- South Korea

- /

- Electrical

- /

- KOSDAQ:A247540

Recent 13% pullback isn't enough to hurt long-term Ecopro BM (KOSDAQ:247540) shareholders, they're still up 802% over 5 years

Ecopro BM. Co., Ltd. (KOSDAQ:247540) shareholders might be concerned after seeing the share price drop 29% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been spectacular. To be precise, the stock price is 783% higher than it was five years ago, a wonderful performance by any measure. Arguably, the recent fall is to be expected after such a strong rise. But the real question is whether the business fundamentals can improve over the long term. While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 61% drop, in the last year. It really delights us to see such great share price performance for investors.

Since the long term performance has been good but there's been a recent pullback of 13%, let's check if the fundamentals match the share price.

View our latest analysis for Ecopro BM

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Ecopro BM actually saw its EPS drop 13% per year.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

In contrast revenue growth of 45% per year is probably viewed as evidence that Ecopro BM is growing, a real positive. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

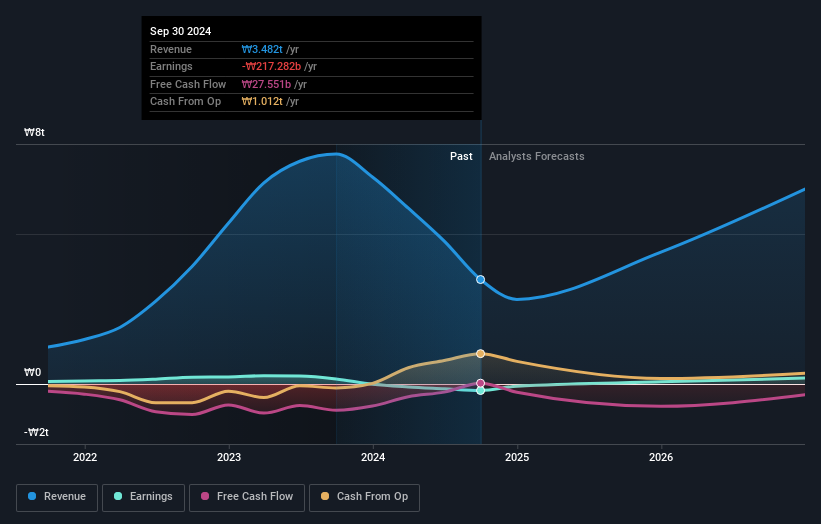

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Ecopro BM is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Ecopro BM stock, you should check out this free report showing analyst consensus estimates for future profits.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Ecopro BM's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Ecopro BM shareholders, and that cash payout contributed to why its TSR of 802%, over the last 5 years, is better than the share price return.

A Different Perspective

We regret to report that Ecopro BM shareholders are down 61% for the year. Unfortunately, that's worse than the broader market decline of 8.7%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 55%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for Ecopro BM that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Ecopro BM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A247540

Ecopro BM

Ecopro BM Co. Ltd. develops and sells cathode materials used in batteries in Korea and internationally.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives