- China

- /

- Metals and Mining

- /

- SHSE:600399

Three Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, with small-cap stocks underperforming and inflation concerns persisting, investors are keenly observing economic indicators that could influence future market movements. Amidst these fluctuations, identifying promising small-cap stocks can be challenging yet rewarding, as they often offer unique opportunities for growth in an uncertain environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| AB Vilkyskiu pienine | 35.79% | 17.20% | 49.04% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| All E Technologies | NA | 27.05% | 31.58% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.75% | 19.36% | 52.36% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Cheryong ElectricLtd (KOSDAQ:A033100)

Simply Wall St Value Rating: ★★★★★★

Overview: Cheryong Electric Co., Ltd. manufactures and sells power electric equipment in South Korea, with a market cap of ₩833.64 billion.

Operations: Cheryong Electric Co., Ltd. generates revenue primarily from the sale of power electric equipment in South Korea. The company has a market capitalization of ₩833.64 billion, reflecting its scale within the industry.

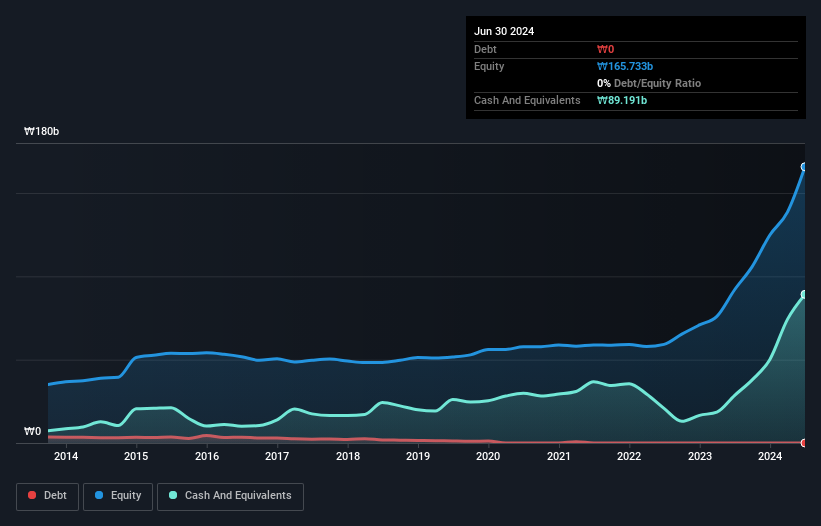

Cheryong Electric, a nimble player in the electrical industry, has been making waves with its impressive earnings growth of 105.7% over the past year, significantly outpacing the industry's 14%. This debt-free company is trading at a value 91.2% below its estimated fair value, suggesting potential upside. Despite recent share price volatility, Cheryong's high-quality earnings and positive free cash flow position it well within its sector. The company's forecasted annual earnings growth of 7.77% further underscores its robust financial health and promising outlook for continued expansion in the coming years.

Fushun Special SteelLTD (SHSE:600399)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fushun Special Steel Co., LTD. and its subsidiaries manufacture and sell steel products both in China and internationally, with a market capitalization of CN¥11.14 billion.

Operations: Fushun Special Steel generates its revenue primarily from the sale of steel products in both domestic and international markets. The company has a market capitalization of CN¥11.14 billion, reflecting its significant presence in the steel industry.

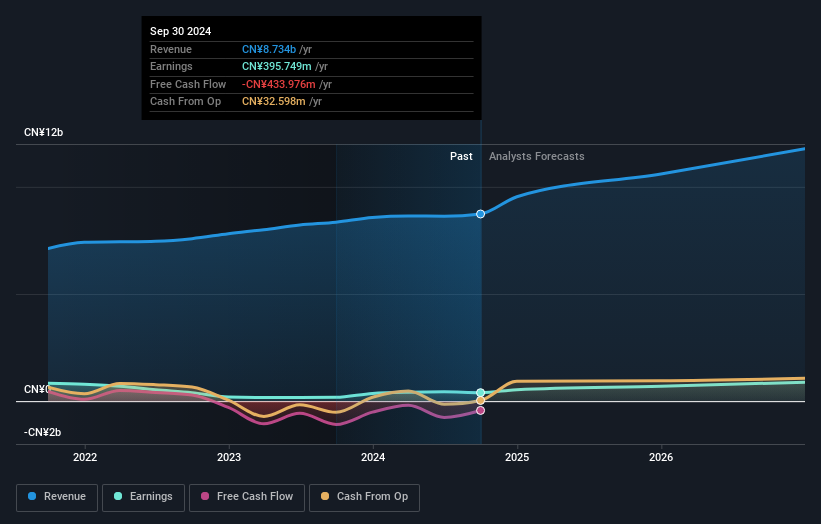

Fushun Special Steel, a notable player in the metals industry, has demonstrated impressive financial resilience with earnings growth of 120% over the past year, outpacing the industry's -1.8%. The company’s net debt to equity ratio stands at a satisfactory 25.1%, indicating sound financial management. Recent buybacks saw Fushun repurchase over 10 million shares for CNY 70 million, reflecting strategic capital allocation. Despite not being free cash flow positive, its interest payments are well covered by EBIT at 13.8x coverage. With a price-to-earnings ratio of 28x below the CN market average, Fushun presents an attractive valuation opportunity.

- Click here and access our complete health analysis report to understand the dynamics of Fushun Special SteelLTD.

Gain insights into Fushun Special SteelLTD's past trends and performance with our Past report.

Shiyan Taixiang IndustryLtd (SZSE:301192)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shiyan Taixiang Industry Co., Ltd focuses on the research, development, production, and sale of auto parts and accessories in China, with a market capitalization of CN¥2.01 billion.

Operations: Shiyan Taixiang Industry Co., Ltd generates revenue primarily from producing automobile engine main bearing caps, amounting to CN¥416.21 million.

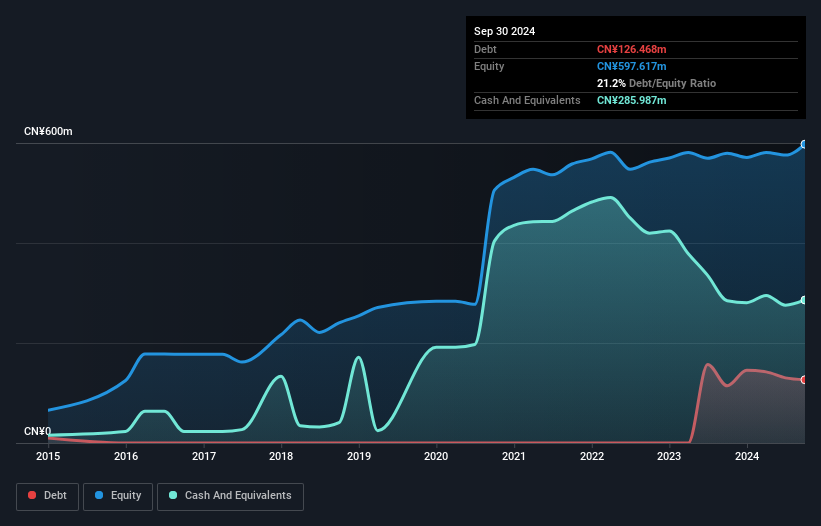

Shiyan Taixiang Industry Ltd. showcases a robust profile with earnings rising 34% over the past year, surpassing the Auto Components industry's 10.5% growth rate. The company reported CNY 311.82 million in sales for the nine months ending September 2024, up from CNY 207.17 million a year prior, while net income reached CNY 43.78 million compared to CNY 27.7 million last year. With cash exceeding total debt and interest payments well-covered by EBIT at a ratio of 74x, financial stability seems solid despite an increased debt-to-equity ratio of 21% over five years, suggesting cautious optimism moving forward.

Make It Happen

- Dive into all 4568 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600399

Fushun Special SteelLTD

Manufactures and sells steel products in China and internationally.

Excellent balance sheet with proven track record.