As global markets navigate a mixed landscape marked by fluctuating consumer confidence and economic indicators, technology stocks have continued to capture investor interest, with the Nasdaq Composite leading gains in recent weeks. In this context, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and resilience amid economic shifts, making them compelling considerations for those exploring opportunities in the tech sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Sarepta Therapeutics | 24.07% | 43.17% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1270 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Seco (BIT:IOT)

Simply Wall St Growth Rating: ★★★★☆☆

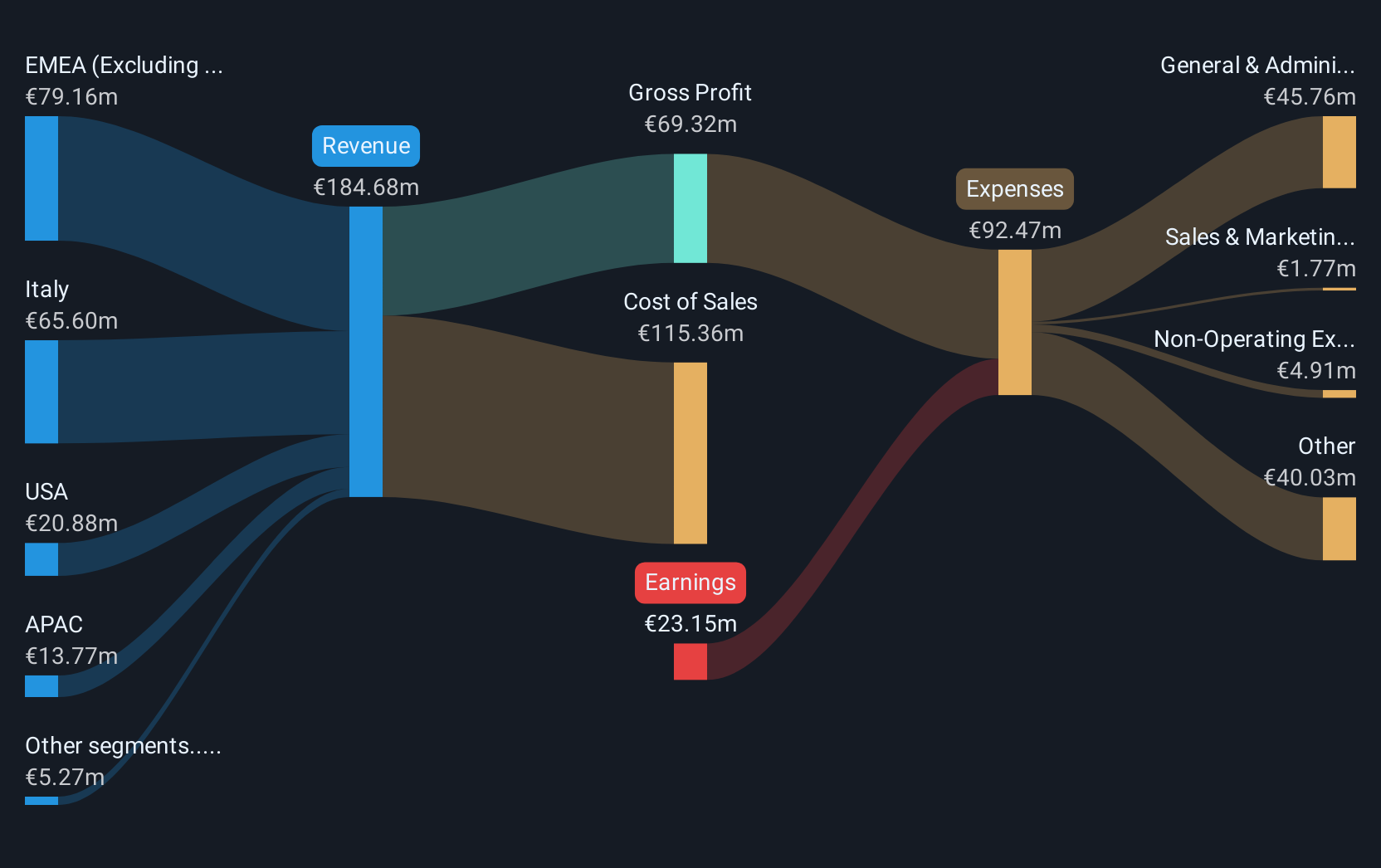

Overview: Seco S.p.A. is a tech company focused on developing and delivering cutting-edge solutions, with a market cap of €242.12 million.

Operations: Seco S.p.A. generates revenue through its tech solutions, focusing on innovative product development and delivery. The company operates with a market capitalization of €242.12 million, emphasizing advanced technology offerings to support its business model.

SECO's recent strategic partnership with Raspberry Pi, focusing on a new Human-Machine Interface solution, underscores its commitment to expanding into industrial IoT applications and leveraging collaborative innovation. Despite a challenging financial period marked by a revenue drop to EUR 141.68 million from EUR 164.52 million and shifting from a net income of EUR 9.67 million to a net loss of EUR 10.07 million in the last nine months, SECO is poised for recovery. The anticipated growth in earnings by an impressive 117.4% annually over the next three years, combined with an expected revenue increase of 11.5% per year, positions SECO favorably against slower Italian market growth projections of just 4% per year. This blend of strategic partnerships and projected financial turnaround highlights SECO’s potential resilience and adaptability in the high-tech sector.

- Navigate through the intricacies of Seco with our comprehensive health report here.

Gain insights into Seco's historical performance by reviewing our past performance report.

Knowit (OM:KNOW)

Simply Wall St Growth Rating: ★★★★☆☆

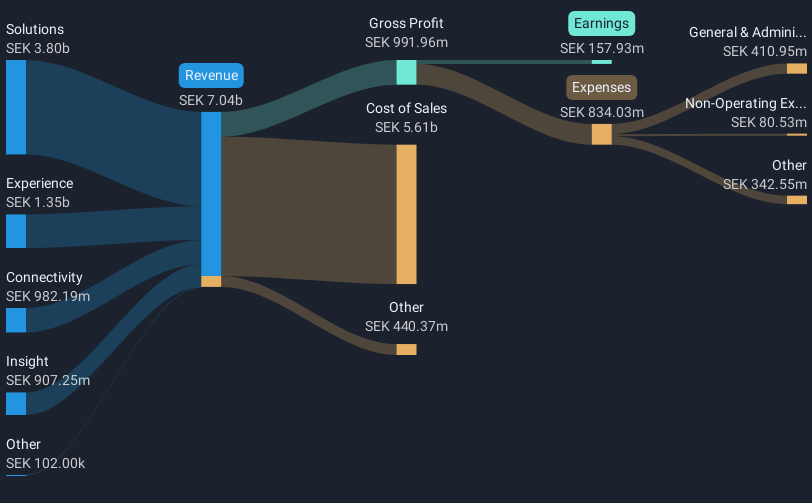

Overview: Knowit AB (publ) is

Operations: Knowit AB (publ) focuses on creating digital solutions through its consultancy services, with primary revenue streams from Solutions (SEK 3.80 billion), Experience (SEK 1.35 billion), Insight (SEK 907.25 million), and Connectivity (SEK 982.19 million).

Amidst executive shifts and a challenging quarter, Knowit's resilience is underscored by its strategic adaptability and a robust pipeline for future growth. Despite recent dips in revenue to SEK 1.33 billion and net income to SEK 3.2 million in Q3 2024, the company's annual earnings are expected to surge by an impressive 36.1%. This forecast outpaces the broader Swedish market's projections significantly, highlighting Knowit’s potential in leveraging technology trends despite current volatility. The firm’s commitment to innovation is evident from its R&D focus, crucial for sustaining long-term competitiveness in the evolving tech landscape.

- Get an in-depth perspective on Knowit's performance by reading our health report here.

Evaluate Knowit's historical performance by accessing our past performance report.

PKSHA Technology (TSE:3993)

Simply Wall St Growth Rating: ★★★★☆☆

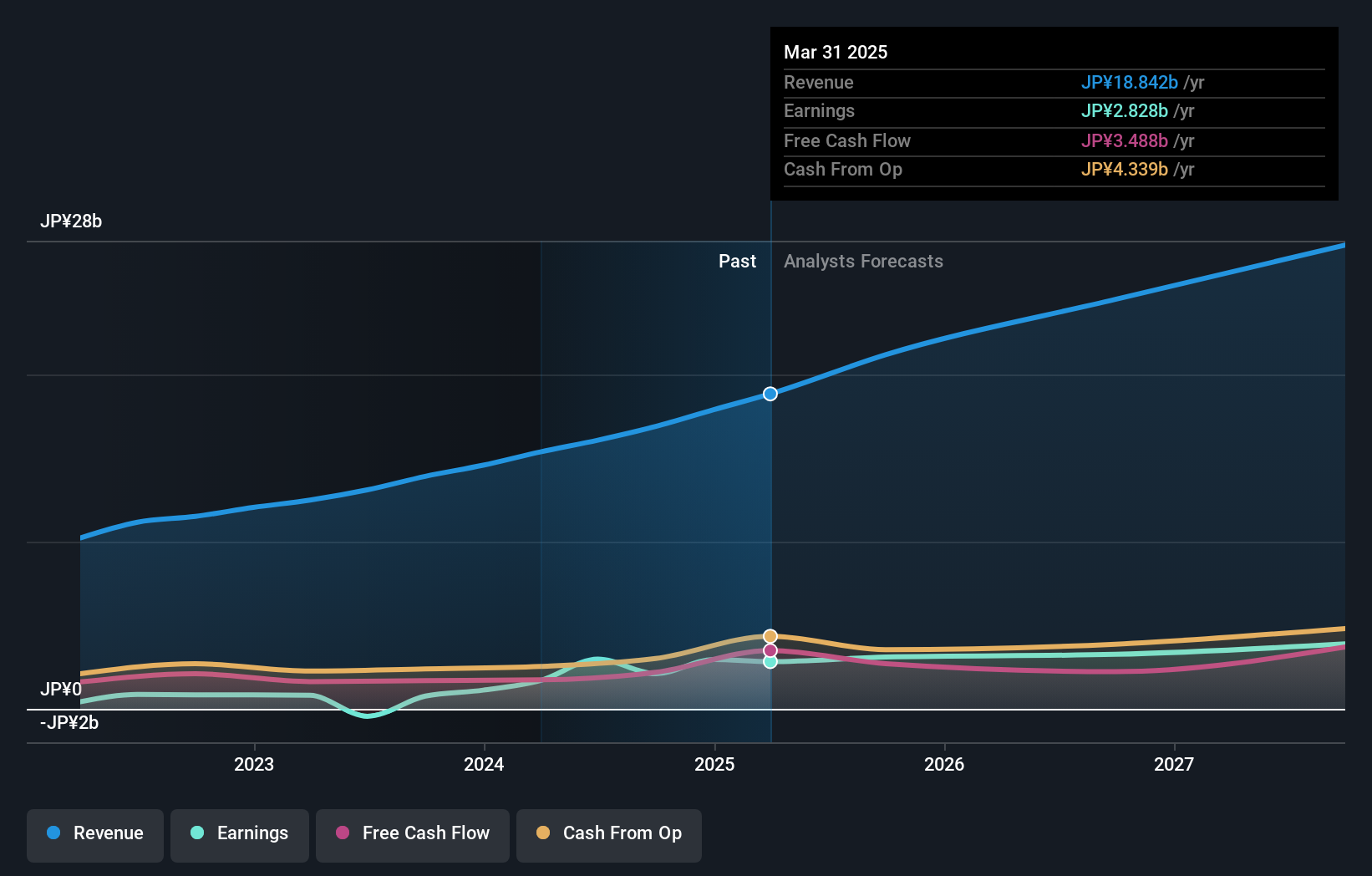

Overview: PKSHA Technology Inc. develops algorithmic solutions in Japan and has a market cap of ¥117.74 billion.

Operations: PKSHA Technology Inc. focuses on creating algorithmic solutions, with its primary revenue generated from software licensing and related services. The company operates within the technology sector in Japan, leveraging advanced algorithms to enhance product offerings.

PKSHA Technology's strategic positioning in the tech sector is underscored by its robust financial forecasts and recent executive decisions. The company anticipates a significant uptick in financial performance with expected net sales reaching JPY 20 billion and an operating profit of JPY 3.35 billion for FY2025, reflecting a clear trajectory of growth amidst market challenges. This outlook is bolstered by a remarkable past year earnings growth of 176.3%, substantially outpacing the software industry's average. Moreover, PKSHA's commitment to innovation is evident from its R&D initiatives, crucial for maintaining competitive edge in rapidly evolving markets. Despite the high volatility in its share price recently, these factors collectively highlight PKSHA’s potential to leverage advanced technologies and market opportunities effectively.

- Click to explore a detailed breakdown of our findings in PKSHA Technology's health report.

Assess PKSHA Technology's past performance with our detailed historical performance reports.

Next Steps

- Take a closer look at our High Growth Tech and AI Stocks list of 1270 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3993

PKSHA Technology

Engages in the development of algorithmic solutions in Japan.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives