- Philippines

- /

- Banks

- /

- PSE:MBT

December 2024 Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate the complexities of cautious Federal Reserve commentary and looming political uncertainties, investors are keenly observing how these factors influence major indices. With U.S. stocks experiencing fluctuations amid rate cut expectations and economic data surprises, the search for stability often leads investors to dividend stocks, which can provide a reliable income stream even in volatile times. In such an environment, a good dividend stock is typically characterized by a strong track record of consistent payouts and financial resilience, offering potential stability amidst broader market turbulence.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.15% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.74% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.48% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Metropolitan Bank & Trust (PSE:MBT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Metropolitan Bank & Trust Company, along with its subsidiaries, offers a range of commercial and investment banking products and services across the Philippines, Asia, the United States, and Europe, with a market cap of ₱337.53 billion.

Operations: Metropolitan Bank & Trust Company's revenue segments include Branch Banking at ₱65.97 billion, Consumer Banking at ₱20.44 billion, Treasury at ₱24.27 billion, Corporate Banking at ₱17.49 billion, and Investment Banking at ₱128 million.

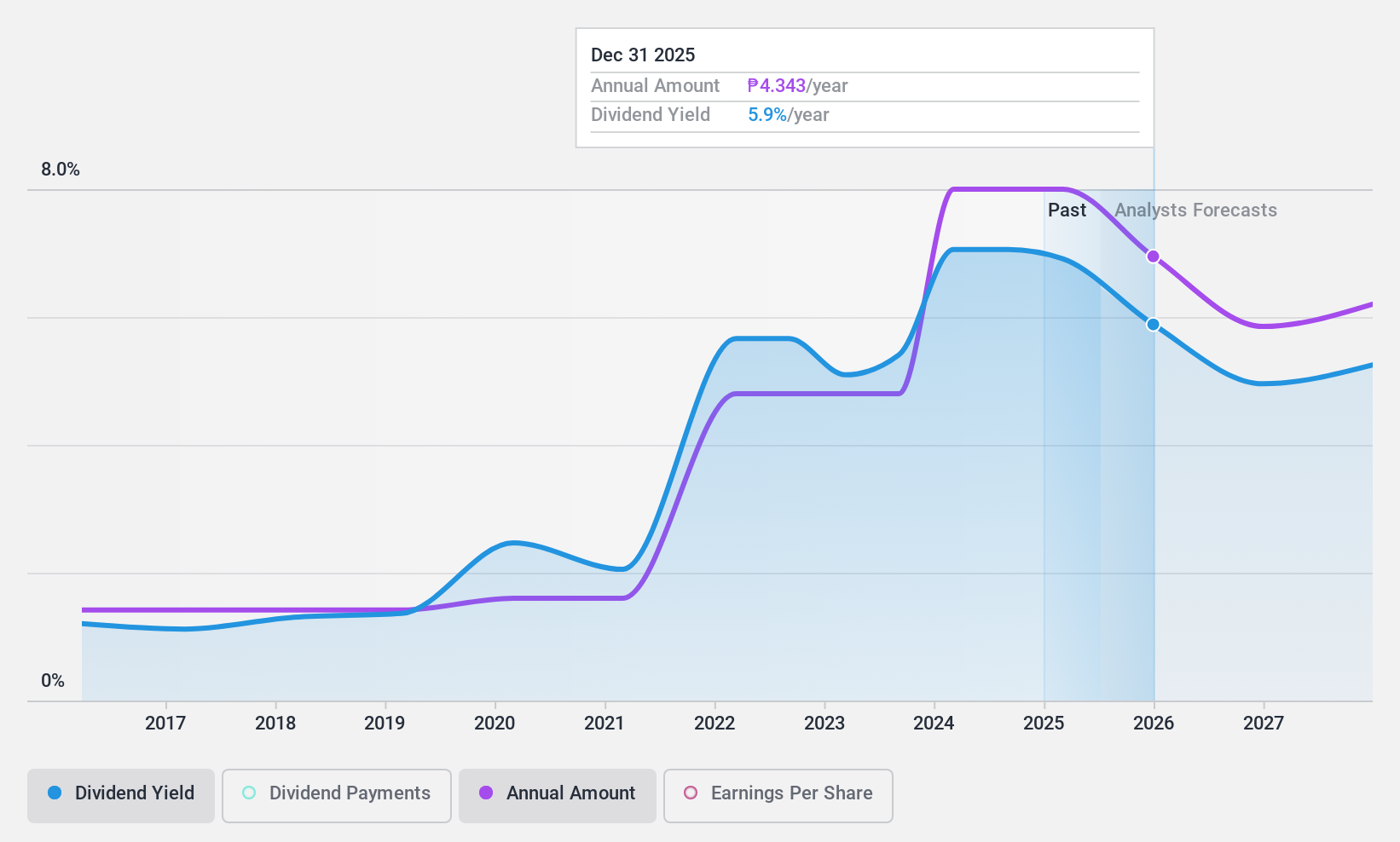

Dividend Yield: 6.7%

Metropolitan Bank & Trust's dividends are well-covered, with a current payout ratio of 29.2% and forecasted to remain sustainable at 37.3% in three years. The bank offers a stable dividend yield of 6.66%, slightly below the top quartile in the Philippine market, but reliable over the past decade with consistent growth. Recent earnings reports show increased profitability, supporting its ability to maintain and potentially grow dividend payments further.

- Take a closer look at Metropolitan Bank & Trust's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Metropolitan Bank & Trust shares in the market.

WELLNEO SUGAR (TSE:2117)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: WELLNEO SUGAR Co., Ltd. manufactures and sells sugar and other food products primarily in Japan, with a market cap of ¥70.28 billion.

Operations: WELLNEO SUGAR Co., Ltd. generates revenue through the production and sale of sugar and various food products mainly within Japan.

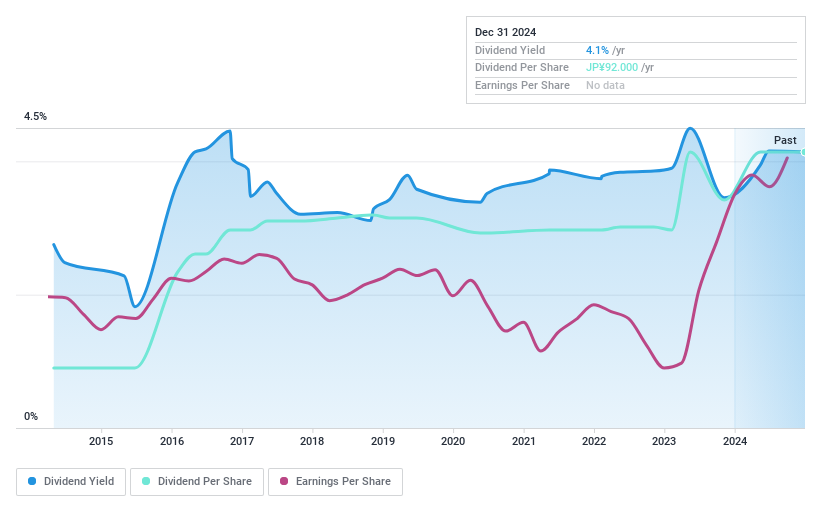

Dividend Yield: 4.2%

WELLNEO SUGAR's dividends are well-supported by earnings with a payout ratio of 31.1% and cash flows at 36.3%. Despite a history of volatility, recent increases indicate growth, with the year-end dividend expected to rise to JPY 56 per share from JPY 46 last year. Trading significantly below its estimated fair value, it offers an attractive yield in the top quartile of the JP market. Recent board actions include retiring treasury shares, potentially enhancing shareholder value.

- Get an in-depth perspective on WELLNEO SUGAR's performance by reading our dividend report here.

- According our valuation report, there's an indication that WELLNEO SUGAR's share price might be on the cheaper side.

SinoPac Financial Holdings (TWSE:2890)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SinoPac Financial Holdings Company Limited operates globally through its subsidiaries, offering a range of services including banking, securities, investment, leasing, and venture capital, with a market cap of NT$298.35 billion.

Operations: SinoPac Financial Holdings generates revenue primarily from its Banking Business, which contributes NT$42.33 billion, and its Securities Business, which adds NT$15.75 billion.

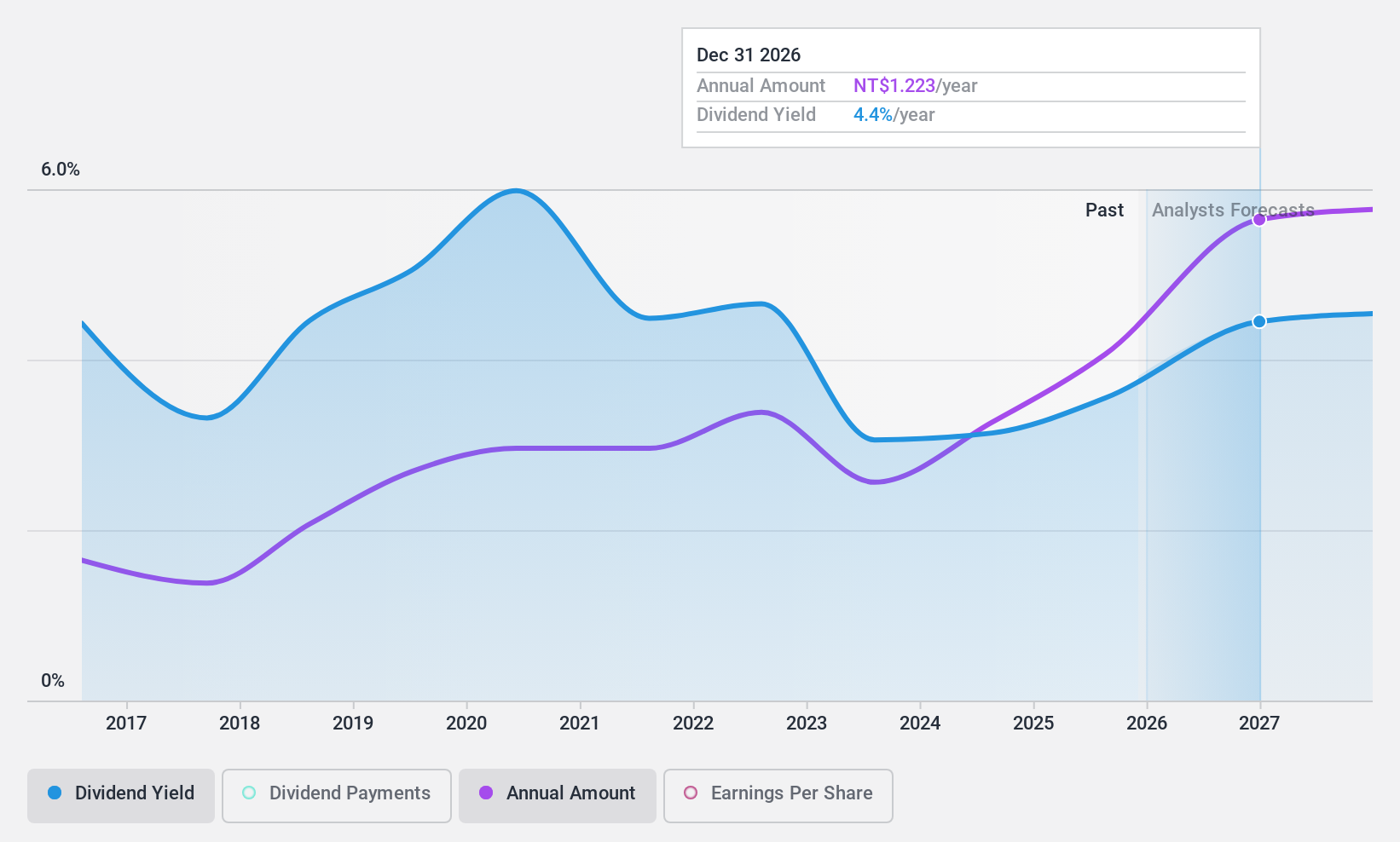

Dividend Yield: 3.1%

SinoPac Financial Holdings' dividends are currently well-covered by earnings with a payout ratio of 41.3%, and they are expected to remain sustainable over the next three years at 47.7%. Despite a history of volatility, dividends have increased over the past decade. Trading at 11.7% below its estimated fair value, SinoPac offers a dividend yield of 3.09%, which is lower than Taiwan's top quartile payers. Recent earnings show net income growth to TWD 6,311 million for Q3 2024 from TWD 5,612 million last year.

- Navigate through the intricacies of SinoPac Financial Holdings with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that SinoPac Financial Holdings is trading behind its estimated value.

Summing It All Up

- Explore the 1937 names from our Top Dividend Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:MBT

Metropolitan Bank & Trust

Provides various commercial and investment banking products and services in the Philippines, rest of Asia, the United States, and Europe.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives