- South Korea

- /

- Chemicals

- /

- KOSE:A014830

UNID Company Ltd.'s (KRX:014830) Shares Leap 30% Yet They're Still Not Telling The Full Story

UNID Company Ltd. (KRX:014830) shareholders have had their patience rewarded with a 30% share price jump in the last month. Notwithstanding the latest gain, the annual share price return of 3.3% isn't as impressive.

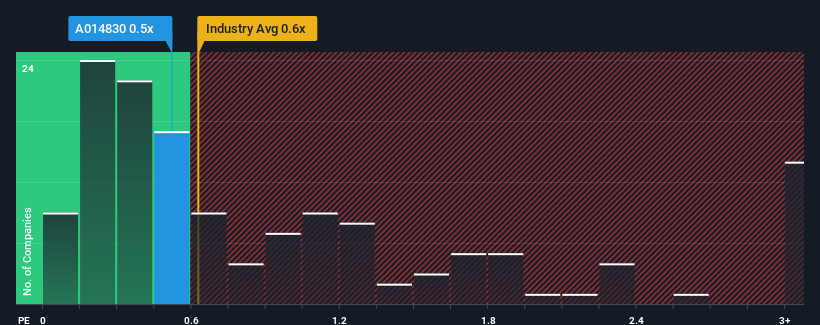

Although its price has surged higher, it's still not a stretch to say that UNID's price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Chemicals industry in Korea, where the median P/S ratio is around 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for UNID

What Does UNID's Recent Performance Look Like?

Recent times haven't been great for UNID as its revenue has been falling quicker than most other companies. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. You'd much rather the company improve its revenue if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on UNID will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For UNID?

The only time you'd be comfortable seeing a P/S like UNID's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 5.4% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 24% over the next year. That's shaping up to be materially higher than the 11% growth forecast for the broader industry.

With this in consideration, we find it intriguing that UNID's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Its shares have lifted substantially and now UNID's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, UNID's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for UNID that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A014830

UNID

Manufactures and sells potassium based chemical products in South Korea and internationally.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success