- South Korea

- /

- Machinery

- /

- KOSE:A009540

3 Stocks That May Be Trading Below Their Estimated Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a period of economic adjustments and interest rate shifts, investors are keeping a close eye on the Federal Reserve's upcoming decisions and their potential impact on market dynamics. Amidst these fluctuations, identifying stocks that may be trading below their estimated intrinsic value can offer opportunities for long-term growth, especially when broader indices face mixed performance. A good stock in this context is one that demonstrates strong fundamentals and resilience despite current market volatility, providing potential value to investors seeking stability and growth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Strike CompanyLimited (TSE:6196) | ¥3645.00 | ¥7281.65 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1129.35 | ₹2250.95 | 49.8% |

| Wuhan Keqian BiologyLtd (SHSE:688526) | CN¥14.62 | CN¥29.09 | 49.7% |

| Lindab International (OM:LIAB) | SEK225.40 | SEK450.75 | 50% |

| Decisive Dividend (TSXV:DE) | CA$5.93 | CA$11.84 | 49.9% |

| GlobalData (AIM:DATA) | £1.875 | £3.75 | 50% |

| Western Alliance Bancorporation (NYSE:WAL) | US$82.86 | US$165.30 | 49.9% |

| HealthEquity (NasdaqGS:HQY) | US$94.77 | US$189.22 | 49.9% |

| Charter Hall Group (ASX:CHC) | A$14.37 | A$28.58 | 49.7% |

| Hanall Biopharma (KOSE:A009420) | ₩32650.00 | ₩65043.15 | 49.8% |

Let's explore several standout options from the results in the screener.

CLASSYS (KOSDAQ:A214150)

Overview: CLASSYS Inc. is a company that supplies medical aesthetics devices globally and has a market cap of ₩3.20 billion.

Operations: The company's revenue is primarily generated from its Surgical & Medical Equipment segment, amounting to ₩215.54 million.

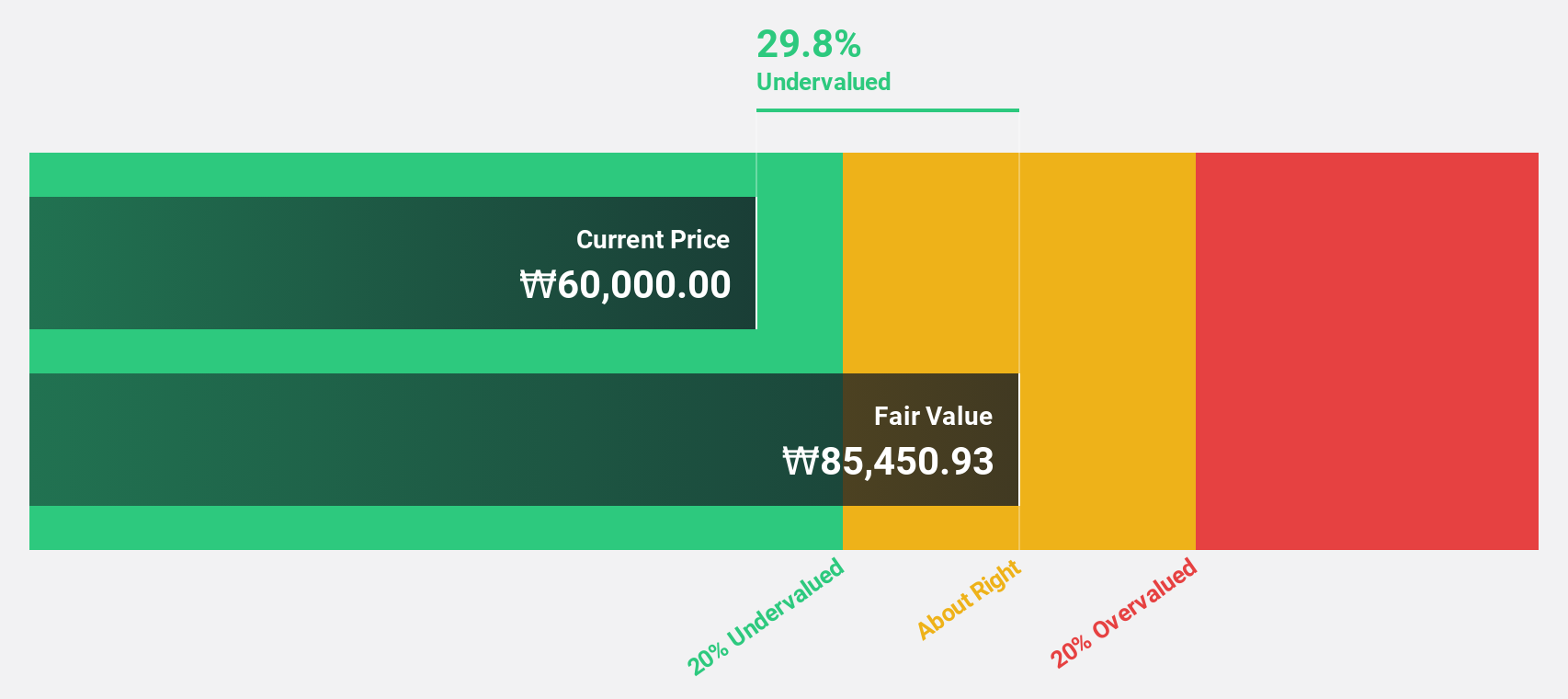

Estimated Discount To Fair Value: 27.3%

CLASSYS is trading at ₩48,800, significantly below its estimated fair value of ₩67,146.83, suggesting it might be undervalued based on discounted cash flow analysis. The company recently announced a share buyback program worth KRW 25 billion to enhance shareholder value and stabilize stock price. With earnings and revenue expected to grow significantly over the next three years, CLASSYS's financial outlook appears robust compared to the broader Korean market growth forecasts.

- According our earnings growth report, there's an indication that CLASSYS might be ready to expand.

- Navigate through the intricacies of CLASSYS with our comprehensive financial health report here.

HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540)

Overview: HD Korea Shipbuilding & Offshore Engineering Co., Ltd. engages in the design and construction of ships and offshore structures, with a market cap of ₩15.17 trillion.

Operations: The company generates revenue from its segments, including Shipbuilding at ₩22.95 billion, Engine at ₩4.38 billion, Marine Plant at ₩732.83 million, and Green Energy at ₩480.22 million.

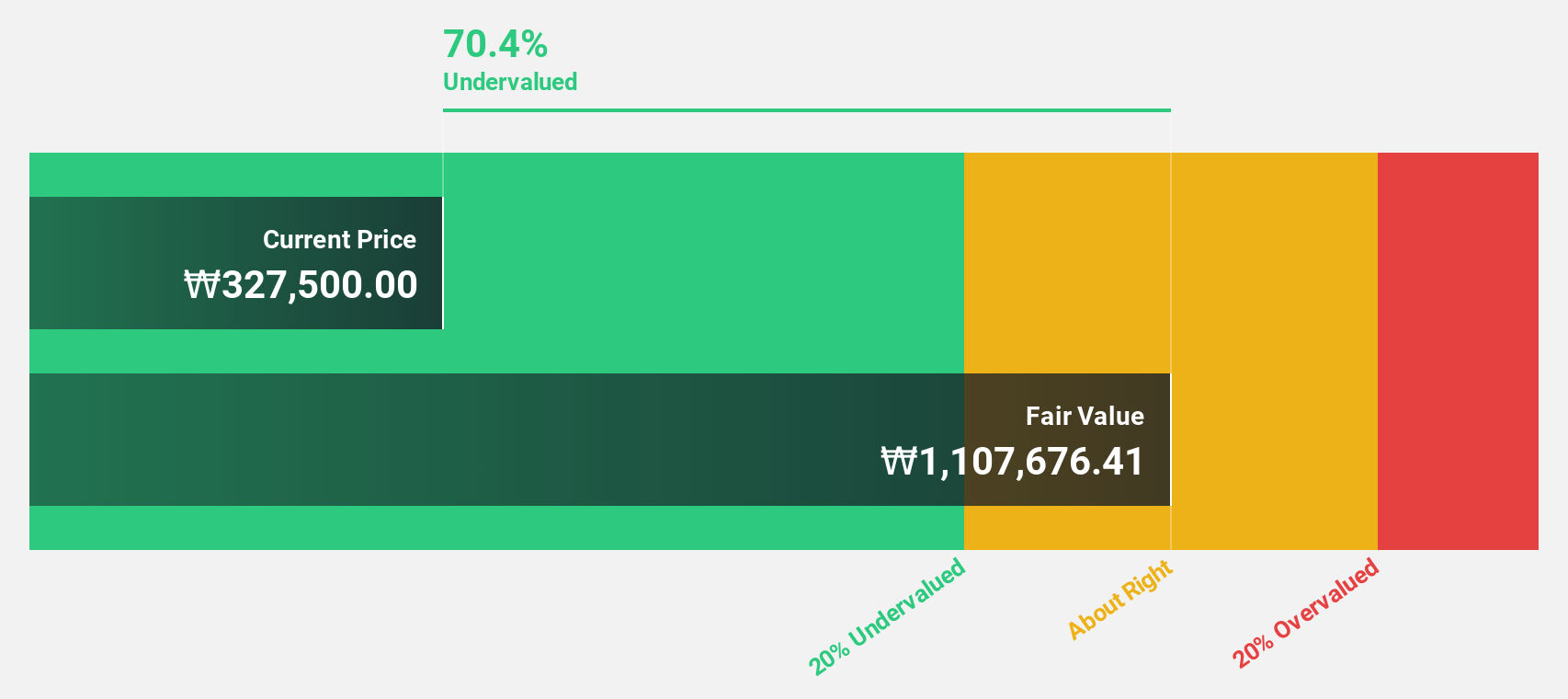

Estimated Discount To Fair Value: 47.3%

HD Korea Shipbuilding & Offshore Engineering is trading at ₩214,500, well below its estimated fair value of ₩406,763.04, indicating potential undervaluation based on discounted cash flow analysis. Despite a drop in quarterly net income to ₩151 billion from ₩337 billion the previous year, nine-month sales increased to ₩19.10 trillion from ₩15.95 trillion. Revenue and earnings are forecasted to grow faster than the Korean market over the next three years.

- Our expertly prepared growth report on HD Korea Shipbuilding & Offshore Engineering implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of HD Korea Shipbuilding & Offshore Engineering.

BioArctic (OM:BIOA B)

Overview: BioArctic AB (publ) is a Swedish company focused on developing biological drugs for central nervous system disorders, with a market cap of SEK19.46 billion.

Operations: The company generates revenue of SEK167.14 million from its biotechnology segment, which involves the development of biological drugs for central nervous system disorders.

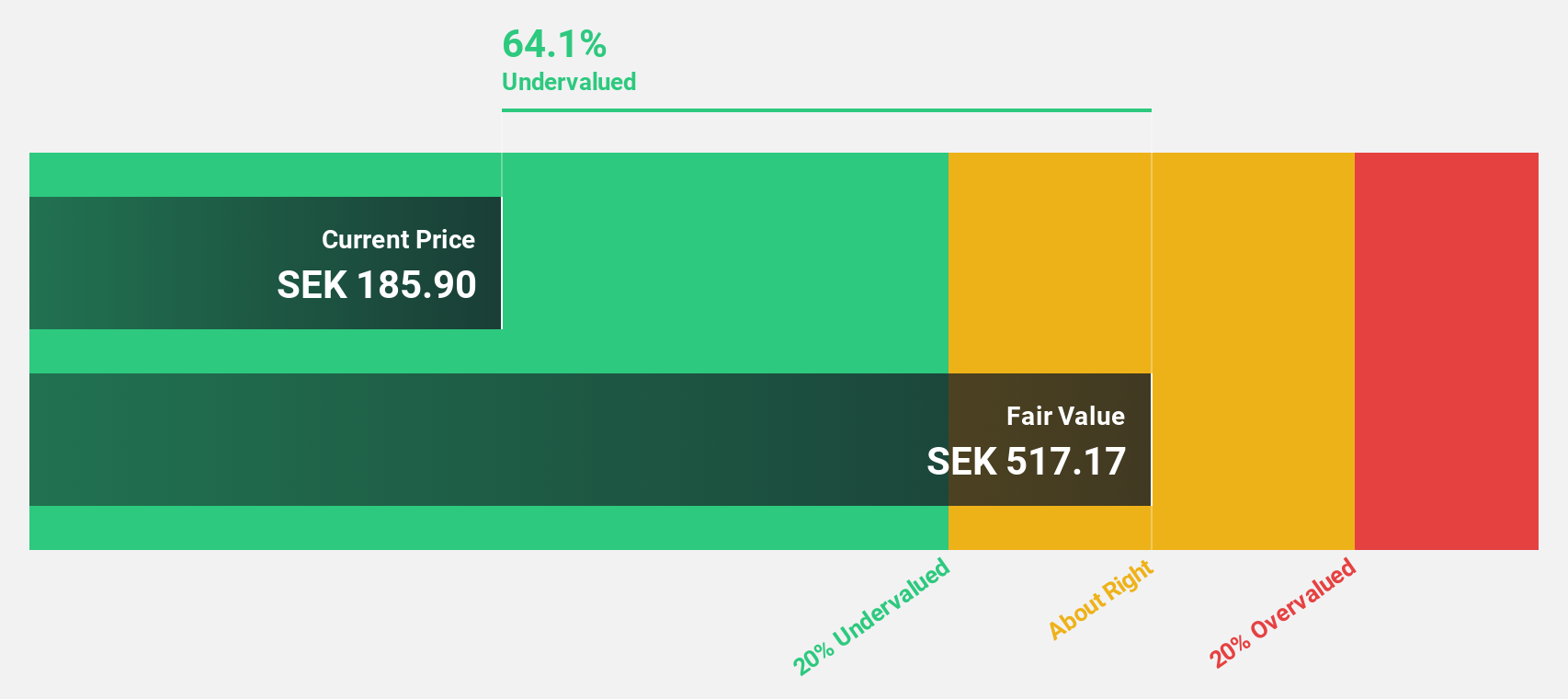

Estimated Discount To Fair Value: 38.2%

BioArctic is trading at SEK 220.2, significantly below its estimated fair value of SEK 356.32, suggesting potential undervaluation. The recent agreement with Bristol Myers Squibb could enhance cash flows through a US$100 million upfront payment and up to US$1.25 billion in milestone payments. Despite recent financial losses, BioArctic's revenue is projected to grow by 49.2% annually, outpacing the Swedish market and potentially supporting future profitability within three years.

- Our earnings growth report unveils the potential for significant increases in BioArctic's future results.

- Get an in-depth perspective on BioArctic's balance sheet by reading our health report here.

Next Steps

- Access the full spectrum of 911 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HD Korea Shipbuilding & Offshore Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A009540

HD Korea Shipbuilding & Offshore Engineering

HD Korea Shipbuilding & Offshore Engineering Co., Ltd.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives