- South Korea

- /

- IT

- /

- KOSDAQ:A042000

3 Stocks With Estimated Discounts Up To 6.7% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic signals, major indices have experienced moderate gains despite recent declines in consumer sentiment and durable goods orders. In this environment, identifying undervalued stocks can be particularly appealing to investors seeking opportunities that may offer potential value relative to their intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Globetronics Technology Bhd (KLSE:GTRONIC) | MYR0.585 | MYR1.17 | 49.9% |

| Decisive Dividend (TSXV:DE) | CA$5.93 | CA$11.83 | 49.9% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.77 | €5.51 | 49.7% |

| Cettire (ASX:CTT) | A$1.565 | A$3.02 | 48.1% |

| Medley (TSE:4480) | ¥3835.00 | ¥7645.06 | 49.8% |

| Ally Financial (NYSE:ALLY) | US$36.01 | US$71.77 | 49.8% |

| Charter Hall Group (ASX:CHC) | A$14.50 | A$28.66 | 49.4% |

| Progress Software (NasdaqGS:PRGS) | US$65.15 | US$129.87 | 49.8% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.45 | NZ$2.89 | 49.8% |

Here's a peek at a few of the choices from the screener.

Cafe24 (KOSDAQ:A042000)

Overview: Cafe24 Corp. operates a global e-commerce platform and has a market cap of ₩819.64 billion.

Operations: The company's revenue segments include Transit at ₩44.06 billion, Clothing at ₩22.16 billion, and Internet Business Solution at ₩237.10 billion.

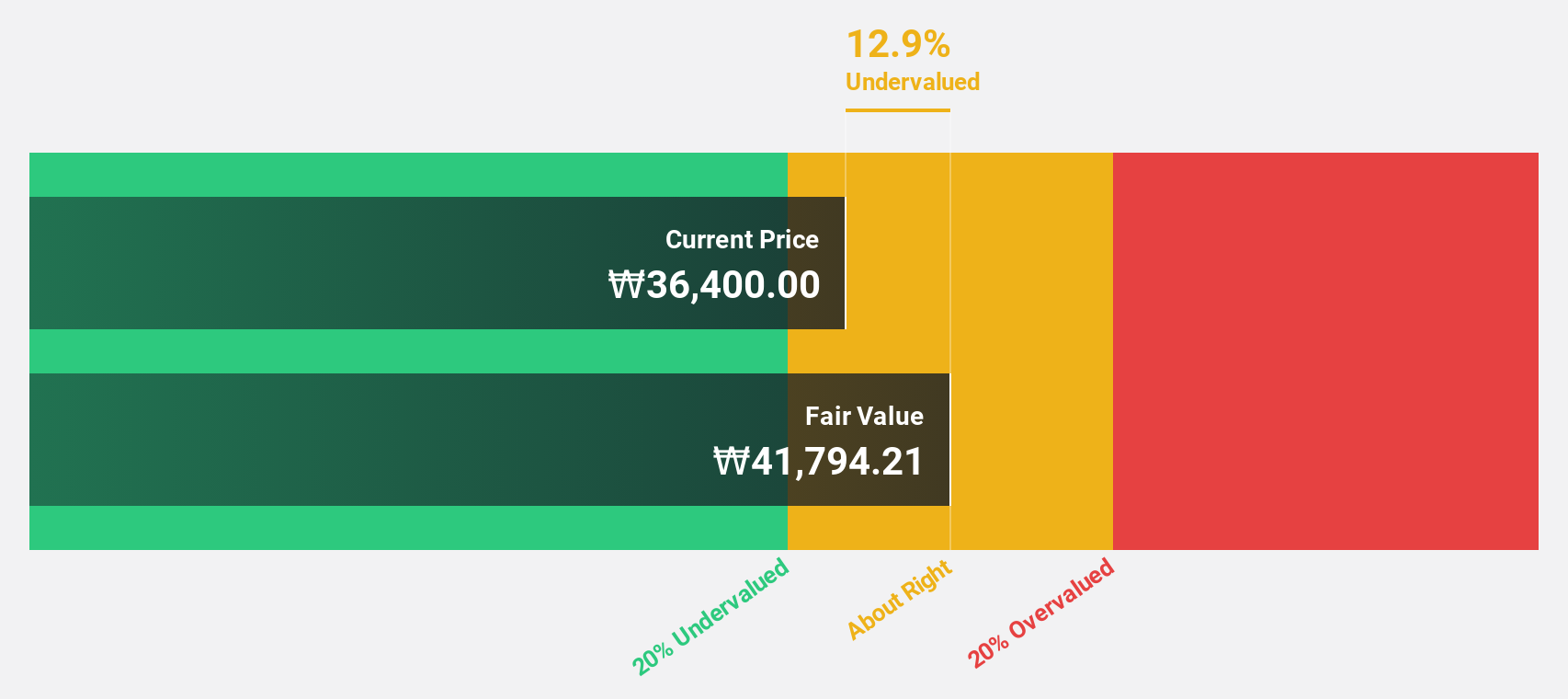

Estimated Discount To Fair Value: 6.7%

Cafe24's current share price of ₩35,900 is trading 6.7% below its estimated fair value of ₩38,468.65, suggesting it may be undervalued based on cash flows. The company has recently become profitable and is expected to see significant earnings growth at 35.5% annually over the next three years, outpacing the Korean market's average growth rate. However, shareholders have faced dilution in the past year and the stock has experienced volatility recently.

- Upon reviewing our latest growth report, Cafe24's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Cafe24 with our comprehensive financial health report here.

Sports Gear (TWSE:6768)

Overview: Sports Gear Co., Ltd. manufactures and sells OEM footwear products across the United States, Europe, Asia, China, Taiwan, and internationally with a market cap of NT$23.53 billion.

Operations: The company's revenue is primarily derived from its Footwear Manufacturing Business, which generated NT$17.27 billion.

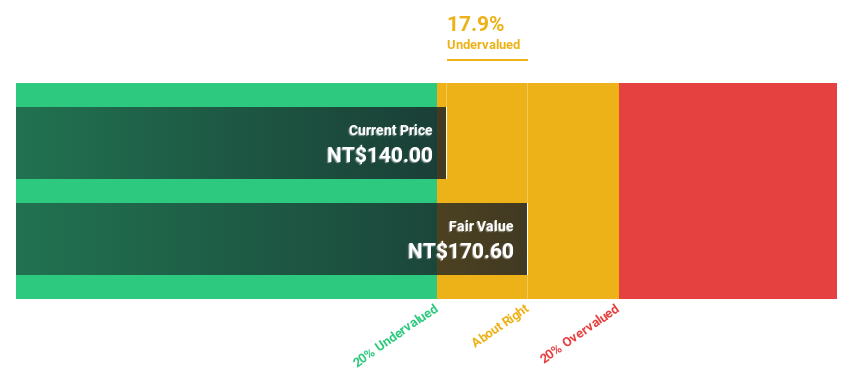

Estimated Discount To Fair Value: 26.2%

Sports Gear Co., Ltd. is trading at NT$124, over 20% below its estimated fair value of NT$168.06, presenting a potential undervaluation based on cash flows. The company reported significant earnings growth of 79.4% over the past year and forecasts suggest earnings could grow by 30.8% annually, surpassing the Taiwan market average of 19.1%. However, its dividend yield of 3.06% is not well supported by free cash flows, which may concern income-focused investors.

- The growth report we've compiled suggests that Sports Gear's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Sports Gear.

Archicom (WSE:ARH)

Overview: Archicom S.A. operates in the real estate sector in Poland with a market capitalization of PLN2.40 billion.

Operations: Archicom S.A. generates revenue through its real estate activities in Poland.

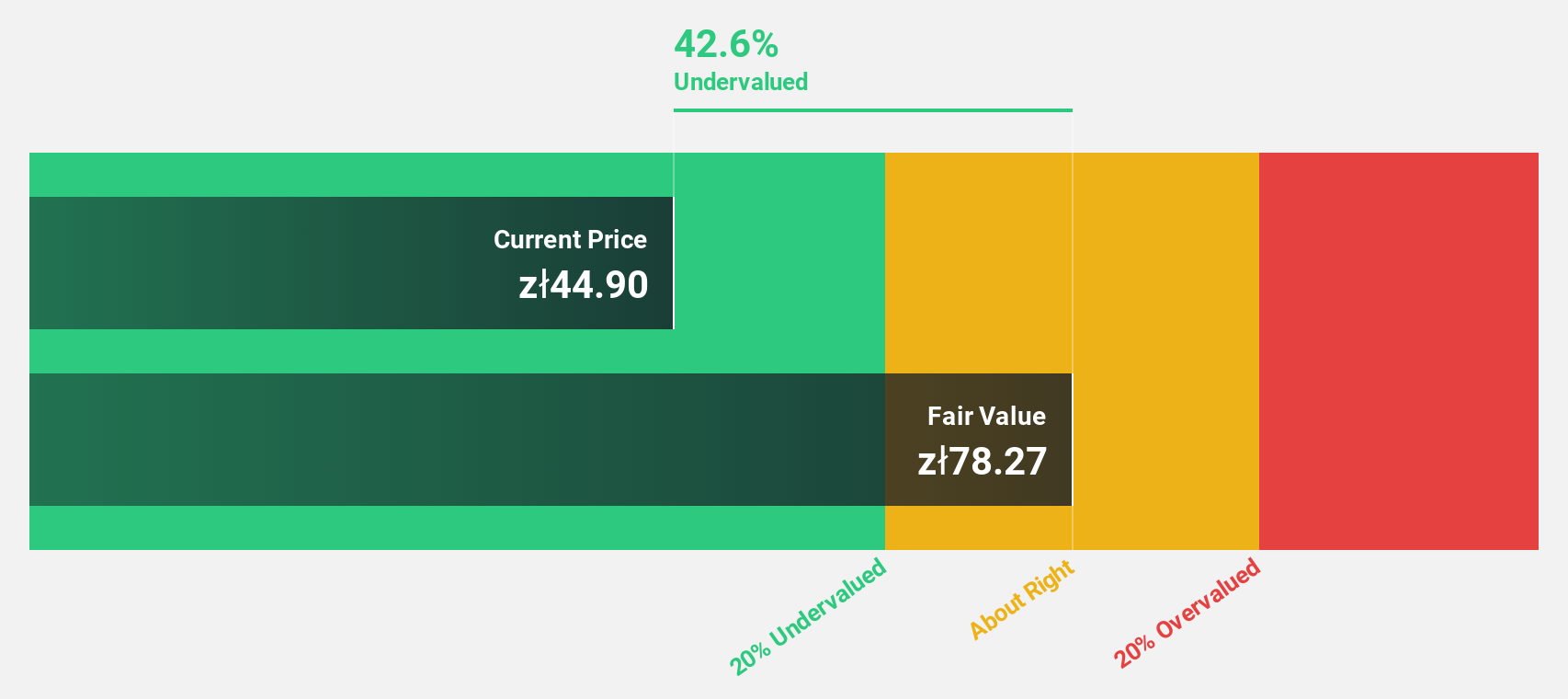

Estimated Discount To Fair Value: 29.1%

Archicom is trading at PLN 41, over 20% below its estimated fair value of PLN 57.85, indicating potential undervaluation based on cash flows. Despite earnings growth of 175.8% last year and a forecasted annual growth rate of 26.3%, which exceeds the Polish market average, recent earnings reports show a decline in net income to PLN 77.56 million from PLN 86.14 million a year ago, raising concerns about dividend sustainability with free cash flow coverage issues.

- Insights from our recent growth report point to a promising forecast for Archicom's business outlook.

- Dive into the specifics of Archicom here with our thorough financial health report.

Summing It All Up

- Discover the full array of 878 Undervalued Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A042000

Flawless balance sheet with reasonable growth potential.