- Japan

- /

- Telecom Services and Carriers

- /

- TSE:3843

FreeBit (TSE:3843) Q2 Net Margin Compression Tests Bullish Growth Narrative

Reviewed by Simply Wall St

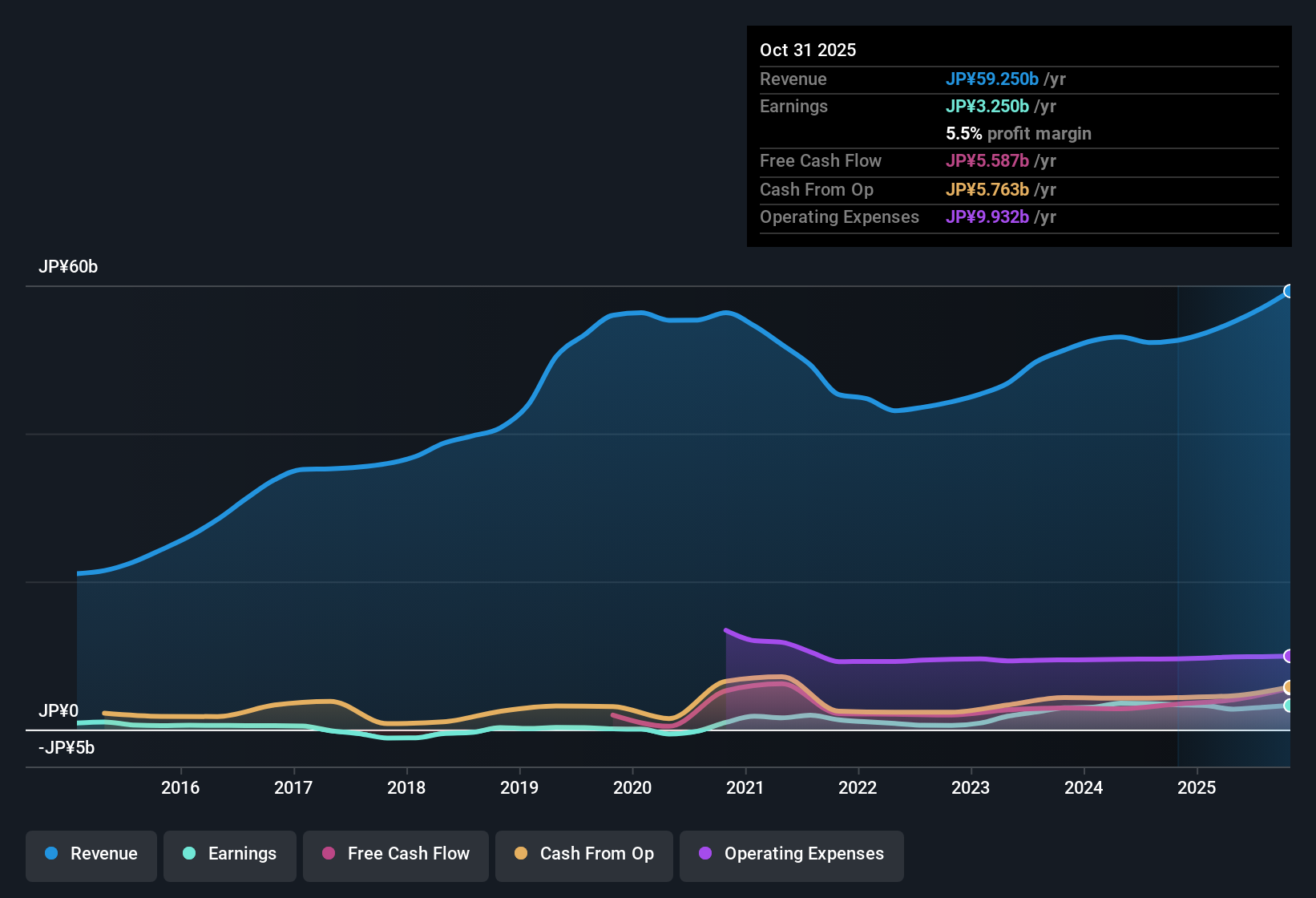

FreeBit (TSE:3843) just turned in a solid Q2 2026 scorecard, posting revenue of about ¥15.6 billion and net income of roughly ¥1.2 billion, which translated into basic EPS of ¥55.38. The company has seen revenue move from approximately ¥13.3 billion in Q2 2025 to ¥15.6 billion this quarter, while net income climbed from about ¥955 million to ¥1.2 billion and EPS shifted from ¥47.44 to ¥55.38, setting the stage for investors to weigh growth against where profitability is settling. With that backdrop, the focus now is on how sustainably FreeBit is converting that higher revenue into margins that can keep sentiment on its side.

See our full analysis for FreeBit.With the latest numbers on the table, the next step is to line them up against the most common narratives around FreeBit to see which story threads hold up and which ones the new margin profile starts to challenge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Forecast EPS Growth at 10.8 Percent Annually

- Forecast annual EPS growth of about 10.8 percent sits above the Japan market forecast of 8.4 percent per year, while trailing twelve month EPS is 153.98 JPY versus 167.60 JPY a year earlier.

- Bulls see the above market growth outlook as proof that FreeBit can monetize its 5G and digital platforms effectively, yet the slip in trailing EPS

- Highlights that recent 12 month earnings of 3,250.30 million JPY compare to 3,354.00 million JPY a year ago, which softens the five year growth story of 25 percent per year.

- Suggests execution on the newer 5G and DX initiatives still needs to show more consistent contribution to match the optimistic growth rate implied in forecasts.

Net Margin Slips to 5.5 Percent

- Trailing twelve month net profit margin is 5.5 percent, down from 6.4 percent a year earlier, even as trailing revenue grew from 52,586.00 million JPY to 59,249.64 million JPY.

- Skeptics focus on this margin compression as a sign that growth is costing more to win, arguing that scaling 5G and DX support may be weighing on profitability

- The drop in margin comes alongside higher trailing revenue of about 59.25 billion JPY, which means more sales are currently translating into a smaller proportion of profit than last year.

- That pattern contrasts with the forecast 10.8 percent annual EPS growth and invites questions about whether cost structures can be tightened enough for earnings to fully reflect the higher top line.

P/E of 10.6x vs Industry 16.4x

- FreeBit trades on a trailing P/E of 10.6 times at a share price of 1,575 JPY, compared with about 16.4 times for the Asian telecom industry, 15.4 times for peers, and 14.2 times for the broader Japan market.

- Supporters of the bullish view argue this discount multiple plus a 2.6 percent dividend yield signal relative value, but the fact that the stock trades above its 1,417.01 JPY DCF fair value creates a tension

- The valuation gap suggests investors are willing to pay more than modelled fair value for the forecast growth profile, despite the recent dip in trailing net margins from 6.4 percent to 5.5 percent.

- At the same time, the lower P/E versus industry and market implies the shares are not priced like a high growth outlier, leaving room for the narrative to shift either toward the growth story or toward the DCF based fair value anchor.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on FreeBit's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Despite a respectable growth outlook, FreeBit faces pressure from slipping net margins and a trailing EPS dip that undercuts the strength of its recent expansion.

If you want businesses where earnings power is backed by consistent execution rather than tightening margins, check out stable growth stocks screener (2103 results) to quickly zero in on steadier performers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3843

FreeBit

Operates as a supporting Internet business, and broadband business company.

Excellent balance sheet established dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)