- Japan

- /

- Capital Markets

- /

- TSE:8624

3 Global Dividend Stocks Offering At Least 4% Yield

Reviewed by Simply Wall St

Amidst a positive shift in global markets, driven by the U.S.-China tariff suspension and cooling inflation rates, investors are increasingly looking toward stable income sources like dividend stocks. In this environment, stocks offering at least a 4% yield can be an attractive option for those seeking consistent returns while navigating the complexities of current market conditions.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| en-japan (TSE:4849) | 4.26% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.39% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.19% | ★★★★★★ |

| Daicel (TSE:4202) | 5.00% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.91% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.75% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.05% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.04% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.52% | ★★★★★★ |

Click here to see the full list of 1574 stocks from our Top Global Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

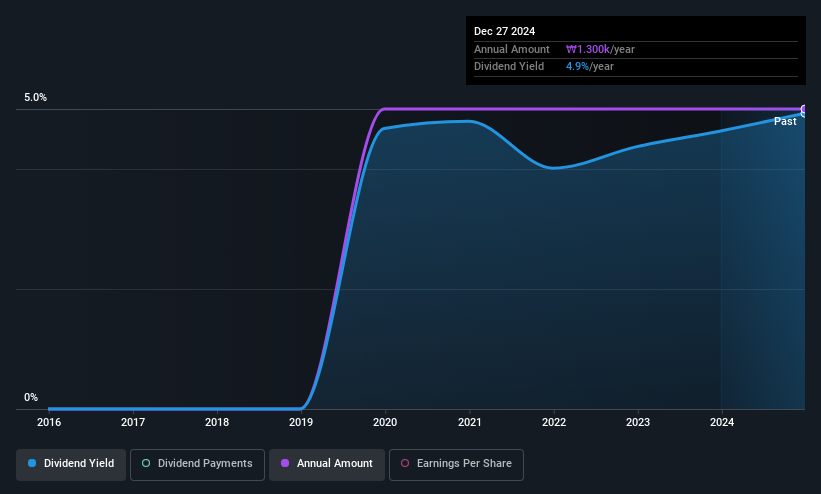

Geumhwa Plant Service & Construction (KOSDAQ:A036190)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Geumhwa Plant Service & Construction Co., Ltd. operates in the construction and plant service industry, with a market cap of approximately ₩167.43 billion.

Operations: Geumhwa Plant Service & Construction Co., Ltd. generates its revenue from various segments within the construction and plant service industry.

Dividend Yield: 4.5%

Geumhwa Plant Service & Construction offers a compelling dividend profile with a low payout ratio of 22.9%, ensuring dividends are well-covered by earnings and cash flows. Despite only six years of dividend history, payments have been stable and growing, placing its yield in the top 25% of KR market payers. Trading at 36.6% below estimated fair value, it presents potential for value investors seeking sustainable dividends amidst recent financial disclosures on May 21, 2025.

- Unlock comprehensive insights into our analysis of Geumhwa Plant Service & Construction stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Geumhwa Plant Service & Construction shares in the market.

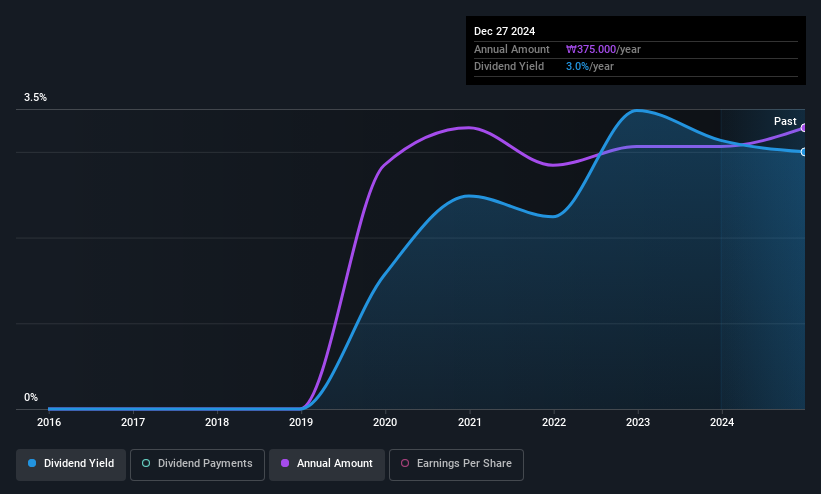

NeoPharm (KOSDAQ:A092730)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NeoPharm Co., Ltd. is a South Korean company that manufactures and sells skincare products, with a market cap of ₩227.74 billion.

Operations: NeoPharm Co., Ltd. generates its revenue primarily from the manufacturing and sale of skincare products in South Korea.

Dividend Yield: 4.1%

NeoPharm's dividend yield of 4.08% ranks in the top 25% of Korean market payers, supported by a payout ratio of 39%, indicating sustainability. Although dividends have been paid for only six years, they are stable and growing. The cash payout ratio is also healthy at 40.8%. Trading at 40.6% below estimated fair value, NeoPharm may attract value investors seeking reliable dividend income despite its relatively short payment history.

- Navigate through the intricacies of NeoPharm with our comprehensive dividend report here.

- The analysis detailed in our NeoPharm valuation report hints at an deflated share price compared to its estimated value.

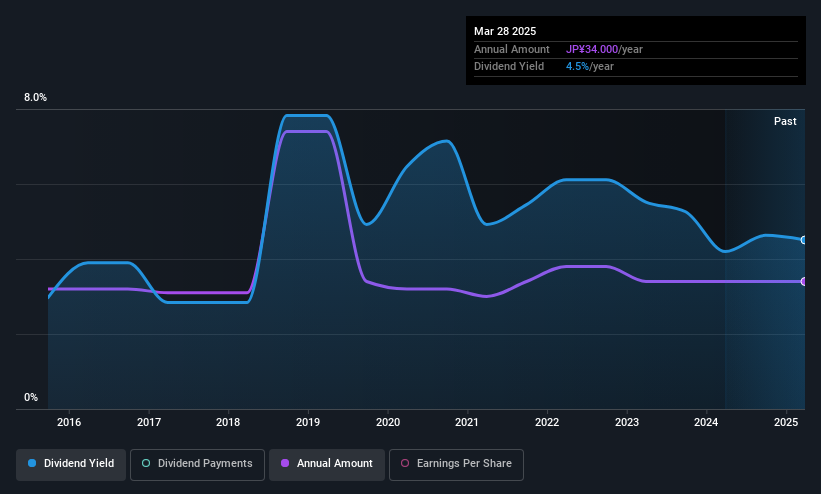

Ichiyoshi Securities (TSE:8624)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ichiyoshi Securities Co., Ltd. offers investment and financial services in Japan, with a market cap of ¥25.77 billion.

Operations: Ichiyoshi Securities Co., Ltd. generates its revenue primarily from its Investment and Financial Services segment, which amounts to ¥18.76 billion.

Dividend Yield: 4.1%

Ichiyoshi Securities offers a dividend yield of 4.13%, placing it in the top 25% of Japanese market payers, with dividends well-covered by earnings and cash flows (payout ratios: 51.7% and 17.4%). Despite this coverage, the company's dividend history is marked by volatility and declines over the past decade. Recently, Ichiyoshi affirmed a ¥17 per share dividend for fiscal year ending March 31, 2025, maintaining last year's payout level.

- Click to explore a detailed breakdown of our findings in Ichiyoshi Securities' dividend report.

- The analysis detailed in our Ichiyoshi Securities valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Embark on your investment journey to our 1574 Top Global Dividend Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8624

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)