.28 million.

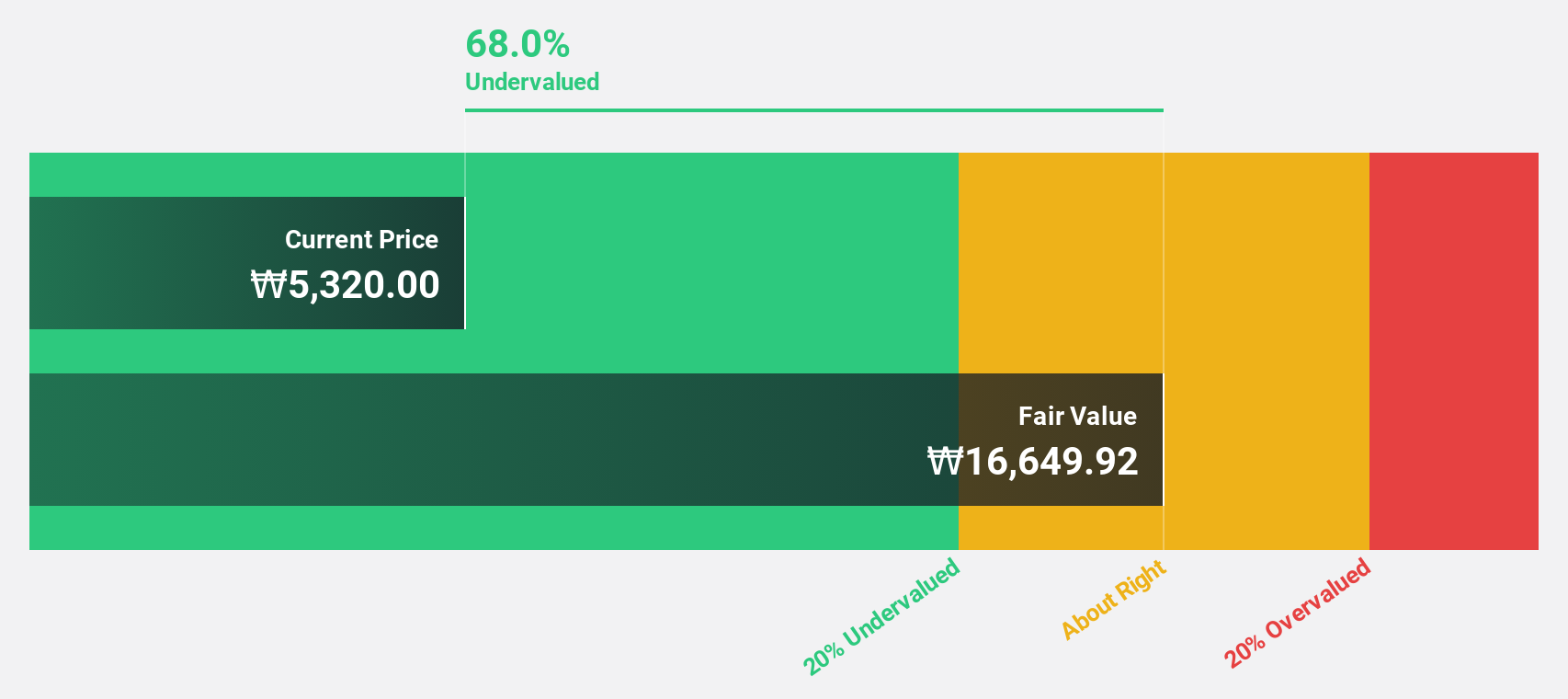

Estimated Discount To Fair Value: 38%

CJ CGV is trading at ₩5,380, which is 38% below its estimated fair value of ₩8,673.79. Despite recent earnings challenges and past shareholder dilution, the company is expected to achieve profitability within three years with earnings growth forecasted at over 120% annually. Revenue growth of 15.4% per year outpaces the broader Korean market's 8.9%. These factors suggest potential undervaluation based on cash flows despite current financial setbacks.

- Our expertly prepared growth report on CJ CGV implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on CJ CGV's balance sheet by reading our health report here.

Tanmiah Food (SASE:2281)

Overview: Tanmiah Food Company, with a market cap of SAR2.45 billion, operates in the food and agriculture sector through its subsidiaries in Saudi Arabia and internationally.

Operations: The company's revenue is primarily generated from its agriculture and food business segment, totaling SAR2.45 billion.

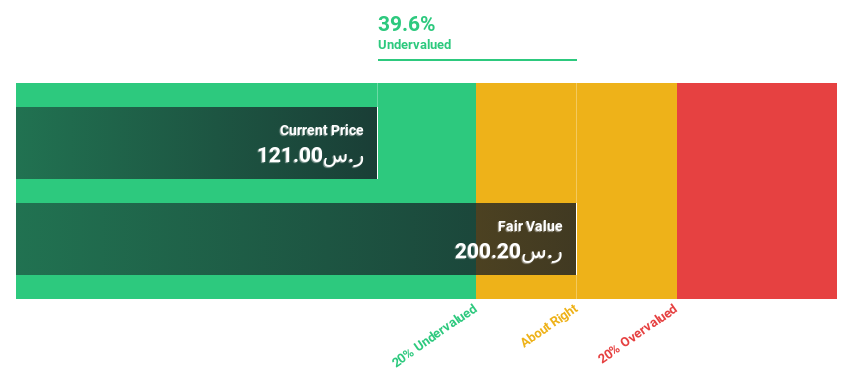

Estimated Discount To Fair Value: 38.8%

Tanmiah Food is trading at SAR 122.6, significantly below its fair value estimate of SAR 200.2, suggesting undervaluation based on cash flows. Despite a high debt level and reliance on non-cash earnings, the company has shown strong financial performance with recent quarterly sales of SAR 657.44 million and net income growth to SAR 24.12 million from the previous year. Earnings are forecasted to grow faster than the Saudi market over the next three years.

- Insights from our recent growth report point to a promising forecast for Tanmiah Food's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Tanmiah Food.

SIIX (TSE:7613)

Overview: SIIX Corporation focuses on the sale and distribution of electronic components both in Japan and internationally, with a market cap of ¥53.49 billion.

Operations: The company's revenue segments include ¥103.89 billion from Japan, ¥27.16 billion from Europe, ¥76.21 billion from the Americas, ¥85.60 billion from Greater China, and ¥115.45 billion from Southeast Asia.

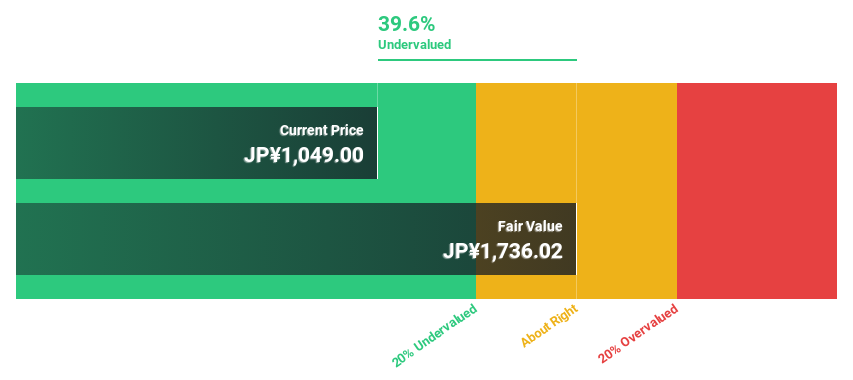

Estimated Discount To Fair Value: 29.3%

SIIX is currently trading at ¥1136, which is 29.3% below its estimated fair value of ¥1606.16, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow significantly at 22.6% annually, outpacing the Japanese market's growth rate of 7.9%. Furthermore, SIIX offers a high and reliable dividend yield of 4.23%, adding appeal for income-focused investors despite limited data on future return on equity forecasts.

- Our growth report here indicates SIIX may be poised for an improving outlook.

- Navigate through the intricacies of SIIX with our comprehensive financial health report here.

Turning Ideas Into Actions

- Explore the 875 names from our Undervalued Stocks Based On Cash Flows screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade CJ CGV, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A079160

CJ CGV

Engages in the operation of theaters under CJ CGV brand name in South Korea.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives