- China

- /

- Consumer Services

- /

- SHSE:600730

Undiscovered Gems with Strong Potential This January 2025

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, small-cap stocks have notably underperformed their larger counterparts, with the Russell 2000 Index slipping into correction territory. Amid these turbulent conditions, investors often seek out undiscovered gems—stocks that may offer strong potential due to solid fundamentals or unique market positioning despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| AB Vilkyskiu pienine | 35.79% | 17.20% | 49.04% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| All E Technologies | NA | 27.05% | 31.58% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.75% | 19.36% | 52.36% | ★★★★☆☆ |

We'll examine a selection from our screener results.

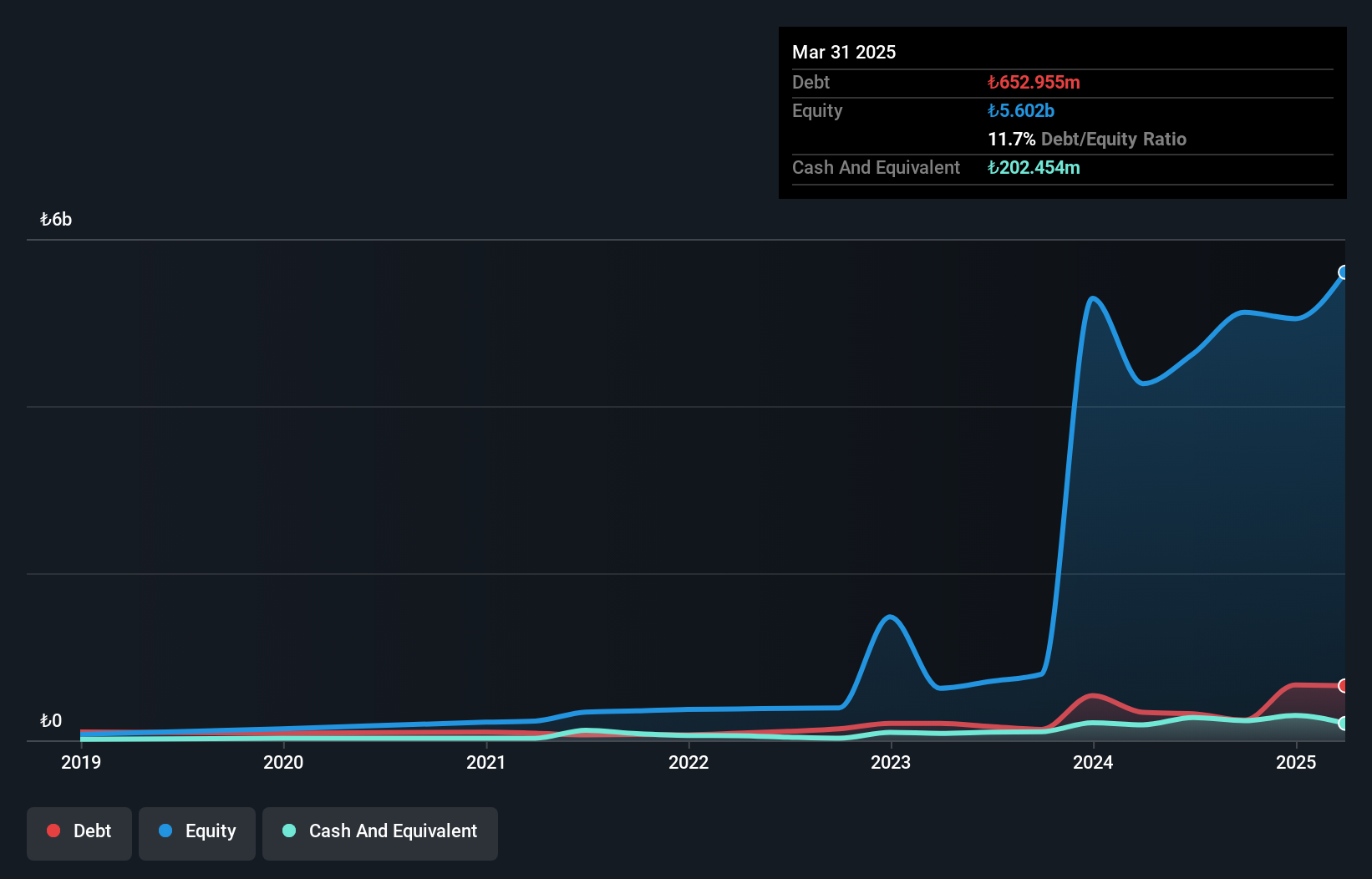

Tureks Turizm Tasimacilik Anonim Sirketi (IBSE:TUREX)

Simply Wall St Value Rating: ★★★★★★

Overview: Tureks Turizm Tasimacilik Anonim Sirketi offers transportation services to public and private institutions in Turkey, with a market cap of TRY18.80 billion.

Operations: Tureks Turizm generates revenue primarily through its transportation services, catering to both public and private sectors in Turkey. The company's financial performance is highlighted by a net profit margin of 15%, indicating efficient cost management relative to its earnings.

Tureks Turizm Tasimacilik Anonim Sirketi, a nimble player in the transportation sector, has demonstrated robust financial health with its debt to equity ratio dropping from 74.2% to 4.7% over five years and interest payments comfortably covered by EBIT at 5x. Despite a volatile share price recently, the company’s earnings have grown impressively at 59.1% annually over five years, though recent earnings growth of 37.2% matched industry performance rather than outpacing it. Recent financials show sales reaching TRY 1,236 million for Q3 but net income fell to TRY 80 million compared to TRY 125 million last year, hinting at some challenges ahead.

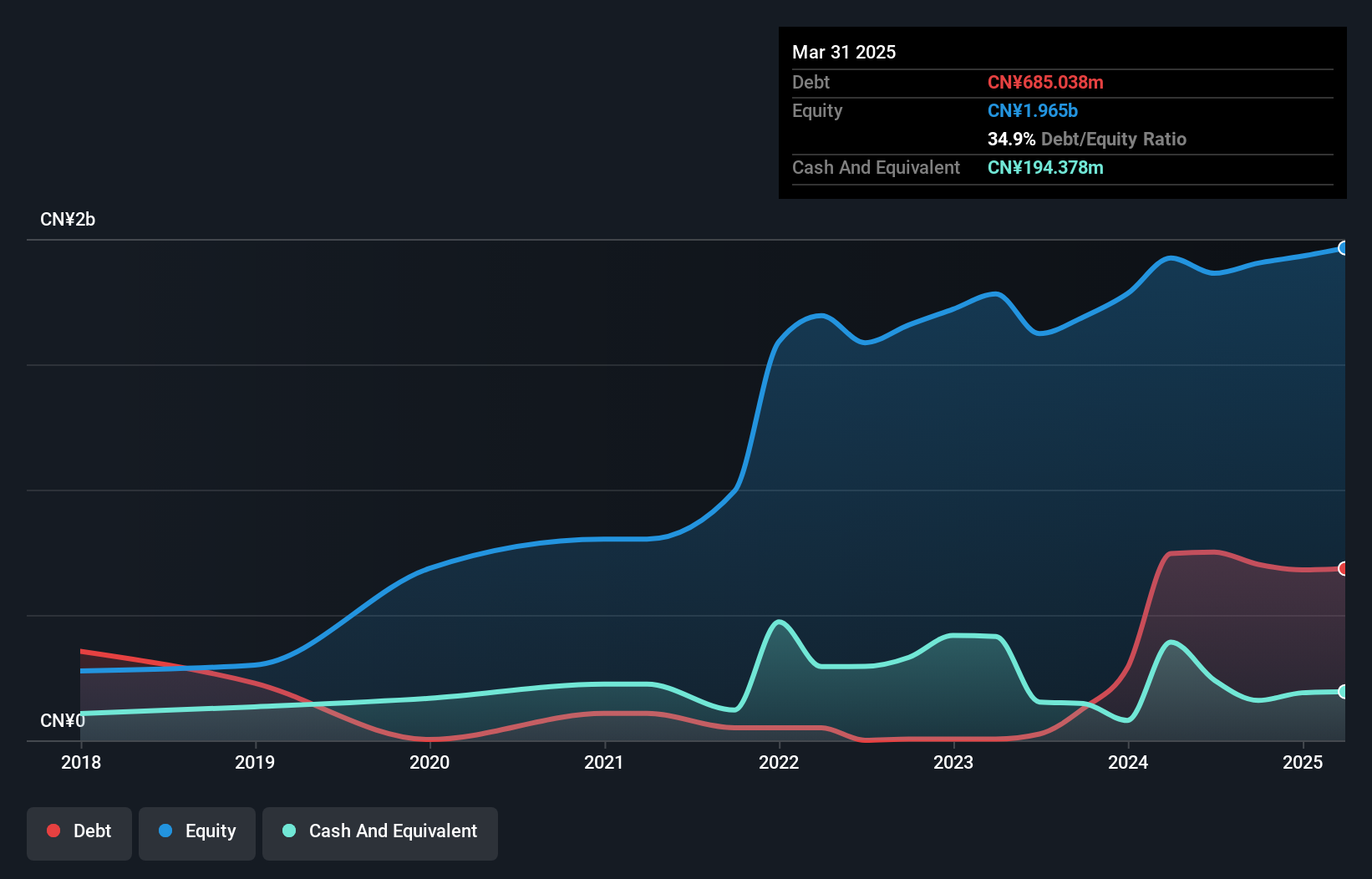

China Hi-Tech Group (SHSE:600730)

Simply Wall St Value Rating: ★★★★★★

Overview: China Hi-Tech Group Co., Ltd. operates in the education and real estate leasing sectors in China, with a market capitalization of approximately CN¥3.46 billion.

Operations: China Hi-Tech Group Co., Ltd. derives its revenue primarily from the education and real estate leasing sectors. The company has a market capitalization of around CN¥3.46 billion.

China Hi-Tech Group, a nimble player in its sector, has recently turned profitable, showcasing impressive earnings growth. The company reported net income of CNY 26.69 million for the first nine months of 2024, up from CNY 5.23 million the previous year. Earnings per share also saw a notable rise to CNY 0.045 from CNY 0.009 year-on-year, reflecting this turnaround. With no debt on its books and high-quality past earnings, China Hi-Tech seems well-positioned within its industry context despite not being free cash flow positive yet; however, it remains an intriguing prospect due to its recent financial achievements and debt-free status.

Zhejiang Oceanking Development (SHSE:603213)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhejiang Oceanking Development Co., Ltd. is involved in the research, development, production, and sale of chlor-alkali-related products, with a market cap of CN¥4.18 billion.

Operations: Zhejiang Oceanking derives its revenue primarily from the sale of chlor-alkali-related products. The company has reported a gross profit margin of 25% in recent periods.

Zhejiang Oceanking Development, a small player in its field, has shown robust performance with earnings growth of 12.4% over the past year, outpacing the Chemicals industry's -4.1%. The company reported sales of CNY 2.01 billion for the first nine months of 2024, up from CNY 1.54 billion last year, although net income slightly dipped to CNY 149.34 million from CNY 154.61 million. With a price-to-earnings ratio at an attractive 17.5x against the broader CN market's 33.4x and interest payments well covered by EBIT at a multiple of 39x, it presents potential value despite rising debt levels over five years to a satisfactory net debt to equity ratio of 28.5%.

Summing It All Up

- Unlock our comprehensive list of 4568 Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600730

China Hi-Tech Group

Engages in the education and real estate leasing businesses in China.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)