- South Korea

- /

- IT

- /

- KOSDAQ:A042000

KRX Growth Companies With High Insider Ownership October 2024

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has experienced a 2.8% decline, yet it has shown resilience with a 4.7% rise over the past year and earnings forecasted to grow by 30% annually. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business and potential alignment of interests with shareholders.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.8% | 49.1% |

| Bioneer (KOSDAQ:A064550) | 15.8% | 97.6% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 99.5% |

| Oscotec (KOSDAQ:A039200) | 26.1% | 122% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 96.7% |

Let's review some notable picks from our screened stocks.

Cafe24 (KOSDAQ:A042000)

Simply Wall St Growth Rating: ★★★★☆☆

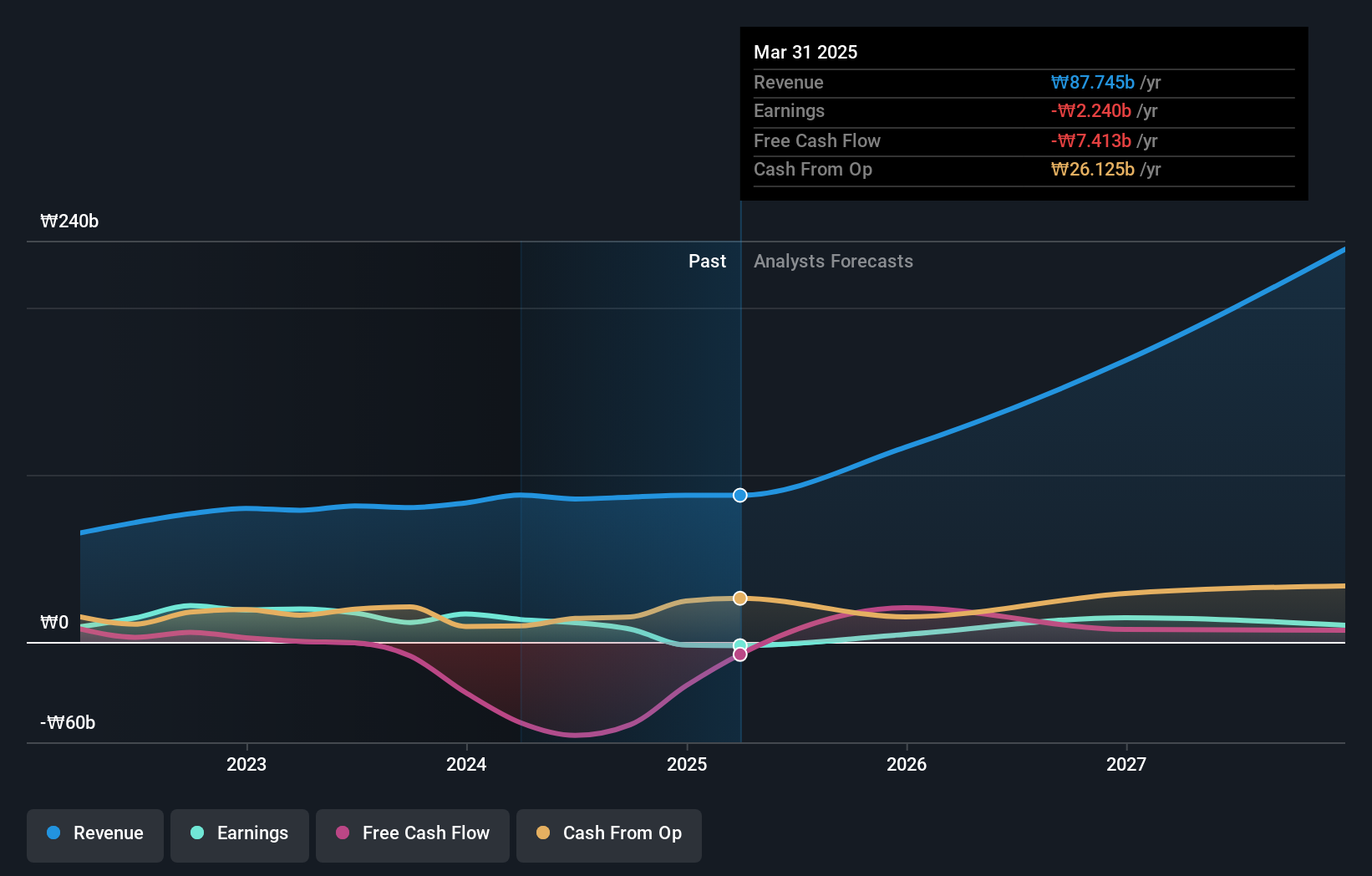

Overview: Cafe24 Corp. operates a global e-commerce platform and has a market cap of approximately ₩730.18 billion.

Operations: The company generates revenue through its various segments, including Transit at ₩42.97 billion, Clothing at ₩21.03 billion, and Internet Business Solution at ₩230.51 billion.

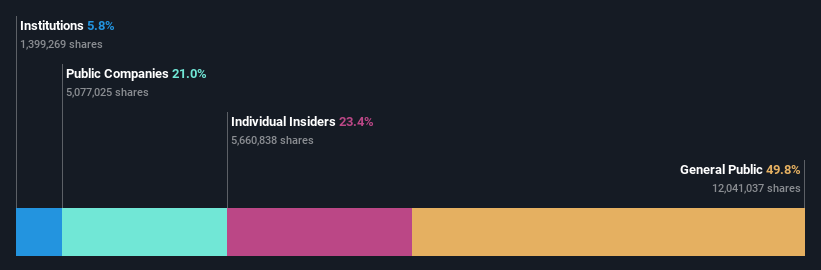

Insider Ownership: 23.4%

Revenue Growth Forecast: 11.1% p.a.

Cafe24, a South Korean growth company, shows promising potential with expected annual earnings growth of 42.47%, outpacing the national market average. Despite recent share price volatility and past shareholder dilution, the company became profitable this year and trades at 29.5% below its estimated fair value. However, revenue growth is projected to be slower than the desired 20% benchmark but still surpasses the overall Korean market rate. Insider trading activity remains stable with no substantial buying or selling reported recently.

- Unlock comprehensive insights into our analysis of Cafe24 stock in this growth report.

- The analysis detailed in our Cafe24 valuation report hints at an deflated share price compared to its estimated value.

Advanced Nano Products (KOSDAQ:A121600)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Advanced Nano Products Co., Ltd. manufactures and sells high-tech materials including displays, semiconductors, secondary batteries, and solar cells in South Korea and internationally, with a market cap of ₩1.09 trillion.

Operations: The company's revenue segment includes Specialty Chemicals, generating ₩85.53 billion.

Insider Ownership: 22.7%

Revenue Growth Forecast: 56.4% p.a.

Advanced Nano Products, a South Korean growth company, is forecasted to achieve significant revenue growth of 56.4% annually, surpassing the market average. Despite this potential, its return on equity is expected to remain low at 12.5% in three years. Recent earnings reports show declining net income and profit margins compared to last year. The stock trades at 64.4% below estimated fair value but has experienced high share price volatility recently with no substantial insider trading activity reported in the past three months.

- Get an in-depth perspective on Advanced Nano Products' performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Advanced Nano Products implies its share price may be too high.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

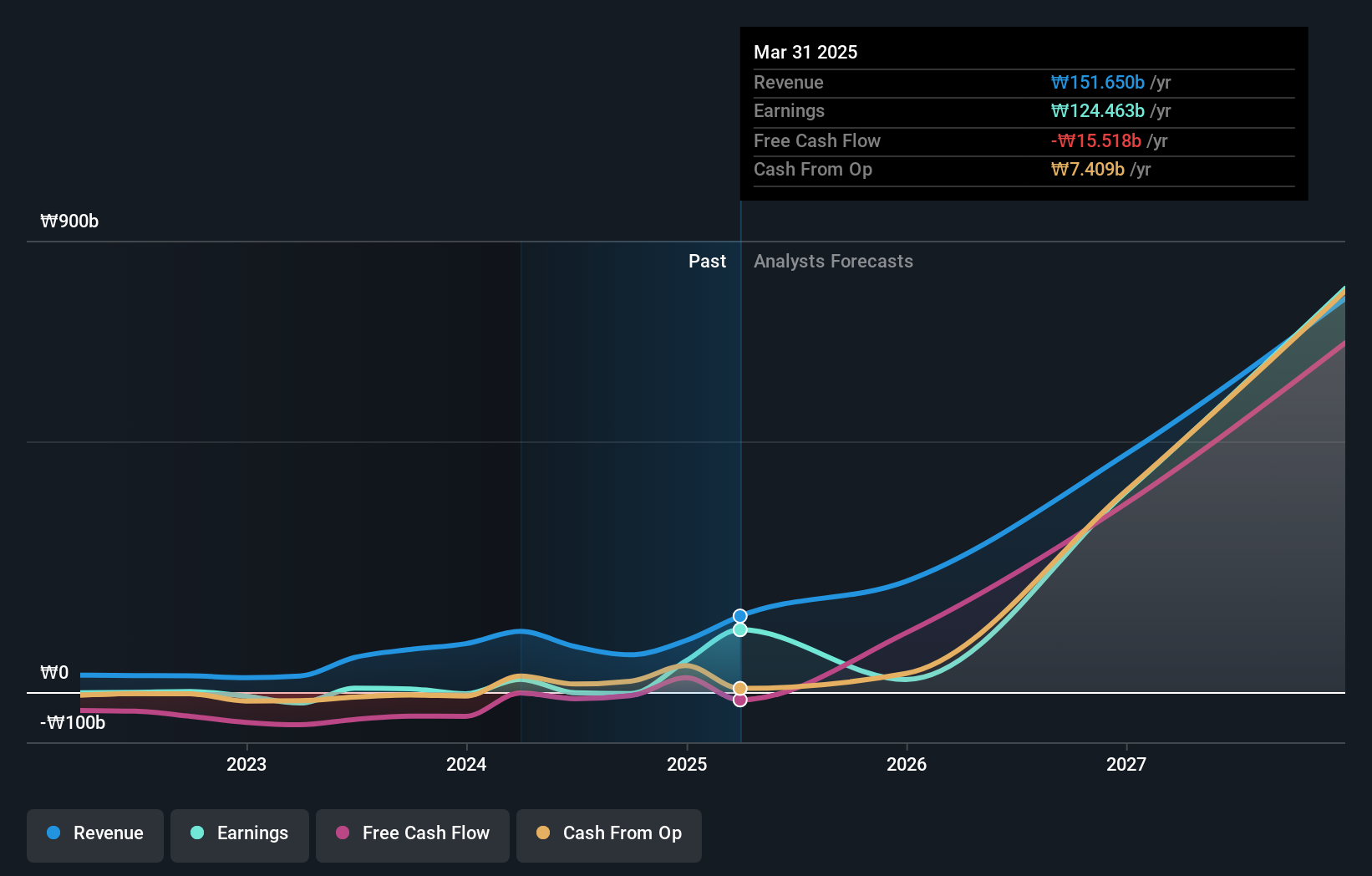

Overview: ALTEOGEN Inc. is a biotechnology company that develops long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩18.91 trillion.

Operations: The company's revenue segment is focused on biotechnology, generating ₩90.79 billion.

Insider Ownership: 26.6%

Revenue Growth Forecast: 64.2% p.a.

Alteogen, a South Korean firm, recently received MFDS approval for Tergase®, enhancing its commercial prospects. The company is forecasted to achieve substantial revenue growth of 64.2% annually and become profitable in the next three years, outperforming market averages. However, it has experienced shareholder dilution and high share price volatility. Despite trading at 72.6% below estimated fair value, there has been no significant insider trading activity in recent months.

- Take a closer look at ALTEOGEN's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that ALTEOGEN is trading beyond its estimated value.

Seize The Opportunity

- Take a closer look at our Fast Growing KRX Companies With High Insider Ownership list of 86 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A042000

Flawless balance sheet with reasonable growth potential.