- Japan

- /

- Commercial Services

- /

- TSE:6287

Top Three Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a mixed bag of economic indicators, including a dip in U.S. consumer confidence and fluctuating indices, investors are keenly observing how these developments might impact their portfolios. Amidst this backdrop, dividend stocks remain an attractive option for those seeking steady income and potential resilience against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.28% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.59% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.35% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.81% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.17% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Oppein Home Group (SHSE:603833)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oppein Home Group Inc. is a cabinetry manufacturer in Asia with a market cap of CN¥42.52 billion.

Operations: Oppein Home Group Inc. generates revenue primarily from its Building Products segment, which amounted to CN¥20.10 billion.

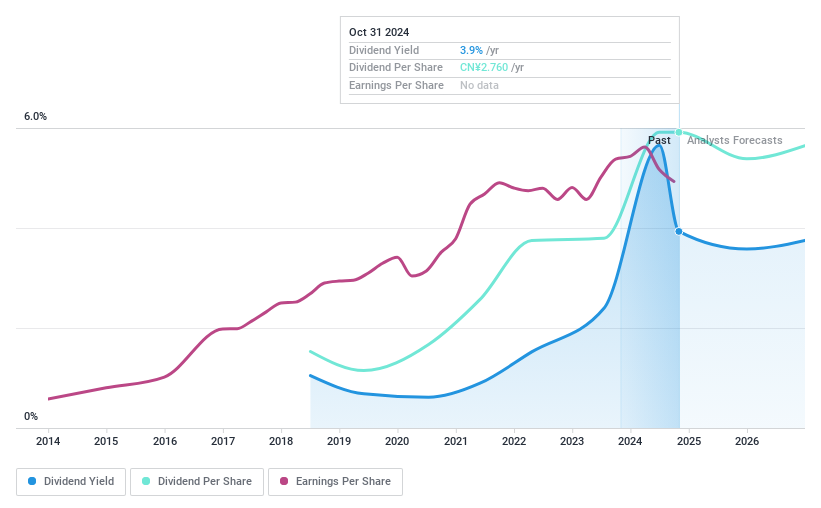

Dividend Yield: 3.9%

Oppein Home Group offers a dividend yield of 3.93%, placing it in the top 25% of CN market dividend payers, with dividends covered by earnings (payout ratio: 61.1%) and cash flows (cash payout ratio: 82.2%). However, its dividends have been volatile over the past six years. The company trades at a favorable P/E ratio of 15.4x compared to the CN market average of 36.1x, despite recent declines in sales and net income for the first nine months of 2024.

- Unlock comprehensive insights into our analysis of Oppein Home Group stock in this dividend report.

- According our valuation report, there's an indication that Oppein Home Group's share price might be on the cheaper side.

Maruha Nichiro (TSE:1333)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Maruha Nichiro Corporation operates in the fishing, fish farming, food processing, trading, meat products, and distribution sectors both in Japan and internationally, with a market cap of ¥151.08 billion.

Operations: Maruha Nichiro Corporation's revenue is derived from its operations in fishing, fish farming, food processing, trading, meat products, and distribution sectors.

Dividend Yield: 3.3%

Maruha Nichiro's dividend yield of 3.33% is below the top quartile in Japan, yet its dividends are well-supported by earnings and cash flows, with payout ratios of 28.6% and 15.3%, respectively. The company maintains stable and reliable dividends over the past decade, although recent financial results were affected by significant one-off items. Trading at a substantial discount to its estimated fair value suggests potential undervaluation despite not being in an ideal financial position regarding debt coverage by operating cash flow.

- Navigate through the intricacies of Maruha Nichiro with our comprehensive dividend report here.

- Our valuation report unveils the possibility Maruha Nichiro's shares may be trading at a discount.

Sato Holdings (TSE:6287)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sato Holdings Corporation manufactures and sells labeling products both in Japan and internationally, with a market cap of ¥71.94 billion.

Operations: Sato Holdings Corporation generates revenue from its Auto-ID Solutions segment, with ¥85.40 billion from overseas operations and ¥85.56 billion from its business in Japan.

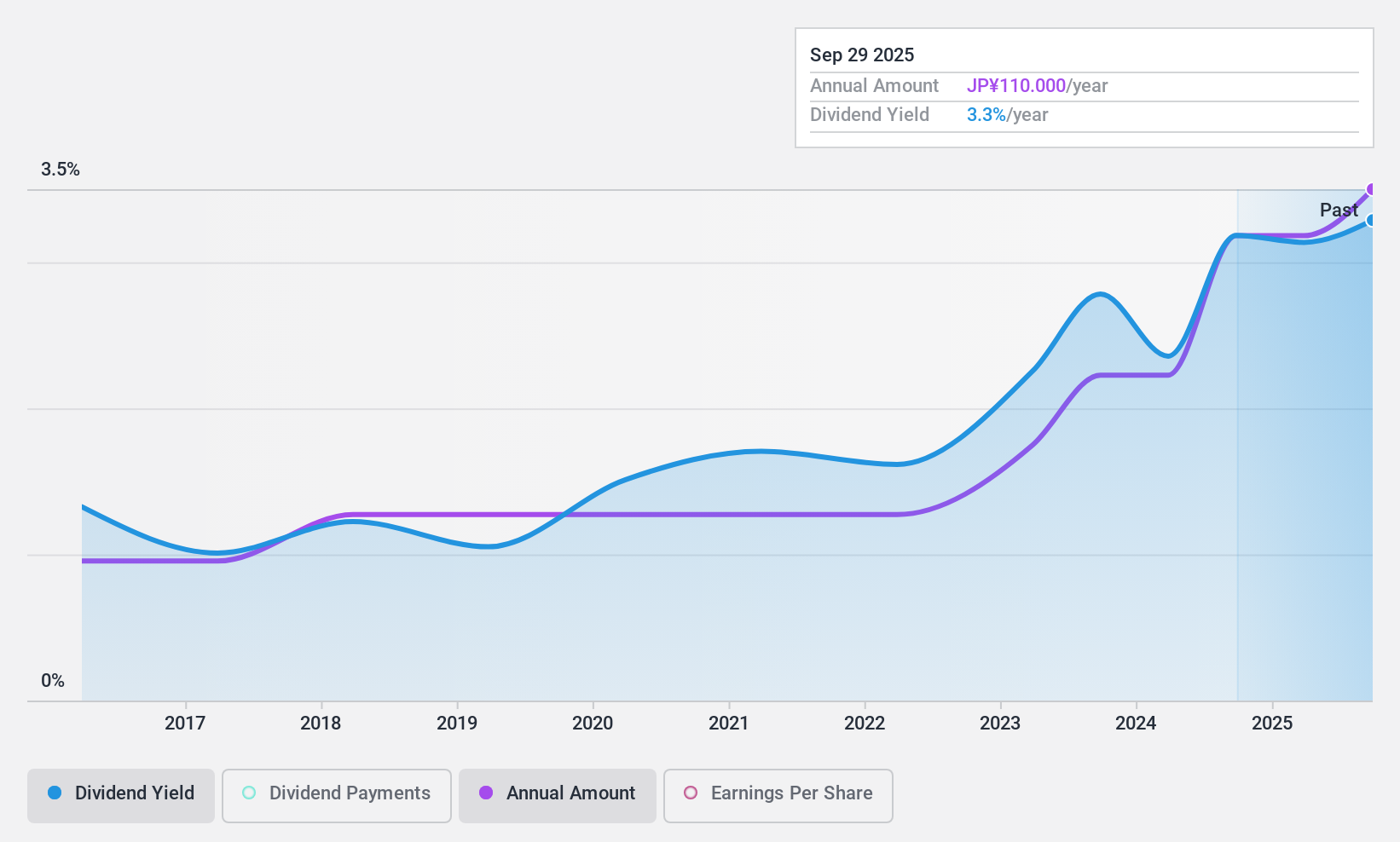

Dividend Yield: 3.3%

Sato Holdings' dividend yield of 3.34% is modest compared to Japan's top quartile, but dividends are reliably covered by earnings and cash flows, with payout ratios of 52.1% and 35.8%, respectively. The company's dividends have been stable over the past decade, with recent increases reflecting its improved financial outlook after raising earnings guidance for fiscal year ending March 2025. However, large one-off items have impacted financial results recently.

- Click to explore a detailed breakdown of our findings in Sato Holdings' dividend report.

- According our valuation report, there's an indication that Sato Holdings' share price might be on the expensive side.

Turning Ideas Into Actions

- Click here to access our complete index of 1938 Top Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6287

Sato Holdings

Engages in the manufacture and sale of labeling products in Japan and internationally.

Flawless balance sheet established dividend payer.