- Philippines

- /

- Consumer Services

- /

- PSE:STI

3 Dividend Stocks With Yields Up To 3.7%

Reviewed by Simply Wall St

As global markets navigate a period of mixed economic signals, with U.S. consumer confidence and manufacturing data showing declines, investors are seeking stability amidst moderate gains in major stock indexes like the S&P 500 and Nasdaq Composite. In this environment, dividend stocks offer an attractive option for those looking to balance potential growth with steady income, providing a buffer against market volatility while potentially benefiting from capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.28% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.59% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.35% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.81% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.17% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

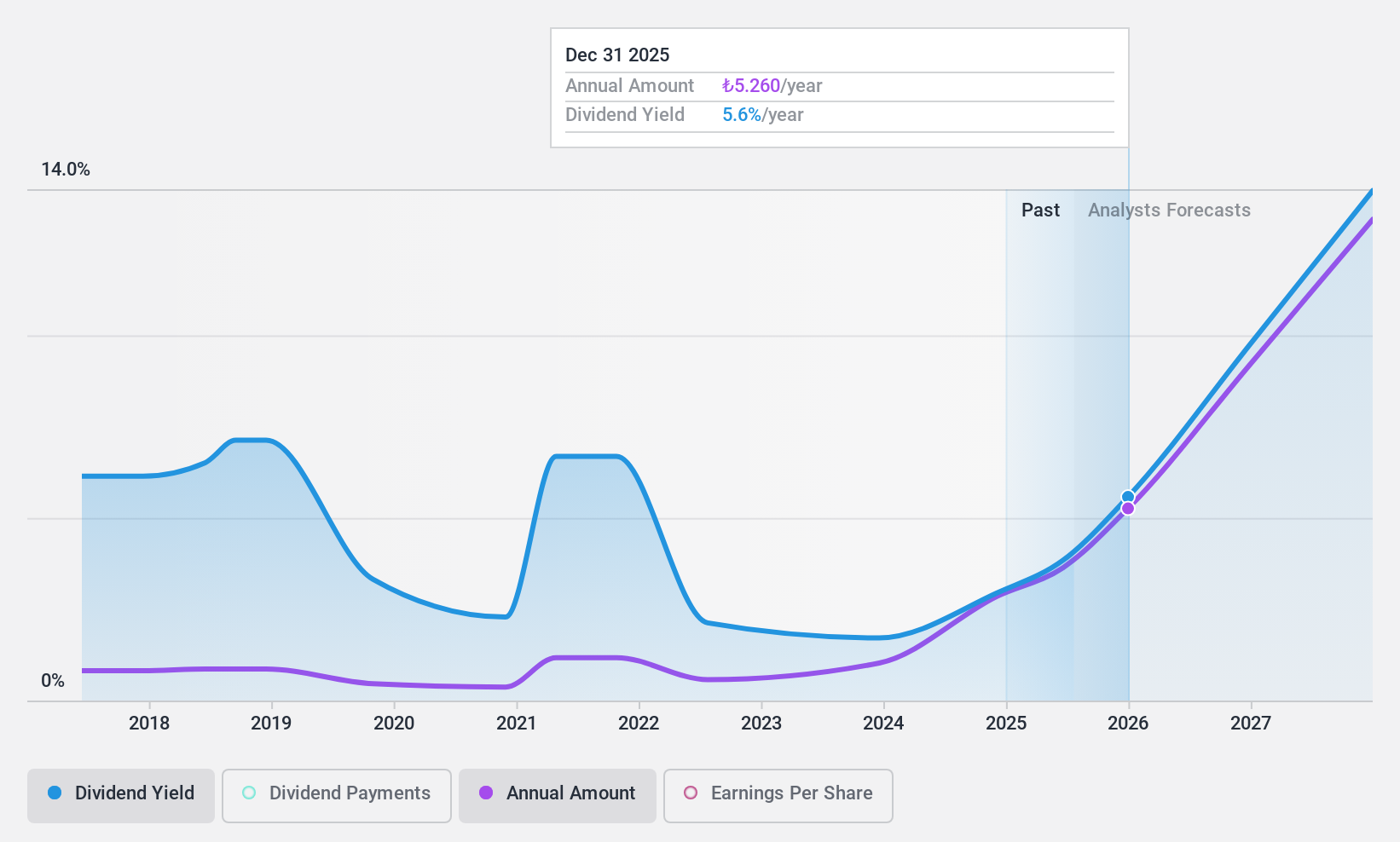

Turkcell Iletisim Hizmetleri (IBSE:TCELL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Turkcell Iletisim Hizmetleri A.S. offers digital services across Turkey, Belarus, the Turkish Republic of Northern Cyprus, and the Netherlands with a market cap of TRY204.94 billion.

Operations: Turkcell Iletisim Hizmetleri's revenue segments include Turkcell Turkey at TRY98.38 billion, Fintech at TRY5.98 billion, and Turkcell International at TRY2.83 billion.

Dividend Yield: 3%

Turkcell Iletisim Hizmetleri offers a dividend yield of 3.03%, ranking it in the top 25% of Turkish market payers, though its dividend history shows volatility with past significant drops. Despite this, dividends are well-covered by earnings (payout ratio: 23.9%) and cash flows (cash payout ratio: 35.6%). Turkcell's recent profitability and forecasted earnings growth of 28.16% per year could enhance future dividend stability, while recent technological advancements bolster its strategic positioning in network security and capacity expansion initiatives.

- Delve into the full analysis dividend report here for a deeper understanding of Turkcell Iletisim Hizmetleri.

- Our expertly prepared valuation report Turkcell Iletisim Hizmetleri implies its share price may be lower than expected.

STI Education Systems Holdings (PSE:STI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: STI Education Systems Holdings, Inc., with a market cap of ₱12.63 billion, operates through its subsidiaries to offer a variety of educational services in the Philippines.

Operations: STI Education Systems Holdings, Inc. generates revenue from its subsidiaries primarily through educational services offered by schools, colleges, and universities amounting to ₱5.09 billion.

Dividend Yield: 3.4%

STI Education Systems Holdings maintains a reliable dividend, currently yielding 3.36%, though below the top 25% in the PH market. Its dividends are well-supported by earnings (payout ratio: 16.2%) and cash flows (cash payout ratio: 26.5%). Recent earnings growth and stable dividends over the past decade enhance its appeal, while the recent PHP 0.045 per share dividend declaration underscores management's commitment to returning value to shareholders amidst robust financial performance.

- Navigate through the intricacies of STI Education Systems Holdings with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of STI Education Systems Holdings shares in the market.

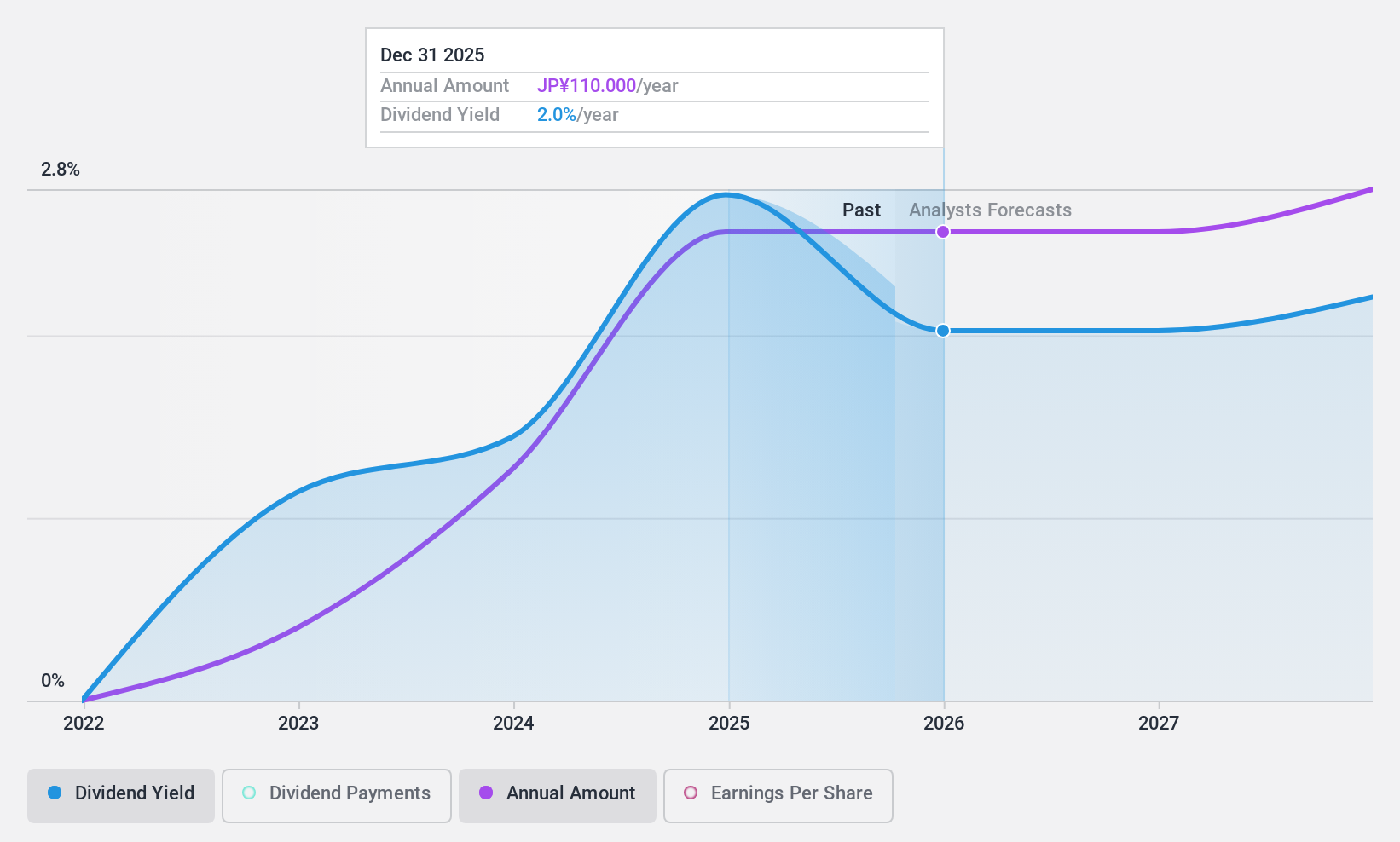

Tera Probe (TSE:6627)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tera Probe, Inc. operates in wafer testing, final testing, and testing technology development while also offering worker dispatching services both in Japan and internationally, with a market cap of ¥26.56 billion.

Operations: Tera Probe, Inc.'s revenue is derived from its operations in wafer testing, final testing, and testing technology development services.

Dividend Yield: 3.8%

Tera Probe's dividend yield of 3.77% ranks in the top 25% of Japan's market, supported by a low payout ratio of 26.6%, ensuring sustainability through earnings and cash flows. Despite only three years of dividend history, payments have been stable and reliable. The company trades at a significant discount to its estimated fair value, offering good relative value compared to peers. However, its highly volatile share price may concern some investors seeking stability.

- Dive into the specifics of Tera Probe here with our thorough dividend report.

- Our valuation report here indicates Tera Probe may be undervalued.

Summing It All Up

- Click through to start exploring the rest of the 1935 Top Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:STI

STI Education Systems Holdings

Through its subsidiaries, provides a range of educational services in the Philippines.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives