- South Korea

- /

- Personal Products

- /

- KOSDAQ:A241710

Market Participants Recognise Cosmecca Korea Co., Ltd.'s (KOSDAQ:241710) Revenues Pushing Shares 29% Higher

The Cosmecca Korea Co., Ltd. (KOSDAQ:241710) share price has done very well over the last month, posting an excellent gain of 29%. The annual gain comes to 217% following the latest surge, making investors sit up and take notice.

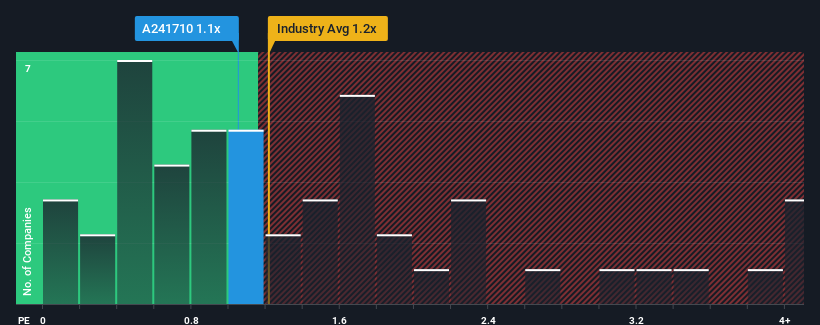

Even after such a large jump in price, it's still not a stretch to say that Cosmecca Korea's price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" compared to the Personal Products industry in Korea, where the median P/S ratio is around 1.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Cosmecca Korea

How Cosmecca Korea Has Been Performing

Recent times have been pleasing for Cosmecca Korea as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cosmecca Korea.How Is Cosmecca Korea's Revenue Growth Trending?

Cosmecca Korea's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. Pleasingly, revenue has also lifted 39% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 13% per annum over the next three years. That's shaping up to be similar to the 14% per year growth forecast for the broader industry.

With this information, we can see why Cosmecca Korea is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Cosmecca Korea appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at Cosmecca Korea's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Cosmecca Korea you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A241710

Cosmecca Korea

Engages in the research and development, manufacture, and sale of skincare products in South Korea and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives