As we enter January 2025, global markets are experiencing a mixed landscape, with

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

Click here to see the full list of 1958 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

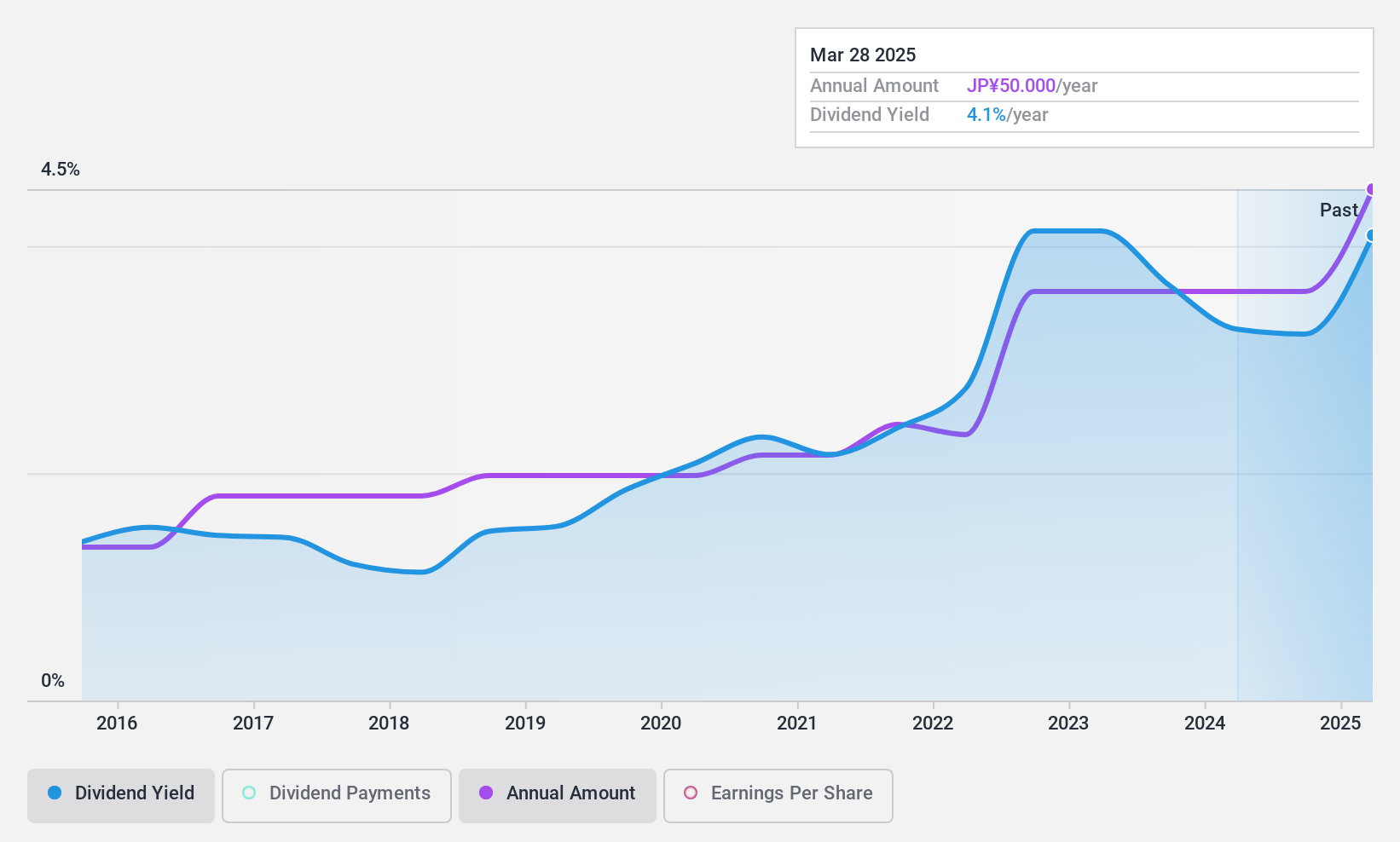

Nihon Parkerizing (TSE:4095)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Nihon Parkerizing Co., Ltd. manufactures and supplies surface treatment chemicals both in Japan and internationally, with a market cap of ¥153.69 billion.

Operations: Nihon Parkerizing Co., Ltd. generates revenue through its Chemicals Segment at ¥58.39 billion, Equipment Business at ¥22.79 billion, and Processing Business at ¥47.28 billion.

Dividend Yield: 3.8%

Nihon Parkerizing offers a compelling dividend profile, with its dividends well-covered by earnings (payout ratio: 39.5%) and cash flows (cash payout ratio: 60.7%). The company has maintained stable and reliable dividends over the past decade, with a yield of 3.83%, placing it in the top quartile of Japanese dividend payers. Despite recent shareholder dilution, its attractive price-to-earnings ratio of 11.6x suggests good value compared to the broader market.

- Get an in-depth perspective on Nihon Parkerizing's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Nihon Parkerizing shares in the market.

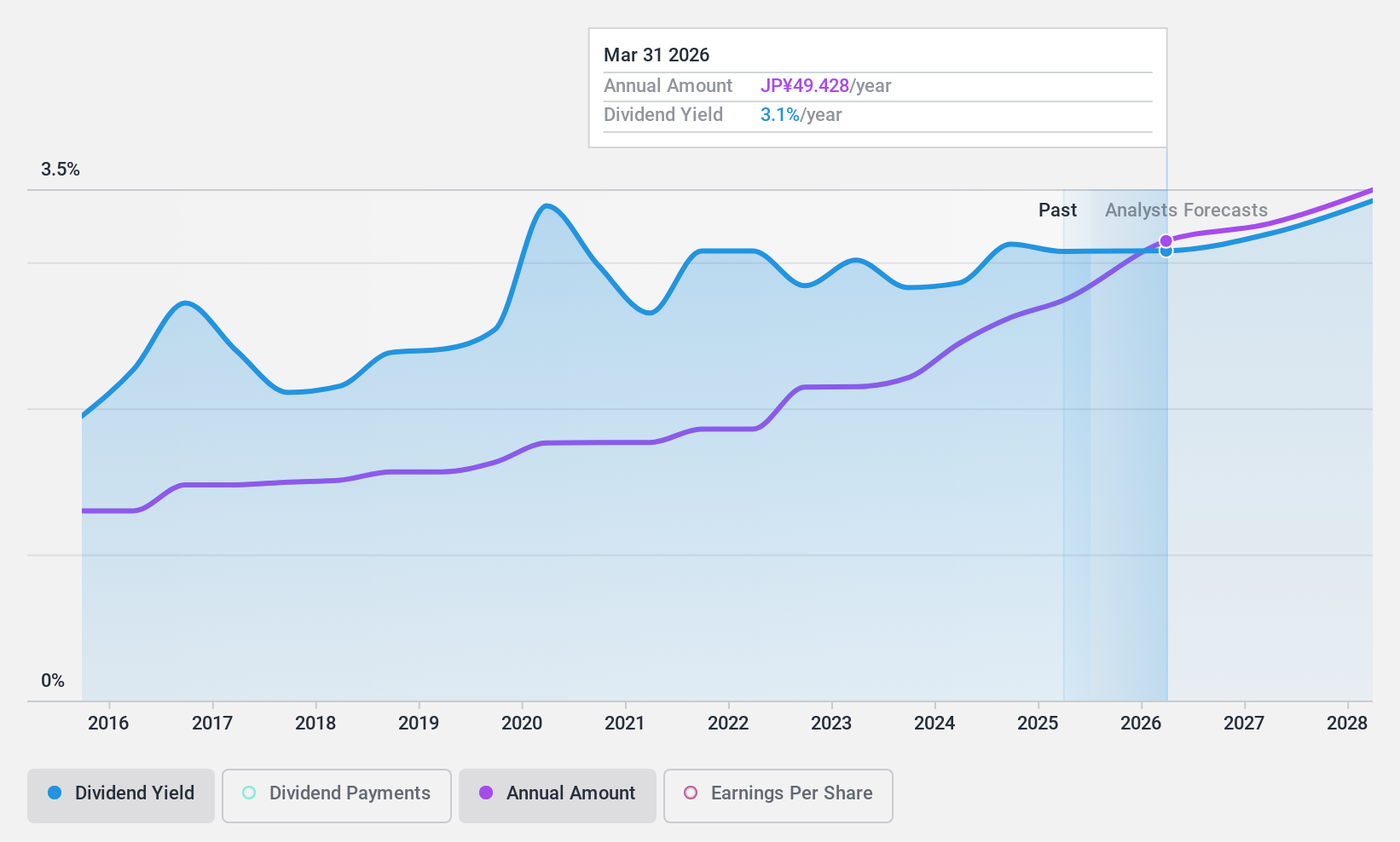

USS (TSE:4732)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: USS Co., Ltd., along with its subsidiaries, operates and manages used vehicle auction sites in Japan, with a market cap of ¥660.73 billion.

Operations: USS Co., Ltd.'s revenue is primarily derived from its Auto Auction segment at ¥78.36 billion, followed by the Purchase and Sales of Used Cars at ¥12.48 billion, and Recycling at ¥8.51 billion.

Dividend Yield: 3.1%

USS Co., Ltd. provides a stable dividend profile, with payments reliably growing over the past decade and well-covered by earnings (payout ratio: 56.4%) and cash flows (cash payout ratio: 52.8%). Despite a lower yield of 3.05% compared to top-tier Japanese dividend payers, its valuation is attractive at 12.4% below estimated fair value. Recent strategic moves include a share repurchase program aimed at enhancing shareholder returns and capital efficiency, further supporting its dividend sustainability strategy.

- Dive into the specifics of USS here with our thorough dividend report.

- Our expertly prepared valuation report USS implies its share price may be too high.

Sumitomo Warehouse (TSE:9303)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Sumitomo Warehouse Co., Ltd. offers integrated logistics services both in Japan and internationally, with a market cap of ¥219.21 billion.

Operations: Sumitomo Warehouse Co., Ltd. generates revenue from its Logistics Business, amounting to ¥175.63 billion, and its Real Estate Business, contributing ¥11.38 billion.

Dividend Yield: 3.6%

Sumitomo Warehouse's dividend yield of 3.6% is slightly below the top 25% in Japan, and its historical volatility raises concerns about reliability. However, dividends are covered by both earnings (payout ratio: 65.3%) and cash flows (cash payout ratio: 65.4%). Recent initiatives include a share buyback program worth ¥2.5 billion to enhance shareholder returns and capital efficiency, potentially supporting future dividend stability despite an unstable track record over the past decade.

- Click here and access our complete dividend analysis report to understand the dynamics of Sumitomo Warehouse.

- In light of our recent valuation report, it seems possible that Sumitomo Warehouse is trading beyond its estimated value.

Key Takeaways

- Navigate through the entire inventory of 1958 Top Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nihon Parkerizing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4095

Nihon Parkerizing

Engages in the manufacture and supply of surface treatment chemicals in Japan and internationally.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives