As global markets navigate through a period of uncertainty marked by inflation concerns and political shifts, small-cap stocks have faced notable challenges, with the Russell 2000 Index recently dipping into correction territory. Amidst this backdrop, discerning investors may find opportunities in lesser-known stocks that demonstrate strong fundamentals and resilience to market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| AB Vilkyskiu pienine | 35.79% | 17.20% | 49.04% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| All E Technologies | NA | 27.05% | 31.58% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.75% | 19.36% | 52.36% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

MicroPort NeuroScientific (SEHK:2172)

Simply Wall St Value Rating: ★★★★★★

Overview: MicroPort NeuroScientific Corporation focuses on the research, development, production, and sale of neuro-interventional medical devices both in China and internationally, with a market cap of approximately HK$4.87 billion.

Operations: MicroPort NeuroScientific generates revenue primarily from the sale of surgical and medical equipment, totaling CN¥774.66 million.

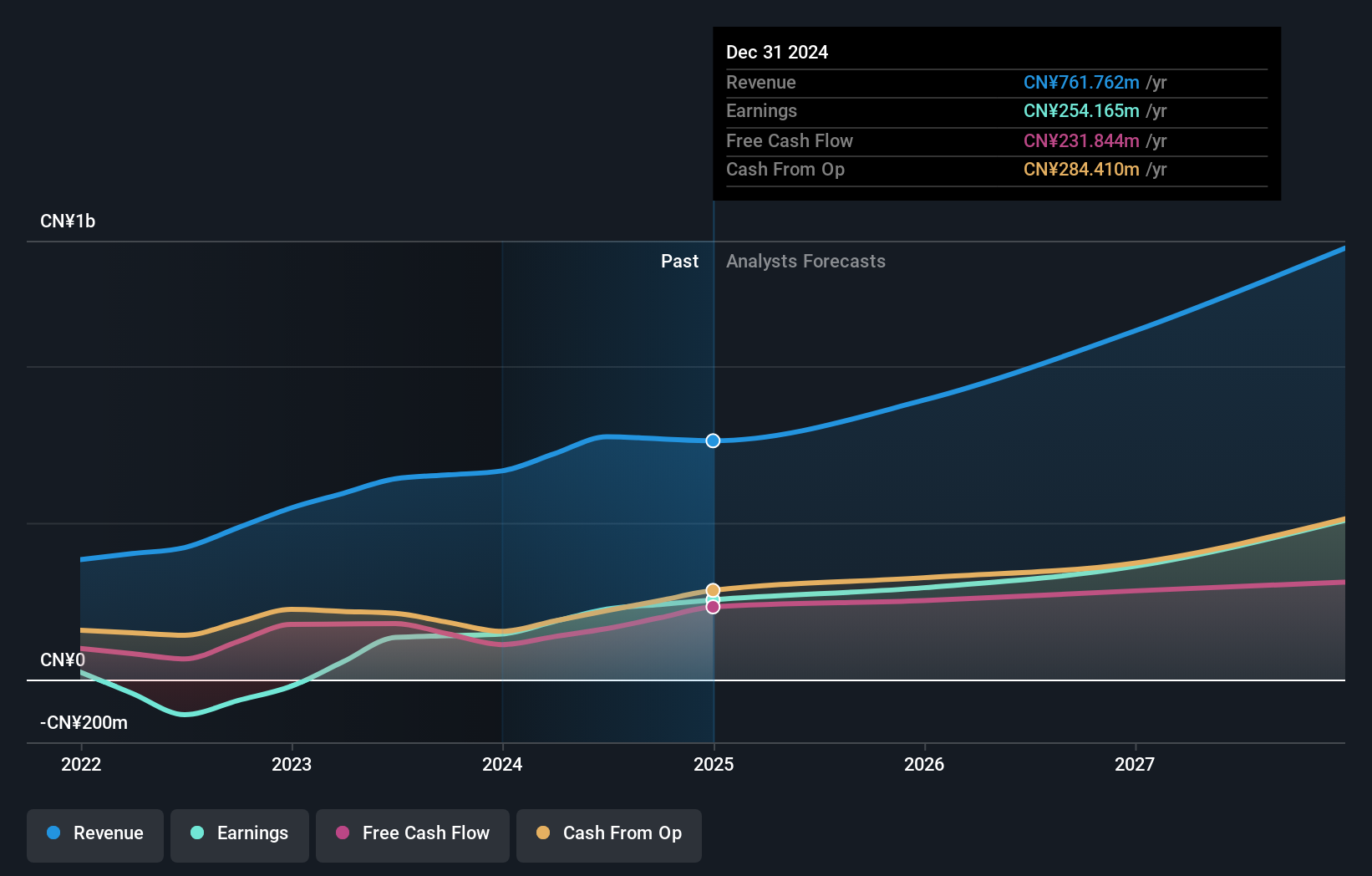

MicroPort NeuroScientific, a nimble player in the medical equipment sector, has showcased impressive growth with earnings surging 67% over the past year, outpacing industry averages. The company is trading at 57.6% below its estimated fair value, indicating potential undervaluation. With no debt on its books for five years and positive free cash flow of RMB 162 million as of January 2025, financial stability seems assured. Recent guidance projects net profit between RMB 236 million and RMB 270 million for 2024, marking a significant increase driven by expanded hospital coverage and overseas revenue growth.

Xinhuanet (SHSE:603888)

Simply Wall St Value Rating: ★★★★★★

Overview: Xinhuanet Co., Ltd. operates a news information service portal in China with a market cap of CN¥11.29 billion.

Operations: Xinhuanet generates revenue primarily through its news information service portal in China. The company focuses on digital advertising and subscription services as key revenue streams. It has reported a net profit margin of 10% over the last five periods, reflecting its ability to manage costs effectively relative to its revenues.

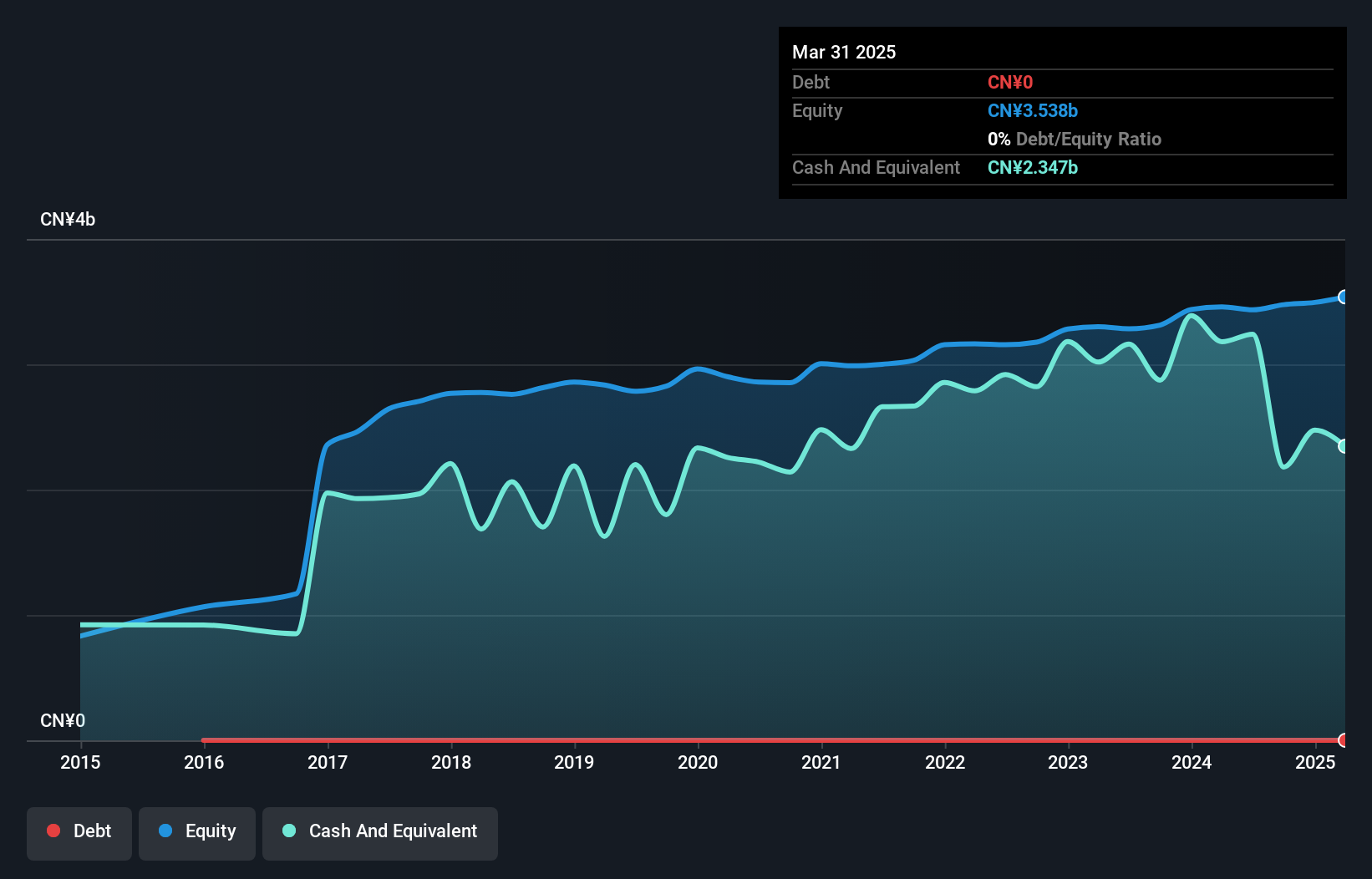

Xinhuanet, a nimble player in the media landscape, showcases a reasonable Price-to-Earnings ratio of 40.3x, undercutting the industry average of 45.9x. Over the past year, earnings have climbed by 10%, outpacing the sector's -10% shift. With no debt on its books for five years and high-quality non-cash earnings, Xinhuanet stands on solid ground financially. For the nine months ending September 2024, net income rose to CNY 155M from CNY 147M previously, with basic EPS inching up to CNY 0.30 from CNY 0.28 last year—a testament to its steady profitability amidst fluctuating sales figures.

- Dive into the specifics of Xinhuanet here with our thorough health report.

Review our historical performance report to gain insights into Xinhuanet's's past performance.

Xiangtan Electrochemical ScientificLtd (SZSE:002125)

Simply Wall St Value Rating: ★★★★★★

Overview: Xiangtan Electrochemical Scientific Co., Ltd focuses on the research, development, production, and sale of battery materials with a market capitalization of CN¥6.37 billion.

Operations: The company generates revenue primarily from the sale of battery materials. It has a market capitalization of CN¥6.37 billion.

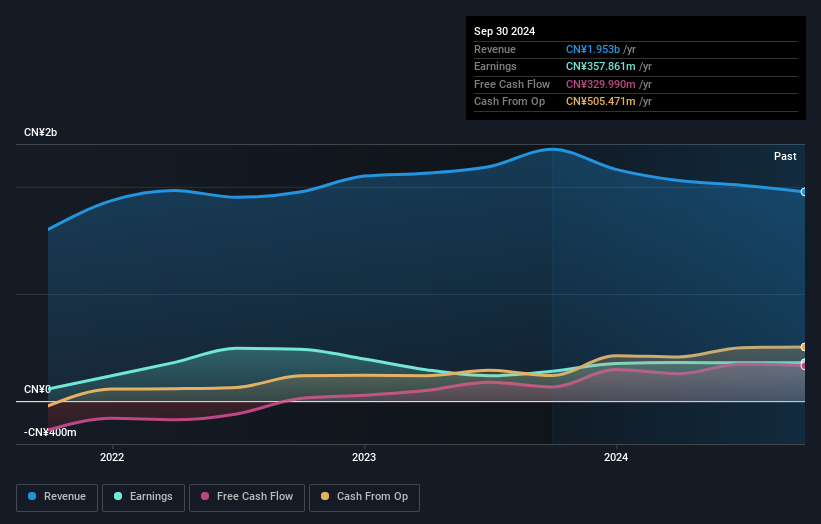

Xiangtan Electrochemical Scientific Co. seems to be carving a niche in the chemicals sector, with its earnings growth of 27.8% outpacing the industry's -4.1%. The company's net debt to equity ratio has impressively dropped from 120.9% to 44.6% over five years, showcasing prudent financial management and satisfactory leverage at 33.6%. Despite a dip in sales from CNY 1,593 million to CNY 1,383 million for the first nine months of 2024, net income slightly rose to CNY 244 million from CNY 239 million last year, indicating robust cost control or operational efficiency improvements amidst leadership changes and strategic board elections recently held in November.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 4565 Undiscovered Gems With Strong Fundamentals now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002125

Xiangtan Electrochemical ScientificLtd

Engages in the research and development, production, and sale of battery materials.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives