- Japan

- /

- Transportation

- /

- TSE:9619

Megaworld And 2 Other Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape, characterized by fluctuating consumer confidence and shifting indices, investors are increasingly seeking stability through dividend stocks. In this context, identifying strong dividend-paying companies like Megaworld can offer a reliable income stream amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 4.85% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.59% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.27% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.84% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.68% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Megaworld (PSE:MEG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Megaworld Corporation, along with its subsidiaries, is involved in the development, sale, and leasing of real estate properties in the Philippines and has a market capitalization of approximately ₱66.74 billion.

Operations: Megaworld Corporation generates revenue from three primary segments: ₱19.96 billion from rental services, ₱51.52 billion from real estate sales, and ₱4.80 billion from hotel operations.

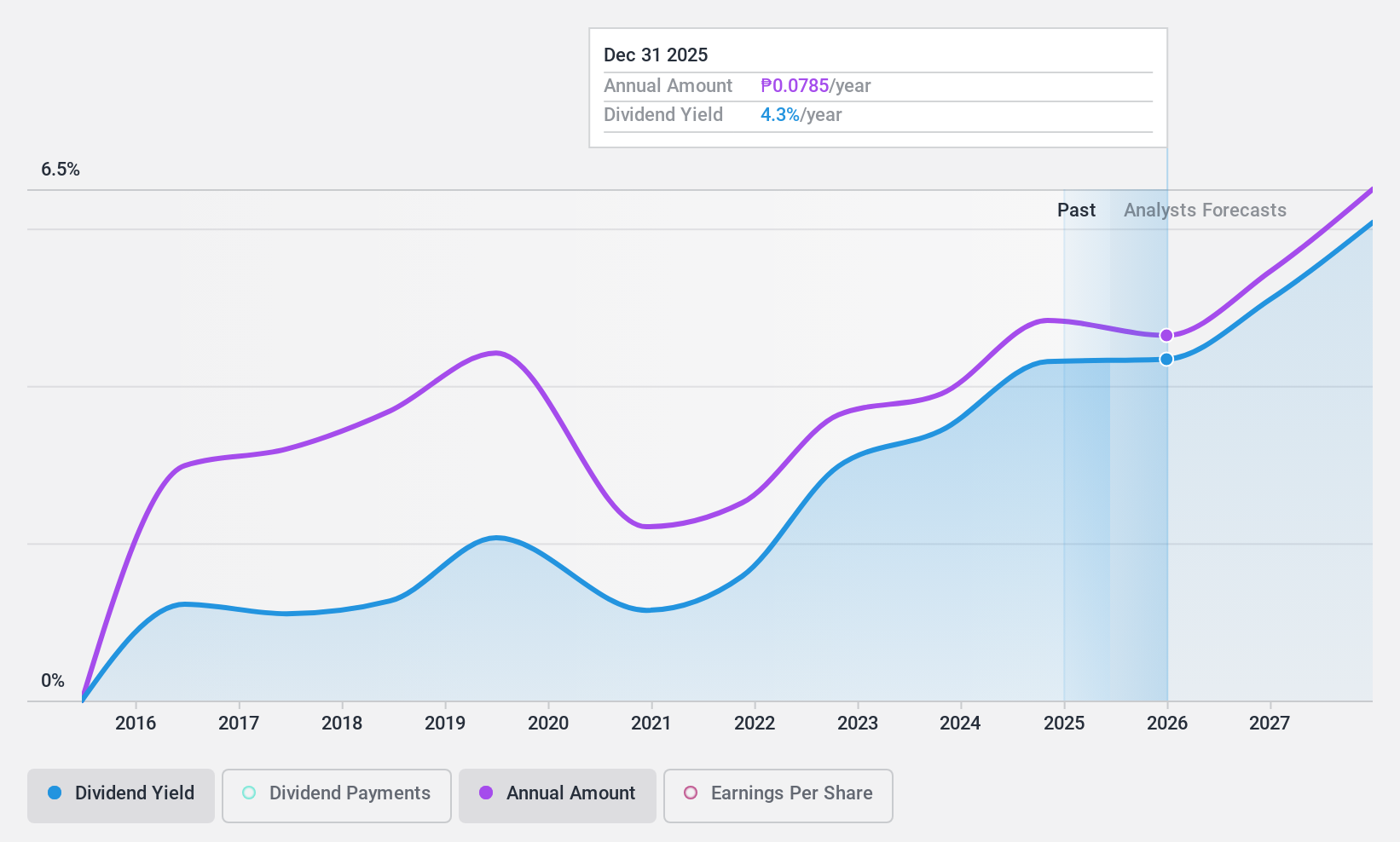

Dividend Yield: 4%

Megaworld Corporation's dividend payments are covered by both earnings and cash flows, with a low payout ratio of 13.5% and a reasonable cash payout ratio of 52.1%. However, the dividends have been volatile over the past decade, indicating an unreliable track record. Despite this instability, Megaworld has shown recent earnings growth and trades at a favorable price-to-earnings ratio compared to the broader Philippine market, suggesting potential value for investors seeking dividend stocks.

- Take a closer look at Megaworld's potential here in our dividend report.

- Our valuation report here indicates Megaworld may be undervalued.

JICHODOLtd (TSE:3597)

Simply Wall St Dividend Rating: ★★★★★★

Overview: JICHODO Co., Ltd. is involved in the planning, manufacturing, and sale of uniforms both in Japan and internationally, with a market cap of ¥25.88 billion.

Operations: JICHODO Co., Ltd. generates revenue primarily from its Manufacture and Sale of Apparel segment, amounting to ¥15.90 billion.

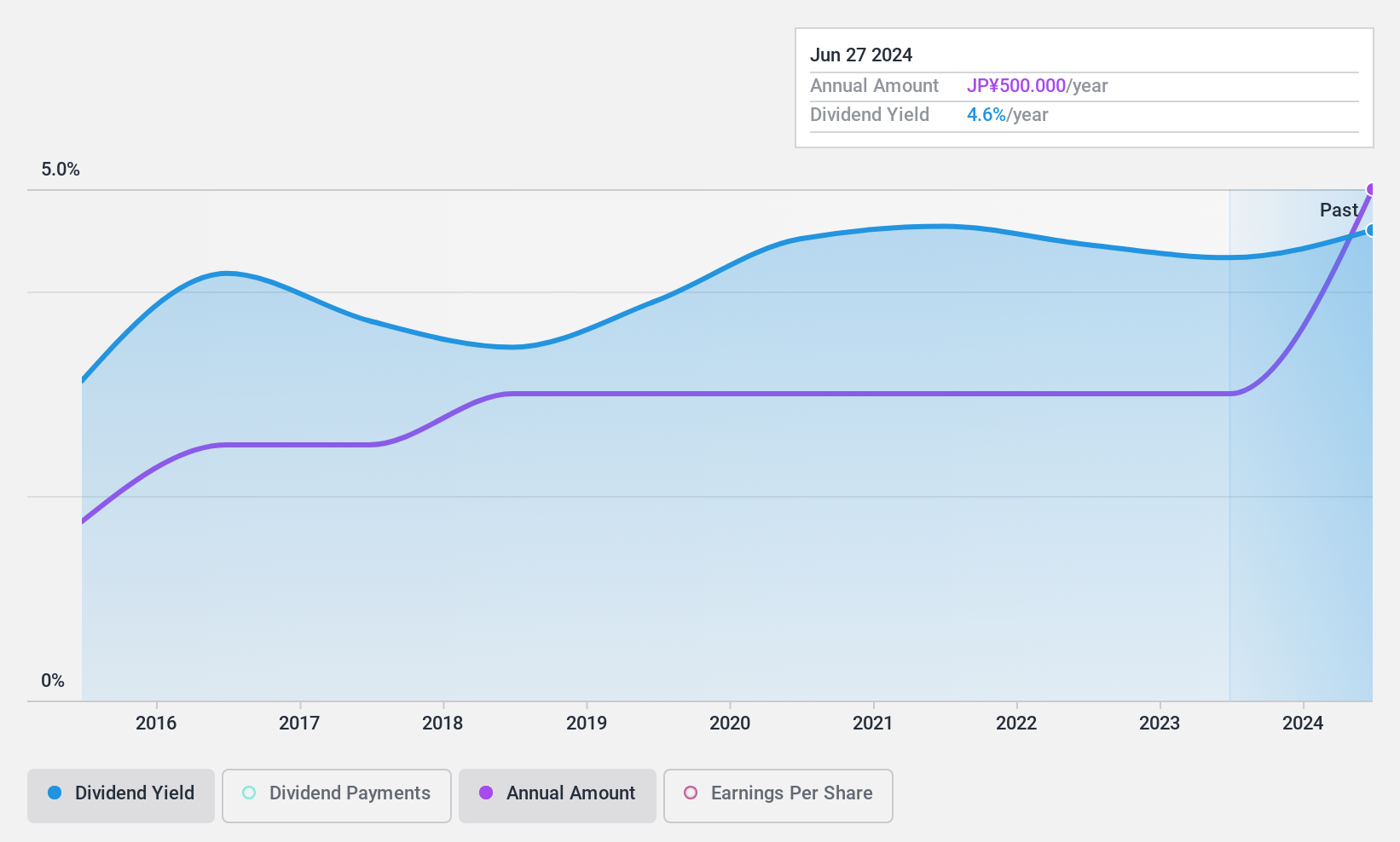

Dividend Yield: 5.5%

JICHODOLtd.'s dividend is well-supported by earnings (payout ratio: 56.5%) and cash flows (cash payout ratio: 37.9%), offering a reliable yield of 5.49%, which ranks in the top quartile of Japan's market. Over the past decade, dividends have been stable and growing, indicating reliability with minimal volatility. Despite a decline in profit margins from last year, JICHODOLtd. trades at a significant discount to its estimated fair value, presenting potential appeal for dividend-focused investors.

- Click here and access our complete dividend analysis report to understand the dynamics of JICHODOLtd.

- The analysis detailed in our JICHODOLtd valuation report hints at an deflated share price compared to its estimated value.

Ichinen HoldingsLtd (TSE:9619)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ichinen Holdings Co., Ltd. operates in automotive leasing, chemicals, parking, machine tool sales, and synthetic resin sectors in Japan with a market cap of ¥44.93 billion.

Operations: Ichinen Holdings Co., Ltd. generates revenue from several segments, including Automobile Leasing Related Business at ¥60.06 billion, Machine Tool Sales Business at ¥36.55 billion, Synthetic Resin Business at ¥20.89 billion, Chemical Business at ¥11.89 billion, and Parking Business at ¥7.73 billion.

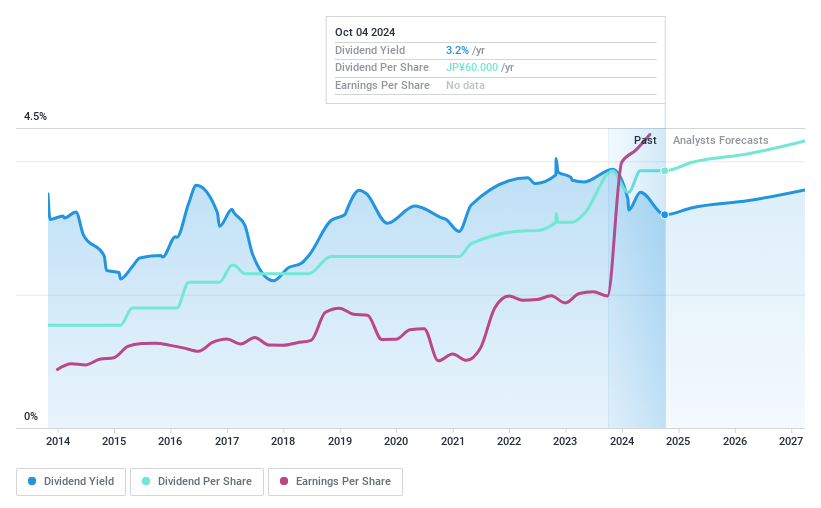

Dividend Yield: 3.3%

Ichinen Holdings Ltd. has increased its dividend to ¥33.00 per share, up from ¥30.00 last year, though its dividends have been volatile over the past decade. The payout ratio is low at 11.7%, indicating strong earnings coverage, and cash flow coverage is also robust at 20.9%. Recent buybacks totaling ¥831.25 million may support stock value, but unstable dividends and forecasted earnings decline pose concerns for long-term reliability in dividend income.

- Delve into the full analysis dividend report here for a deeper understanding of Ichinen HoldingsLtd.

- In light of our recent valuation report, it seems possible that Ichinen HoldingsLtd is trading behind its estimated value.

Turning Ideas Into Actions

- Take a closer look at our Top Dividend Stocks list of 1938 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9619

Ichinen HoldingsLtd

Engages in automotive leasing, chemical, parking, machine tool sales, and synthetic resin businesses in Japan.

Undervalued with proven track record and pays a dividend.