As global markets navigate a mixed economic landscape, with U.S. consumer confidence dipping and European stocks experiencing moderate gains, investors are closely watching for opportunities amid these fluctuations. In this environment, dividend stocks can offer a measure of stability and potential income, making them an attractive consideration for those looking to balance growth with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 4.85% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.59% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.27% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.84% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.68% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

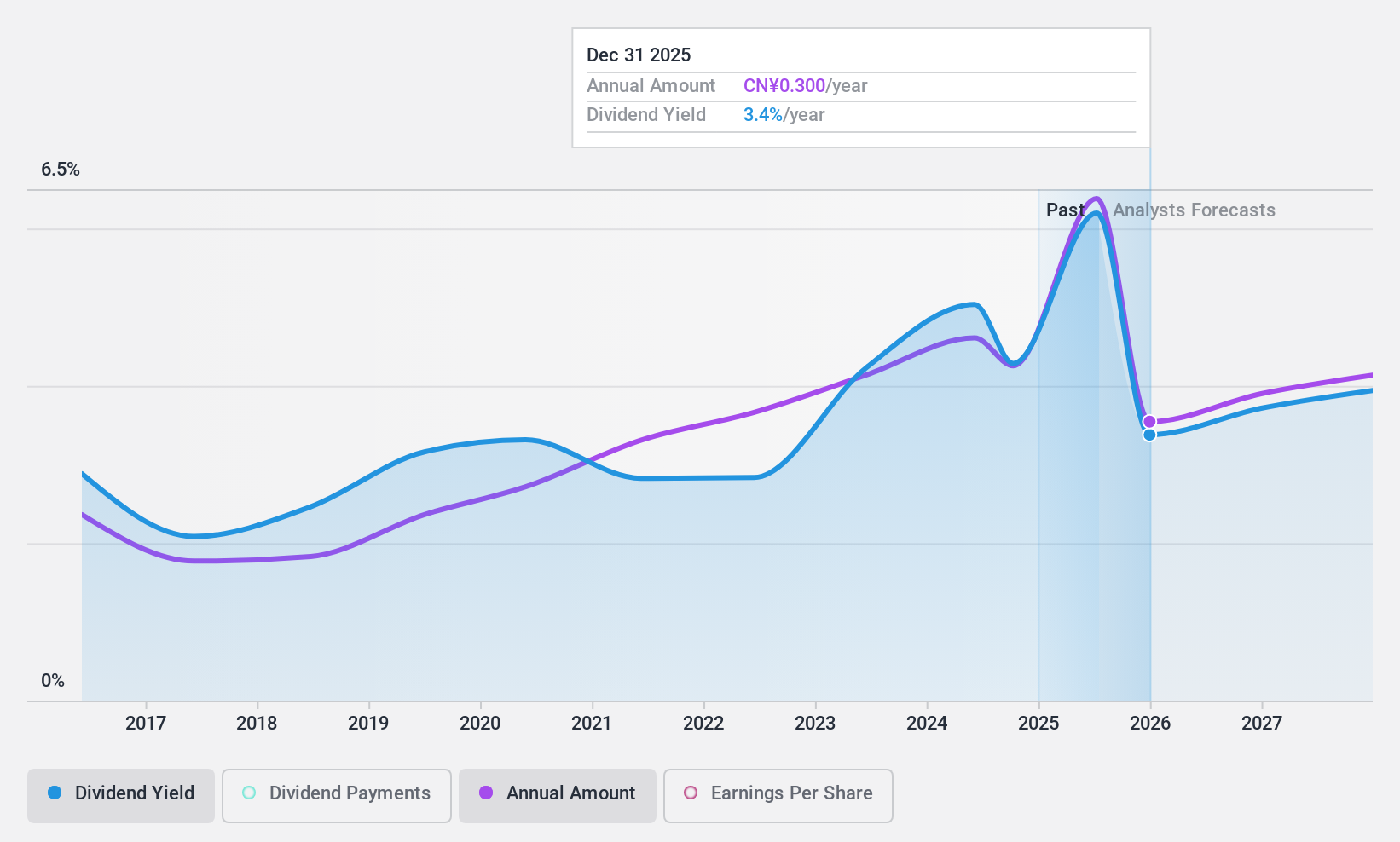

Xi'an Shaangu Power (SHSE:601369)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xi'an Shaangu Power Co., Ltd. offers systematic solutions and services in the People's Republic of China, with a market capitalization of CN¥15.20 billion.

Operations: Xi'an Shaangu Power Co., Ltd. generates revenue through its provision of systematic solutions and services in the People’s Republic of China.

Dividend Yield: 4.1%

Xi'an Shaangu Power's dividend yield of 4.06% ranks in the top 25% of CN market payers, yet its reliability is questionable due to volatility and a high payout ratio of 101.2%, indicating dividends are not well covered by earnings. Despite recent revenue growth to CNY 7.29 billion, net income declined, affecting dividend sustainability. The stock trades at a favorable P/E ratio of 15.9x compared to the market's 36.1x, offering potential value amidst these challenges.

- Dive into the specifics of Xi'an Shaangu Power here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Xi'an Shaangu Power shares in the market.

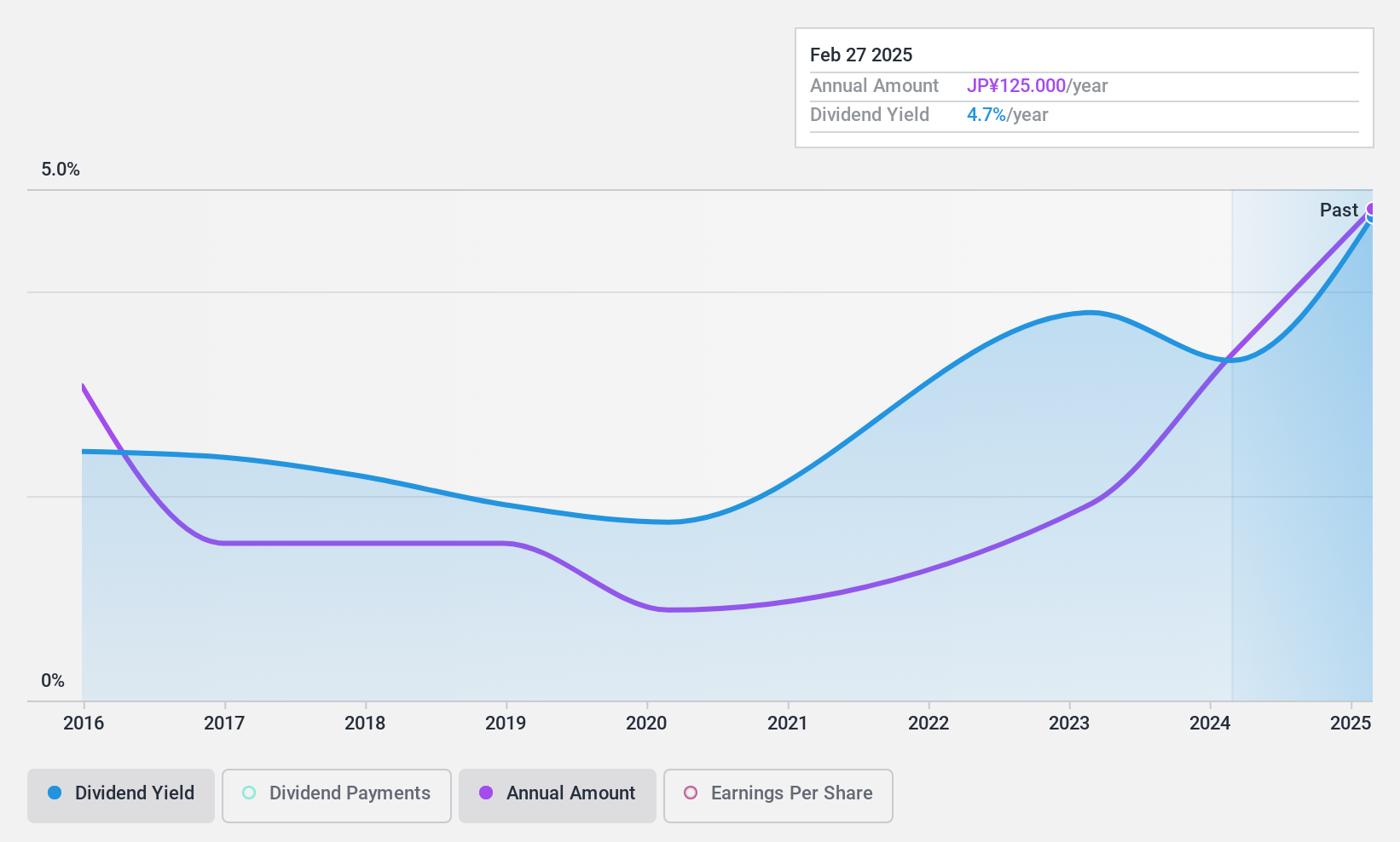

Sanyo Shokai (TSE:8011)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sanyo Shokai Ltd. is a Japanese company involved in the manufacture and sale of men's and women's clothing and accessories, with a market cap of ¥31.67 billion.

Operations: Sanyo Shokai Ltd. generates its revenue primarily through the production and distribution of apparel and accessories for both men and women in Japan.

Dividend Yield: 4.3%

Sanyo Shokai's dividend yield of 4.25% places it among the top 25% in Japan, supported by a low payout ratio of 44.6%, ensuring dividends are well-covered by earnings and cash flows. However, its dividend history is marked by volatility and unreliability over the past decade, despite recent growth. The company trades at a significant discount to estimated fair value, enhancing potential appeal for investors seeking value amidst its ongoing share buyback program aimed at boosting shareholder returns.

- Delve into the full analysis dividend report here for a deeper understanding of Sanyo Shokai.

- Our valuation report unveils the possibility Sanyo Shokai's shares may be trading at a discount.

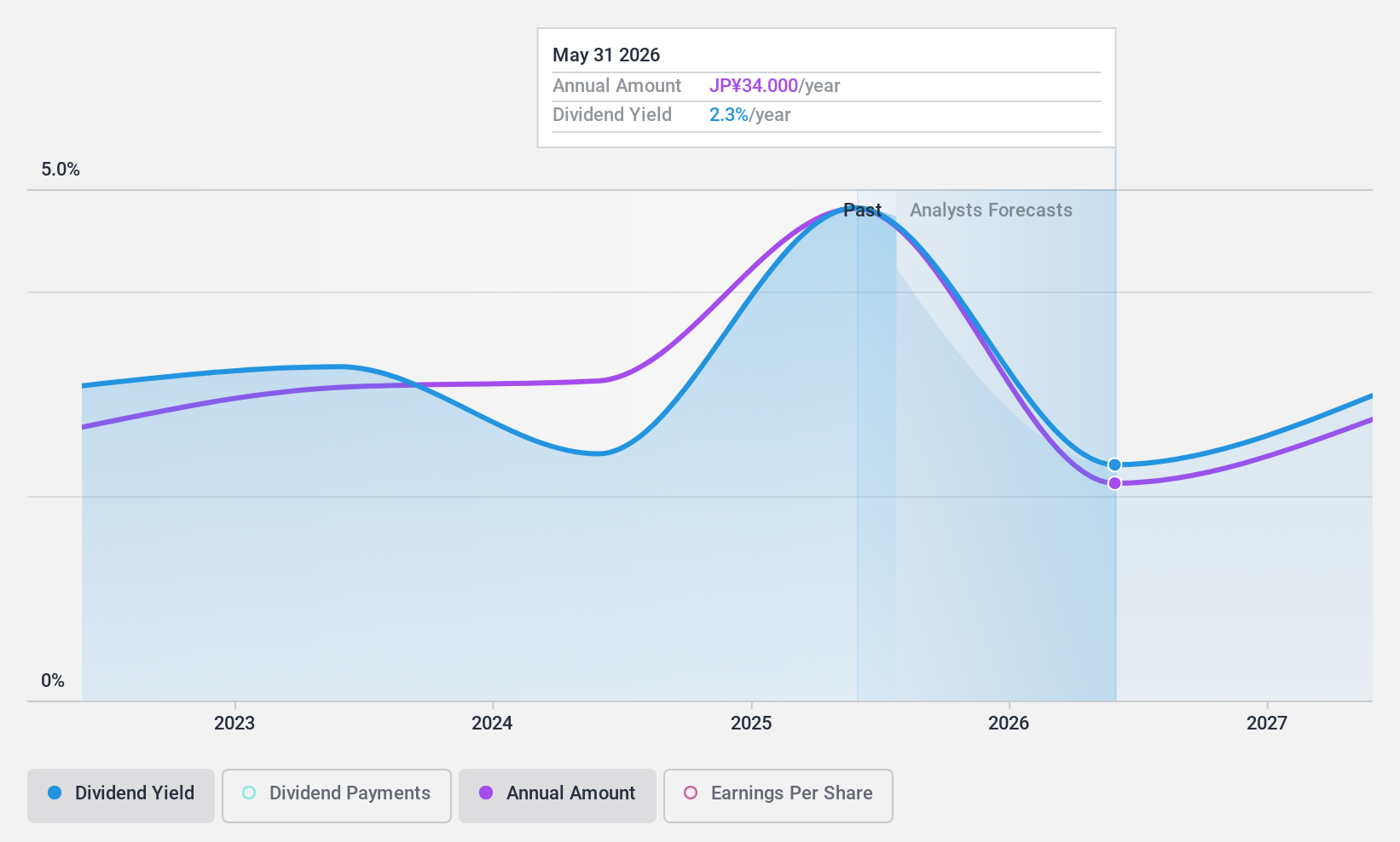

Bewith (TSE:9216)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bewith, Inc. operates contact and call centers and offers BPO services using digital technologies in Japan, with a market cap of ¥21.33 billion.

Operations: Bewith, Inc.'s revenue is primarily derived from its Contact Center and BPO Business, generating ¥37.70 billion.

Dividend Yield: 5%

Bewith's dividend yield of 5.02% ranks in the top 25% of Japanese dividend payers, supported by a payout ratio of 45%, indicating dividends are well-covered by earnings and cash flows. Despite only three years of payments, dividends have been stable with no volatility. Trading at a significant discount to estimated fair value, Bewith offers potential value for investors, although its short dividend history may be a consideration for some.

- Get an in-depth perspective on Bewith's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Bewith's current price could be quite moderate.

Summing It All Up

- Explore the 1938 names from our Top Dividend Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8011

Sanyo Shokai

Engages in the manufacture and sale of men's and women's clothes and accessories in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives