- South Korea

- /

- Consumer Durables

- /

- KOSE:A066570

LG Electronics Inc. (KRX:066570) Not Lagging Market On Growth Or Pricing

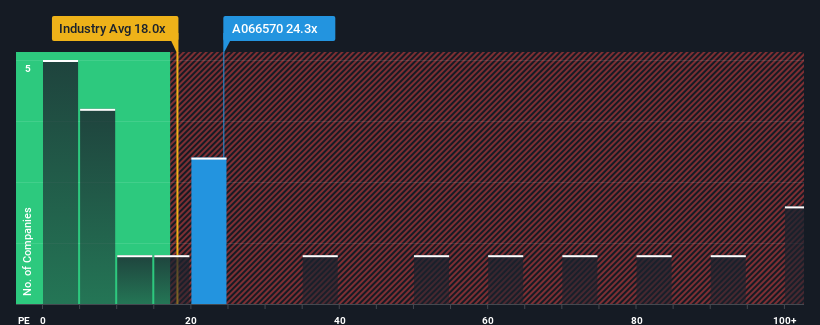

When close to half the companies in Korea have price-to-earnings ratios (or "P/E's") below 13x, you may consider LG Electronics Inc. (KRX:066570) as a stock to avoid entirely with its 24.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times haven't been advantageous for LG Electronics as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for LG Electronics

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as LG Electronics' is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 42% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 73% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 76% per annum as estimated by the analysts watching the company. That's shaping up to be materially higher than the 21% per annum growth forecast for the broader market.

With this information, we can see why LG Electronics is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of LG Electronics' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for LG Electronics that you should be aware of.

If you're unsure about the strength of LG Electronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A066570

LG Electronics

Manufactures and sells consumer and commercial products worldwide.

Flawless balance sheet and fair value.