- India

- /

- Electronic Equipment and Components

- /

- NSEI:REDINGTON

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainty surrounding the incoming Trump administration's policies, investors are witnessing a mixed performance across sectors, with financials and energy benefiting from deregulation hopes while healthcare faces challenges. Amidst this backdrop of fluctuating indices and policy shifts, dividend stocks present an attractive option for those seeking stable income streams; their potential to provide consistent returns makes them a compelling choice in today's volatile economic environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.61% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.59% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.85% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.55% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.84% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.04% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.59% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.49% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1976 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

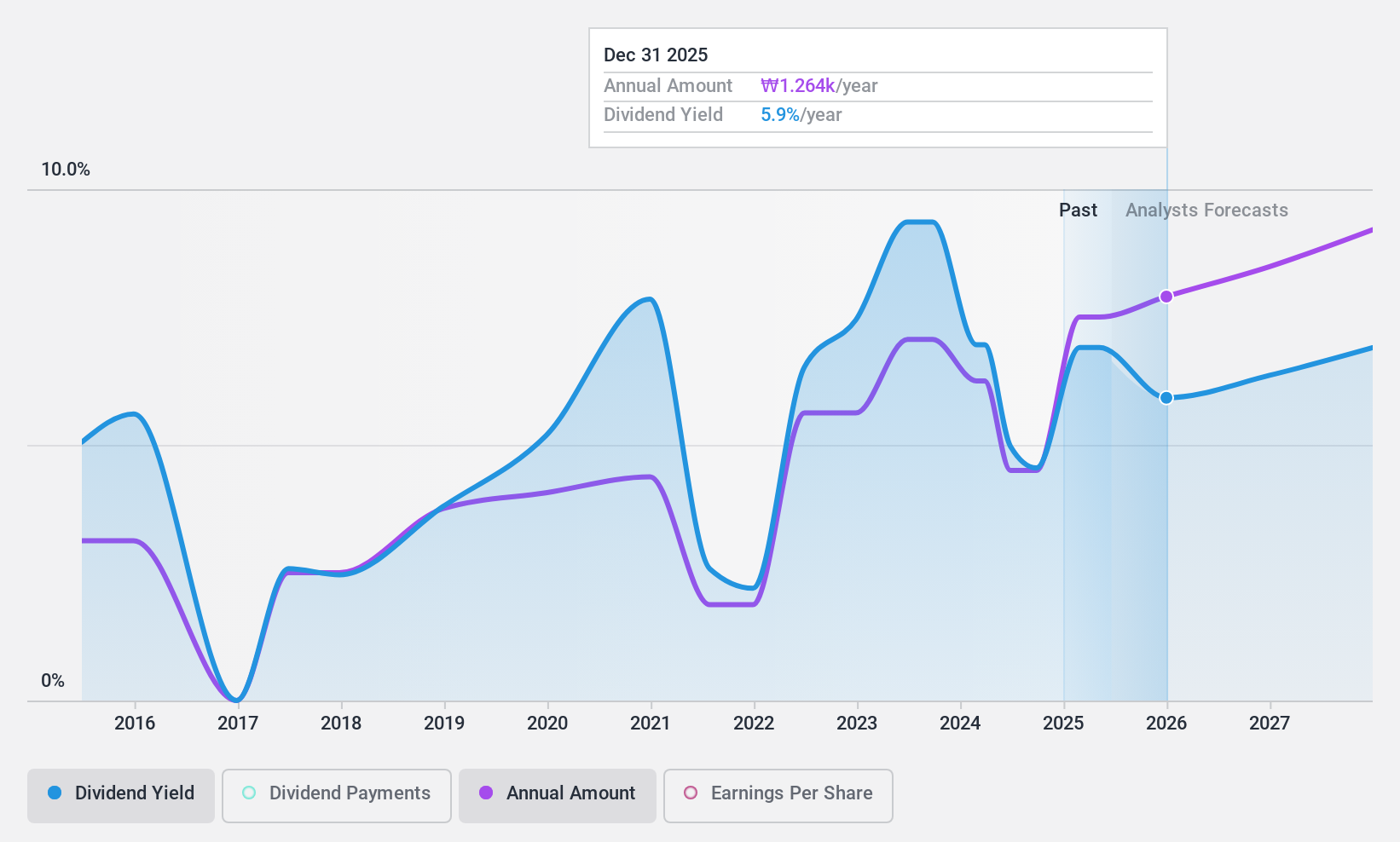

Woori Financial Group (KOSE:A316140)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Woori Financial Group Inc., along with its subsidiaries, operates as a commercial bank offering various financial services to individual, business, and institutional customers in Korea, with a market cap of ₩12.33 trillion.

Operations: Woori Financial Group Inc.'s revenue segments include Banking with ₩7.45 billion, Capital at ₩282.19 million, Credit Cards generating ₩468.39 million, and Investment Banking contributing -₩26.20 million.

Dividend Yield: 4.3%

Woori Financial Group's dividend yield of 4.33% places it in the top quartile of KR market dividend payers, supported by a low payout ratio of 34.1%, indicating dividends are well covered by earnings. Despite this, its dividend history has been volatile over the past decade, with significant fluctuations and an unstable track record. Recent earnings reports show steady growth in net income, which could support future dividend sustainability if volatility is managed effectively.

- Click here and access our complete dividend analysis report to understand the dynamics of Woori Financial Group.

- Our valuation report here indicates Woori Financial Group may be undervalued.

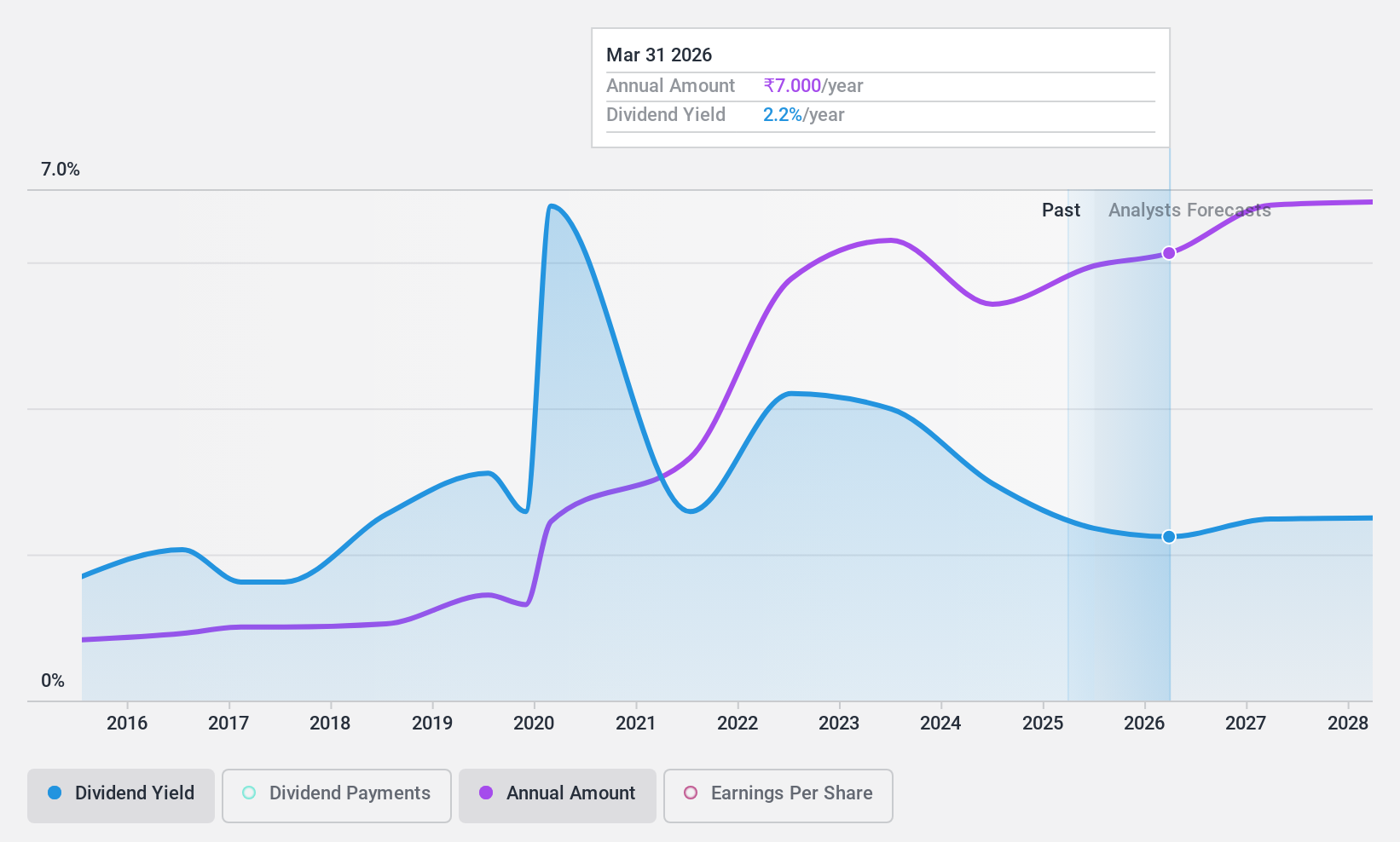

Redington (NSEI:REDINGTON)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Redington Limited offers supply chain solutions both in India and internationally, with a market capitalization of ₹151.57 billion.

Operations: Redington Limited's revenue segments include Information Technology Products at ₹621.34 billion, Mobility Products at ₹204.56 billion, and Services at ₹13.45 billion.

Dividend Yield: 3.2%

Redington's dividend yield of 3.2% ranks it among the top 25% of Indian market dividend payers, supported by a low payout ratio of 39.8%, indicating strong coverage by earnings and cash flows. However, its dividend history has been volatile over the past decade with significant annual drops exceeding 20%. Recent earnings show increased sales but slightly lower net income compared to last year, highlighting potential challenges in maintaining consistent dividends.

- Delve into the full analysis dividend report here for a deeper understanding of Redington.

- The valuation report we've compiled suggests that Redington's current price could be quite moderate.

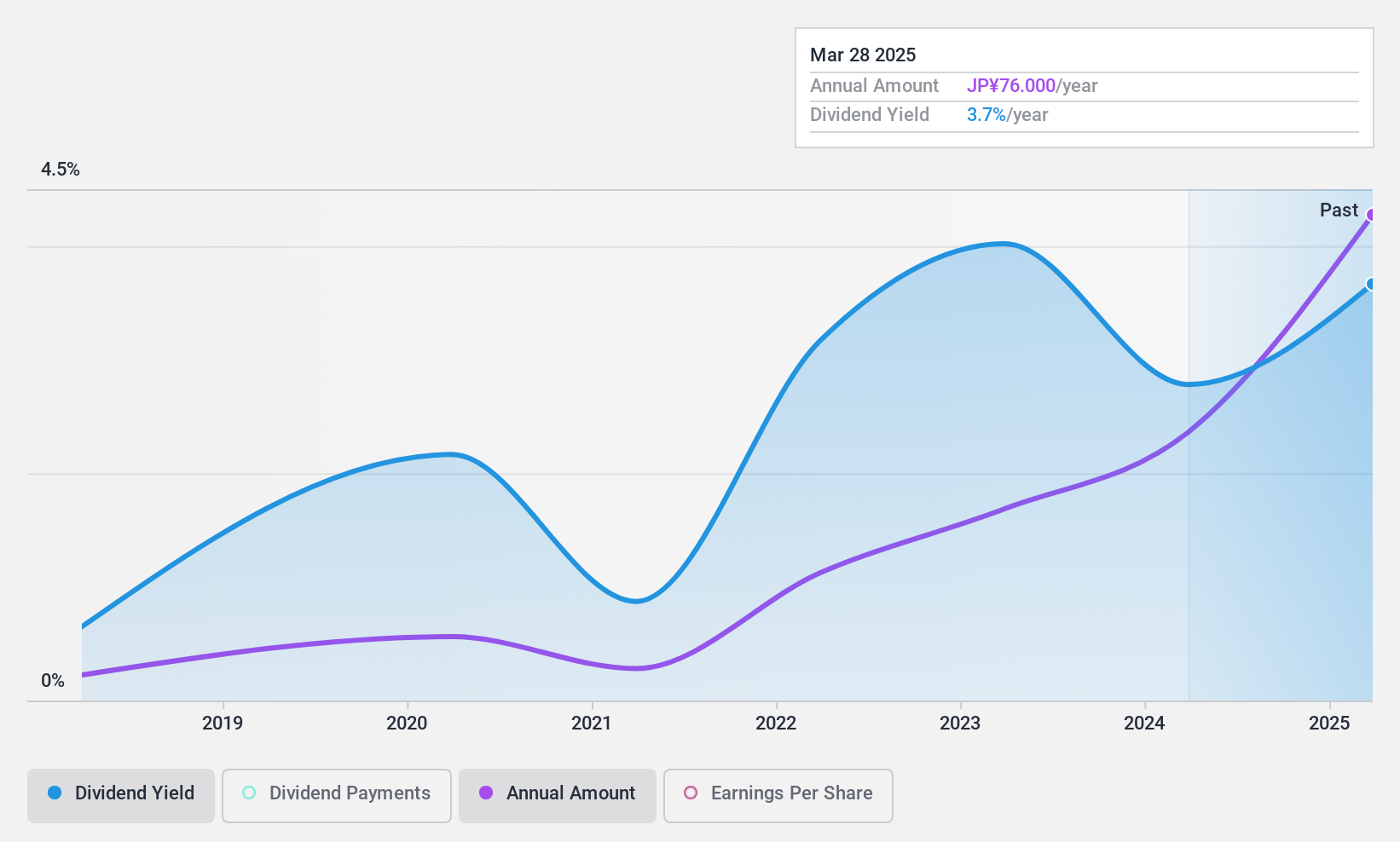

Nippo (TSE:9913)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippo Ltd., along with its subsidiaries, engages in the manufacturing and trading of industrial materials and plastic molded products both in Japan and internationally, with a market cap of ¥19.08 billion.

Operations: Nippo Ltd.'s revenue is derived from its operations in manufacturing and trading industrial materials and plastic molded products across domestic and international markets.

Dividend Yield: 3.6%

Nippo's dividend yield of 3.59% is slightly below the top 25% of Japanese market payers, with a payout ratio of 48.4%, indicating dividends are well covered by earnings and cash flows. Despite this coverage, the dividend history has been unstable over the past decade with significant volatility and unreliability but shows growth over ten years. The cash payout ratio stands at a reasonable 53.5%, further supporting dividend sustainability despite past fluctuations.

- Dive into the specifics of Nippo here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Nippo shares in the market.

Taking Advantage

- Take a closer look at our Top Dividend Stocks list of 1976 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:REDINGTON

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives