- Japan

- /

- Electronic Equipment and Components

- /

- TSE:8060

Canon MJ (TSE:8060) Maintains 5.9% Profit Margin, Reinforcing Reliable Earnings Narrative

Reviewed by Simply Wall St

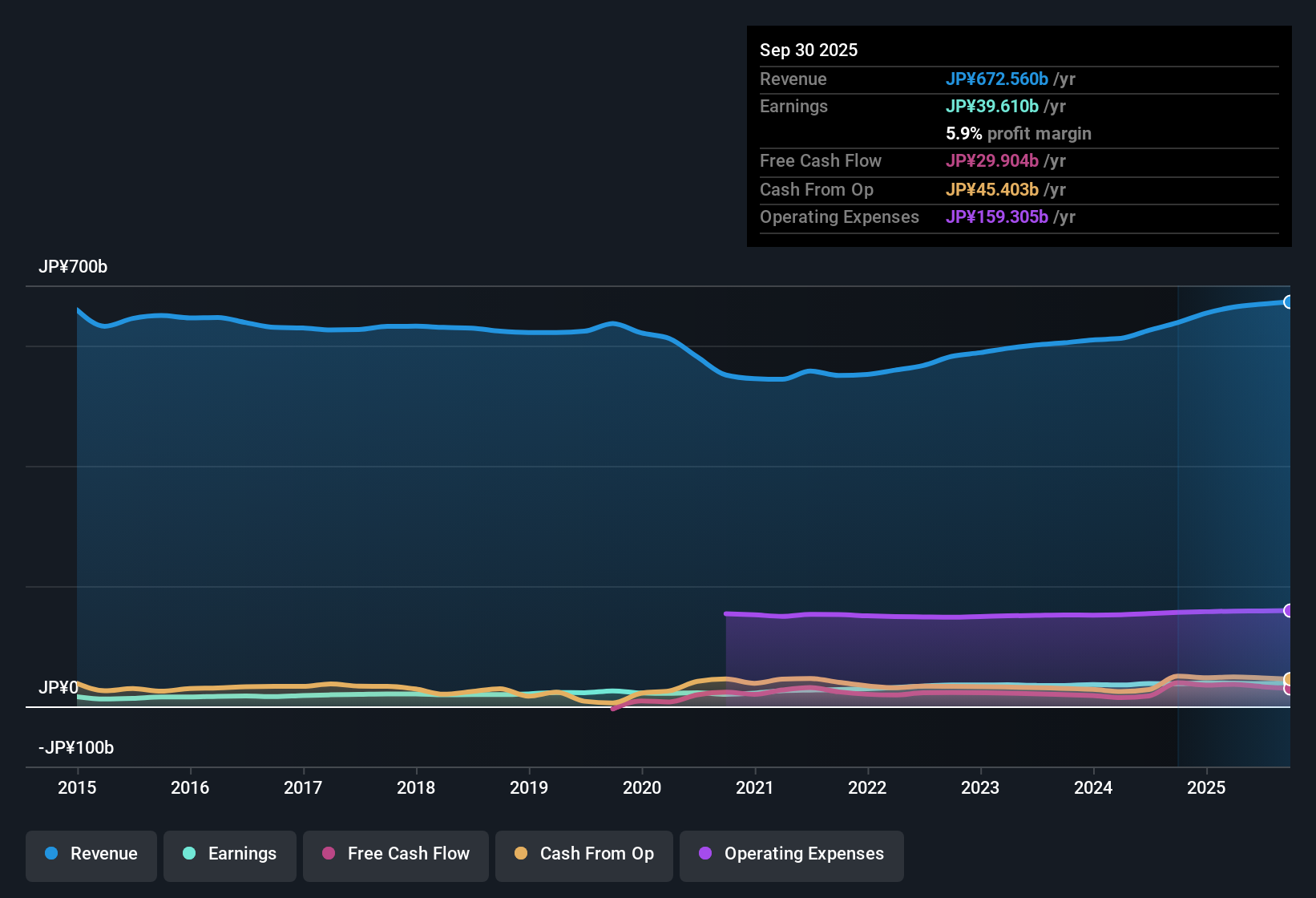

Canon Marketing Japan (TSE:8060) reported revenue growth of 1.1% per year, trailing the broader Japanese market’s pace of 4.4%. Earnings are projected to grow at 4.7% annually, behind the national market’s expected 8%, with the company’s net profit margin steady at 5.9% compared to last year. Investors will note that while recent profit growth is positive at 5.3% compared to the five-year average of 10.2%, the latest figures point to more modest expansion ahead rather than a dramatic shift in the company’s earnings story.

See our full analysis for Canon Marketing Japan.Now, let’s see how these numbers compare to the prevailing narratives. Which perspectives do the results reinforce, and where might consensus be challenged?

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Consistency Stands Out

- The net profit margin held steady at 5.9% year over year, even as five-year average earnings growth of 10.2% slowed to 5.3% in the latest period.

- What is notable is that, although the latest annual profit growth dipped below the longer-term average, the stable margin signals strong operational efficiency and resilience, especially as margins often get squeezed in slower growth years.

- Sustaining a 5.9% margin when growth moderates supports the argument that solid execution and cost management are in place.

- Still, the deceleration in earnings may temper hopes for a quick return to double-digit performance, even as the core business remains profitable.

Growth Trails Market, but Upside Remains

- Revenue is forecast to rise at just 1.1% per year compared to the Japanese market’s expected 4.4% annual growth, and projected earnings growth of 4.7% per year also lags the 8% market rate.

- Prevailing market perspective emphasizes that while growth rates are below market averages, the company’s track record for sustained profit increases and high earnings quality supports a narrative of gradual, dependable expansion rather than sharp accelerations.

- The contrast between slower forecast growth and the historically strong five-year average earnings jump of 10.2% highlights the challenge of sustaining outperformance as conditions normalize.

- Forecasts for continued profit and revenue gains, even if modest, suggest that the company’s edge lies in enduring operational reliability rather than headline-grabbing acceleration.

Valuation Discount Suggests Hidden Potential

- With a current share price of 6,139.00 and a DCF fair value estimate at 7,943.30, the stock trades at a sizable discount, though its price-to-earnings ratio is higher than both industry and peer averages.

- This sizable DCF discount strongly supports arguments that investors may be undervaluing the company’s future cash flow strength, especially given the absence of major risks beyond a single minor caution on dividend sustainability.

- The mismatch between a discounted share price and premium P/E suggests that the market assigns a valuation buffer for quality, but might not be fully accounting for the durability of profit margins and stable growth forecasts.

- High earnings quality and steady profits further support optimism among holders who focus on intrinsic value over short-term performance versus peers.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Canon Marketing Japan's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

With forecasted earnings and revenue growth lagging the wider market, Canon Marketing Japan faces hurdles to delivering meaningful acceleration in the near term.

If consistent outperformance matters to you, consider finding steadier growth and profit track records through stable growth stocks screener (2095 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8060

Canon Marketing Japan

Engages in the marketing and sale of Canon products and related solutions in Japan.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)