- Philippines

- /

- Industrials

- /

- PSE:DMC

3 Reliable Dividend Stocks Yielding Up To 8.9%

Reviewed by Simply Wall St

As global markets experience broad-based gains with U.S. indexes approaching record highs, investors are increasingly looking for stable income sources amid ongoing geopolitical tensions and economic uncertainties. In this context, dividend stocks stand out as a reliable option, offering consistent returns through regular payouts while potentially benefiting from the positive sentiment driven by strong labor market data and housing sales reports.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.24% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.52% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.90% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.90% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★☆ |

Click here to see the full list of 1976 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

DMCI Holdings (PSE:DMC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DMCI Holdings, Inc. operates in general construction, coal and nickel mining, power generation, real estate development, water concession, and manufacturing both in the Philippines and internationally with a market cap of approximately ₱139.68 billion.

Operations: DMCI Holdings, Inc.'s revenue segments include DMCI Homes with ₱11.55 billion and DMCI Mining with ₱2.43 billion.

Dividend Yield: 8.9%

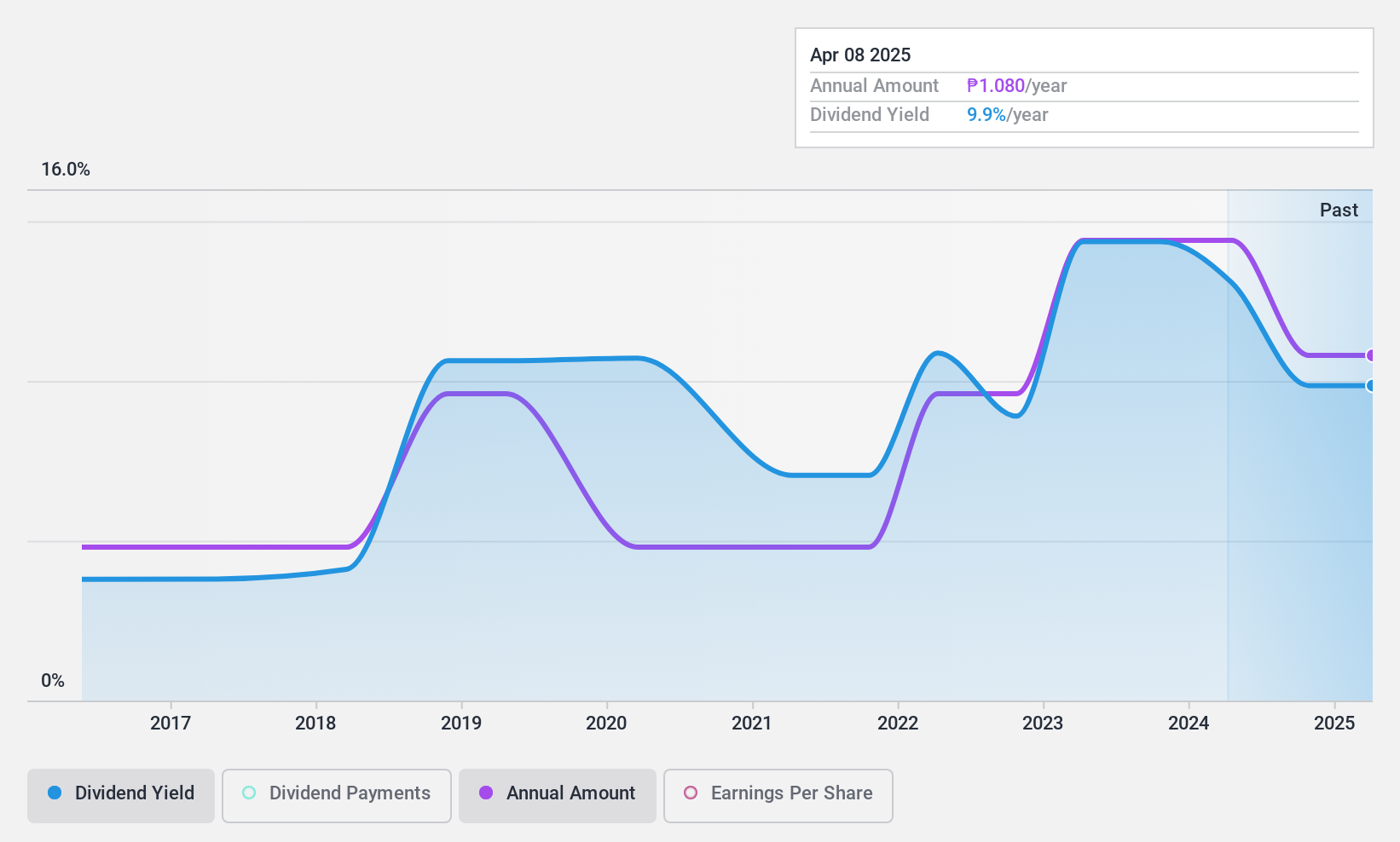

DMCI Holdings offers a compelling dividend profile, trading at 55.4% below its estimated fair value with a dividend yield of 8.94%, placing it in the top 25% of Philippine market payers. Despite volatile dividends over the past decade, payouts are well-covered by earnings and cash flows, with payout ratios around 30%. Recent earnings show mixed results but a special cash dividend was declared in October 2024, reflecting potential shareholder value return.

- Take a closer look at DMCI Holdings' potential here in our dividend report.

- The valuation report we've compiled suggests that DMCI Holdings' current price could be quite moderate.

Dai-ichi Life Holdings (TSE:8750)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dai-ichi Life Holdings, Inc. operates through its subsidiaries to provide insurance products in Japan, the United States, and internationally, with a market cap of ¥3.48 trillion.

Operations: Dai-ichi Life Holdings, Inc. generates revenue through its subsidiaries by offering insurance products across Japan, the United States, and other international markets.

Dividend Yield: 3.1%

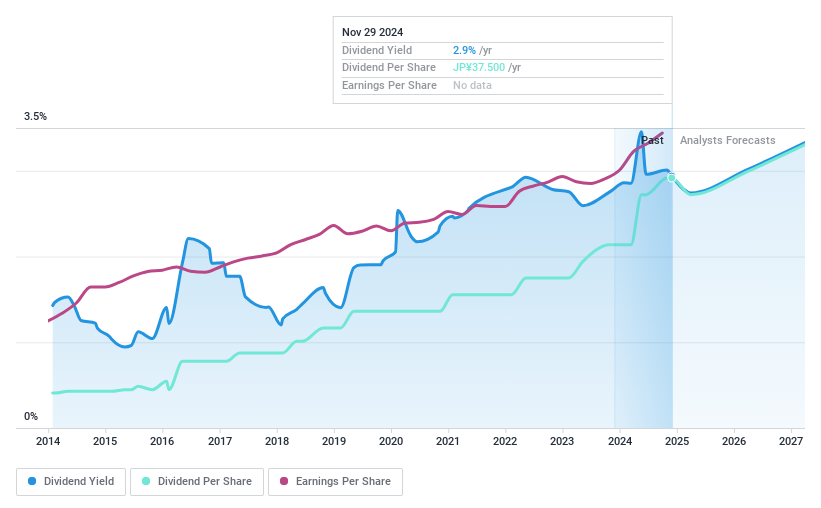

Dai-ichi Life Holdings maintains a stable dividend profile, with payments growing steadily over the past decade. The company trades at a good value, 49.1% below estimated fair value, and offers a reliable dividend yield of 3.11%, though this is lower than top-tier Japanese payers. Dividends are well-covered by earnings and cash flows, with payout ratios of 41.6% and 12.4%, respectively. Recent share buybacks may indicate confidence in financial health amidst forecasted earnings growth of 1.03%.

- Click here to discover the nuances of Dai-ichi Life Holdings with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Dai-ichi Life Holdings' share price might be too pessimistic.

Hamakyorex (TSE:9037)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hamakyorex Co., Ltd. operates in the 3PL logistics and truck transportation sector both in Japan and internationally, with a market cap of ¥92.24 billion.

Operations: Hamakyorex Co., Ltd.'s revenue is primarily derived from its Logistics Center Business, which generates ¥94.19 billion, and its Autonomous Cargo Transportation Business, contributing ¥53.54 billion.

Dividend Yield: 3%

Hamakyorex's dividend yield of 2.96% is lower than top Japanese payers, but dividends are well-covered by a low payout ratio of 27.5% and cash flows at 73.5%. Despite past volatility in dividend payments, earnings have grown by 17.9%, supporting sustainability. The stock trades below estimated fair value and recent share buybacks totaling ¥991.82 million suggest strategic capital management, complemented by a new joint venture to expand logistics services in Japan and beyond.

- Get an in-depth perspective on Hamakyorex's performance by reading our dividend report here.

- Our expertly prepared valuation report Hamakyorex implies its share price may be lower than expected.

Seize The Opportunity

- Unlock our comprehensive list of 1976 Top Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:DMC

DMCI Holdings

Through its subsidiaries, engages in the general construction, coal and nickel mining, power generation, real estate development, water concession, and manufacturing businesses in the Philippines and internationally.

Flawless balance sheet established dividend payer.