- South Korea

- /

- Auto Components

- /

- KOSE:A161390

Earnings growth of 7.3% over 3 years hasn't been enough to translate into positive returns for Hankook Tire & Technology (KRX:161390) shareholders

Investors are understandably disappointed when a stock they own declines in value. But it can difficult to make money in a declining market. The Hankook Tire & Technology Co., Ltd. (KRX:161390) is down 14% over three years, but the total shareholder return is -7.8% once you include the dividend. And that total return actually beats the market decline of 8.3%. The last month has also been disappointing, with the stock slipping a further 17%.

Since Hankook Tire & Technology has shed ₩226b from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Hankook Tire & Technology

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Although the share price is down over three years, Hankook Tire & Technology actually managed to grow EPS by 24% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

We're actually a quite surprised to see the share price down while EPS have grown strongly. So we'll have to take a look at other metrics to try to understand the price action.

Revenue is actually up 10.0% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching Hankook Tire & Technology more closely, as sometimes stocks fall unfairly. This could present an opportunity.

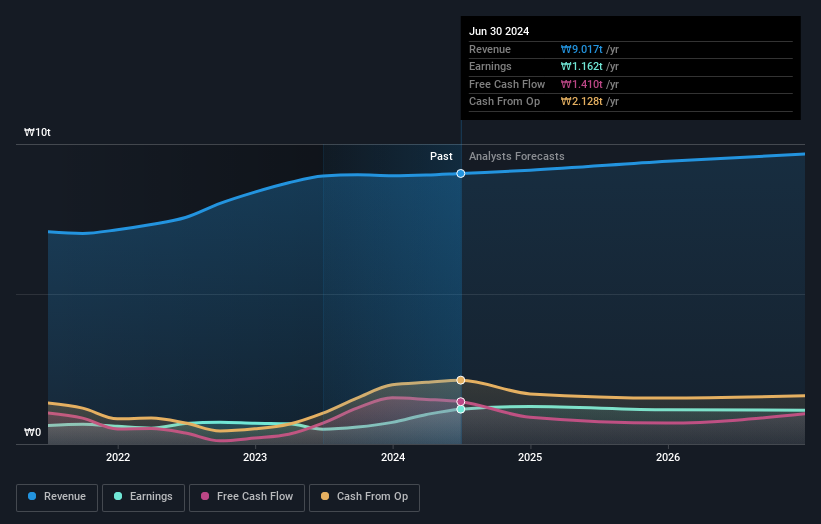

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Hankook Tire & Technology is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Hankook Tire & Technology's TSR for the last 3 years was -7.8%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market gained around 12% in the last year, Hankook Tire & Technology shareholders lost 1.6% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 4% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Hankook Tire & Technology is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hankook Tire & Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A161390

Flawless balance sheet and undervalued.