- South Korea

- /

- Entertainment

- /

- KOSDAQ:A078340

Com2uS Corporation's (KOSDAQ:078340) Stock is Soaring But Financials Seem Inconsistent: Will The Uptrend Continue?

Com2uS (KOSDAQ:078340) has had a great run on the share market with its stock up by a significant 34% over the last three months. But the company's key financial indicators appear to be differing across the board and that makes us question whether or not the company's current share price momentum can be maintained. Particularly, we will be paying attention to Com2uS' ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

See our latest analysis for Com2uS

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Com2uS is:

8.9% = ₩87b ÷ ₩975b (Based on the trailing twelve months to September 2020).

The 'return' is the income the business earned over the last year. Another way to think of that is that for every ₩1 worth of equity, the company was able to earn ₩0.09 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Com2uS' Earnings Growth And 8.9% ROE

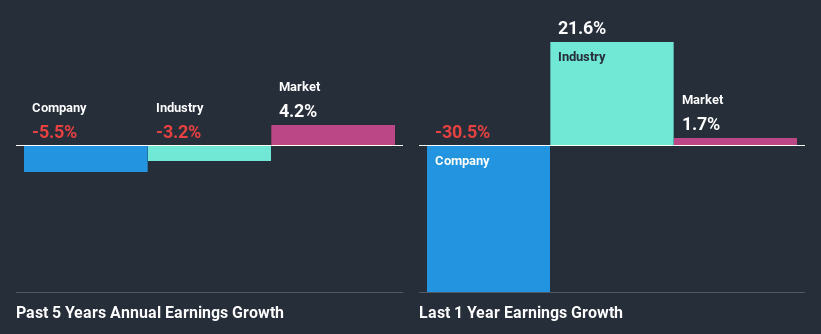

On the face of it, Com2uS' ROE is not much to talk about. We then compared the company's ROE to the broader industry and were disappointed to see that the ROE is lower than the industry average of 12%. Given the circumstances, the significant decline in net income by 5.5% seen by Com2uS over the last five years is not surprising. However, there could also be other factors causing the earnings to decline. For instance, the company has a very high payout ratio, or is faced with competitive pressures.

As a next step, we compared Com2uS' performance with the industry and found thatCom2uS' performance is depressing even when compared with the industry, which has shrunk its earnings at a rate of 3.2% in the same period, which is a slower than the company.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. What is A078340 worth today? The intrinsic value infographic in our free research report helps visualize whether A078340 is currently mispriced by the market.

Is Com2uS Using Its Retained Earnings Effectively?

When we piece together Com2uS' low three-year median payout ratio of 16% (where it is retaining 84% of its profits), calculated for the last three-year period, we are puzzled by the lack of growth. The low payout should mean that the company is retaining most of its earnings and consequently, should see some growth. So there could be some other explanations in that regard. For example, the company's business may be deteriorating.

In addition, Com2uS only recently started paying a dividend so the management probably decided the shareholders prefer dividends even though earnings have been shrinking. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 12% over the next three years. Accordingly, the expected drop in the payout ratio explains the expected increase in the company's ROE to 13%, over the same period.

Conclusion

Overall, we have mixed feelings about Com2uS. Even though it appears to be retaining most of its profits, given the low ROE, investors may not be benefitting from all that reinvestment after all. The low earnings growth suggests our theory correct. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

If you’re looking to trade Com2uS, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A078340

Com2uS

Develops and publishes mobile games in South Korea, the United States, China, Japan, Taiwan, Southeast Asia, Europe, and internationally.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)