- Hong Kong

- /

- Real Estate

- /

- SEHK:1972

3 Asian Stocks That May Be Priced Below Their Estimated Value In April 2025

Reviewed by Simply Wall St

As global markets grapple with escalating trade tensions and fluctuating consumer sentiment, the Asian stock landscape presents unique opportunities for investors seeking value. In this environment of heightened uncertainty, identifying stocks that may be priced below their estimated value can offer a strategic advantage, as these equities have the potential to provide robust returns when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Auras Technology (TPEX:3324) | NT$460.00 | NT$903.00 | 49.1% |

| Nishi-Nippon Financial Holdings (TSE:7189) | ¥1840.00 | ¥3651.91 | 49.6% |

| BMC Medical (SZSE:301367) | CN¥65.98 | CN¥130.26 | 49.3% |

| Alexander Marine (TWSE:8478) | NT$143.00 | NT$281.65 | 49.2% |

| Hyundai Rotem (KOSE:A064350) | ₩105600.00 | ₩209268.74 | 49.5% |

| Kokusai Electric (TSE:6525) | ¥2114.00 | ¥4140.43 | 48.9% |

| LITALICO (TSE:7366) | ¥1160.00 | ¥2301.87 | 49.6% |

| World Fitness Services (TWSE:2762) | NT$79.60 | NT$156.15 | 49% |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥6.80 | CN¥13.32 | 48.9% |

| Swire Properties (SEHK:1972) | HK$15.98 | HK$31.79 | 49.7% |

We'll examine a selection from our screener results.

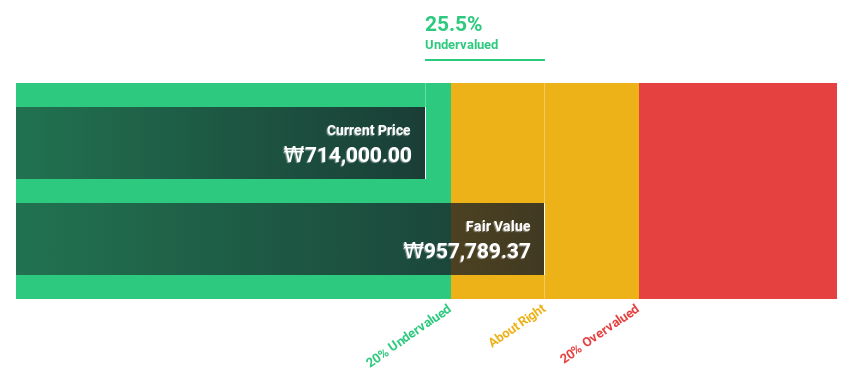

Korea Zinc Company (KOSE:A010130)

Overview: Korea Zinc Company, Ltd. is a general non-ferrous metal smelting company operating primarily in South Korea with a market cap of ₩12.55 trillion.

Operations: The company generates revenue from several segments, including ₩2.77 billion from imports and exports of non-ferrous metals and ₩9.42 billion from the manufacturing and sales of non-ferrous metals, along with contributions from waste disposal services amounting to ₩410.42 million.

Estimated Discount To Fair Value: 17.4%

Korea Zinc Company is trading at ₩691,000, below its estimated fair value of ₩836,911.30. Despite volatile share prices and lower profit margins compared to the previous year, earnings are forecast to grow significantly at 51.24% annually over the next three years—outpacing the Korean market. Recent changes in company bylaws and board appointments aim to enhance governance and transparency, though dividends remain poorly covered by cash flows and have decreased recently from previous levels.

- Upon reviewing our latest growth report, Korea Zinc Company's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Korea Zinc Company.

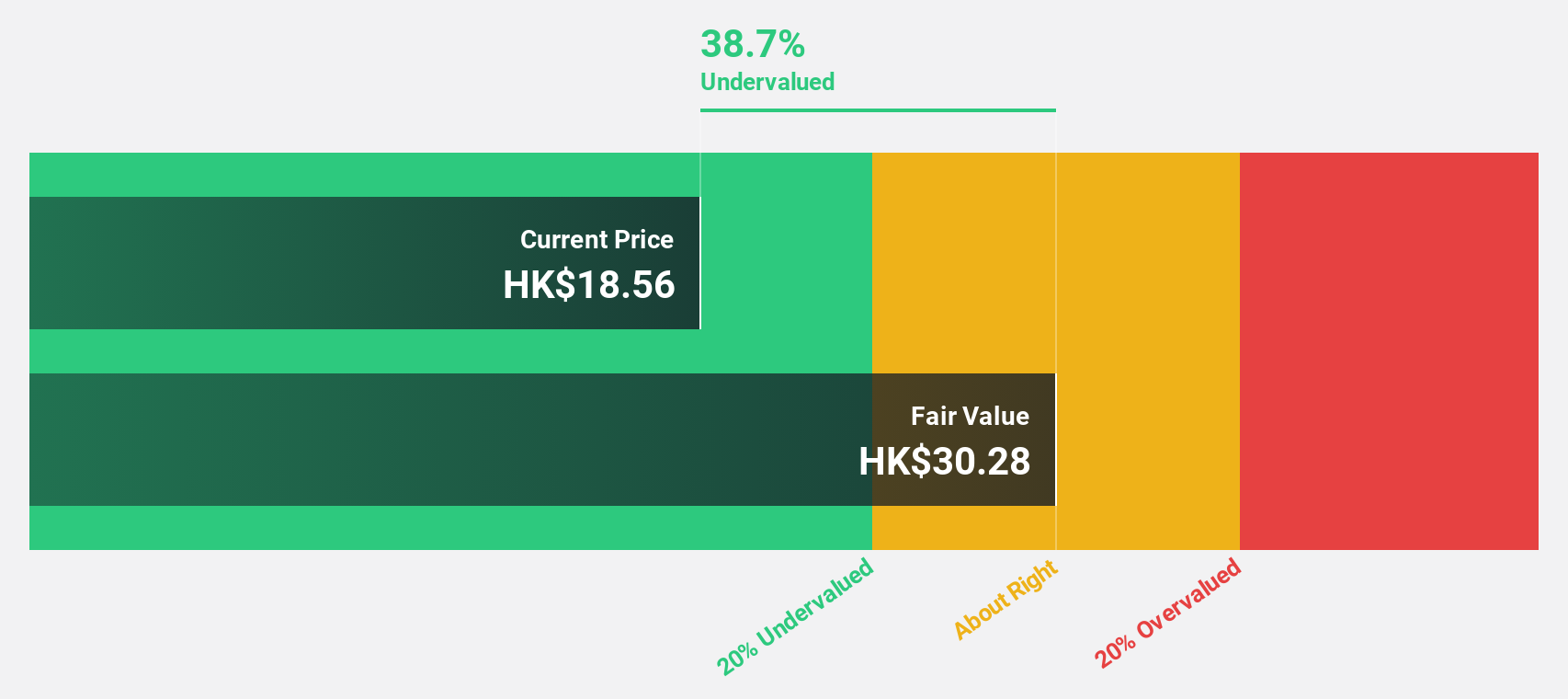

Swire Properties (SEHK:1972)

Overview: Swire Properties Limited, along with its subsidiaries, focuses on the development, ownership, and operation of mixed-use commercial properties in Hong Kong, Mainland China, and the United States with a market cap of HK$92.14 billion.

Operations: The company's revenue is derived from three main segments: Property Investment generating HK$14.78 billion, Hotels contributing HK$824 million, and Property Trading adding HK$67 million.

Estimated Discount To Fair Value: 49.7%

Swire Properties is trading at HK$15.98, significantly below its estimated fair value of HK$31.79, offering potential upside based on discounted cash flow analysis. Despite recent financial setbacks with a net loss of HK$766 million for 2024, earnings are projected to grow by 34.24% annually over the next three years, exceeding market averages. However, its dividend yield of 6.88% is not well covered by earnings or free cash flows despite recent increases and share buybacks totaling HK$750 million completed in late 2024.

- The growth report we've compiled suggests that Swire Properties' future prospects could be on the up.

- Get an in-depth perspective on Swire Properties' balance sheet by reading our health report here.

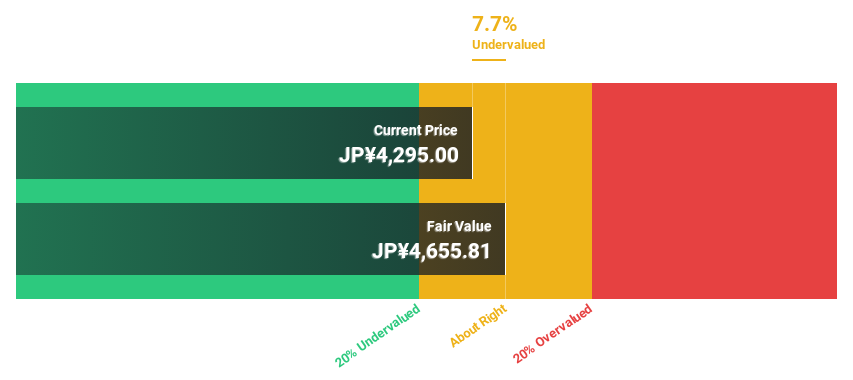

OMRON (TSE:6645)

Overview: OMRON Corporation operates in industrial automation, device and module solutions, social systems, and healthcare businesses globally with a market cap of ¥811.60 billion.

Operations: The company's revenue segments include Industrial Automation Business at ¥362.48 billion, Social Systems, Solutions and Service Business at ¥156.33 billion, Healthcare Business at ¥144.60 billion, Devices & Module Solutions Business at ¥140.41 billion, and Data Solution Business at ¥40.81 billion.

Estimated Discount To Fair Value: 11.6%

OMRON is trading at ¥4,122, undervalued by 11.6% based on its estimated fair value of ¥4,661.95. Despite a drop in profit margins from 3.7% to 0.9%, earnings are expected to grow significantly at 41.29% annually, surpassing the JP market average of 7.7%. Recent guidance revisions show improved operating income expectations for FY2025 and a fixed-income offering of ¥40 billion supports liquidity amid these growth forecasts and cash flow considerations.

- Our earnings growth report unveils the potential for significant increases in OMRON's future results.

- Click here to discover the nuances of OMRON with our detailed financial health report.

Seize The Opportunity

- Investigate our full lineup of 273 Undervalued Asian Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Swire Properties, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1972

Swire Properties

Develops, owns, and operates mixed-use, primarily commercial properties in Hong Kong, Mainland China, and the United States.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives