- South Korea

- /

- Semiconductors

- /

- KOSE:A281820

None Features 3 Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets navigate a period of fluctuating consumer confidence and mixed economic indicators, small-cap stocks have shown resilience despite broader market volatility. In this context, identifying promising stocks often involves looking for companies with strong fundamentals and growth potential that may not yet be fully recognized by the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

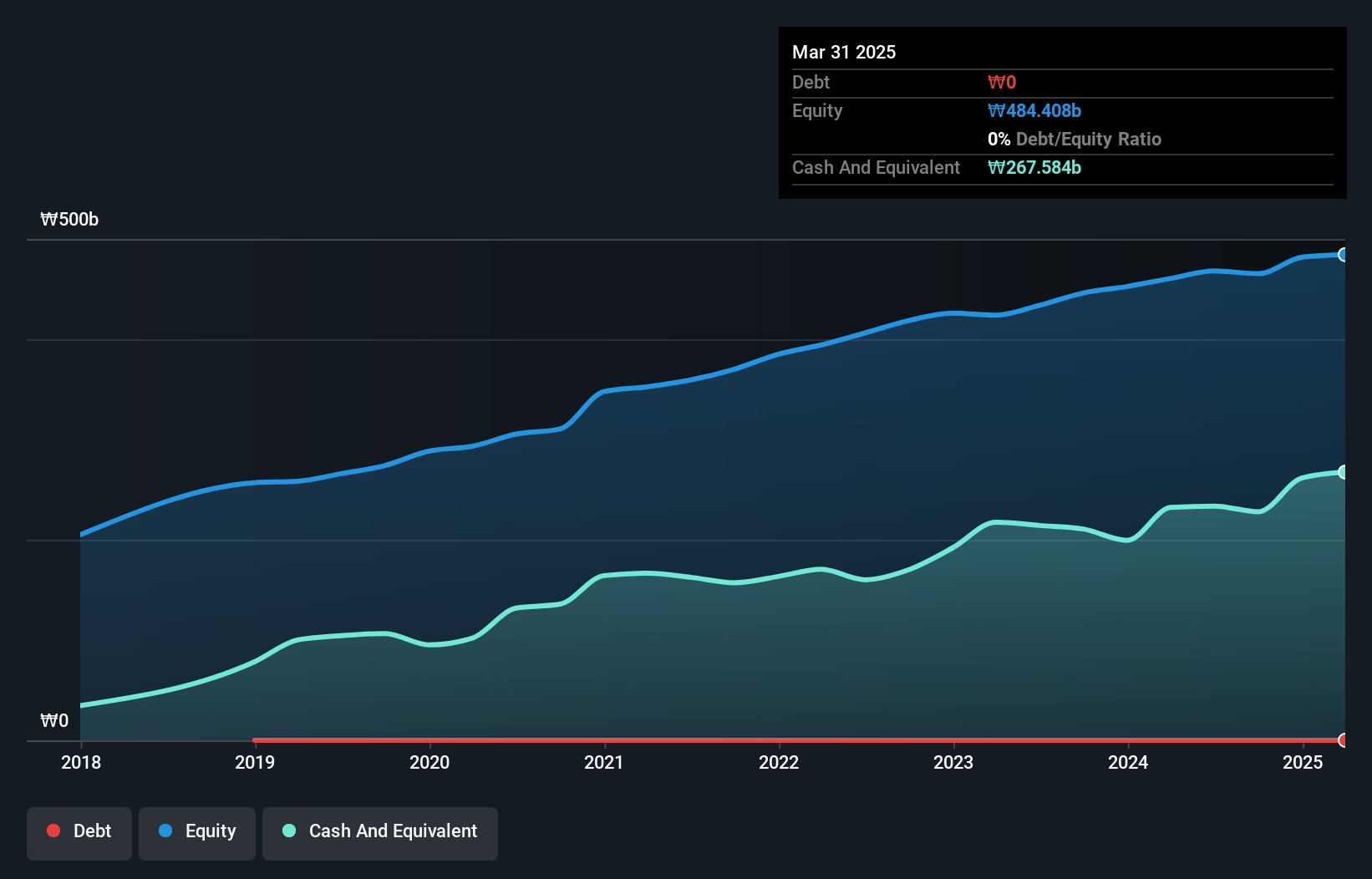

KCTech (KOSE:A281820)

Simply Wall St Value Rating: ★★★★★★

Overview: KCTech Co., Ltd. is a South Korean company involved in the manufacture and distribution of semiconductor systems, display systems, and electronic materials, with a market cap of ₩543.44 billion.

Operations: KCTech generates revenue primarily from the semiconductor systems, display systems, and electronic materials sectors. The company's market cap is ₩543.44 billion.

KCTech, a nimble player in the semiconductor space, is debt-free and boasts high-quality earnings. While its recent earnings growth of 0.4% lags behind the industry's 7.4%, it remains on solid ground with a positive free cash flow position. The company's forecasted annual earnings growth of 30.95% suggests potential for future expansion despite current performance hurdles. Notably, KCTech has not engaged in share repurchases recently, indicating a focus on reinvestment or other strategic priorities rather than returning capital to shareholders at this time.

- Delve into the full analysis health report here for a deeper understanding of KCTech.

Assess KCTech's past performance with our detailed historical performance reports.

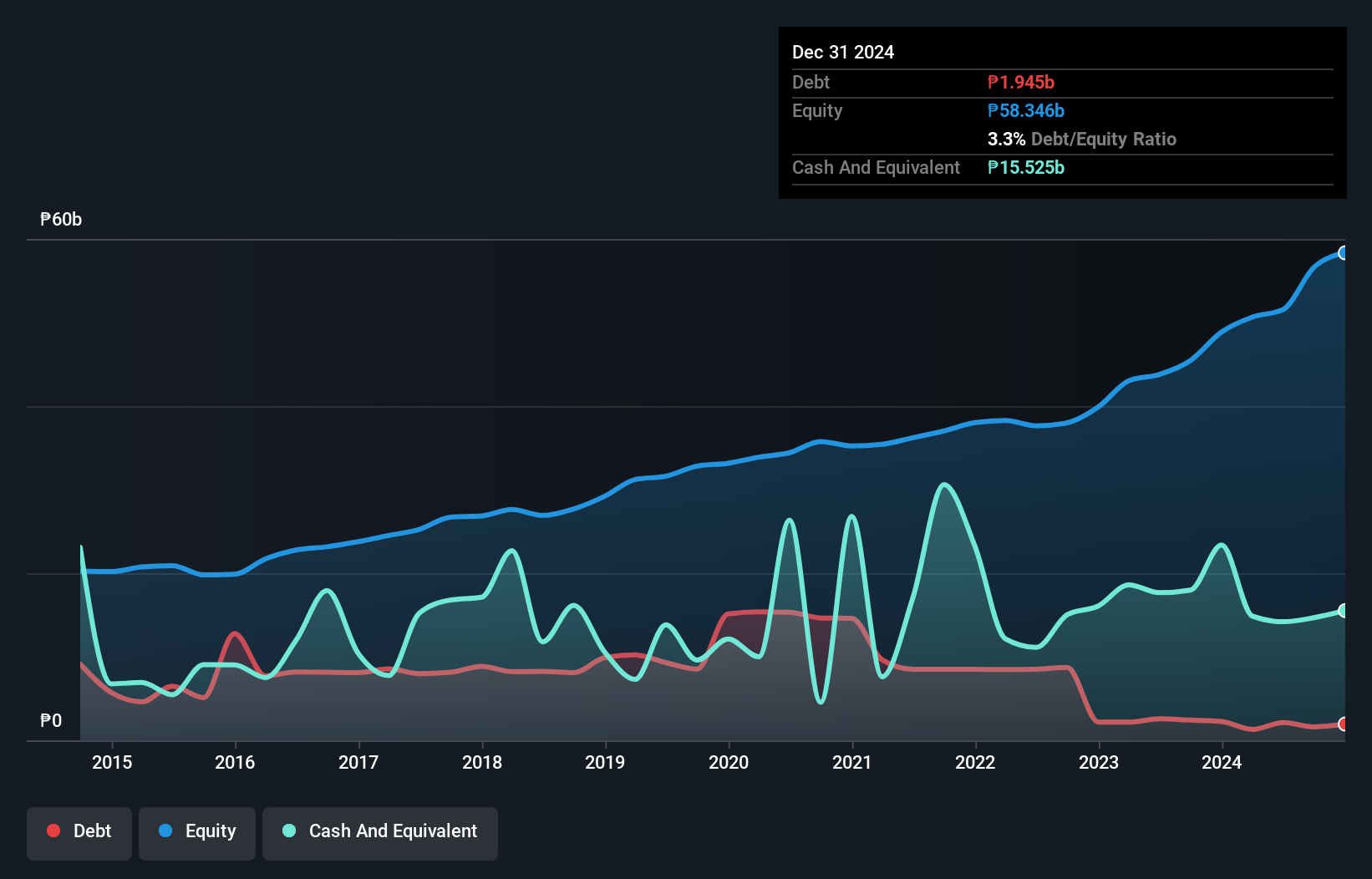

Asia United Bank (PSE:AUB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Asia United Bank Corporation, with a market cap of ₱44.77 billion, offers a range of banking and financial services to individual consumers, MSMEs, and corporations in the Philippines through its subsidiaries.

Operations: The bank generates revenue primarily from branch banking, which contributes ₱9.46 billion, followed by commercial banking at ₱4.14 billion and treasury operations at ₱3.35 billion. Consumer banking adds another ₱2.58 billion to its revenue streams.

Asia United Bank, with total assets of ₱352 billion and equity of ₱56.6 billion, showcases robust financial health. Its earnings growth of 38.8% surpasses the industry average, highlighting its competitive edge. The bank's net income for Q3 2024 was ₱3.35 billion, significantly higher than the previous year's ₱1.95 billion, while basic earnings per share rose to ₱4.59 from ₱4.01 a year ago. With a net interest margin of 4.8% and sufficient bad loan allowance at 108%, AUB seems well-positioned in the market despite having a high bad loans ratio at 2%.

- Navigate through the intricacies of Asia United Bank with our comprehensive health report here.

Examine Asia United Bank's past performance report to understand how it has performed in the past.

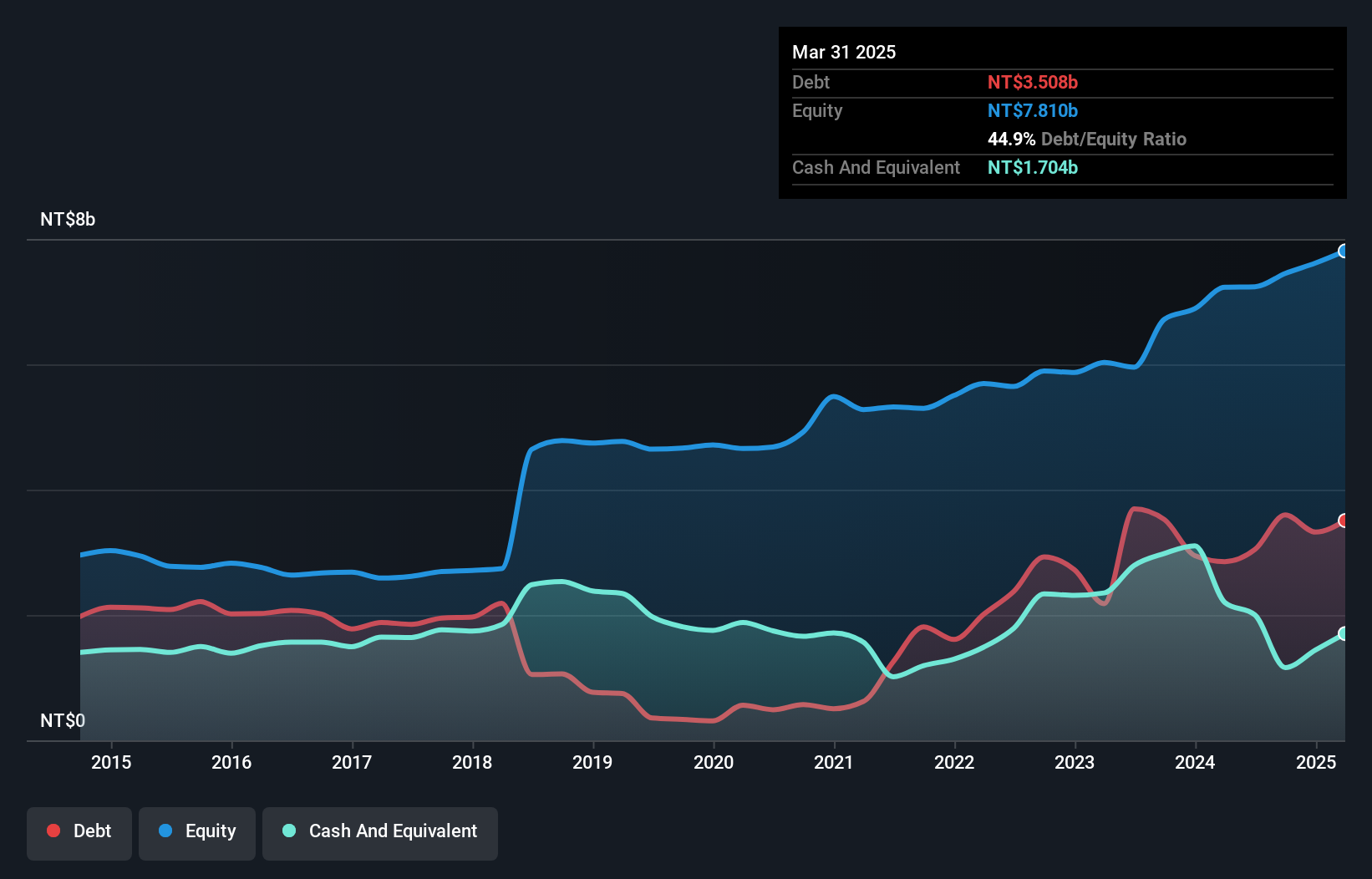

INPAQ Technology (TPEX:6284)

Simply Wall St Value Rating: ★★★★★☆

Overview: INPAQ Technology Co., Ltd. specializes in circuit protection components and antenna products for various electronics sectors across Taiwan, China, Hong Kong, and globally, with a market cap of NT$12.17 billion.

Operations: INPAQ Technology generates revenue primarily from its Antenna Division and Components Department, with the Antenna Division contributing NT$4.06 billion and the Components Department NT$3.26 billion.

INPAQ Technology, a smaller player in the electronics space, has shown impressive earnings growth of 37.6% over the past year, outpacing its industry peers. The company's price-to-earnings ratio stands at 15.2x, indicating potentially good value compared to the TW market's 21x. Despite a satisfactory net debt to equity ratio of 32.7%, INPAQ's debt has risen from 7.1% to 48.3% over five years, which might be concerning for some investors. Recently, they completed a share repurchase program worth TWD 19.5 million and reported nine-month sales of TWD 5.53 billion with net income reaching TWD 699 million.

- Click to explore a detailed breakdown of our findings in INPAQ Technology's health report.

Explore historical data to track INPAQ Technology's performance over time in our Past section.

Summing It All Up

- Reveal the 4638 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KCTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A281820

KCTech

Engages in the manufacture and distribution of semiconductor systems, display systems, and electronic materials in South Korea.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion