- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A101490

S&S Tech Among 3 Growth Stocks With Strong Insider Confidence

Reviewed by Simply Wall St

As global markets navigate a holiday-shortened week, major indices have shown moderate gains, led by large-cap growth stocks in the U.S., despite a decline in consumer confidence and mixed economic indicators. In this landscape of cautious optimism, insider ownership can serve as a strong indicator of confidence in a company's potential for growth, making it an important factor to consider when evaluating investment opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's dive into some prime choices out of the screener.

S&S Tech (KOSDAQ:A101490)

Simply Wall St Growth Rating: ★★★★★★

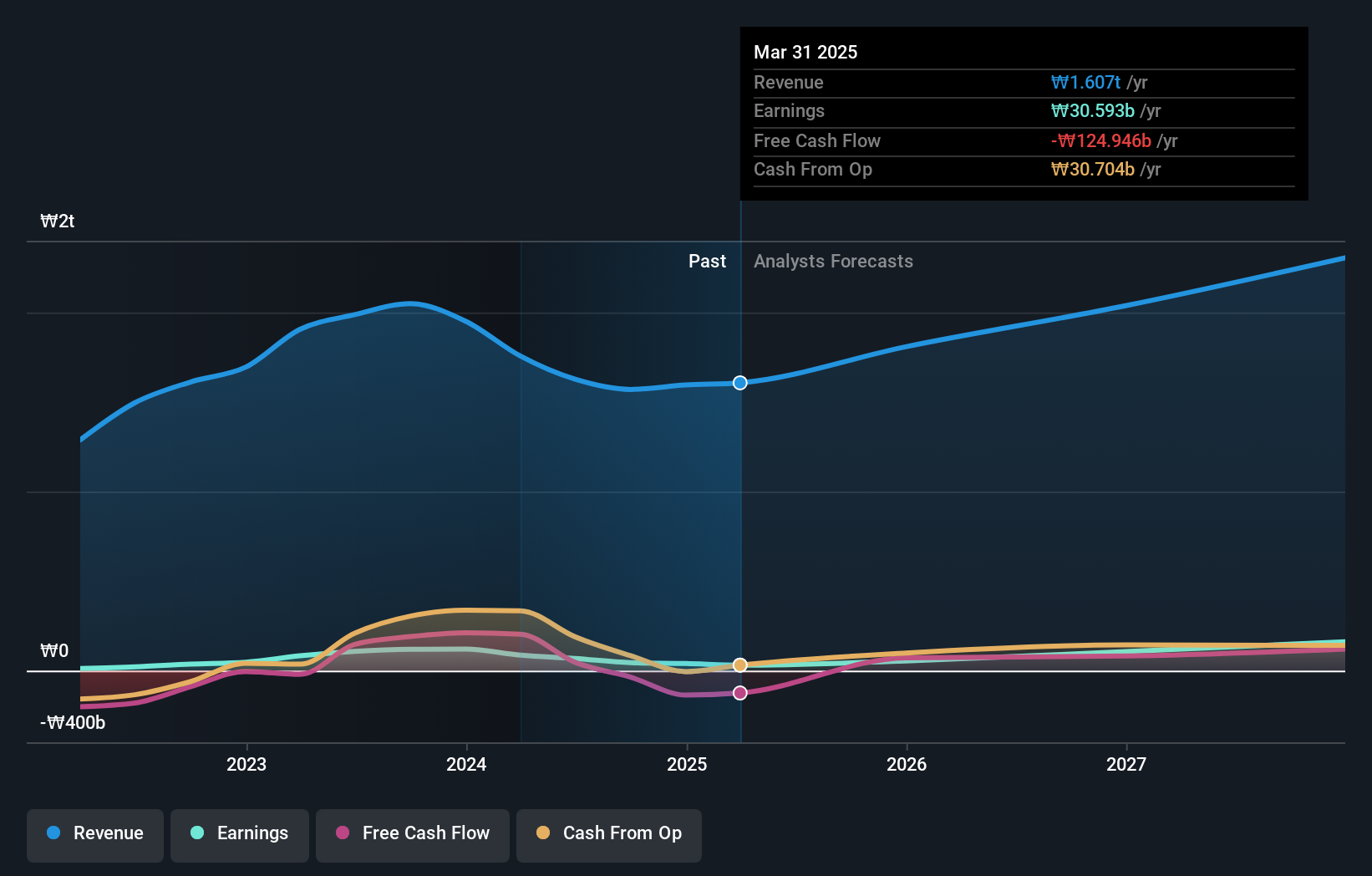

Overview: S&S Tech Corporation manufactures and sells blank masks globally, with a market cap of ₩536.15 billion.

Operations: The company's revenue is derived from S&S Lab Co., Ltd. (₩1.56 billion), S&S Tech Co., Ltd. (₩158.48 billion), and S&S Investment Co., Ltd. (₩10.65 billion).

Insider Ownership: 23.2%

Earnings Growth Forecast: 45% p.a.

S&S Tech demonstrates strong growth potential with earnings forecasted to grow significantly, outpacing the KR market at 45% annually. Recent earnings reports show net income improvements, with third-quarter net income rising to KRW 8.21 billion from KRW 6.29 billion year-on-year. Despite high insider ownership, there has been no substantial insider trading activity recently. The company completed a share buyback of KRW 2.12 billion, indicating confidence in its future prospects amidst robust revenue growth expectations of 35.1% annually.

- Delve into the full analysis future growth report here for a deeper understanding of S&S Tech.

- The analysis detailed in our S&S Tech valuation report hints at an inflated share price compared to its estimated value.

Solum (KOSE:A248070)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Solum Co., Ltd. is a company that manufactures and markets power modules, digital tuners, and electronic shelf labels to customers both in South Korea and internationally, with a market cap of ₩934.97 billion.

Operations: The company's revenue is derived from two main segments: the ICT Business, which generates ₩432.21 million, and the Electronic Components Division, contributing ₩1.14 billion.

Insider Ownership: 16.6%

Earnings Growth Forecast: 50% p.a.

Solum's earnings are forecast to grow significantly at 50% annually, outpacing the KR market. Despite a recent dip in profit margins from 5.8% to 2.8%, the company is trading at a substantial discount to its estimated fair value and has completed a share buyback worth KRW 3.36 billion, signaling confidence in its future prospects. However, Solum faces challenges with high debt levels and slower revenue growth compared to earnings projections.

- Click here to discover the nuances of Solum with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Solum is trading behind its estimated value.

R&G PharmaStudies (SZSE:301333)

Simply Wall St Growth Rating: ★★★★☆☆

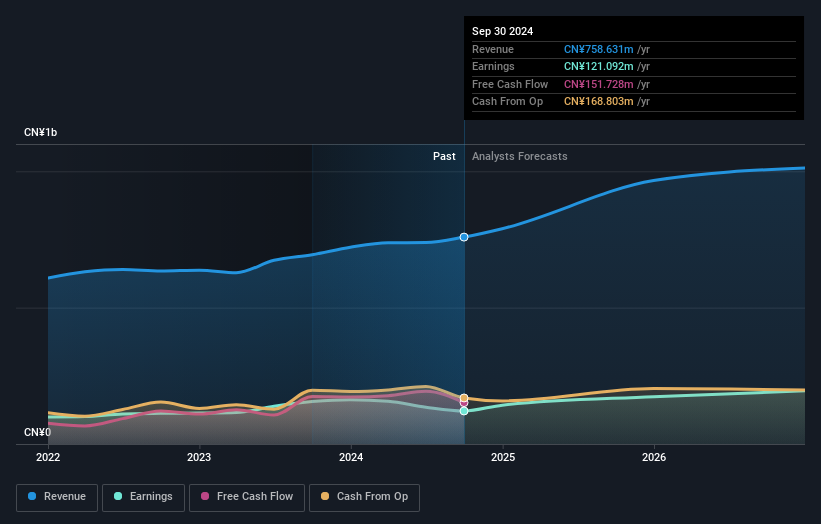

Overview: R&G PharmaStudies Co., Ltd. offers clinical research outsourcing services to pharmaceutical and medical device companies, as well as scientific research institutions in China, with a market cap of CN¥4.83 billion.

Operations: The company generates revenue from its Research and Experimental Development segment, totaling CN¥758.63 million.

Insider Ownership: 12.2%

Earnings Growth Forecast: 27% p.a.

R&G PharmaStudies is experiencing significant earnings growth, forecasted at 27% annually, surpassing the CN market's 25.2%. Despite this, revenue growth at 18.1% per year lags behind the desired 20%, although it still exceeds the broader market's rate. Recent changes in company bylaws and a completed share buyback of CNY 56.06 million suggest strategic adjustments and confidence in future performance despite recent volatility and lower net income compared to last year.

- Click here and access our complete growth analysis report to understand the dynamics of R&G PharmaStudies.

- Our expertly prepared valuation report R&G PharmaStudies implies its share price may be too high.

Turning Ideas Into Actions

- Discover the full array of 1505 Fast Growing Companies With High Insider Ownership right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A101490

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives