- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6999

KOA (TSE:6999) Net Margin Rebound Reinforces Turnaround Narrative Despite Lofty Valuation

Reviewed by Simply Wall St

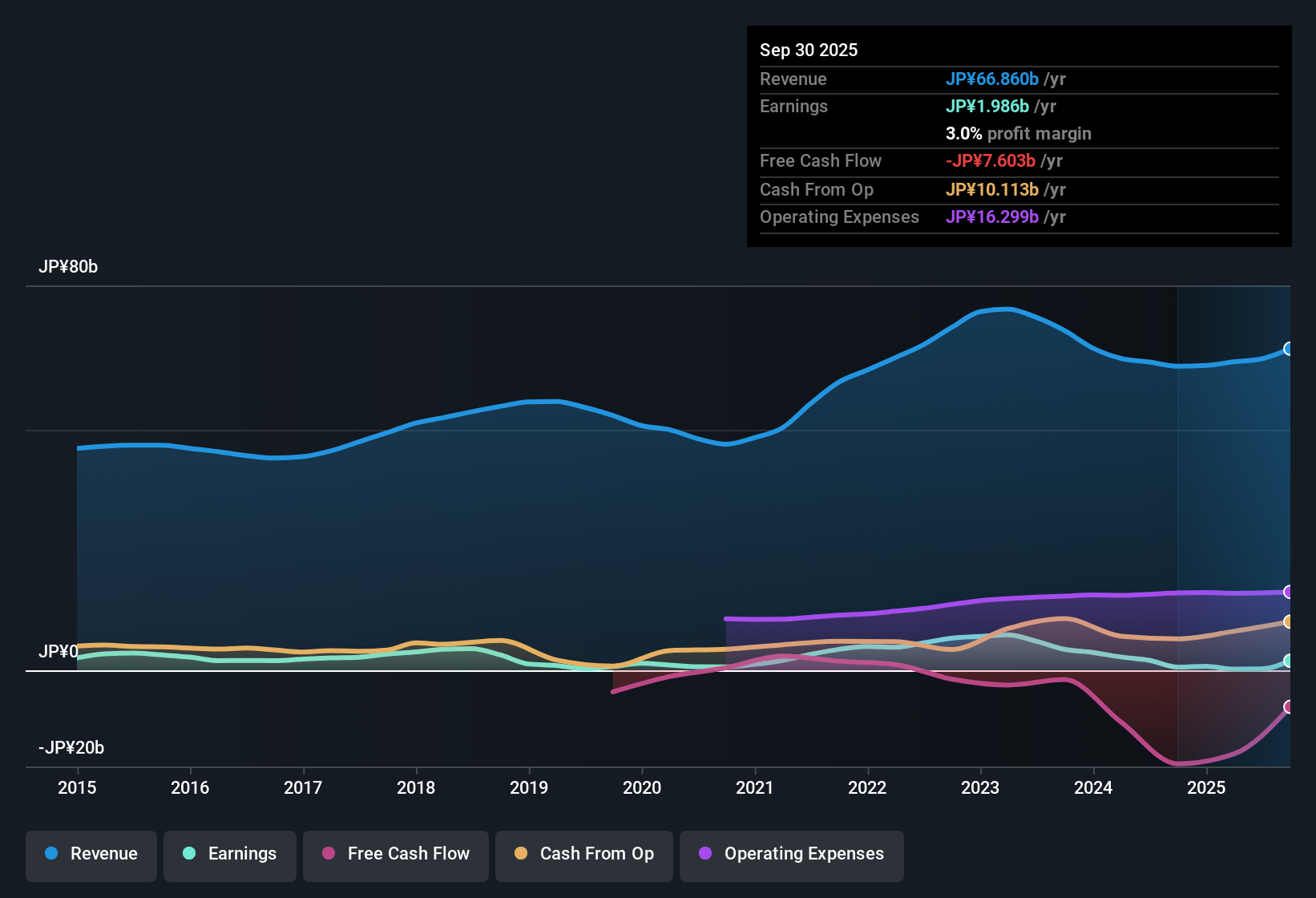

KOA (TSE:6999) delivered an impressive turnaround this year, with earnings growing 194.2% after a five-year period that averaged a 12.7% annual decline. Net profit margins rose to 3%, up from 1.1% the prior year, while revenue is now forecast to expand 4.6% per year, outpacing the Japanese market's 4.4% projection. With earnings now set to climb at 17.5% annually, investors are watching KOA closely for signs of a sustained operational recovery.

See our full analysis for KOA.Now, it’s time to see how these headline figures stack up against the widely followed narratives and market expectations. Some stories could be reinforced, while others may face fresh scrutiny.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margins Hit 3% After Rebound

- KOA’s net profit margins improved to 3% this year, up from 1.1% last year, indicating greater efficiency in turning revenue into actual profit than before.

- The prevailing analysis highlights KOA’s positive operational momentum, anchored in this margin uplift. This is seen as a sign that the company has moved beyond its previous five-year stretch averaging a 12.7% annual decline in earnings.

- This margin expansion is notable because it arrives alongside a dramatic swing in earnings growth, up 194.2% year over year, which directly supports the idea that KOA is executing a turnaround.

- Still, the data shows improvement from a low base, suggesting margin strength will need to persist for investors to see sustained rewards.

Valuation Jumps to 28x P/E

- KOA is now trading at a price-to-earnings ratio of 28x, a substantial premium above both its industry average of 14.9x and peer average of 18.9x.

- Despite clear signs of an operational turnaround, the prevailing market view raises caution as the current share price of 1,497.00 significantly exceeds the DCF fair value estimate of 761.30 and sits above analyst target levels of 1,035.00.

- This valuation gap means investors are paying well above both fair value and sector norms. Large future upside will depend on KOA sustaining or accelerating its recent profit growth.

- Paying a premium is only justified if the company can deliver on its ambitious annual earnings growth forecast of 17.5%, which is more than double the Japanese market average of 8.1%.

Dividend Flagged as Potential Risk

- KOA’s dividend has been identified as potentially unsustainable in recent filings, tempering the otherwise strong financial narrative.

- While accelerated earnings and margin gains suggest underlying business improvement, market participants remain on guard for future changes to the payout.

- This skepticism is rooted in the contrast between improving bottom-line results and the possibility that dividend levels cannot be maintained as anticipated.

- If KOA’s operational turnaround slows, the company may be forced to reevaluate its dividend policies, reminding investors to monitor for signals beyond growth metrics.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on KOA's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

KOA’s elevated valuation, sitting far above fair value and peer averages, means investors face significant risk if the company’s turnaround momentum fades.

For those seeking better value and lower price risk, discover opportunities among these 875 undervalued stocks based on cash flows, where stocks are trading at more attractive levels relative to fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KOA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6999

KOA

Develops, manufactures, and sells circuit components in Japan, Asia, America, and Europe.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)