- South Korea

- /

- Banks

- /

- KOSE:A316140

Woori Financial Group (KOSE:A316140) Reports Q3 Earnings; Digital Banking Initiatives Drive Growth

Reviewed by Simply Wall St

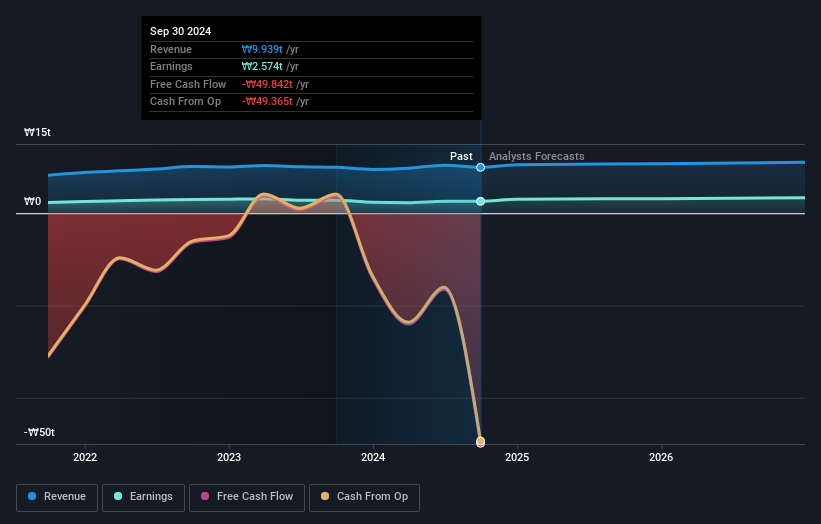

Woori Financial Group (KOSE:A316140) recently announced its earnings for the third quarter and the first nine months of 2024, showing a slight increase in net interest income and net income compared to the previous year. The company's strategic focus on digital banking and sustainable finance, coupled with a successful capital issuance, highlights its growth potential despite challenges such as a lower-than-desired ROE and high debt levels. The report also covers key areas including risk management, market trends, and external threats impacting Woori Financial Group's future performance.

Innovative Factors Supporting Woori Financial Group

Woori Financial Group has demonstrated strong financial performance, with its Net Interest Margin (NIM) increasing by 7 basis points in Q2, showcasing effective interest rate management. The successful issuance of USD 550 million in Tier 1 capital, as highlighted by CFO Sung-Wook Lee, reflects market confidence and bolsters the company's capital base for future growth. Furthermore, the company maintains a solid risk management framework, evidenced by a credit cost ratio of 0.42%, indicating healthy asset quality. Analysts forecast a target price more than 20% higher than the current share price, suggesting growth potential. Trading at ₩15,890, significantly below the estimated fair value of ₩59,526.73, the company appears undervalued, presenting a favorable investment opportunity.

Vulnerabilities Impacting Woori Financial Group

While Woori Financial Group shows promise, it faces challenges with a Return on Equity (ROE) of 7.8%, which is below the desired threshold of 20%. The company's net profit margin has decreased to 25.9% from 28.1% the previous year, indicating potential profitability issues. Additionally, the high net debt to equity ratio of 89.5% raises concerns about financial leverage. The slower-than-expected growth in Risk-Weighted Assets (RWA) suggests difficulties in expanding the loan portfolio, as noted by analyst Hye-jin Park during recent earnings calls.

Emerging Markets Or Trends for Woori Financial Group

Woori Financial Group is capitalizing on digital banking trends by expanding its digital offerings, aiming to capture more market share. Investments in AI and fintech partnerships, as prioritized by CFO Sung-Wook Lee, are expected to enhance operational efficiency and customer experience. The growing consumer demand for sustainable finance products presents an opportunity for Woori to innovate and attract a new customer segment, thus enhancing brand loyalty and market share. Analysts agree that the stock price is likely to rise by 23.6%, indicating positive market sentiment.

External Factors Threatening Woori Financial Group

Economic uncertainties pose risks to Woori Financial Group's growth and profitability, requiring careful strategic foresight. Regulatory changes, as monitored by Chief Risk Officer Jang-Geun Park, could increase compliance costs and impact operations. Additionally, supply chain disruptions, which the company is addressing, may affect operational efficiency and service delivery, potentially leading to customer dissatisfaction. The company's unstable dividend track record, with payments described as volatile, adds another layer of risk to its financial stability.

Conclusion

Woori Financial Group's strategic initiatives in digital banking and fintech partnerships position it well to capture emerging market opportunities and enhance customer experience, which could drive future growth. Challenges such as a lower-than-desired Return on Equity and high financial leverage remain. The company's effective interest rate management and healthy asset quality reflect a solid foundation for improvement. The stock is currently trading at ₩15,890, significantly below its estimated fair value of ₩59,526.73, suggesting that the market may not fully recognize its growth potential. As the company continues to address external threats like economic uncertainties and regulatory changes, its focus on innovation and sustainable finance products could enhance its market share and profitability in the long run.

Next Steps

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Woori Financial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About KOSE:A316140

Woori Financial Group

Operates as a commercial bank that provides a range of financial services to individual, business, and institutional customers in Korea.

Very undervalued with flawless balance sheet and pays a dividend.