- South Korea

- /

- IT

- /

- KOSDAQ:A042000

KRX Value Stocks Estimated Below Intrinsic Worth For October 2024

Reviewed by Simply Wall St

The South Korean stock market has recently experienced fluctuations, alternating between gains and losses as the KOSPI index hovers just above the 2,580-point mark. Amidst this mixed global forecast and varied earnings reports, investors may find opportunities in undervalued stocks that are estimated to be trading below their intrinsic worth, presenting potential value in a volatile market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| PharmaResearch (KOSDAQ:A214450) | ₩233000.00 | ₩423550.96 | 45% |

| T'Way Air (KOSE:A091810) | ₩3325.00 | ₩5631.12 | 41% |

| TSE (KOSDAQ:A131290) | ₩53400.00 | ₩99434.22 | 46.3% |

| Wonik Ips (KOSDAQ:A240810) | ₩27200.00 | ₩48604.66 | 44% |

| Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

| Intellian Technologies (KOSDAQ:A189300) | ₩48800.00 | ₩90211.74 | 45.9% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1443.00 | ₩2842.01 | 49.2% |

| ADTechnologyLtd (KOSDAQ:A200710) | ₩14300.00 | ₩24625.60 | 41.9% |

| Global Tax Free (KOSDAQ:A204620) | ₩3890.00 | ₩6436.70 | 39.6% |

| Hotel ShillaLtd (KOSE:A008770) | ₩43000.00 | ₩80756.33 | 46.8% |

Let's dive into some prime choices out of the screener.

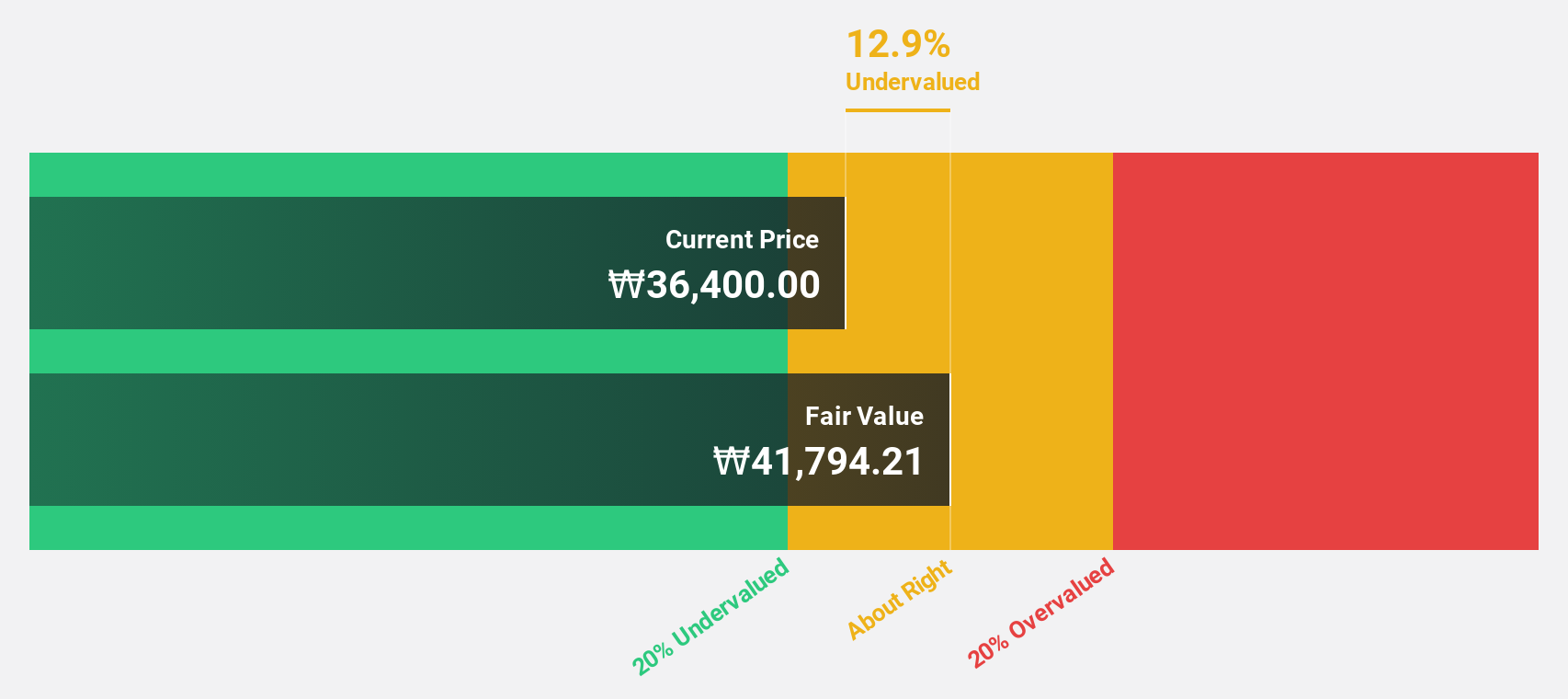

Cafe24 (KOSDAQ:A042000)

Overview: Cafe24 Corp. operates a global e-commerce platform and has a market cap of ₩597.20 billion.

Operations: The company's revenue segments include Transit at ₩42.97 billion, Clothing at ₩21.03 billion, and Internet Business Solution at ₩230.51 billion.

Estimated Discount To Fair Value: 35.5%

Cafe24 is trading at ₩24,700, significantly below its estimated fair value of ₩38,297.86. This undervaluation aligns with the discounted cash flow analysis showing it over 20% below fair value. Despite recent volatility and large one-off items affecting earnings quality, Cafe24's profitability has improved this year. Earnings are projected to grow 42.78% annually over the next three years, outpacing the South Korean market's growth rate of 29.5%.

- Our earnings growth report unveils the potential for significant increases in Cafe24's future results.

- Navigate through the intricacies of Cafe24 with our comprehensive financial health report here.

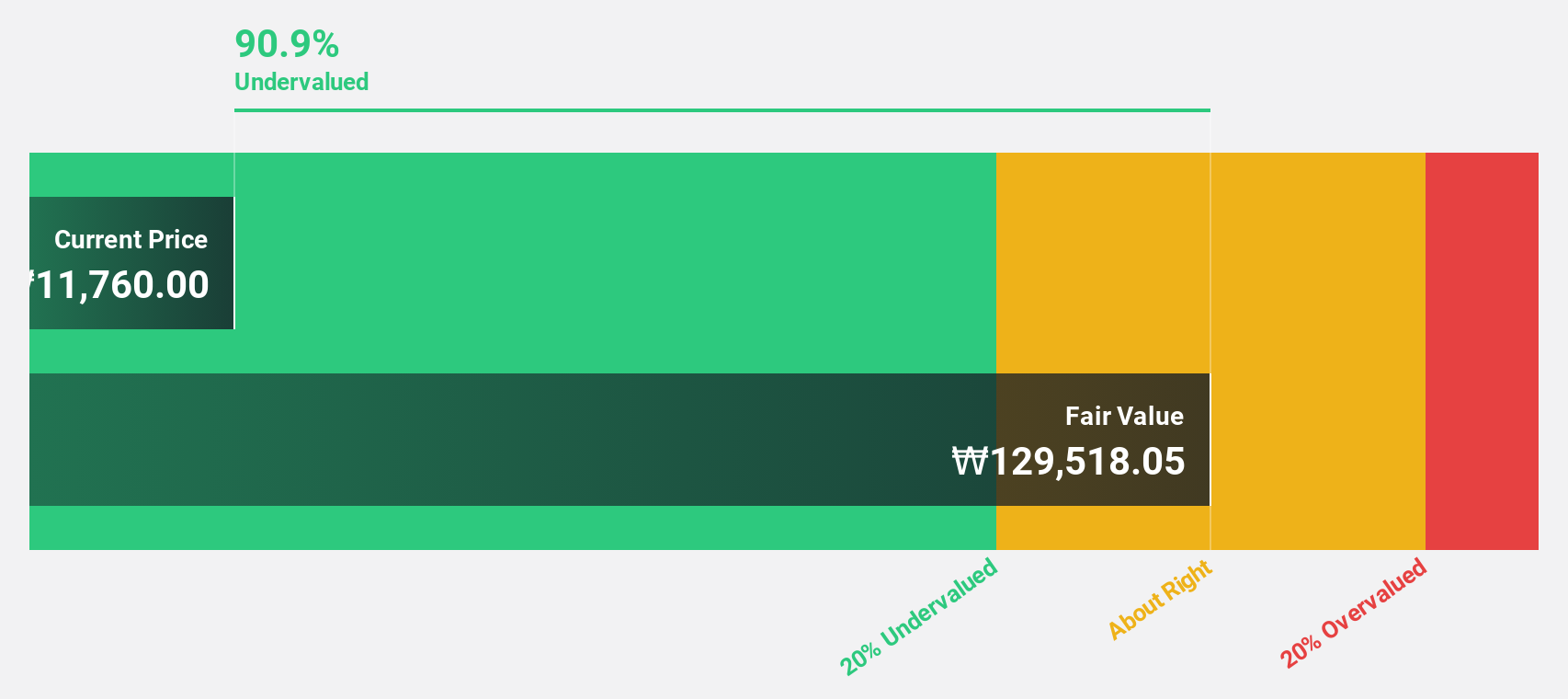

ZeusLtd (KOSDAQ:A079370)

Overview: Zeus Co., Ltd. offers semiconductor, robot, and display total solutions both in South Korea and internationally, with a market cap of approximately ₩358.64 billion.

Operations: The company's revenue segments include Valve at ₩23.67 billion and Equipment Division at ₩467.14 billion.

Estimated Discount To Fair Value: 36%

Zeus Ltd. is trading at ₩11,600, notably below its estimated fair value of ₩18,137.41, reflecting a significant undervaluation based on discounted cash flow analysis. Despite recent share price volatility, earnings are projected to grow 44.19% annually over the next three years, surpassing the South Korean market growth rate of 29.5%. Recent earnings reports show substantial improvement in profitability with net income reaching ₩6.79 billion in Q2 2024 from a loss last year.

- Our growth report here indicates ZeusLtd may be poised for an improving outlook.

- Dive into the specifics of ZeusLtd here with our thorough financial health report.

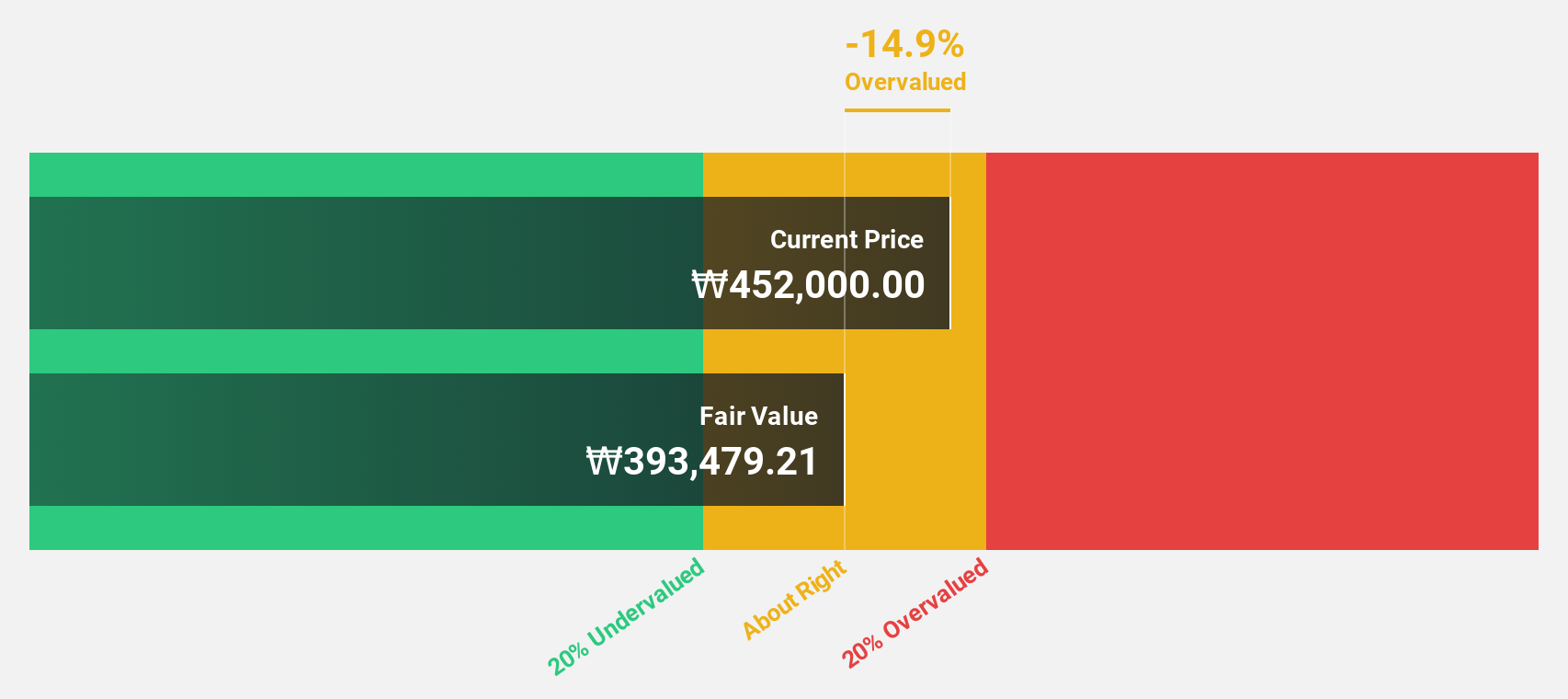

HD Hyundai Electric (KOSE:A267260)

Overview: HD Hyundai Electric Co., Ltd. manufactures and sells electrical equipment in South Korea, with a market cap of ₩12.42 billion.

Operations: The company's revenue is primarily derived from its Electric Equipment segment, which generated approximately ₩3.21 billion.

Estimated Discount To Fair Value: 23.4%

HD Hyundai Electric is trading at ₩345,000, significantly below its fair value estimate of ₩450,148.36, suggesting undervaluation based on discounted cash flow analysis. Earnings are forecast to grow 24.25% annually over the next three years but below the South Korean market's rate of 29.5%. Despite high share price volatility recently, its inclusion in the FTSE All-World Index highlights recognition in global markets and potential investor interest.

- In light of our recent growth report, it seems possible that HD Hyundai Electric's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of HD Hyundai Electric.

Next Steps

- Click here to access our complete index of 31 Undervalued KRX Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A042000

Flawless balance sheet with reasonable growth potential.