- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2291

Undiscovered Gems With Promising Potential For December 2024

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have faced particular challenges, with indices such as the S&P 600 experiencing notable declines amid cautious Federal Reserve commentary and political uncertainties. Despite these headwinds, economic indicators like strong consumer spending and positive jobs data suggest underlying resilience that could benefit smaller companies poised for growth. Identifying promising stocks in this environment requires a focus on those with robust fundamentals and potential to capitalize on favorable economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Libra Insurance | 38.26% | 44.30% | 56.31% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

LEPU ScienTech Medical Technology (Shanghai) (SEHK:2291)

Simply Wall St Value Rating: ★★★★★★

Overview: LEPU ScienTech Medical Technology (Shanghai) Co., Ltd. is an investment holding company involved in the research, development, manufacture, and commercialization of interventional medical devices globally, with a market capitalization of approximately HK$6.17 billion.

Operations: LEPU ScienTech generates revenue primarily from the sale of interventional medical devices. The company's financial performance is characterized by its focus on research and development, impacting its cost structure significantly.

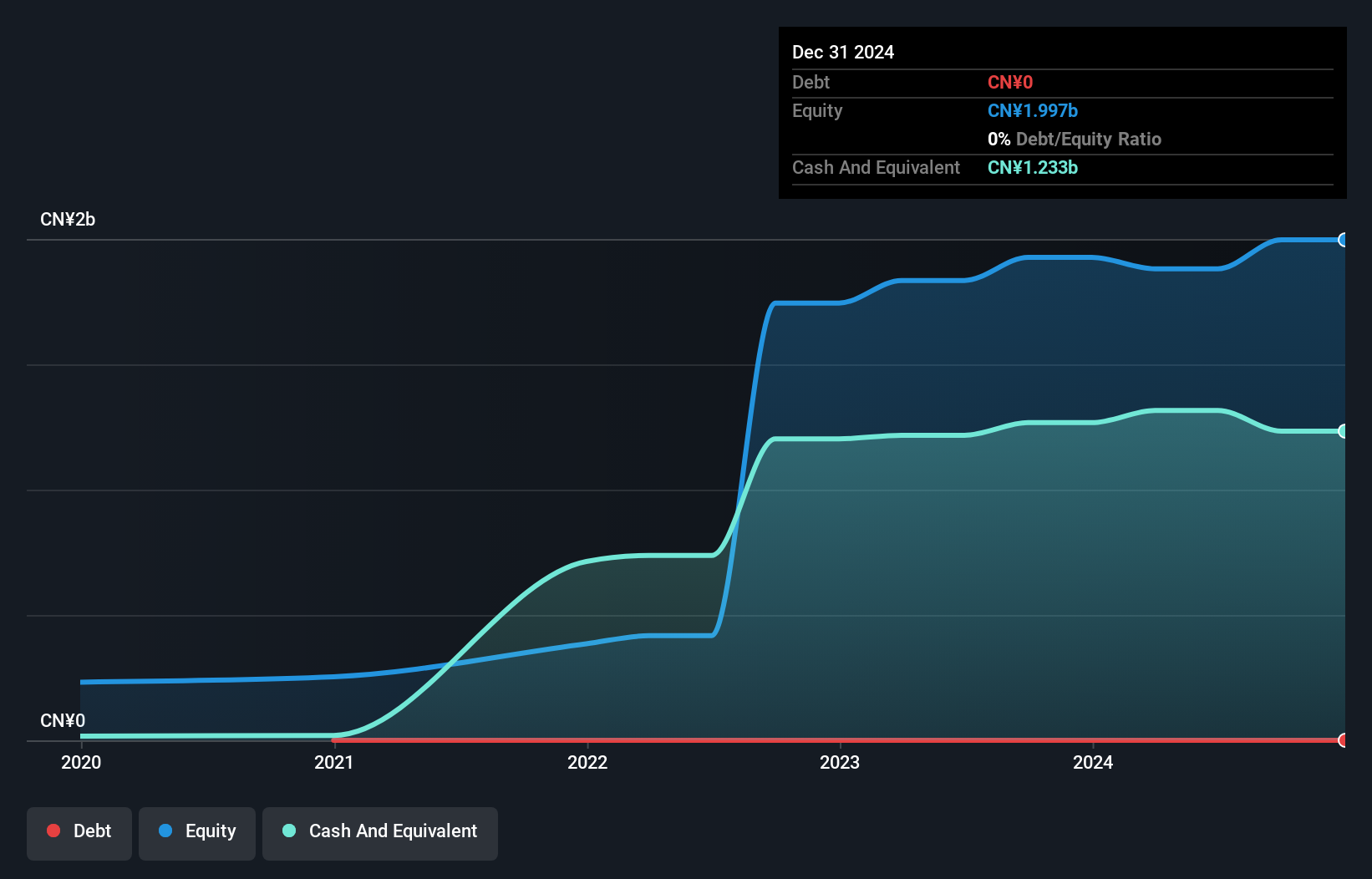

LEPU ScienTech Medical Technology, a small player in the medical equipment sector, has shown remarkable growth with earnings surging by 586% over the past year, outpacing the industry's -4% performance. The company reported net income of CNY 140 million for the first half of 2024, up from CNY 76 million in the previous year. Trading at approximately 20.6% below its estimated fair value suggests potential undervaluation. With no debt on its books for five years and positive free cash flow reaching CNY 118 million as of December 2024, LEPU seems well-positioned financially despite recent leadership changes.

- Click here and access our complete health analysis report to understand the dynamics of LEPU ScienTech Medical Technology (Shanghai).

Learn about LEPU ScienTech Medical Technology (Shanghai)'s historical performance.

I'LL (TSE:3854)

Simply Wall St Value Rating: ★★★★★★

Overview: I'LL Inc. operates a system solution business in Japan and has a market cap of ¥67.86 billion.

Operations: The company generates revenue through its system solution business in Japan. It has a market cap of ¥67.86 billion.

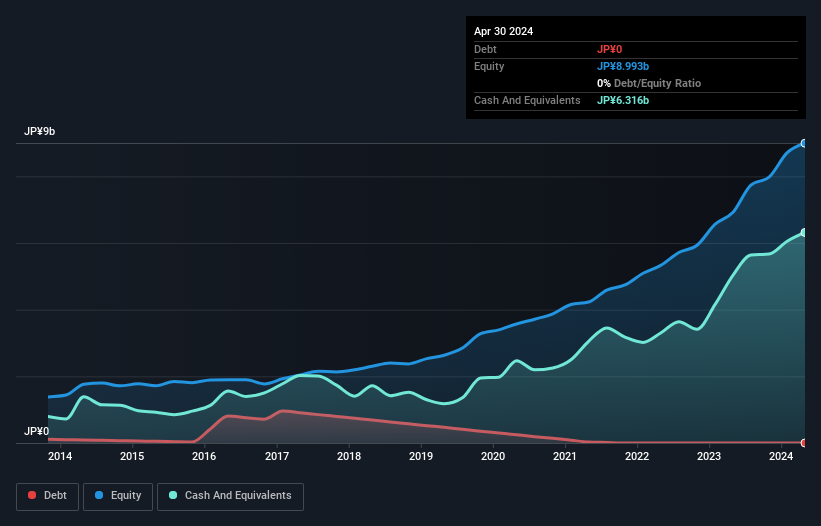

I'LL, a nimble player in the tech sector, stands out with its high-quality earnings and robust free cash flow. Over the past five years, earnings have surged at an impressive 25.2% annually, reflecting strong operational efficiency. The company is debt-free now compared to a 10.8% debt-to-equity ratio five years ago, highlighting prudent financial management. Although recent growth of 5% lags behind the software industry’s 12.7%, future projections suggest a promising annual growth rate of 14.61%. This combination of financial health and potential for expansion positions I'LL as an intriguing prospect within its industry landscape.

- Dive into the specifics of I'LL here with our thorough health report.

Assess I'LL's past performance with our detailed historical performance reports.

Starts (TSE:8850)

Simply Wall St Value Rating: ★★★★★★

Overview: Starts Corporation Inc. operates in the construction, real estate management, and tenant recruitment sectors both in Japan and internationally, with a market capitalization of approximately ¥189.21 billion.

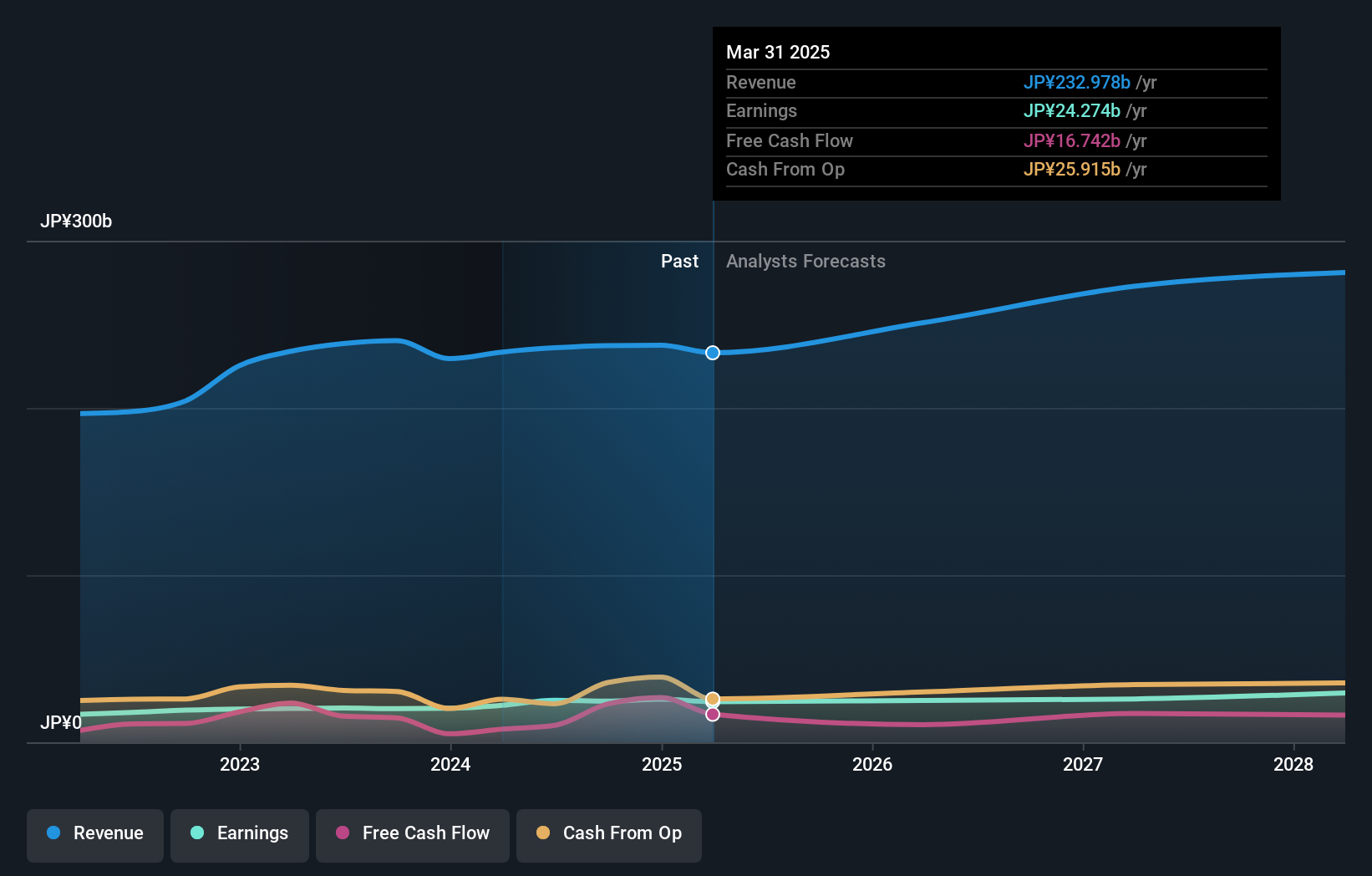

Operations: Starts Corporation Inc. generates revenue primarily from its Real Estate Management Business at ¥97.17 billion and Construction Business at ¥84.69 billion, supplemented by segments like Finance and Consulting, and Hotel and Leisure. The company experiences a notable net profit margin trend that reflects its operational efficiency across diverse sectors in Japan and internationally.

Starts Corporation, a notable contender in the real estate sector, has been trading at 50.4% below its estimated fair value, presenting a potential opportunity for investors. Over the past five years, its debt to equity ratio impressively decreased from 80.1% to 39%, indicating improved financial health. The company also demonstrated robust earnings growth of 10.6% annually over this period and maintains a positive free cash flow position. Recently, Starts completed a significant share buyback program repurchasing 1.5 million shares for ¥4,906 million as part of efforts to return profits to shareholders and enhance shareholder value.

- Click here to discover the nuances of Starts with our detailed analytical health report.

Explore historical data to track Starts' performance over time in our Past section.

Key Takeaways

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4611 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2291

LEPU ScienTech Medical Technology (Shanghai)

An investment holding company, engages in the research, development, manufacture, and commercialization of interventional medical devices worldwide.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives