Fujitsu (TSE:6702) Q2 Earnings Call Set for Oct 31, 2024, Following Successful Share Buyback Completion

Reviewed by Simply Wall St

Fujitsu (TSE:6702) is navigating a dynamic period marked by strategic developments and market challenges. The company recently completed a significant buyback of 9.7 million shares, enhancing shareholder value, and is set to report its Q2 2025 results on October 31, 2024, during its board meeting. While Fujitsu's earnings growth has outpaced the industry average, it faces challenges such as modest dividend yields and below-market revenue growth forecasts. Readers can expect a detailed discussion on Fujitsu's competitive advantages, strategic gaps, and areas for expansion, along with an analysis of market volatility affecting its position.

Get an in-depth perspective on Fujitsu's performance by reading our analysis here.

Competitive Advantages That Elevate Fujitsu

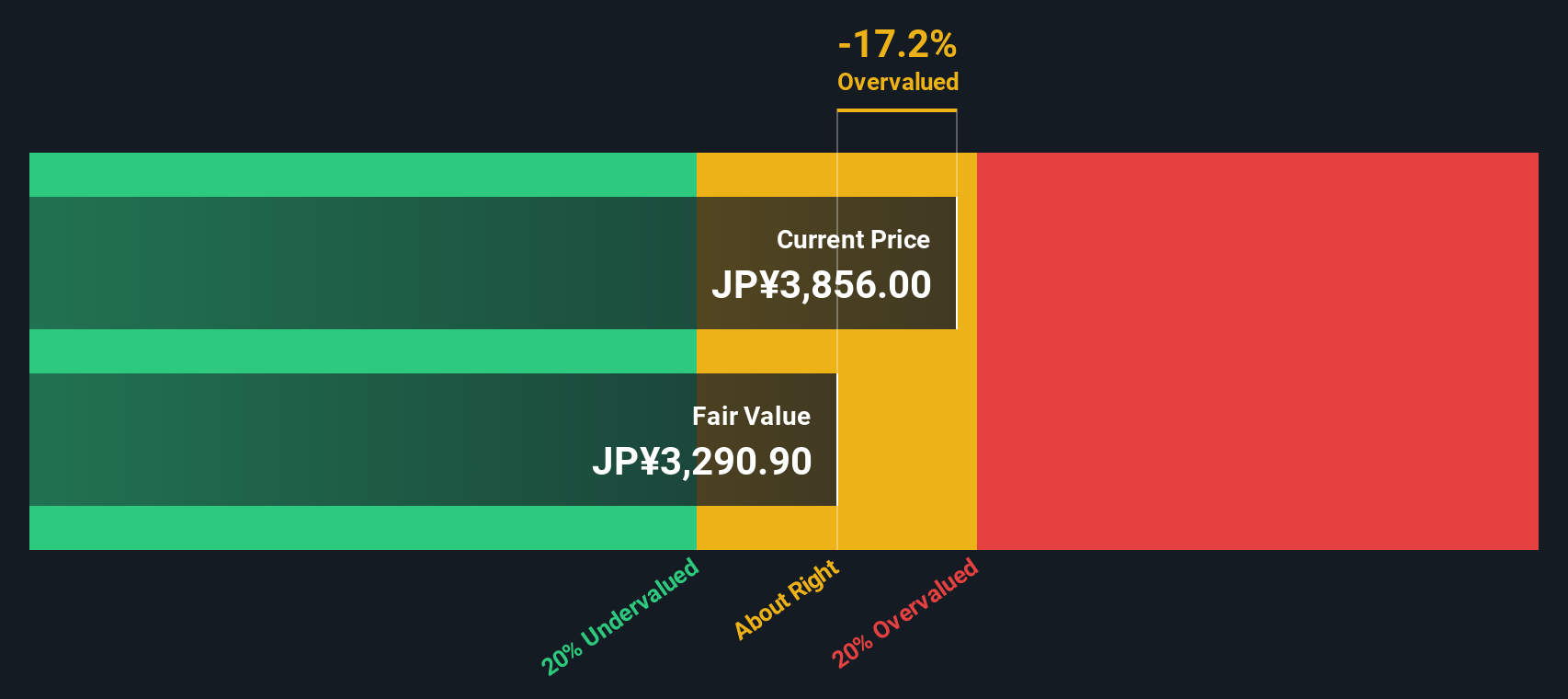

Fujitsu has demonstrated impressive earnings growth, with a 39.6% increase over the past year, surpassing the IT industry average of 9.9%. This performance is bolstered by improved net profit margins, rising to 6.8% from 4.9% the previous year. The company's financial health is further reinforced by its ability to cover interest payments on debt with an EBIT coverage of 52.8 times, indicating strong fiscal management. Moreover, Fujitsu's strategic buyback of 9.7 million shares, representing 0.53% of its total, underscores its commitment to enhancing shareholder value. The company is trading below its estimated fair value of ¥2915.85 at ¥2801.5, suggesting potential for price appreciation. Explore the current health of Fujitsu and how it reflects on its financial stability and growth potential.

Strategic Gaps That Could Affect Fujitsu

While Fujitsu's earnings growth is commendable, its Return on Equity (ROE) at 13.9% falls short of the 20% threshold, indicating room for improvement. Future earnings growth is projected at 8.4% per year, slightly below the JP market forecast of 8.9%. Additionally, the company's revenue growth forecast of 2.2% per year lags behind the JP market's 4.2%. Fujitsu's dividend yield of 1% is also modest compared to the top 25% of dividend payers in the JP market, which average 3.82%. To gain deeper insights into Fujitsu's historical performance, explore our detailed analysis of past performance.

Areas for Expansion and Innovation for Fujitsu

Fujitsu is poised to capitalize on emerging opportunities, particularly in Southeast Asia, where it sees significant demand for its products. The company's investment in digital transformation aims to streamline operations and enhance customer experience, positioning it for future growth. Recent regulatory changes have also created a more favorable environment for Fujitsu's offerings, potentially enhancing its competitive advantage. See what the latest analyst reports say about Fujitsu's future prospects and potential market movements.

Market Volatility Affecting Fujitsu's Position

Economic headwinds pose a potential threat to Fujitsu, with leadership expressing caution regarding consumer spending. Supply chain disruptions continue to challenge production and delivery timelines, necessitating a focus on risk management. Furthermore, regulatory hurdles could impact operations, highlighting the need for strategic foresight. To learn about how Fujitsu's valuation metrics are shaping its market position, check out our detailed analysis of Fujitsu's Valuation.

Conclusion

Fujitsu's impressive earnings growth of 39.6% and improved net profit margins highlight its strong fiscal management and ability to enhance shareholder value through strategic initiatives like share buybacks. However, its current Return on Equity of 13.9% and modest dividend yield suggest areas for improvement compared to market expectations. The company's investment in digital transformation and expansion into Southeast Asia positions it well for future growth, despite projected earnings and revenue growth slightly trailing market forecasts. While Fujitsu's Price-To-Earnings Ratio of 20.3x indicates a premium compared to the industry average, its trading price below the estimated fair value of ¥2915.85 suggests potential for price appreciation, contingent on effectively navigating economic headwinds and supply chain challenges.

Make It Happen

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:6702

Fujitsu

Operates as an information and communication technology company in Japan and internationally.

Flawless balance sheet with proven track record.