- China

- /

- Communications

- /

- SZSE:300213

Top 3 High Growth Tech Stocks in Asia

Reviewed by Simply Wall St

As global markets navigate the implications of interest rate cuts and concerns over technology stock valuations, Asia's tech sector remains a focal point for investors seeking growth opportunities. In this dynamic environment, identifying high-growth tech stocks involves evaluating companies that demonstrate resilience and innovation amid shifting economic conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Zhongji Innolight | 35.08% | 35.94% | ★★★★★★ |

| Fositek | 37.83% | 51.54% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Beijing Jiaxun Feihong Electrical (SZSE:300213)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Jiaxun Feihong Electrical Co., Ltd. operates in the electrical industry and has a market capitalization of approximately CN¥5.39 billion.

Operations: Beijing Jiaxun Feihong Electrical Co., Ltd. focuses on the electrical sector, generating revenue through various segments within the industry. The company's financial performance is characterized by its market presence and operational scale, with a significant market capitalization of CN¥5.39 billion.

Despite a challenging year with a net loss reported in the recent earnings for Q3 2025, Beijing Jiaxun Feihong Electrical's future prospects appear robust with an anticipated annual revenue growth of 23.3% and earnings growth forecast at an impressive 94.7%. This performance starkly contrasts the broader Chinese market expectations, positioning it favorably in a competitive landscape. The company's commitment to innovation is evident from its R&D investments, crucial for sustaining long-term growth in the rapidly evolving tech sector. Additionally, its inclusion in the S&P Global BMI Index underscores its potential relevance on a global scale.

- Get an in-depth perspective on Beijing Jiaxun Feihong Electrical's performance by reading our health report here.

Understand Beijing Jiaxun Feihong Electrical's track record by examining our Past report.

Rakus (TSE:3923)

Simply Wall St Growth Rating: ★★★★★☆

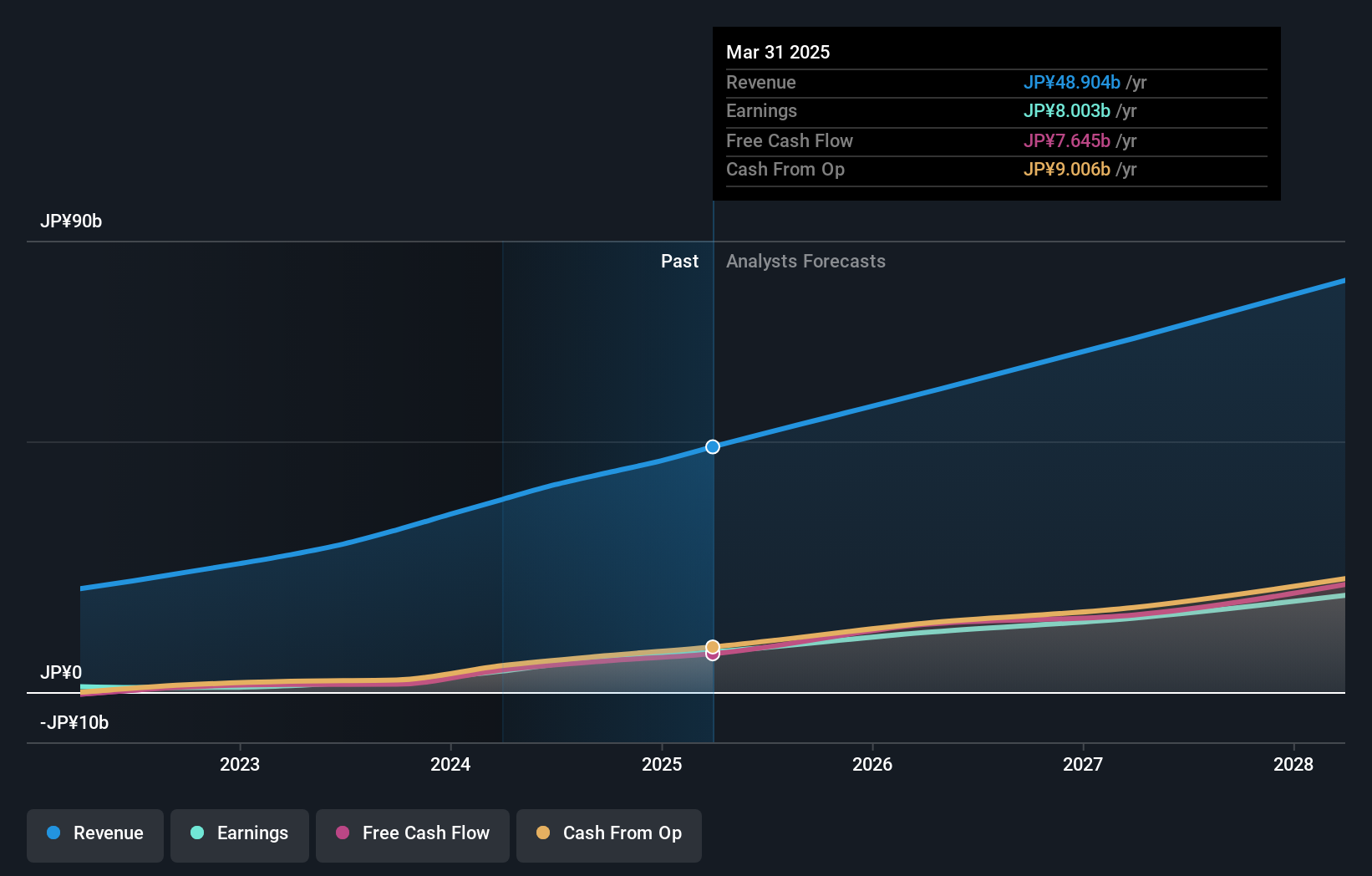

Overview: Rakus Co., Ltd. operates in Japan, offering cloud services through its subsidiaries, with a market capitalization of ¥370.68 billion.

Operations: The company generates revenue primarily from its Cloud Business, amounting to ¥46.96 billion, and also has an IT Outsourcing Business contributing ¥7.74 billion.

Amidst a dynamic landscape, Rakus Co., Ltd. showcases robust growth, with recent upward revisions in its financial forecasts highlighting resilience and strategic agility. October's sales surged to JPY 5.2 billion, underscoring a strong performance especially in its Cloud and IT Outsourcing segments. This momentum is mirrored by an enhanced earnings guidance for FY2026, projecting net sales of JPY 60 billion and profits attributable to owners at JPY 12.1 billion—a testament to effective cost management and operational efficiency. Moreover, the company's proactive shareholder return policy through rising dividends reflects a commitment to delivering value, setting it apart in Asia’s high-growth tech sphere.

- Click to explore a detailed breakdown of our findings in Rakus' health report.

Assess Rakus' past performance with our detailed historical performance reports.

Trend Micro (TSE:4704)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Trend Micro Incorporated is a global company that develops and sells security-related software and services for computers, with a market cap of ¥9.07 billion.

Operations: Trend Micro generates revenue primarily from its security-related software and services, with significant contributions from the Asia Pacific region at ¥103.52 billion, followed by Japan at ¥87.20 billion. The company also sees substantial sales in Europe and the Americas, amounting to ¥67.88 billion and ¥68.31 billion respectively.

Trend Micro, a frontrunner in cybersecurity solutions, is making significant strides in adapting to the evolving tech landscape. With an impressive annual earnings growth of 12.1% and revenue growth at 4.6%, the company's commitment to innovation is evident through its substantial R&D expenses which are strategically aligned with emerging threats in cybersecurity. Recent product launches like Trend Vision One™ AI Security Package underscore its proactive stance in securing AI-driven environments against sophisticated cyber threats. The company further demonstrated financial agility by repurchasing shares worth ¥10 billion, enhancing shareholder value amidst dynamic market conditions. This blend of strategic R&D investment and agile market maneuvers positions Trend Micro uniquely within Asia’s tech sector, poised for sustained growth as it navigates the complexities of modern cyber defense.

- Dive into the specifics of Trend Micro here with our thorough health report.

Review our historical performance report to gain insights into Trend Micro's's past performance.

Key Takeaways

- Click this link to deep-dive into the 189 companies within our Asian High Growth Tech and AI Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Jiaxun Feihong Electrical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300213

Beijing Jiaxun Feihong Electrical

Beijing Jiaxun Feihong Electrical Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)