- Philippines

- /

- Real Estate

- /

- PSE:FJP

Penny Stocks With Promising Potential In December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets are experiencing a mixed bag of economic indicators, with U.S. consumer confidence dipping and major stock indexes showing moderate gains during the holiday-shortened week. Amidst these broader market dynamics, penny stocks—often associated with smaller or newer companies—continue to offer intriguing opportunities for investors seeking growth at lower price points. Despite being considered a niche area, when these stocks come with strong financial health and solid fundamentals, they present an underappreciated potential for significant returns.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.75 | MYR443.74M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$44.38B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.555 | A$65.06M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

Click here to see the full list of 5,829 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Nanoform Finland Oyj (HLSE:NANOFH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nanoform Finland Oyj provides nanotechnology and drug particle engineering services to the pharmaceutical and biotech industries in Europe and the United States, with a market cap of €108.62 million.

Operations: The company's revenue of €2.43 million is derived from its expertise in nanotechnology and drug particle engineering services.

Market Cap: €108.62M

Nanoform Finland Oyj, with a market cap of €108.62 million and revenue of €2.43 million, is focused on nanotechnology services for the pharmaceutical sector in Europe and the U.S. Despite its innovative niche, the company remains unprofitable with increasing losses over recent years. Revenue growth is projected at 55.7% annually; however, profitability isn't expected soon. Nanoform's financial stability is supported by a strong cash position covering liabilities and no debt burden, but shareholders have faced dilution as shares outstanding increased by 9%. The stock exhibits high volatility compared to most Finnish stocks.

- Click to explore a detailed breakdown of our findings in Nanoform Finland Oyj's financial health report.

- Examine Nanoform Finland Oyj's earnings growth report to understand how analysts expect it to perform.

F & J Prince Holdings (PSE:FJP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: F & J Prince Holdings Corporation, along with its subsidiaries, operates in real estate, power generation, information technology, and business process outsourcing sectors with a market capitalization of ₱870 million.

Operations: The company generates revenue of ₱204.11 million from investing in real and personal properties.

Market Cap: ₱869.96M

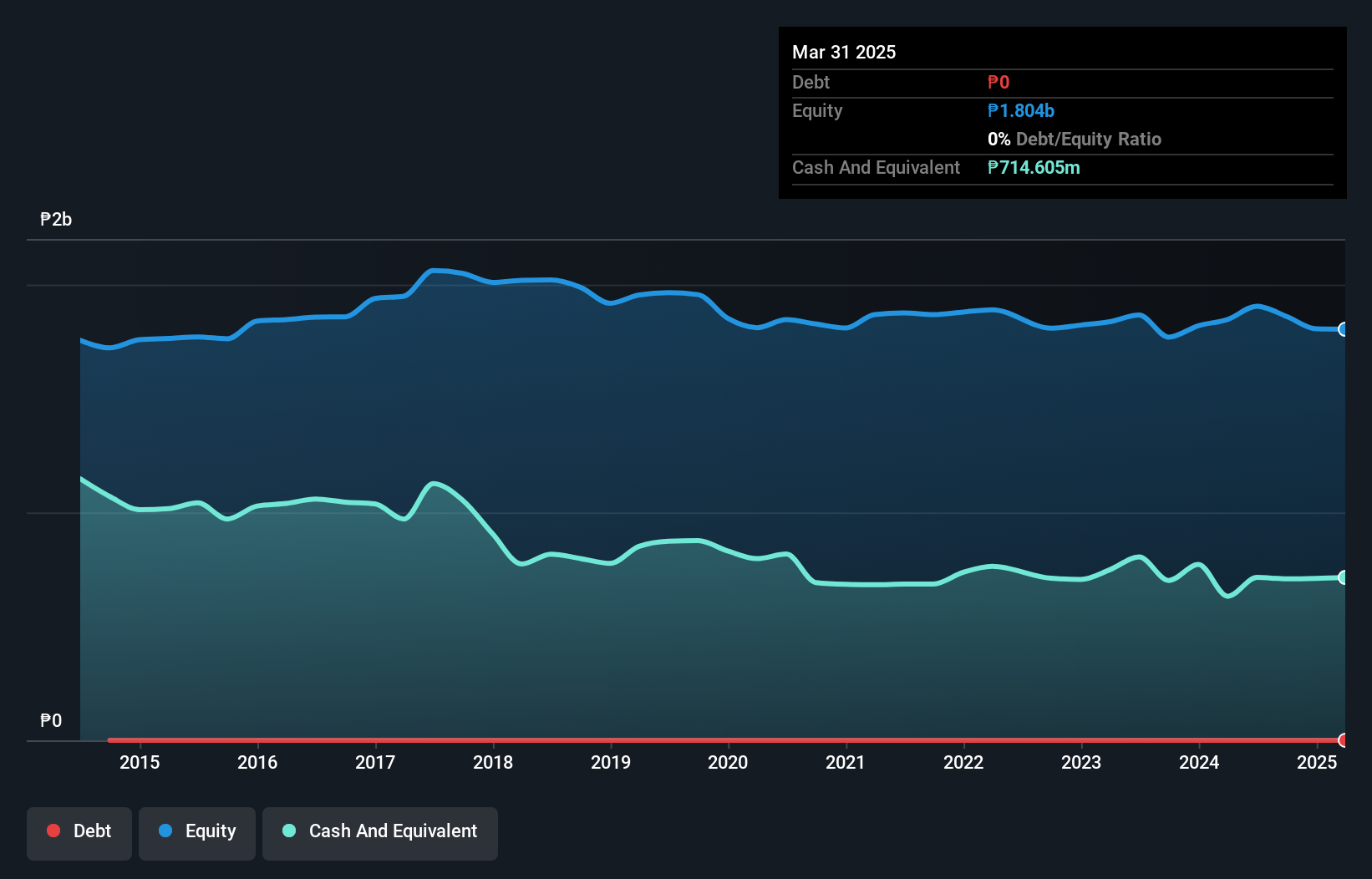

F & J Prince Holdings Corporation, with a market cap of ₱870 million, operates across multiple sectors including real estate and power generation. Despite a low Return on Equity of 6%, the company has demonstrated significant earnings growth, notably 98.7% over the past year. It maintains a debt-free status and has stable short-term assets exceeding liabilities. However, its revenue remains modest at ₱204 million, and recent financial results show fluctuating net income figures with third-quarter earnings decreasing compared to last year. The stock's high volatility may pose risks for investors seeking stability in their portfolios.

- Dive into the specifics of F & J Prince Holdings here with our thorough balance sheet health report.

- Gain insights into F & J Prince Holdings' past trends and performance with our report on the company's historical track record.

Utron (TASE:UTRN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Utron Ltd specializes in the planning, development, production, construction, marketing, and maintenance of autonomous parking solutions and has a market cap of ₪94.97 million.

Operations: The company generates revenue of ₪95.71 million from its heavy construction segment.

Market Cap: ₪94.97M

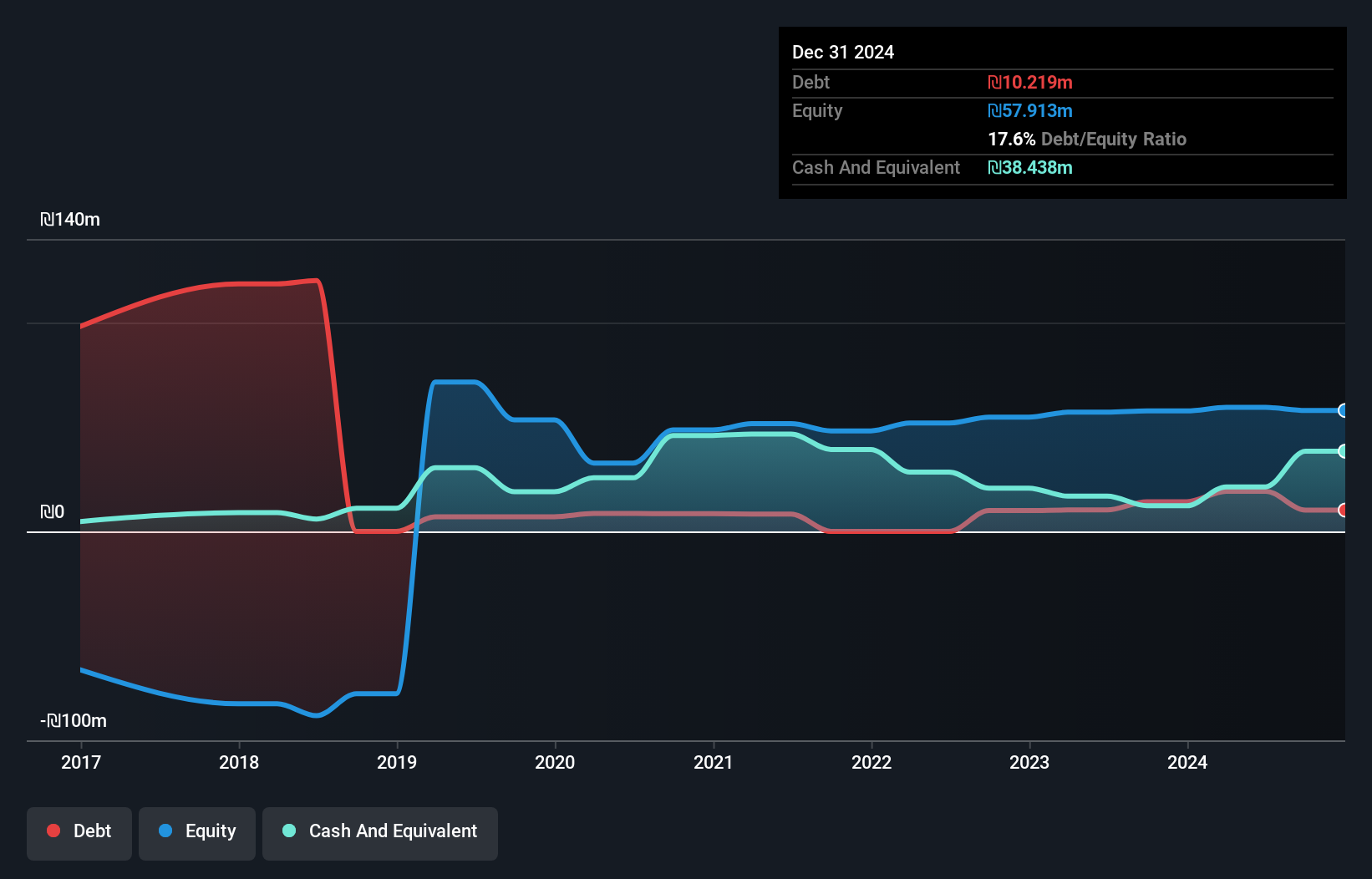

Utron Ltd, with a market cap of ₪94.97 million, has shown financial resilience despite challenges. The company maintains more cash than its total debt and covers interest payments moderately well with EBIT at 2.3 times coverage. While Utron's earnings growth was negative last year, it achieved profitability over the past five years with a notable annual growth rate of 62.7%. Short-term assets significantly exceed liabilities, providing liquidity strength. However, the stock remains highly volatile and profit margins have declined to 0.9% from last year's 1.8%. Investors should consider these factors when evaluating Utron in the penny stock segment.

- Click here to discover the nuances of Utron with our detailed analytical financial health report.

- Gain insights into Utron's historical outcomes by reviewing our past performance report.

Seize The Opportunity

- Embark on your investment journey to our 5,829 Penny Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:FJP

F & J Prince Holdings

Engages in the investment in real estate properties in the Philippines.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives