As global markets navigate a landscape of record-high U.S. indexes and positive economic indicators, investors are keenly watching for opportunities amid the ongoing geopolitical uncertainties and policy shifts. In this context, identifying potentially undervalued stocks can be crucial, as these investments may offer appealing entry points when broader market conditions exhibit resilience and growth potential.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.08 | US$99.93 | 49.9% |

| Truecaller (OM:TRUE B) | SEK47.98 | SEK95.84 | 49.9% |

| Nordic Waterproofing Holding (OM:NWG) | SEK172.40 | SEK344.25 | 49.9% |

| Kitron (OB:KIT) | NOK31.18 | NOK62.32 | 50% |

| CS Wind (KOSE:A112610) | ₩41600.00 | ₩83136.08 | 50% |

| PLAIDInc (TSE:4165) | ¥1604.00 | ¥3207.80 | 50% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.86 | 49.9% |

| Neosperience (BIT:NSP) | €0.57 | €1.14 | 50% |

| BATM Advanced Communications (LSE:BVC) | £0.188 | £0.38 | 50% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2905.00 | ¥5793.18 | 49.9% |

Here we highlight a subset of our preferred stocks from the screener.

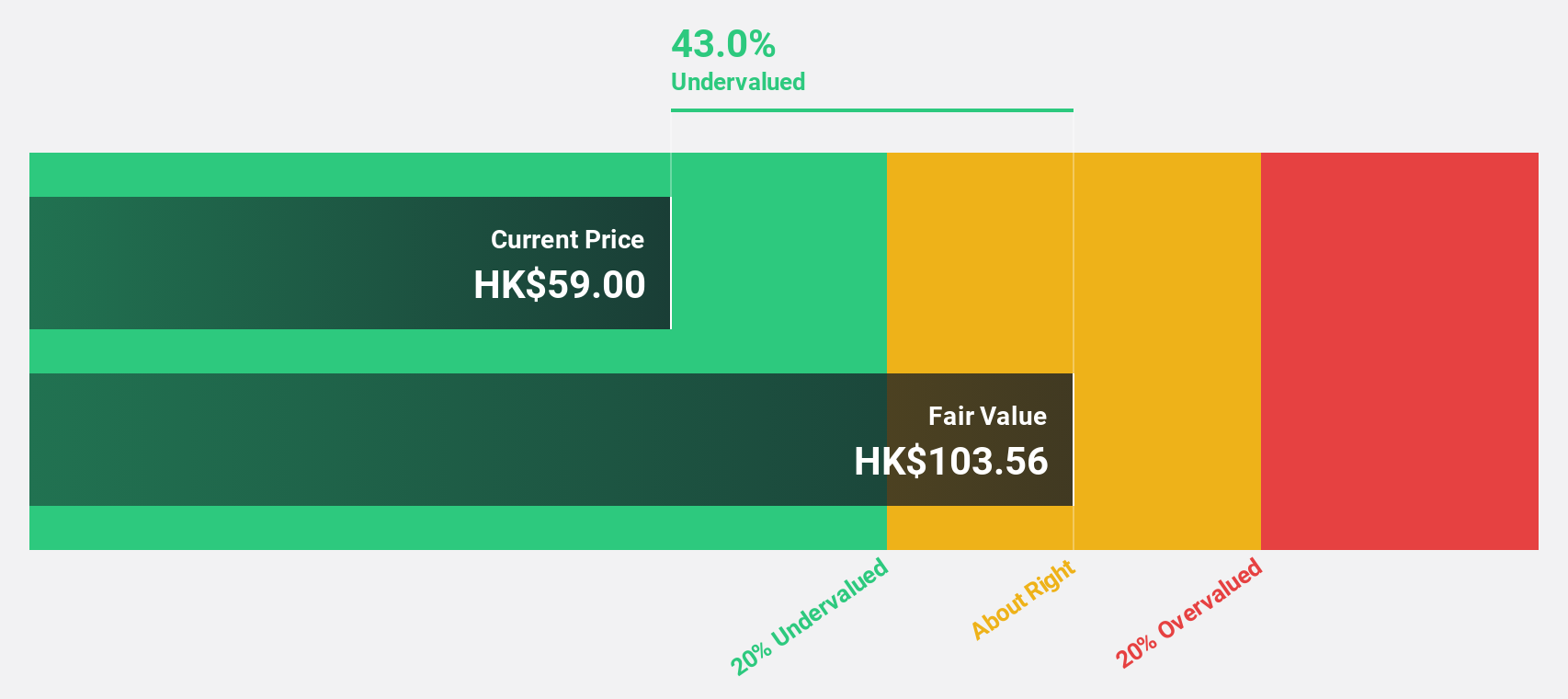

Giant Biogene Holding (SEHK:2367)

Overview: Giant Biogene Holding Co., Ltd. is an investment holding company focused on the research, development, manufacture, and sale of bioactive material-based beauty and health products in China, with a market cap of HK$53.03 billion.

Operations: The company generates its revenue from the biotechnology segment, amounting to CN¥4.46 billion.

Estimated Discount To Fair Value: 45.7%

Giant Biogene Holding is trading at HK$52.55, significantly below its estimated fair value of HK$96.78, highlighting potential undervaluation based on cash flows. Despite past shareholder dilution, the company's earnings grew by 68.1% over the last year and are projected to grow 23.44% annually, outpacing the Hong Kong market's average growth rate of 11.4%. Revenue is also expected to increase by 20.9% per year, surpassing market expectations.

- The growth report we've compiled suggests that Giant Biogene Holding's future prospects could be on the up.

- Click here to discover the nuances of Giant Biogene Holding with our detailed financial health report.

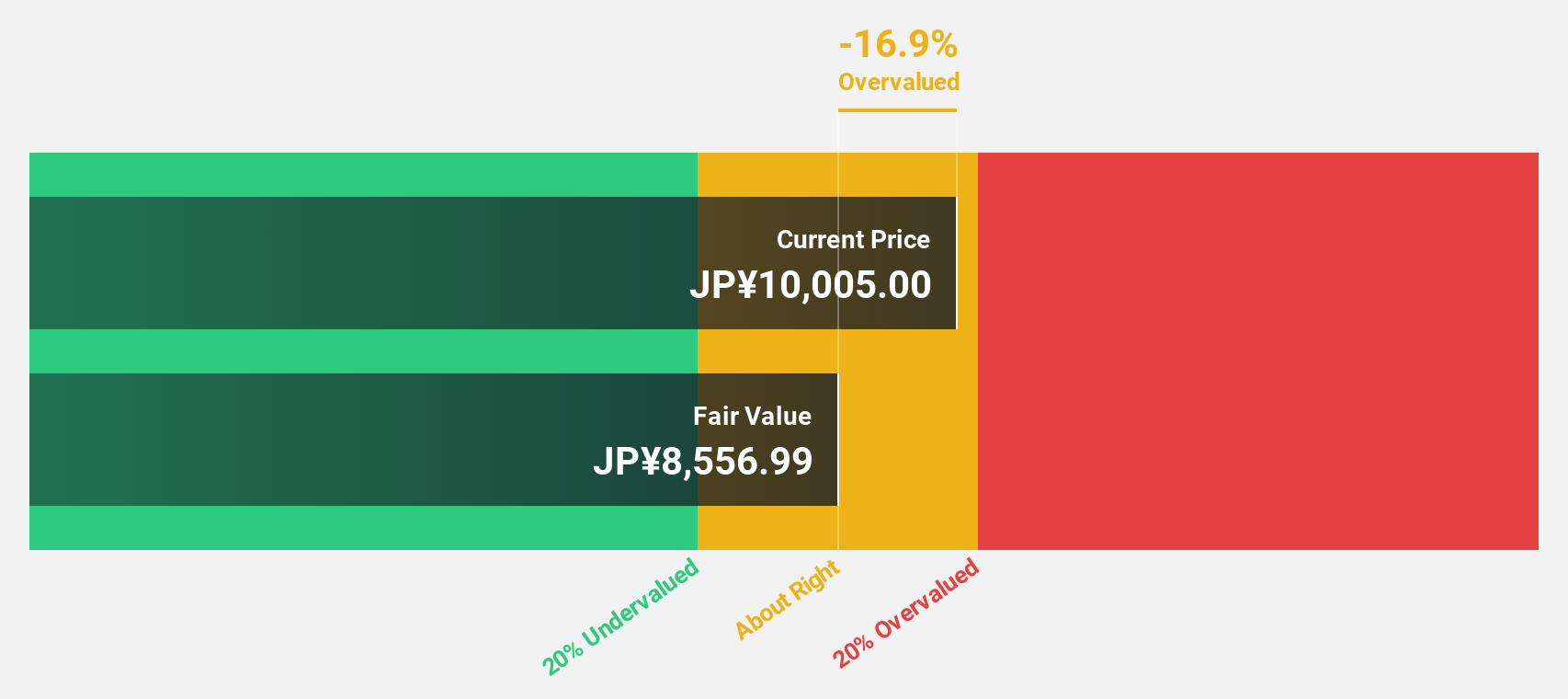

Trend Micro (TSE:4704)

Overview: Trend Micro Incorporated is a company that develops and sells security-related software for computers and related services both in Japan and internationally, with a market cap of ¥1.09 trillion.

Operations: The company's revenue segments are comprised of ¥85.04 billion from Japan, ¥65.17 billion from Europe, ¥70.30 billion from the Americas, and ¥125.59 billion from the Asia Pacific region.

Estimated Discount To Fair Value: 26.4%

Trend Micro is trading at ¥8,327, significantly below its estimated fair value of ¥11,310.35, suggesting it may be undervalued based on cash flows. The company's earnings grew by 72% over the past year and are forecast to grow 17.1% annually, outpacing the Japanese market's average growth rate of 7.9%. Recent innovations in AI-driven security tools enhance Trend Micro's product offerings and support its proactive security management strategy in cloud environments.

- According our earnings growth report, there's an indication that Trend Micro might be ready to expand.

- Navigate through the intricacies of Trend Micro with our comprehensive financial health report here.

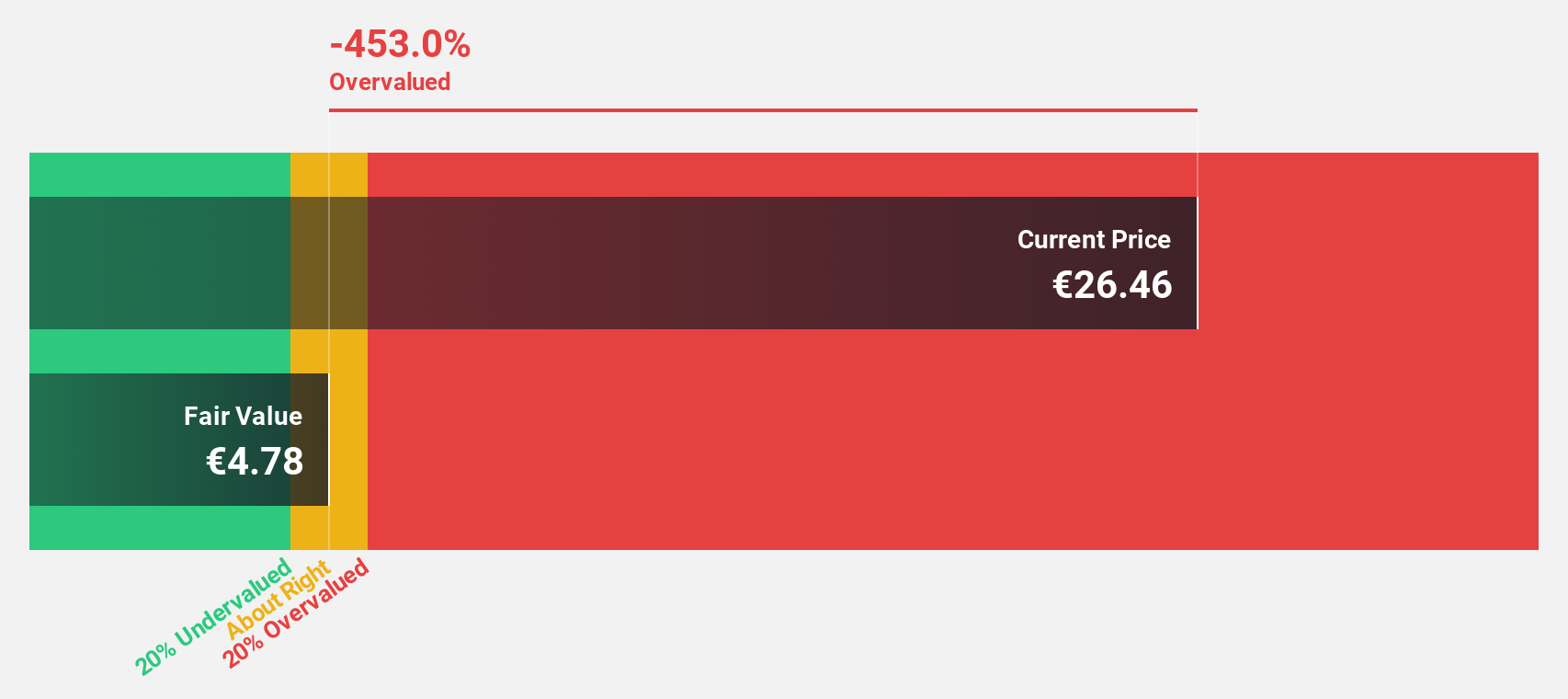

AUTO1 Group (XTRA:AG1)

Overview: AUTO1 Group SE operates a digital automotive platform for buying and selling used cars online in Europe, with a market cap of €2.53 billion.

Operations: The company's revenue is comprised of €1.14 billion from Retail and €4.76 billion from Merchant segments.

Estimated Discount To Fair Value: 23.7%

AUTO1 Group, trading at €11.64, is undervalued compared to its estimated fair value of €15.26. The company reported a significant turnaround with third-quarter net income of €7.65 million, up from a net loss the previous year. Revenue is projected to grow at 8.1% annually, surpassing the German market average of 5.6%. Despite high share price volatility and low forecasted ROE (6.2%), earnings are expected to increase substantially by 138% per year over the next three years.

- Our earnings growth report unveils the potential for significant increases in AUTO1 Group's future results.

- Unlock comprehensive insights into our analysis of AUTO1 Group stock in this financial health report.

Next Steps

- Unlock our comprehensive list of 914 Undervalued Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trend Micro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4704

Trend Micro

Develops and sells security-related software for computers and related services in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives